ICT Unicorn Model EA

- Experts

- Daniel Mandachi

- Version: 1.0

- Activations: 10

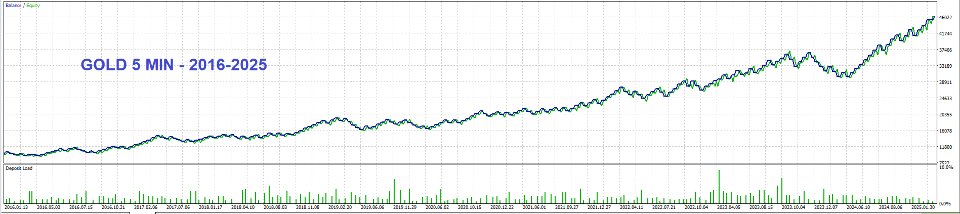

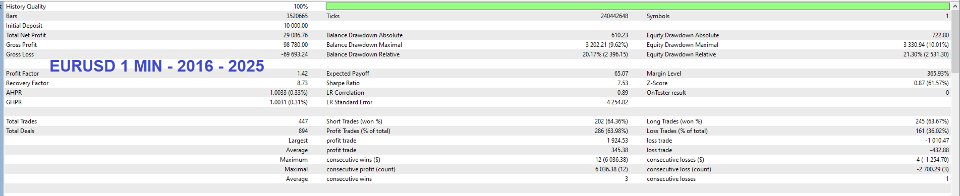

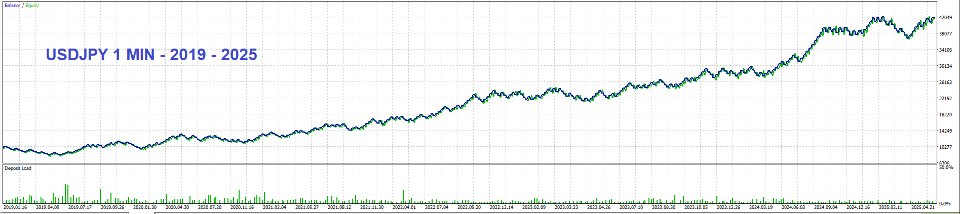

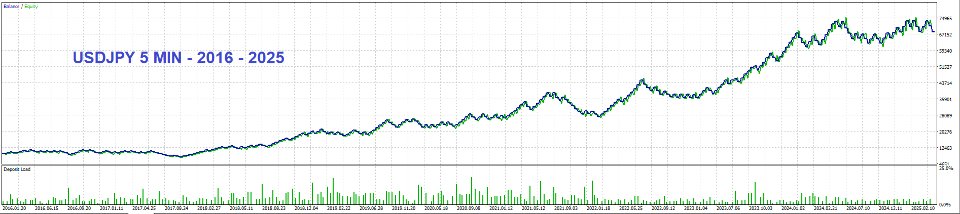

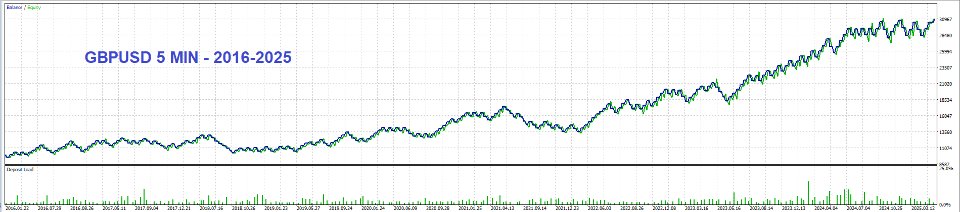

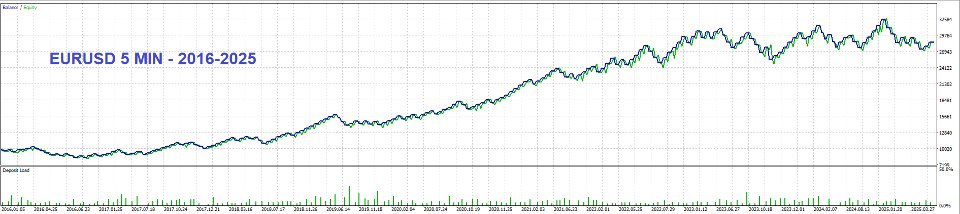

ICT Unicorn Model EA is a fully automated trading system designed around a high-probability smart money concept known as the Unicorn Model. This model leverages a precise confluence between two powerful price action phenomena: breaker blocks and fair value gaps (FVGs).

The strategy identifies moments where a breaker block, formed after a liquidity sweep and market structure shift, aligns perfectly with a nearby fair value gap. This overlapping zone acts as a high-probability area for reversals or continuations, depending on the market context.

By combining these concepts, the EA pinpoints key areas where price is likely to react decisively. This layered approach offers refined trade entries.

Strategy Logic (How it Works):

-

Swing Structure Detection:

The EA continuously monitors price action to detect major swing highs and lows based on a configurable swing length. This allows it to identify structural breaks, a key condition for both breaker blocks and fair value gaps. -

Liquidity Sweep & Breaker Block Formation:

After price breaks a previous swing high or low, often sweeping liquidity, the EA looks for a breaker block, which is a special kind of price zone that forms when an earlier move fails and price reverses sharply. This zone typically represents an area where smart money may re-enter the market in the opposite direction. -

Fair Value Gap (FVG) Identification:

The EA scans for imbalances created between three consecutive candles, a sign of inefficiency in price delivery. Only significant FVGs are considered valid. -

Unicorn Zone Validation:

A valid Unicorn Model is confirmed when the breaker block and FVG overlap. This zone becomes the EA’s focus for potential entries. -

Entry & Confirmation:

Upon retest of the unicorn zone, the EA places a trade in the direction of the expected reversal, using predefined risk/reward settings. Optional confirmation filters, including internal bar structure, are used to improve accuracy.

Bullish and Bearish Models:

-

Bullish Unicorn:

Forms after a lower low followed by a higher high, with a bullish breaker and FVG overlap acting as a reversal zone. -

Bearish Unicorn:

Forms after a higher high followed by a lower low, with a bearish breaker and overlapping FVG acting as resistance.

Key Features:

-

Automated pattern recognition of ICT-based market structure

-

Entry logic based on swing breaks, breaker blocks, and FVG overlap

-

Adjustable risk-to-reward ratios and trailing stop options

-

Multiple position sizing modes: fixed lot, percent balance/equity/margin, or fixed dollar risk

Suggested Use:

-

Best on major FX pairs or indices with clear price structure

-

Suitable for any timeframes

-

Optimal for traders looking to automate ICT-style entry techniques without over-complicating their setup.

Important Notes

-

This product does not guarantee profit and is not a “get-rich-quick” solution.

-

No martingale, no grid, no arbitrage strategies are used.

-

Always test and optimize settings before deploying in live environments.

-

Past performance does not guarantee future results.