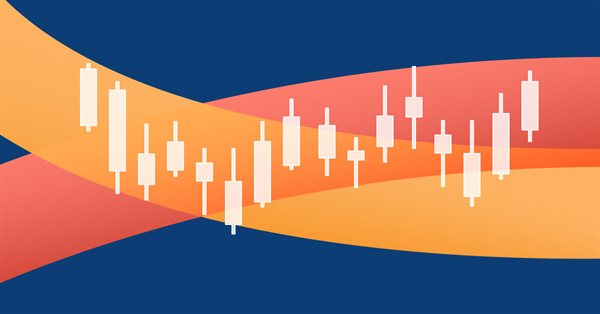

Creating an MQL5 Expert Advisor Based on the PIRANHA Strategy by Utilizing Bollinger Bands

In this article, we create an Expert Advisor (EA) in MQL5 based on the PIRANHA strategy, utilizing Bollinger Bands to enhance trading effectiveness. We discuss the key principles of the strategy, the coding implementation, and methods for testing and optimization. This knowledge will enable you to deploy the EA in your trading scenarios effectively

Price Action Analysis Toolkit Development (Part 49): Integrating Trend, Momentum, and Volatility Indicators into One MQL5 System

Simplify your MetaTrader 5 charts with the Multi Indicator Handler EA. This interactive dashboard merges trend, momentum, and volatility indicators into one real‑time panel. Switch instantly between profiles to focus on the analysis you need most. Declutter with one‑click Hide/Show controls and stay focused on price action. Read on to learn step‑by‑step how to build and customize it yourself in MQL5.

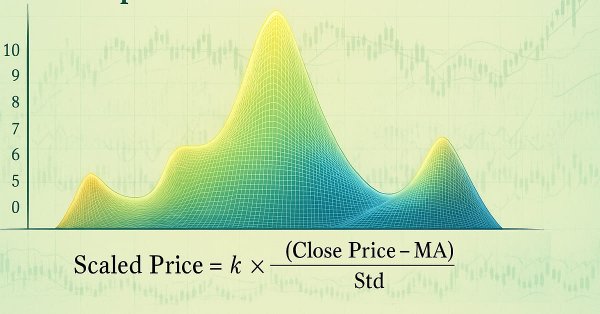

Developing a Trading Strategy: The Triple Sine Mean Reversion Method

This article introduces the Triple Sine Mean Reversion Method, a trading strategy built upon a new mathematical indicator — the Triple Sine Oscillator (TSO). The TSO is derived from the sine cube function, which oscillates between –1 and +1, making it suitable for identifying overbought and oversold market conditions. Overall, the study demonstrates how mathematical functions can be transformed into practical trading tools.

From Novice to Expert: Support and Resistance Strength Indicator (SRSI)

In this article, we will share insights on how to leverage MQL5 programming to pinpoint market levels—differentiating between weaker and strongest price levels. We will fully develop a working, Support and Resistance Strength Indicator (SRSI).

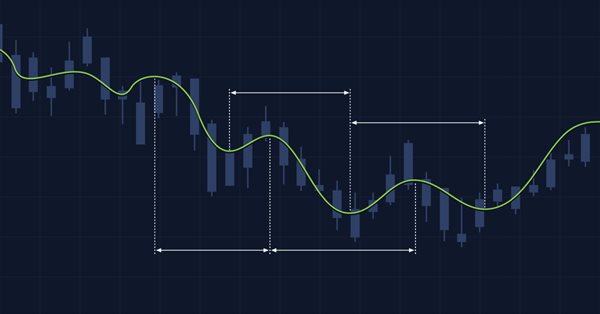

Price Action Analysis Toolkit Development (Part 52): Master Market Structure with Multi-Timeframe Visual Analysis

This article presents the Multi‑Timeframe Visual Analyzer, an MQL5 Expert Advisor that reconstructs and overlays higher‑timeframe candles directly onto your active chart. It explains the implementation, key inputs, and practical outcomes, supported by an animated demo and chart examples showing instant toggling, multi‑timeframe confirmation, and configurable alerts. Read on to see how this tool can make chart analysis faster, clearer, and more efficient.

Price Action Analysis Toolkit Development (Part 47): Tracking Forex Sessions and Breakouts in MetaTrader 5

Global market sessions shape the rhythm of the trading day, and understanding their overlap is vital to timing entries and exits. In this article, we’ll build an interactive trading sessions EA that brings those global hours to life directly on your chart. The EA automatically plots color‑coded rectangles for the Asia, Tokyo, London, and New York sessions, updating in real time as each market opens or closes. It features on‑chart toggle buttons, a dynamic information panel, and a scrolling ticker headline that streams live status and breakout messages. Tested on different brokers, this EA combines precision with style—helping traders see volatility transitions, identify cross‑session breakouts, and stay visually connected to the global market’s pulse.

Cycle analysis using the Goertzel algorithm

In this article we present code utilities that implement the goertzel algorithm in Mql5 and explore two ways in which the technique can be used in the analysis of price quotes for possible strategy development.

Developing a trading Expert Advisor from scratch (Part 12): Times and Trade (I)

Today we will create Times & Trade with fast interpretation to read the order flow. It is the first part in which we will build the system. In the next article, we will complete the system with the missing information. To implement this new functionality, we will need to add several new things to the code of our Expert Advisor.

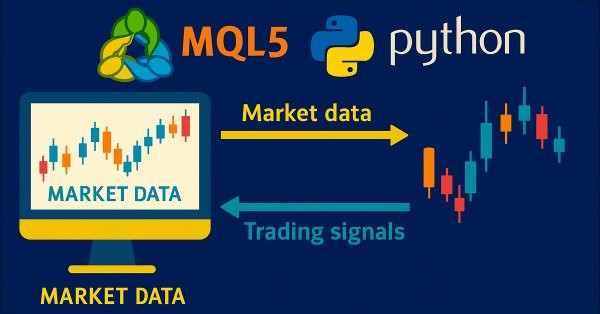

Price Action Analysis Toolkit Development (Part 36): Unlocking Direct Python Access to MetaTrader 5 Market Streams

Harness the full potential of your MetaTrader 5 terminal by leveraging Python’s data-science ecosystem and the official MetaTrader 5 client library. This article demonstrates how to authenticate and stream live tick and minute-bar data directly into Parquet storage, apply sophisticated feature engineering with Ta and Prophet, and train a time-aware Gradient Boosting model. We then deploy a lightweight Flask service to serve trade signals in real time. Whether you’re building a hybrid quant framework or enhancing your EA with machine learning, you’ll walk away with a robust, end-to-end pipeline for data-driven algorithmic trading.

Continuous futures contracts in MetaTrader 5

A short life span of futures contracts complicates their technical analysis. It is difficult to technically analyze short charts. For example, number of bars on the day chart of the UX-9.13 Ukrainian Stock index future is more than 100. Therefore, trader creates synthetic long futures contracts. This article explains how to splice futures contracts with different dates in the MetaTrader 5 terminal.

Developing a trading Expert Advisor from scratch (Part 16): Accessing data on the web (II)

Knowing how to input data from the Web into an Expert Advisor is not so obvious. It is not so easy to do without understanding all the possibilities offered by MetaTrader 5.

Calculating mathematical expressions (Part 2). Pratt and shunting yard parsers

In this article, we consider the principles of mathematical expression parsing and evaluation using parsers based on operator precedence. We will implement Pratt and shunting-yard parser, byte-code generation and calculations by this code, as well as view how to use indicators as functions in expressions and how to set up trading signals in Expert Advisors based on these indicators.

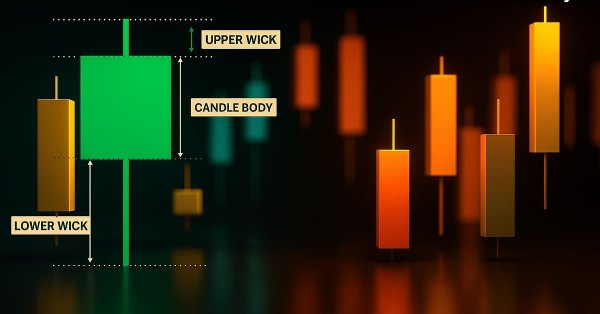

Trading strategy based on the improved Doji candlestick pattern recognition indicator

The metabar-based indicator detected more candles than the conventional one. Let's check if this provides real benefit in the automated trading.

Understanding MQL5 Object-Oriented Programming (OOP)

As developers, we need to learn how to create and develop software that can be reusable and flexible without duplicated code especially if we have different objects with different behaviors. This can be smoothly done by using object-oriented programming techniques and principles. In this article, we will present the basics of MQL5 Object-Oriented programming to understand how we can use principles and practices of this critical topic in our software.

Developing a trading Expert Advisor from scratch (Part 15): Accessing data on the web (I)

How to access online data via MetaTrader 5? There are a lot of websites and places on the web, featuring a huge amount information. What you need to know is where to look and how best to use this information.

Timeseries in DoEasy library (part 49): Multi-period multi-symbol multi-buffer standard indicators

In the current article, I will improve the library classes to implement the ability to develop multi-symbol multi-period standard indicators requiring several indicator buffers to display their data.

Non-linear indicators

In this article, I will make an attempt to consider some ways of building non-linear indicators and their use in trading. There are quite a few indicators in the MetaTrader trading platform that use non-linear approaches.

Mountain or Iceberg charts

How do you like the idea of adding a new chart type to the MetaTrader 5 platform? Some people say it lacks a few things that other platforms offer. But the truth is, MetaTrader 5 is a very practical platform as it allows you to do things that can't be done (or at least can't be done easily) in many other platforms.

Developing a trading Expert Advisor from scratch (Part 10): Accessing custom indicators

How to access custom indicators directly in an Expert Advisor? A trading EA can be truly useful only if it can use custom indicators; otherwise, it is just a set of codes and instructions.

Price Action Analysis Toolkit Development (Part 26): Pin Bar, Engulfing Patterns and RSI Divergence (Multi-Pattern) Tool

Aligned with our goal of developing practical price-action tools, this article explores the creation of an EA that detects pin bar and engulfing patterns, using RSI divergence as a confirmation trigger before generating any trading signals.

The price movement model and its main provisions. (Part 3): Calculating optimal parameters of stock exchange speculations

Within the framework of the engineering approach developed by the author based on the probability theory, the conditions for opening a profitable position are found and the optimal (profit-maximizing) take profit and stop loss values are calculated.

Canvas based indicators: Filling channels with transparency

In this article I'll introduce a method for creating custom indicators whose drawings are made using the class CCanvas from standard library and see charts properties for coordinates conversion. I'll approach specially indicators which need to fill the area between two lines using transparency.

Introduction to MQL5 (Part 10): A Beginner's Guide to Working with Built-in Indicators in MQL5

This article introduces working with built-in indicators in MQL5, focusing on creating an RSI-based Expert Advisor (EA) using a project-based approach. You'll learn to retrieve and utilize RSI values, handle liquidity sweeps, and enhance trade visualization using chart objects. Additionally, the article emphasizes effective risk management, including setting percentage-based risk, implementing risk-reward ratios, and applying risk modifications to secure profits.

Forecasting with ARIMA models in MQL5

In this article we continue the development of the CArima class for building ARIMA models by adding intuitive methods that enable forecasting.

Multiple indicators on one chart (Part 02): First experiments

In the previous article "Multiple indicators on one chart" I presented the concept and the basics of how to use multiple indicators on one chart. In this article, I will provide the source code and will explain it in detail.

Developing a trading Expert Advisor from scratch (Part 8): A conceptual leap

What is the easiest way to implement new functionality? In this article, we will take one step back and then two steps forward.

Timeseries in DoEasy library (part 44): Collection class of indicator buffer objects

The article deals with creating a collection class of indicator buffer objects. I am going to test the ability to create and work with any number of buffers for indicators (the maximum number of buffers that can be created in MQL indicators is 512).

Price Action Analysis Toolkit Development (Part 13): RSI Sentinel Tool

Price action can be effectively analyzed by identifying divergences, with technical indicators such as the RSI providing crucial confirmation signals. In the article below, we explain how automated RSI divergence analysis can identify trend continuations and reversals, thereby offering valuable insights into market sentiment.

How to create a custom True Strength Index indicator using MQL5

Here is a new article about how to create a custom indicator. This time we will work with the True Strength Index (TSI) and will create an Expert Advisor based on it.

MQL5 Wizard Techniques you should know (Part 48): Bill Williams Alligator

The Alligator Indicator, which was the brain child of Bill Williams, is a versatile trend identification indicator that yields clear signals and is often combined with other indicators. The MQL5 wizard classes and assembly allow us to test a variety of signals on a pattern basis, and so we consider this indicator as well.

CCI indicator. Three transformation steps

In this article, I will make additional changes to the CCI affecting the very logic of this indicator. Moreover, we will be able to see it in the main chart window.

Category Theory in MQL5 (Part 1)

Category Theory is a diverse and expanding branch of Mathematics which as of yet is relatively uncovered in the MQL community. These series of articles look to introduce and examine some of its concepts with the overall goal of establishing an open library that attracts comments and discussion while hopefully furthering the use of this remarkable field in Traders' strategy development.

Automating The Market Sentiment Indicator

In this article, we automate a custom market sentiment indicator that classifies market conditions into bullish, bearish, risk-on, risk-off, and neutral. The Expert Advisor delivers real-time insights into prevailing sentiment while streamlining the analysis process for current market trends or direction.

Introduction to MQL5 (Part 15): A Beginner's Guide to Building Custom Indicators (IV)

In this article, you'll learn how to build a price action indicator in MQL5, focusing on key points like low (L), high (H), higher low (HL), higher high (HH), lower low (LL), and lower high (LH) for analyzing trends. You'll also explore how to identify the premium and discount zones, mark the 50% retracement level, and use the risk-reward ratio to calculate profit targets. The article also covers determining entry points, stop loss (SL), and take profit (TP) levels based on the trend structure.

Multiple indicators on one chart (Part 03): Developing definitions for users

Today we will update the functionality of the indicator system for the first time. In the previous article within the "Multiple indicators on one chart" we considered the basic code which allows using more than one indicator in a chart subwindow. But what was presented was just the starting base of a much larger system.

Improve Your Trading Charts With Interactive GUI's in MQL5 (Part I): Movable GUI (I)

Unleash the power of dynamic data representation in your trading strategies or utilities with our comprehensive guide on creating movable GUI in MQL5. Dive into the core concept of chart events and learn how to design and implement simple and multiple movable GUI on the same chart. This article also explores the process of adding elements to your GUI, enhancing their functionality and aesthetic appeal.

Introduction to MQL5 (Part 9): Understanding and Using Objects in MQL5

Learn to create and customize chart objects in MQL5 using current and historical data. This project-based guide helps you visualize trades and apply MQL5 concepts practically, making it easier to build tools tailored to your trading needs.

Parafrac Oscillator: Combination of Parabolic and Fractal Indicator

We will explore how the Parabolic SAR and the Fractal indicator can be combined to create a new oscillator-based indicator. By integrating the unique strengths of both tools, traders can aim at developing a more refined and effective trading strategy.

Statistical Arbitrage with predictions

We will walk around statistical arbitrage, we will search with python for correlation and cointegration symbols, we will make an indicator for Pearson's coefficient and we will make an EA for trading statistical arbitrage with predictions done with python and ONNX models.

Price Action Analysis Toolkit Development (Part 42): Interactive Chart Testing with Button Logic and Statistical Levels

In a world where speed and precision matter, analysis tools need to be as smart as the markets we trade. This article presents an EA built on button logic—an interactive system that instantly transforms raw price data into meaningful statistical levels. With a single click, it calculates and displays mean, deviation, percentiles, and more, turning advanced analytics into clear on-chart signals. It highlights the zones where price is most likely to bounce, retrace, or break, making analysis both faster and more practical.