How can century-old functions update your trading strategies?

This article considers the Rademacher and Walsh functions. We will explore ways to apply these functions to financial time series analysis and also consider various applications for them in trading.

Reimagining Classic Strategies (Part 18): Searching For Candlestick Patterns

This article helps new community members search for and discover their own candlestick patterns. Describing these patterns can be daunting, as it requires manually searching and creatively identifying improvements. Here, we introduce the engulfing candlestick pattern and show how it can be enhanced for more profitable trading applications.

Formulating Dynamic Multi-Pair EA (Part 5): Scalping vs Swing Trading Approaches

This part explores how to design a Dynamic Multi-Pair Expert Advisor capable of adapting between Scalping and Swing Trading modes. It covers the structural and algorithmic differences in signal generation, trade execution, and risk management, allowing the EA to intelligently switch strategies based on market behavior and user input.

Risk-Based Trade Placement EA with On-Chart UI (Part 1): Designing the User Interface

Learn how to build a clean and professional on-chart control panel in MQL5 for a Risk-Based Trade Placement Expert Advisor. This step-by-step guide explains how to design a functional GUI that allows traders to input trade parameters, calculate lot size, and prepare for automated order placement.

Developing a multi-currency Expert Advisor (Part 22): Starting the transition to hot swapping of settings

If we are going to automate periodic optimization, we need to think about auto updates of the settings of the EAs already running on the trading account. This should also allow us to run the EA in the strategy tester and change its settings within a single run.

Neural Networks in Trading: Memory Augmented Context-Aware Learning (MacroHFT) for Cryptocurrency Markets

I invite you to explore the MacroHFT framework, which applies context-aware reinforcement learning and memory to improve high-frequency cryptocurrency trading decisions using macroeconomic data and adaptive agents.

Developing a Trading Strategy: The Butterfly Oscillator Method

In this article, we demonstrated how the fascinating mathematical concept of the Butterfly Curve can be transformed into a practical trading tool. We constructed the Butterfly Oscillator and built a foundational trading strategy around it. The strategy effectively combines the oscillator's unique cyclical signals with traditional trend confirmation from moving averages, creating a systematic approach for identifying potential market entries.

Optimizing Long-Term Trades: Engulfing Candles and Liquidity Strategies

This is a high-timeframe-based EA that makes long-term analyses, trading decisions, and executions based on higher-timeframe analyses of W1, D1, and MN. This article will explore in detail an EA that is specifically designed for long-term traders who are patient enough to withstand and hold their positions during tumultuous lower time frame price action without changing their bias frequently until take-profit targets are hit.

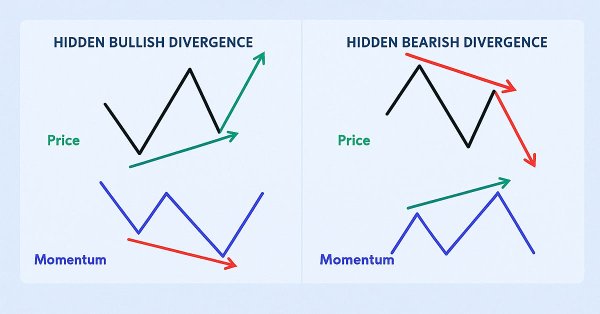

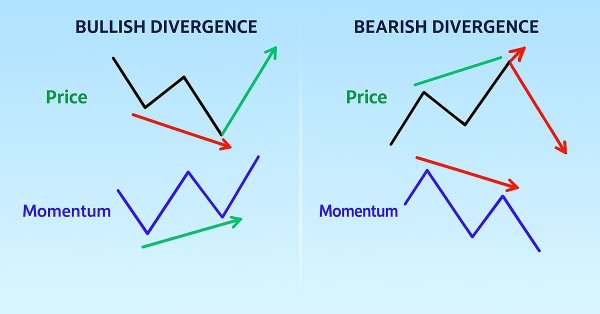

Automating Trading Strategies in MQL5 (Part 38): Hidden RSI Divergence Trading with Slope Angle Filters

In this article, we build an MQL5 EA that detects hidden RSI divergences via swing points with strength, bar ranges, tolerance, and slope angle filters for price and RSI lines. It executes buy/sell trades on validated signals with fixed lots, SL/TP in pips, and optional trailing stops for risk control.

The MQL5 Standard Library Explorer (Part 3): Expert Standard Deviation Channel

In this discussion, we will develop an Expert Advisor using the CTrade and CStdDevChannel classes, while applying several filters to enhance profitability. This stage puts our previous discussion into practical application. Additionally, I’ll introduce another simple approach to help you better understand the MQL5 Standard Library and its underlying codebase. Join the discussion to explore these concepts in action.

Neural Networks in Trading: A Multi-Agent System with Conceptual Reinforcement (Final Part)

We continue to implement the approaches proposed by the authors of the FinCon framework. FinCon is a multi-agent system based on Large Language Models (LLMs). Today, we will implement the necessary modules and conduct comprehensive testing of the model on real historical data.

Self Optimizing Expert Advisors in MQL5 (Part 16): Supervised Linear System Identification

Linear system identifcation may be coupled to learn to correct the error in a supervised learning algorithm. This allows us to build applications that depend on statistical modelling techniques without necessarily inheriting the fragility of the model's restrictive assumptions. Classical supervised learning algorithms have many needs that may be supplemented by pairing these models with a feedback controller that can correct the model to keep up with current market conditions.

Neural Networks in Trading: A Multi-Agent System with Conceptual Reinforcement (FinCon)

We invite you to explore the FinCon framework, which is a a Large Language Model (LLM)-based multi-agent system. The framework uses conceptual verbal reinforcement to improve decision making and risk management, enabling effective performance on a variety of financial tasks.

From Novice to Expert: Revealing the Candlestick Shadows (Wicks)

In this discussion, we take a step forward to uncover the underlying price action hidden within candlestick wicks. By integrating a wick visualization feature into the Market Periods Synchronizer, we enhance the tool with greater analytical depth and interactivity. This upgraded system allows traders to visualize higher-timeframe price rejections directly on lower-timeframe charts, revealing detailed structures that were once concealed within the shadows.

Introduction to MQL5 (Part 27): Mastering API and WebRequest Function in MQL5

This article introduces how to use the WebRequest() function and APIs in MQL5 to communicate with external platforms. You’ll learn how to create a Telegram bot, obtain chat and group IDs, and send, edit, and delete messages directly from MT5, building a strong foundation for mastering API integration in your future MQL5 projects.

Automating Trading Strategies in MQL5 (Part 37): Regular RSI Divergence Convergence with Visual Indicators

In this article, we build an MQL5 EA that detects regular RSI divergences using swing points with strength, bar limits, and tolerance checks. It executes trades on bullish or bearish signals with fixed lots, SL/TP in pips, and optional trailing stops. Visuals include colored lines on charts and labeled swings for better strategy insights.

Building a Smart Trade Manager in MQL5: Automate Break-Even, Trailing Stop, and Partial Close

Learn how to build a Smart Trade Manager Expert Advisor in MQL5 that automates trade management with break-even, trailing stop, and partial close features. A practical, step-by-step guide for traders who want to save time and improve consistency through automation.

Introduction to MQL5 (Part 26): Building an EA Using Support and Resistance Zones

This article teaches you how to build an MQL5 Expert Advisor that automatically detects support and resistance zones and executes trades based on them. You’ll learn how to program your EA to identify these key market levels, monitor price reactions, and make trading decisions without manual intervention.

From Novice to Expert: Parameter Control Utility

Imagine transforming the traditional EA or indicator input properties into a real-time, on-chart control interface. This discussion builds upon our foundational work in the Market Periods Synchronizer indicator, marking a significant evolution in how we visualize and manage higher-timeframe (HTF) market structures. Here, we turn that concept into a fully interactive utility—a dashboard that brings dynamic control and enhanced multi-period price action visualization directly onto the chart. Join us as we explore how this innovation reshapes the way traders interact with their tools.

Neural Networks in Trading: A Multimodal, Tool-Augmented Agent for Financial Markets (Final Part)

We continue to develop the algorithms for FinAgent, a multimodal financial trading agent designed to analyze multimodal market dynamics data and historical trading patterns.

Introduction to MQL5 (Part 25): Building an EA that Trades with Chart Objects (II)

This article explains how to build an Expert Advisor (EA) that interacts with chart objects, particularly trend lines, to identify and trade breakout and reversal opportunities. You will learn how the EA confirms valid signals, manages trade frequency, and maintains consistency with user-selected strategies.

Neural Networks in Trading: A Multimodal, Tool-Augmented Agent for Financial Markets (FinAgent)

We invite you to explore FinAgent, a multimodal financial trading agent framework designed to analyze various types of data reflecting market dynamics and historical trading patterns.

Dynamic Swing Architecture: Market Structure Recognition from Swings to Automated Execution

This article introduces a fully automated MQL5 system designed to identify and trade market swings with precision. Unlike traditional fixed-bar swing indicators, this system adapts dynamically to evolving price structure—detecting swing highs and swing lows in real time to capture directional opportunities as they form.

The MQL5 Standard Library Explorer (Part 2): Connecting Library Components

Today, we take an important step toward helping every developer understand how to read class structures and quickly build Expert Advisors using the MQL5 Standard Library. The library is rich and expandable, yet it can feel like being handed a complex toolkit without a manual. Here we share and discuss an alternative integration routine—a concise, repeatable workflow that shows how to connect classes reliably in real projects.

MQL5 Wizard Techniques you should know (Part 85): Using Patterns of Stochastic-Oscillator and the FrAMA with Beta VAE Inference Learning

This piece follows up ‘Part-84’, where we introduced the pairing of Stochastic and the Fractal Adaptive Moving Average. We now shift focus to Inference Learning, where we look to see if laggard patterns in the last article could have their fortunes turned around. The Stochastic and FrAMA are a momentum-trend complimentary pairing. For our inference learning, we are revisiting the Beta algorithm of a Variational Auto Encoder. We also, as always, do the implementation of a custom signal class designed for integration with the MQL5 Wizard.

Introduction to MQL5 (Part 24): Building an EA that Trades with Chart Objects

This article teaches you how to create an Expert Advisor that detects support and resistance zones drawn on the chart and executes trades automatically based on them.

Neural Networks in Trading: An Agent with Layered Memory (Final Part)

We continue our work on creating the FinMem framework, which uses layered memory approaches that mimic human cognitive processes. This allows the model not only to effectively process complex financial data but also to adapt to new signals, significantly improving the accuracy and effectiveness of investment decisions in dynamically changing markets.

MQL5 Wizard Techniques you should know (Part 84): Using Patterns of Stochastic Oscillator and the FrAMA - Conclusion

The Stochastic Oscillator and the Fractal Adaptive Moving Average are an indicator pairing that could be used for their ability to compliment each other within an MQL5 Expert Advisor. We introduced this pairing in the last article, and now look to wrap up by considering its 5 last signal patterns. In exploring this, as always, we use the MQL5 wizard to build and test out their potential.

Self Optimizing Expert Advisors in MQL5 (Part 15): Linear System Identification

Trading strategies may be challenging to improve because we often don’t fully understand what the strategy is doing wrong. In this discussion, we introduce linear system identification, a branch of control theory. Linear feedback systems can learn from data to identify a system’s errors and guide its behavior toward intended outcomes. While these methods may not provide fully interpretable explanations, they are far more valuable than having no control system at all. Let’s explore linear system identification and observe how it may help us as algorithmic traders to maintain control over our trading applications.

Risk Management (Part 1): Fundamentals for Building a Risk Management Class

In this article, we'll cover the basics of risk management in trading and learn how to create your first functions for calculating the appropriate lot size for a trade, as well as a stop-loss. Additionally, we will go into detail about how these features work, explaining each step. Our goal is to provide a clear understanding of how to apply these concepts in automated trading. Finally, we will put everything into practice by creating a simple script with an include file.

MQL5 Wizard Techniques you should know (Part 83): Using Patterns of Stochastic Oscillator and the FrAMA — Behavioral Archetypes

The Stochastic Oscillator and the Fractal Adaptive Moving Average are another indicator pairing that could be used for their ability to compliment each other within an MQL5 Expert Advisor. We look at the Stochastic for its ability to pinpoint momentum shifts, while the FrAMA is used to provide confirmation of the prevailing trends. In exploring this indicator pairing, as always, we use the MQL5 wizard to build and test out their potential.

Neural Networks in Trading: An Agent with Layered Memory

Layered memory approaches that mimic human cognitive processes enable the processing of complex financial data and adaptation to new signals, thereby improving the effectiveness of investment decisions in dynamic markets.

Introduction to MQL5 (Part 22): Building an Expert Advisor for the 5-0 Harmonic Pattern

This article explains how to detect and trade the 5-0 harmonic pattern in MQL5, validate it using Fibonacci levels, and display it on the chart.

From Novice to Expert: Market Periods Synchronizer

In this discussion, we introduce a Higher-to-Lower Timeframe Synchronizer tool designed to solve the problem of analyzing market patterns that span across higher timeframe periods. The built-in period markers in MetaTrader 5 are often limited, rigid, and not easily customizable for non-standard timeframes. Our solution leverages the MQL5 language to develop an indicator that provides a dynamic and visual way to align higher timeframe structures within lower timeframe charts. This tool can be highly valuable for detailed market analysis. To learn more about its features and implementation, I invite you to join the discussion.

Reusing Invalidated Orderblocks As Mitigation Blocks (SMC)

In this article, we explore how previously invalidated orderblocks can be reused as mitigation blocks within Smart Money Concepts (SMC). These zones reveal where institutional traders re-enter the market after a failed orderblock, providing high-probability areas for trade continuation in the dominant trend.

Building AI-Powered Trading Systems in MQL5 (Part 4): Overcoming Multiline Input, Ensuring Chat Persistence, and Generating Signals

In this article, we enhance the ChatGPT-integrated program in MQL5 overcoming multiline input limitations with improved text rendering, introducing a sidebar for navigating persistent chat storage using AES256 encryption and ZIP compression, and generating initial trade signals through chart data integration.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention (Final Part)

In the previous article, we explored the theoretical foundations and began implementing the approaches of the Multitask-Stockformer framework, which combines the wavelet transform and the Self-Attention multitask model. We continue to implement the algorithms of this framework and evaluate their effectiveness on real historical data.

MQL5 Wizard Techniques you should know (Part 82): Using Patterns of TRIX and the WPR with DQN Reinforcement Learning

In the last article, we examined the pairing of Ichimoku and the ADX under an Inference Learning framework. For this piece we revisit, Reinforcement Learning when used with an indicator pairing we considered last in ‘Part 68’. The TRIX and Williams Percent Range. Our algorithm for this review will be the Quantile Regression DQN. As usual, we present this as a custom signal class designed for implementation with the MQL5 Wizard.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention

We invite you to explore a framework that combines wavelet transforms and a multi-task self-attention model, aimed at improving the responsiveness and accuracy of forecasting in volatile market conditions. The wavelet transform allows asset returns to be decomposed into high and low frequencies, carefully capturing long-term market trends and short-term fluctuations.

From Novice to Expert: Demystifying Hidden Fibonacci Retracement Levels

In this article, we explore a data-driven approach to discovering and validating non-standard Fibonacci retracement levels that markets may respect. We present a complete workflow tailored for implementation in MQL5, beginning with data collection and bar or swing detection, and extending through clustering, statistical hypothesis testing, backtesting, and integration into an MetaTrader 5 Fibonacci tool. The goal is to create a reproducible pipeline that transforms anecdotal observations into statistically defensible trading signals.