Powerful Pivot Point Weekly

- Indicators

- Samuele Borella

- Version: 1.0

- Activations: 6

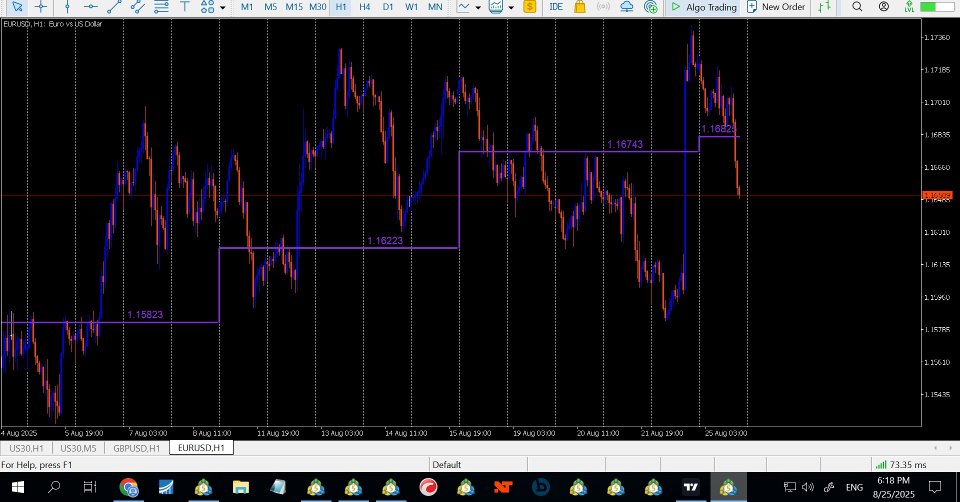

Pivot_Point_Weekly plots one thing and does it exceptionally well: the classic weekly pivot (P) calculated from the previous week’s high, low, and close. It renders each week’s pivot as a clean horizontal “step,” with short, perfectly vertical joins from week to week so you can see the regime shifts at a glance—without cluttering your chart with a forest of levels.

This indicator is intentionally minimalist: no S1/R1 ladders, no fib variations, no autoscaling circus. Just the weekly “balance price” the market respected (or rejected), displayed in a way that works on any timeframe and for any symbol you trade.

What is a weekly pivot—and why it matters

A pivot point is a simple average of price that old-school floor traders used to map out the day’s likely “balance” area. The classic formula is:

Pivot (P) = (High + Low + Close) / 3

While this calculation is typically applied to the previous day for intraday trading, many swing traders and systematic intraday traders rely on the previous week’s pivot. Weekly pivots have a few advantages:

-

Noise reduction: Weekly data smooths the random chop you often get on daily pivots.

-

Institutional rhythm: Many funds and desks rebalance and reassess on weekly cycles. Prior-week balance levels often act as “gravity.”

-

Context on lower timeframes: On M1–H1 charts, the weekly pivot acts like a slow, steady mean—great for confluence.

In practice, the weekly pivot behaves like a fair-value magnet. Price often mean-reverts toward it when stretched, or it uses it as an intrawEEK “spine” during trends.

What makes this indicator different

-

Only the essential level: Plots the previous-week classic pivot (P)—nothing else—so your eye isn’t distracted by five support/resistance tiers you don’t plan to trade.

-

Step-style rendering: Each week is a crisp horizontal segment; between weeks you get a short vertical join. The result looks like a “snake” that moves only when the underlying weekly balance changes—perfect for regime reading.

-

Time-aware starts: A Start Offset (minutes) lets you align the Monday boundary to the market you trade (e.g., indices with a Sunday micro-session). No more “half Sundays” bleeding into your week.

-

Labelled prices: Each step carries its price label above the line so you always know the exact level.

-

Broker-agnostic week separators: The indicator picks Monday opens from D1 data and draws weekly bars from W1 to compute pivots, keeping boundaries stable.

-

Ultra-light: Uses chart objects (trend lines and text) rather than heavy buffers or recalcs. It idles quietly and refreshes on a short timer or on new weekly data.

Inputs (defaults shown)

-

Weeks to draw ( InpLookbackWeeks = 52 )

How many weekly steps to render back in time. -

Color ( InpColor = BlueViolet )

The line + label color. Keep it high-contrast against your chart. -

Line & join width ( InpLineWidth = 3 )

Thickness of both horizontals and the short vertical joins. -

Price label font size ( InpFontSize = 10 )

Font size for the pivot price printed above each line. -

Price label offset (points) ( InpTextOffsetPoints = 10.0 )

How far above the line the label sits (in symbol points). -

Draw current week to NOW / Next Monday ( InpExtendToNextMon = false )

-

false (default): The current week’s step draws only up to “now.”

-

true: The current week’s step draws all the way to next Monday—handy for cleaner screenshots or forward planning.

-

-

Start offset (minutes) ( InpStartOffsetMin = 60 )

Shifts the Monday boundary forward by N minutes.-

Indices / CFDs with Sunday micro-sessions: 60 is a sensible default to avoid starting the week at an illiquid Sunday print.

-

FX: 0 is often fine (use broker time).

-

-

Auto-recheck every N seconds ( InpRebuildSecs = 3 )

Micro-refresh cadence. Lightweight; leave it as is unless you want it slower.

Note: We removed miscellaneous “status labels” from both the code and the inputs so the user window is cleaner and clients can’t break anything by toggling non-essential switches.

Quick start

-

Attach the indicator to any chart and timeframe (it’s timeframe-agnostic).

-

If you trade US30/US100/US500 or cash indices, keep Start Offset = 60 to ignore the thin Sunday (broker-time dependent).

-

If you trade FX, set Start Offset = 0 unless your broker’s “Monday” opens awkwardly early.

-

Decide whether you want the current week’s line to run to now (default) or to next Monday (aesthetics/screenshots).

-

Keep the default BlueViolet, width 3 unless your theme demands otherwise.

You’ll see a ladder of horizontal steps—each the prior week’s pivot—with tight vertical hops between them. The price label sits just above each step.

How to use the weekly pivot in practice

Think of the weekly pivot as both context and actionable level.

1) Mean reversion “back to fair value”

-

When price stretches far from the weekly P and momentum stalls (e.g., lower-timeframe divergence, exhaustion wicks), a rotation back toward P is common.

-

Entries: look for confirmation on your chosen lower timeframe (e.g., M15/M5 structure break) in the direction of the move back to P.

-

Exits: partial near P, trail the rest in case it “overshoots and hugs.”

2) Trend alignment (use P as a spine)

-

In strong directional weeks, price may ride one side of P.

-

Use the pivot as a dynamic bias filter: bias long above P, short below P—but demand structure confirmation; don’t use P alone.

3) Pullback-to-pivot continuation

-

In uptrends: watch for a pullback to P that holds and flips back up—often a high-R multiple entry.

-

In downtrends: mirror logic from above.

4) Opening drive / weekly reprice

-

Monday–Tuesday often see a decisive push away from last week’s balance.

-

If the new week blasts through P and holds, don’t fight it; treat P as broken structure, and look for continuation trades in the break direction.

5) Confluence with other structure

-

Weekly P + HTF levels (prior weekly high/low), VWAP, session opens, or round numbers strengthens the zone.

-

One clean level + one clean trigger > three noisy indicators.

Pro tip: Use the vertical joins as mental “regime switches.” Large vertical hops from week to week signal a meaningful shift in weekly balance—be slower fading those.

Why weekly instead of daily pivots?

-

Cleaner signal: Daily pivots are popular but can be very reactive (and noisy) in fast markets. Weekly pivots update less often and reveal the bigger mean.

-

Fewer fake-outs: Weekly pivots aren’t whipsawed by a single unexpected news candle the way daily pivots can be.

-

Better for swing and structured intraday: If you plan trades over multiple sessions, weekly pivots give you a durable backbone.

If you love daily pivots, keep them—but add the weekly P for higher-timeframe context. Many traders find the combo reduces overtrading and improves target selection.

Settings playbook by market

-

US indices (cash CFDs): Start Offset = 60 (or 90) often lines the “Monday start” with the meaningful cash-session handoff on your broker.

-

FX majors: Start Offset = 0 . If your broker’s Monday D1 candle includes a tiny Sunday sliver that skews your week, try 30–60.

-

Crypto: Because markets run 24/7, weekly boundaries matter even more. Keep Offset = 0 ; use the weekly P as your “week spine.”

Risk and trade management ideas

-

Stops: Don’t hide stops on the pivot. Place them beyond the structure you’re trading (e.g., above a swing high if shorting a failure to reclaim P).

-

Targets: For mean-revert trades, P itself is a rational first target. In trend trades, P can be the entry or add-on trigger rather than the target.

-

Sizing: Weekly pivots are HTF levels—give your trades breathing room or drop to a lower timeframe for precision entries.

-

News: Weekly pivots survive most single data releases, but major macro events (CPI, NFP, FOMC, central bank) can reset behavior around the pivot. Have a rule.

Common mistakes to avoid

-

Treating P as a wall: The pivot is not a brick wall. It’s a balance estimate. Price often travels through it, pauses, then chooses a side.

-

Ignoring context: Always ask, “Are we trending or balancing?” The same level behaves differently in each regime.

-

Overfitting offsets: Use Start Offset to fix obvious boundary issues, not to cherry-pick a perfect backtest.

-

Stacking indicators: Simplicity is the edge here. One clean level + clear price action usually beats five conflicting tools.

Installation & usage notes (MT5)

-

Copy Pivot_Point_Weekly.mq5 to MQL5/Indicators/ and compile.

-

Drag Pivot_Point_Weekly from the Navigator onto any chart.

-

Configure Start Offset for your symbol type (60 for indices, 0 for FX is a good baseline).

-

Set Extend to Next Monday to true if you want a full-length current week line for screenshots; otherwise leave at false.

-

Keep Lookback = 52 unless you need fewer steps for visual clarity.

The indicator self-updates on a short timer and on new weekly bars. It’s extremely light; you can run it on your main workspace without lag.

Under the hood (for the curious)

-

Weekly pivot values come from W1 data: P = (H + L + C) / 3 using the previous week’s OHLC.

-

Weekly boundaries (the step start/stop) are aligned via D1 Mondays, then shifted by your Start Offset (minutes) to suit instruments with off-hours trading or Sunday micro-sessions.

-

Steps are drawn as trend objects (no rays), joins are perfectly vertical (both points at the same timestamp), and labels are text objects placed just above each step with your chosen offset.

Example workflows

-

Scalper who respects HTF: Trade your usual M1–M5 triggers, but check: are we above or below weekly P? Fade trades against P only with exceptional structure; otherwise, let P be your “risk-on/off” switch.

-

Intraday mean-revert: When price stretches away from P during London/NY and stalls, hunt reversions into P. Exit partial at P; keep a runner for an overshoot.

-

Swing alignment: On H4/D1, if price reclaims P early in the week and the vertical join shows a sizable upward shift from last week, set a bullish bias until proven otherwise.

FAQ

Does it repaint?

No. Each weekly pivot is fixed once the prior week closes. The current week’s line length grows with time (if you set “to now”), but the value for that week does not change once it’s defined.

Why don’t you draw S1/R1 etc.?

Clarity. Many traders only use the weekly P for context and a single actionable level. If you want a full ladder, you can stack a separate S/R indicator on top—but most find the chart cleaner (and decision-making faster) with just P.

My broker’s “Monday” seems odd. What should I do?

Use Start Offset. If your Monday begins on a Sunday micro-session, add 30–90 minutes so the first “Monday” time slice lines up with the deeper-liquidity open. The default 60 suits many index CFDs.

What if I want screenshots without the line cutting off mid-week?

Set Extend to Next Monday = true. That draws the current step forward to the next Monday boundary (great for product cards or documentation).

A few trading tips

-

Combine the weekly pivot with last week’s high/low. When P sits near that range mid-point, expect balance; when the new week opens far from P, expect reprice toward it (or a strong hold away from it).

-

Use time-of-day/session. A reclaim of P during the NY cash session carries different weight than a reclaim at 2 a.m. your broker time.

-

Keep a journal of how your instrument behaves relative to P. Every market has quirks. Some hug the weekly pivot for hours; others treat it as a launchpad.

-

Risk first. Pivots are tools, not guarantees. Size modestly and let structure, not hope, decide your exit.

Pivot_Point_Weekly gives you the weekly market “fair value” in the cleanest possible way: one level per week, drawn as an easy-to-read step, labeled, and aligned to sensible week boundaries.