MaxStack GBPxUSD Premium

💵 Pricing

-

Price increase with $50 after every 10 copies sold

🔹 MaxStack GBPxUSD PREMIUM

Simple setup. Strong results. Built for GBPUSD – 15-Minute Chart

(Set your chart to 15 minutes and attach the EA)

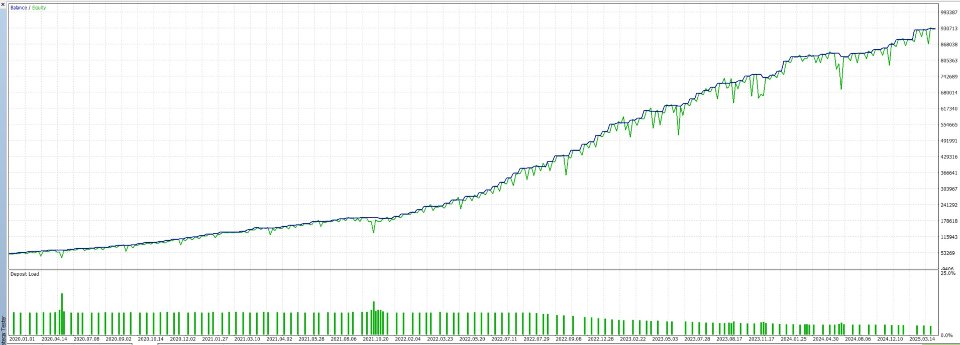

MaxStack GBPUSD PREMIUM is a precision-built Expert Advisor made specifically for GBPUSD, designed to deliver consistent results through smart margin-based risk allocation.

You can use the default settings or tailor it to your own deposit and leverage setup. Simply optimize your preferred Risk Margin Percentage, attach the EA, and let it handle the rest — from trade execution to compounding your profits with active risk control.

🧠 Strategy Engine – How It Works:

The EA is powered by a trend-following logic with dynamic position management. Trades are placed based on confirmed market direction, then managed with a layered risk-protection system:

-

📌 Initial Stop-Loss is set at entry to protect capital from the start

-

🔐 Smart SL Upgrades automatically trail and lock in profit as the trade moves in favor direction

-

🔄 Risk Margin Allocation gives you control over trade exposure, letting you scale gains while managing drawdown

-

🚫 No martingale, no grid — just clean, compounding logic with clear trade boundaries

This setup allows MaxStack to scale up profits when the market aligns, while automatically capping risk to suit your capital — ideal for both aggressive and conservative traders.

✅ Why You’ll Like It:

-

Designed optimized and focused for GBPUSD

-

One simple input: Max Risk Exposure [1 - 100]

-

Works great on any account size or leverage

-

Unlock High returns with flexible Risk Margin allocation.

-

Optimized for 15 minutes chart

-

No martingale, no grid, no messy settings

-

Clean, controlled logic for long-term growth

MaxStack GBPUSD PREMIUM is for every traders who want the best results without the complexity.

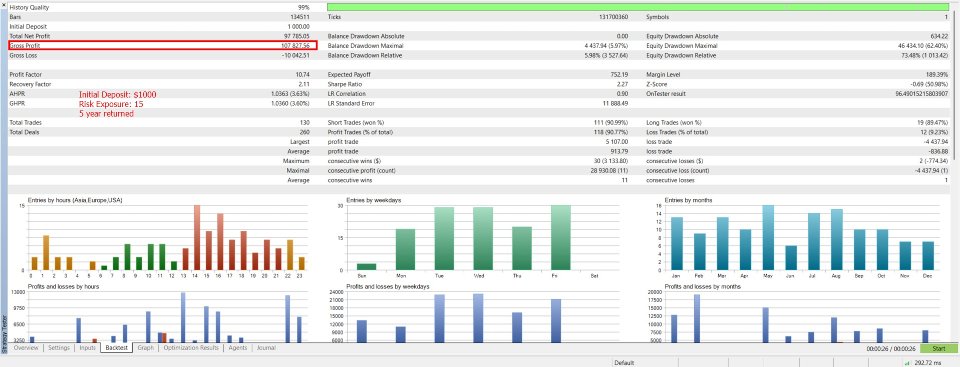

🔧 Recommended Settings:

-

Max Risk Exposure: 1–3

Low Risk – Low to Moderate Returns -

Max Risk Exposure: 4 – 9

Moderate Risk – Moderate to High Returns -

Max Risk Exposure: > 9

High Risk – Extremely High Returns

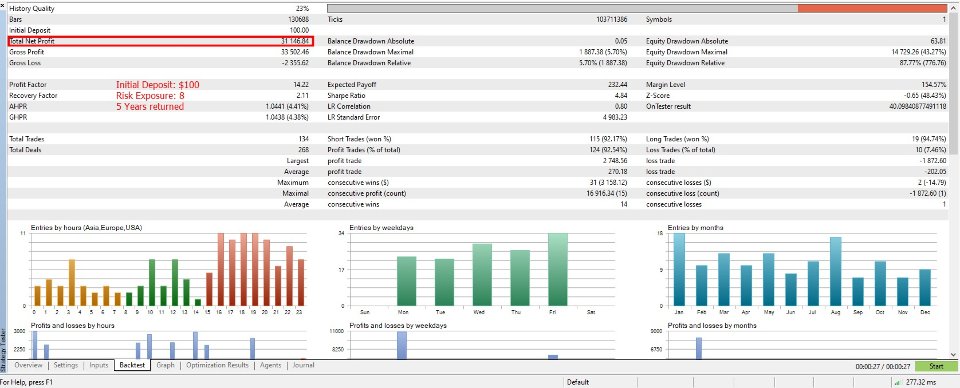

⚠️ Note:

For smaller deposit accounts (e.g., $100), using a very low Max Risk Exposure (e.g., 1–3%) may result in the EA being unable to place trades, as the calculated lot size falls below the broker's minimum (typically 0.01 lot).

To ensure proper operation, increase the setting to 4 – 7% or higher, depending on your deposit and leverage.

Adjust the value carefully to match your account size — this helps the EA open trades while avoiding excessive risk or potential drawdown that could wipe out the account.

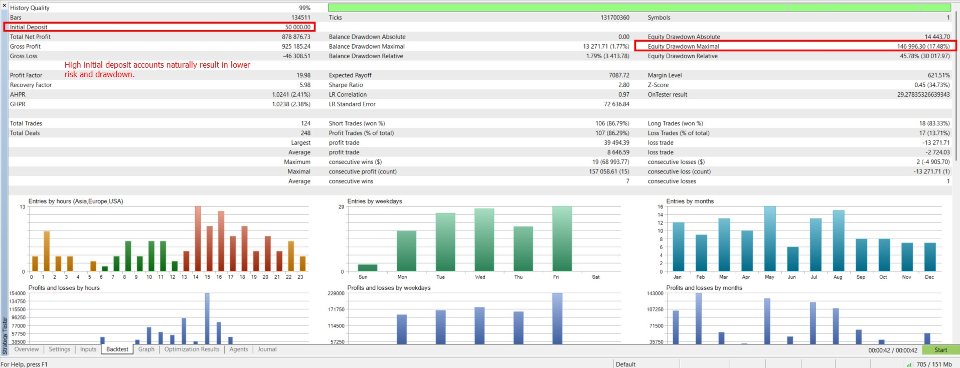

⚠️ Note:

On larger deposit accounts (e.g., $100,000+), actual risk exposure is naturally limited due to broker-imposed trade size caps (e.g., 50-lot maximum). As a result, even with higher Max Risk Exposure settings, the effective risk exposure typically stays around 2–3%.

For standard deposit accounts, it's recommended to adjust the Max Risk Exposure setting according to your capital and risk appetite.

Suggested range: 5–9% for balanced growth and controlled drawdown.