Omega Trend Indicator Product Page: https://www.mql5.com/en/market/product/29423

Omega Trend EA Product Page: https://www.mql5.com/en/market/product/56222

Please, check my other products in MQL5 Market:

- Infinity Trader EA: MT4 version | MT5 version

- Forex Gold Investor: MT4 version | MT5 version

- Forex Trend Detector: MT4 version | MT5 version

- GOLD Scalper PRO: MT4 version | MT5 version

- Omega Trend EA: MT4 version

- BF Scalper PRO: MT4 version | MT5 version

- Smart Scalper PRO: MT4 version | MT5 version

- News Scope EA PRO: MT4 version | MT5 version

- Trend Matrix EA: MT4 version | MT5 version

MQL5 channel. For news and discount here: https://www.mql5.com/en/channels/fxautomater

Omega Trend Indicator Basic Information

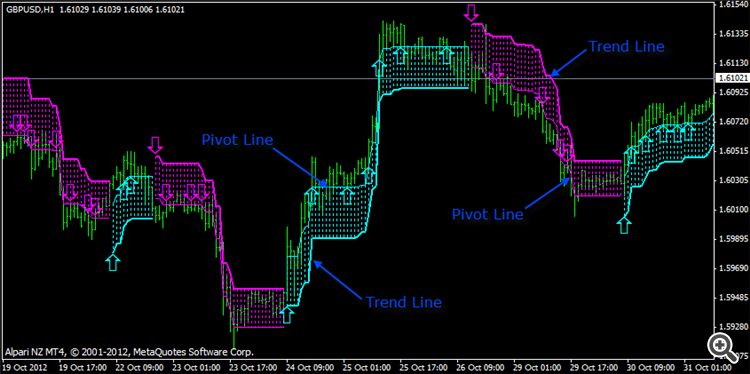

The Omega Trend Indicator is an advanced tool that has been specifically designed to detect market trends early, and follow them successfully. The Omega Trend Indicator draws two lines. The main (thicker) Trend Line represents the presumed lower or upper volatility limits of the current market trend. A break in the main Trend Line indicates a potential reversal or shift in the movement of the trend. The Trend Line also indicates the best point to place a stop loss order. In Omega Trend Indicator, the Trend Line indicates the exact point of the initial stop loss, as well as where the trailing stop is moving. For uptrends the Trend Line is blue, for downtrends it’s pink (see below image).

The secondary (thinner) Pivot Line represents the presumed Pivot level of the market. Breaks in this line can be used for short-term/scalping trades following the current market trend indicated by the Trend Line.

How to Use Omega Trend Indicator for Successful Manual Trading

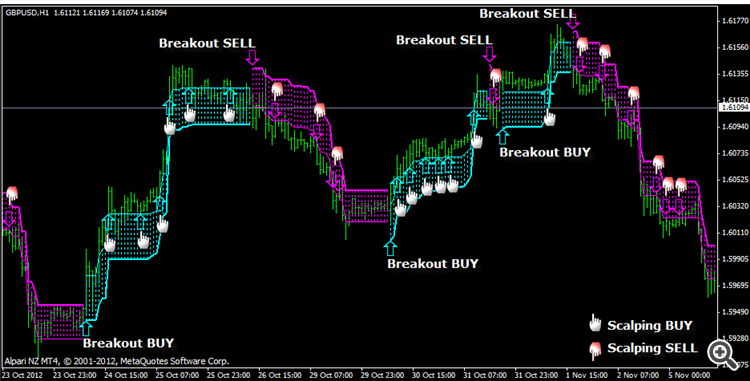

Although the Omega Trend Indicator’s signals are clear and easy to interpret (see below image), there are a few steps you should follow to filter out false trading signals.

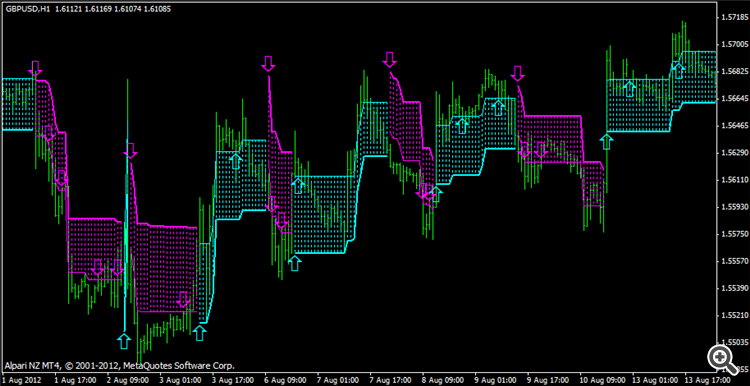

First, you need to be able to recognize a choppy market and try to ignore it. A choppy market is a market that is highly volatile but results in no overall price movement, in either direction. These price spikes and sharp rebounds from the range borders can generate a series of poor signals. In Figure 3, you can see an example of a choppy market.

A choppy market presents the worst possible conditions for any breakout or impulse trading strategy. If you use the Omega Trend Indicator under these conditions, don’t be surprised if you have poor results.

Omega Trend Indicator signals are at their most reliable, when following the market in trend or swing mode. Avoid trading in periods of low liquidity. In these periods, the market is generally in a narrow range. Periods of low liquidity normally occur after the close of the NY trading session and often throughout the entire Asian session. The best signals from the Omega Trend Indicator could be expected during the London and the NY trading sessions (8-21 GMT). Timing is crucial in FOREX trading for the profits, especially with breakout and impulse-following strategies.

I recommend Omega Trend Indicator for the EURUSD, EURJPY, USDCHF, GBPJPY and GBPUSD currency pairs. As well all market instruments with a trending behavior are appropriate. You can use Omega Trend Indicator on all time frames, for scalping, day trading or long-term investing.

I strongly recommend that you adapt visually the indicator lines to the chart. The default settings are not suitable for all chart periods and all market instruments. The most important settings you should try to adapt are: Volatility_Period, TrendLine_Level, PivotLine_Level and Bar_Acceleration.

Omega Trend Indicator Settings:

- Show_Arrows - show/hide the signal arrows on the chart

- Show_Histogram - show/hide the indicator histogram

- Show_PivotLine - show/hide the pivot line

- Alerts - activate/deactivate the signal alerts

- Send_Push_Notifications - true/false – enable/disable push notifications to mobile phones

- Prefix - The value of the parameter will be added as a prefix to all alerts/signals generated by Omega Trend Indicator.

- Volatility_Period - the indicator period of the volatility calculation.

- Smooth_Factor - the smoothing factor of Omega Trend Indicator lines. The default value of the Smooth_Factor is zero, which means that smoothing is not used.

- Max_Width_Pips - the maximum distance allowed between the Trend Line and the market price in standard 4 digit pips. This parameter limits the initial stop loss and the trailing stop values.

- Min_Follow_Pips - the minimum distance allowed between the Trend Line and the market price in standard 4 digit pips. This parameter defines the minimal value allowed for the trailing stop.

- TrendLine_Level - this parameter defines the relationship between market volatility and movement of the Trend Line towards the market price.

- PivotLine_Level - this parameter defines the correlation between market volatility and the movement of the Pivot Line towards the market price.

- Bar_Acceleration - an acceleration constant that controls the Trend Line’s convergence with the market price after every chart bar. If the Bar_Acceleration value is zero, this method is not applied.

- Profit_Acceleration - an acceleration constant that controls the Trend Line’s convergence with the market price based on the realized profit. If the Profit_Acceleration value is zero, this method is not applied.

- Max_Bars - the maximum number of bars allowed for the Omega Trend Indicator to calculate and visualize.