Larry Williams Market Secrets (Part 6): Measuring Volatility Breakouts Using Market Swings

This article demonstrates how to design and implement a Larry Williams volatility breakout Expert Advisor in MQL5, covering swing-range measurement, entry-level projection, risk-based position sizing, and backtesting on real market data.

Neural Networks in Trading: Two-Dimensional Connection Space Models (Final Part)

We continue to explore the innovative Chimera framework – a two-dimensional state-space model that uses neural network technologies to analyze multidimensional time series. This method provides high forecasting accuracy with low computational cost.

MQL5 Trading Tools (Part 11): Correlation Matrix Dashboard (Pearson, Spearman, Kendall) with Heatmap and Standard Modes

In this article, we build a correlation matrix dashboard in MQL5 to compute asset relationships using Pearson, Spearman, and Kendall methods over a set timeframe and bars. The system offers standard mode with color thresholds and p-value stars, plus heatmap mode with gradient visuals for correlation strengths. It includes an interactive UI with timeframe selectors, mode toggles, and a dynamic legend for efficient analysis of symbol interdependencies.

Forex arbitrage trading: A simple synthetic market maker bot to get started

Today we will take a look at my first arbitrage robot — a liquidity provider (if you can call it that) for synthetic assets. Currently, this bot is successfully operating as a module in a large machine learning system, but I pulled up an old Forex arbitrage robot from the cloud, so let's take a look at it and think about what we can do with it today.

Neural Networks in Trading: Two-Dimensional Connection Space Models (Chimera)

In this article, we will explore the innovative Chimera framework: a two-dimensional state-space model that uses neural networks to analyze multivariate time series. This method offers high accuracy with low computational cost, outperforming traditional approaches and Transformer architectures.

Larry Williams Market Secrets (Part 4): Automating Short-Term Swing Highs and Lows in MQL5

Master the automation of Larry Williams’ short-term swing patterns using MQL5. In this guide, we develop a fully configurable Expert Advisor (EA) that leverages non-random market structures. We’ll cover how to integrate robust risk management and flexible exit logic, providing a solid foundation for systematic strategy development and backtesting.

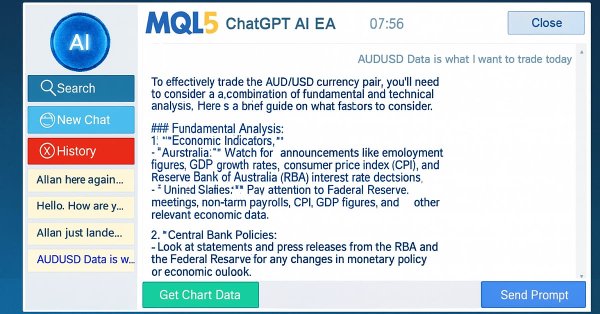

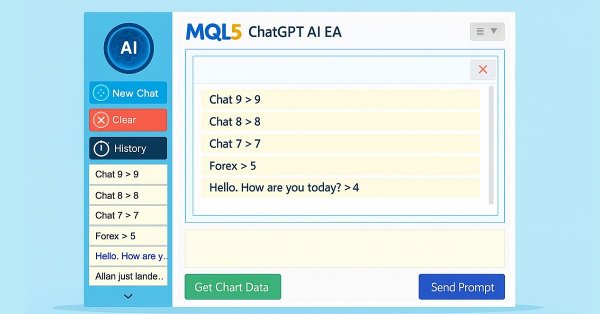

Building AI-Powered Trading Systems in MQL5 (Part 8): UI Polish with Animations, Timing Metrics, and Response Management Tools

In this article, we enhance the AI-powered trading system in MQL5 with user interface improvements, including loading animations for request preparation and thinking phases, as well as timing metrics displayed in responses for better feedback. We add response management tools like regenerate buttons to re-query the AI and export options to save the last response to a file, streamlining interaction.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model (Final Part)

We continue exploring a multi-task learning framework based on ResNeXt, which is characterized by modularity, high computational efficiency, and the ability to identify stable patterns in data. Using a single encoder and specialized "heads" reduces the risk of model overfitting and improves the quality of forecasts.

From Novice to Expert: Higher Probability Signals

In high-probability support and resistance zones, valid entry confirmation signals are always present once the zone has been correctly identified. In this discussion, we build an intelligent MQL5 program that automatically detects entry conditions within these zones. We leverage well-known candlestick patterns alongside native confirmation indicators to validate trade decisions. Click to read further.

From Novice to Expert: Navigating Market Irregularities

Market rules are continuously evolving, and many once-reliable principles gradually lose their effectiveness. What worked in the past no longer works consistently over time. Today’s discussion focuses on probability ranges and how they can be used to navigate market irregularities. We will leverage MQL5 to develop an algorithm capable of trading effectively even in the choppiest market conditions. Join this discussion to find out more.

From Novice to Expert: Automating Trade Discipline with an MQL5 Risk Enforcement EA

For many traders, the gap between knowing a risk rule and following it consistently is where accounts go to die. Emotional overrides, revenge trading, and simple oversight can dismantle even the best strategy. Today, we will transform the MetaTrader 5 platform into an unwavering enforcer of your trading rules by developing a Risk Enforcement Expert Advisor. Join this discussion to find out more.

Building AI-Powered Trading Systems in MQL5 (Part 7): Further Modularization and Automated Trading

In this article, we enhance the AI-powered trading system's modularity by separating UI components into a dedicated include file. The system now automates trade execution based on AI-generated signals, parsing JSON responses for BUY/SELL/NONE with entry/SL/TP, visualizing patterns like engulfing or divergences on charts with arrows, lines, and labels, and optional auto-signal checks on new bars.

From Novice to Expert: Trading the RSI with Market Structure Awareness

In this article, we will explore practical techniques for trading the Relative Strength Index (RSI) oscillator with market structure. Our focus will be on channel price action patterns, how they are typically traded, and how MQL5 can be leveraged to enhance this process. By the end, you will have a rule-based, automated channel-trading system designed to capture trend continuation opportunities with greater precision and consistency.

Automating Trading Strategies in MQL5 (Part 46): Liquidity Sweep on Break of Structure (BoS)

In this article, we build a Liquidity Sweep on Break of Structure (BoS) system in MQL5 that detects swing highs/lows over a user-defined length, labels them as HH/HL/LH/LL to identify BOS (HH in uptrend or LL in downtrend), and spots liquidity sweeps when price wicks beyond the swing but closes back inside on a bullish/bearish candle.

Adaptive Smart Money Architecture (ASMA): Merging SMC Logic With Market Sentiment for Dynamic Strategy Switching

This topic explores how to build an Adaptive Smart Money Architecture (ASMA)—an intelligent Expert Advisor that merges Smart Money Concepts (Order Blocks, Break of Structure, Fair Value Gaps) with real-time market sentiment to automatically choose the best trading strategy depending on current market conditions.

Mastering Kagi Charts in MQL5 (Part 2): Implementing Automated Kagi-Based Trading

Learn how to build a complete Kagi-based trading Expert Advisor in MQL5, from signal construction to order execution, visual markers, and a three-stage trailing stop. Includes full code, testing results, and a downloadable set file.

Fortified Profit Architecture: Multi-Layered Account Protection

In this discussion, we introduce a structured, multi-layered defense system designed to pursue aggressive profit targets while minimizing exposure to catastrophic loss. The focus is on blending offensive trading logic with protective safeguards at every level of the trading pipeline. The idea is to engineer an EA that behaves like a “risk-aware predator”—capable of capturing high-value opportunities, but always with layers of insulation that prevent blindness to sudden market stress.

Automating Trading Strategies in MQL5 (Part 45): Inverse Fair Value Gap (IFVG)

In this article, we create an Inverse Fair Value Gap (IFVG) detection system in MQL5 that identifies bullish/bearish FVGs on recent bars with minimum gap size filtering, tracks their states as normal/mitigated/inverted based on price interactions (mitigation on far-side breaks, retracement on re-entry, inversion on close beyond far side from inside), and ignores overlaps while limiting tracked FVGs.

From Novice to Expert: Developing a Geographic Market Awareness with MQL5 Visualization

Trading without session awareness is like navigating without a compass—you're moving, but not with purpose. Today, we're revolutionizing how traders perceive market timing by transforming ordinary charts into dynamic geographical displays. Using MQL5's powerful visualization capabilities, we'll build a live world map that illuminates active trading sessions in real-time, turning abstract market hours into intuitive visual intelligence. This journey sharpens your trading psychology and reveals professional-grade programming techniques that bridge the gap between complex market structure and practical, actionable insight.

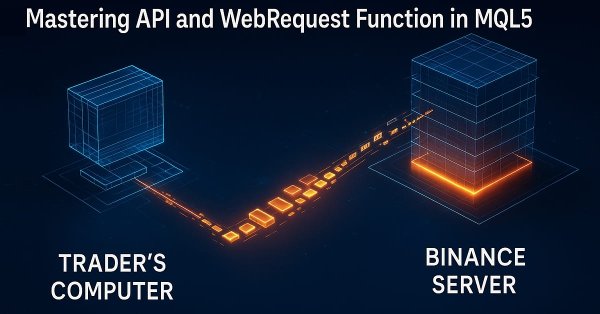

Introduction to MQL5 (Part 30): Mastering API and WebRequest Function in MQL5 (IV)

Discover a step-by-step tutorial that simplifies the extraction, conversion, and organization of candle data from API responses within the MQL5 environment. This guide is perfect for newcomers looking to enhance their coding skills and develop robust strategies for managing market data efficiently.

Automating Trading Strategies in MQL5 (Part 44): Change of Character (CHoCH) Detection with Swing High/Low Breaks

In this article, we develop a Change of Character (CHoCH) detection system in MQL5 that identifies swing highs and lows over a user-defined bar length, labels them as HH/LH for highs or LL/HL for lows to determine trend direction, and triggers trades on breaks of these swing points, indicating a potential reversal, and trades the breaks when the structure changes.

Neural Networks in Trading: Multi-Task Learning Based on the ResNeXt Model

A multi-task learning framework based on ResNeXt optimizes the analysis of financial data, taking into account its high dimensionality, nonlinearity, and time dependencies. The use of group convolution and specialized heads allows the model to effectively extract key features from the input data.

The MQL5 Standard Library Explorer (Part 5): Multiple Signal Expert

In this session, we will build a sophisticated, multi-signal Expert Advisor using the MQL5 Standard Library. This approach allows us to seamlessly blend built-in signals with our own custom logic, demonstrating how to construct a powerful and flexible trading algorithm. For more, click to read further.

Automating Trading Strategies in MQL5 (Part 43): Adaptive Linear Regression Channel Strategy

In this article, we implement an adaptive Linear Regression Channel system in MQL5 that automatically calculates the regression line and standard deviation channel over a user-defined period, only activates when the slope exceeds a minimum threshold to confirm a clear trend, and dynamically recreates or extends the channel when the price breaks out by a configurable percentage of channel width.

Introduction to MQL5 (Part 29): Mastering API and WebRequest Function in MQL5 (III)

In this article, we continue mastering API and WebRequest in MQL5 by retrieving candlestick data from an external source. We focus on splitting the server response, cleaning the data, and extracting essential elements such as opening time and OHLC values for multiple daily candles, preparing the data for further analysis.

The MQL5 Standard Library Explorer (Part 4): Custom Signal Library

Today, we use the MQL5 Standard Library to build custom signal classes and let the MQL5 Wizard assemble a professional Expert Advisor for us. This approach simplifies development so that even beginner programmers can create robust EAs without in-depth coding knowledge, focusing instead on tuning inputs and optimizing performance. Join this discussion as we explore the process step by step.

Automating Trading Strategies in MQL5 (Part 42): Session-Based Opening Range Breakout (ORB) System

In this article, we create a fully customizable session-based Opening Range Breakout (ORB) system in MQL5 that lets us set any desired session start time and range duration, automatically calculates the high and low of that opening period, and trades only confirmed breakouts in the direction of the move.

Neural Networks in Trading: Hierarchical Dual-Tower Transformer (Final Part)

We continue to build the Hidformer hierarchical dual-tower transformer model designed for analyzing and forecasting complex multivariate time series. In this article, we will bring the work we started earlier to its logical conclusion — we will test the model on real historical data.

Mastering Kagi Charts in MQL5 (Part I): Creating the Indicator

Learn how to build a complete Kagi Chart engine in MQL5—constructing price reversals, generating dynamic line segments, and updating Kagi structures in real time. This first part teaches you how to render Kagi charts directly on MetaTrader 5, giving traders a clear view of trend shifts and market strength while preparing for automated Kagi-based trading logic in Part 2.

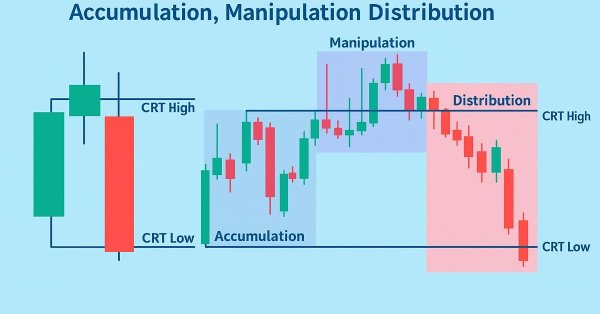

Automating Trading Strategies in MQL5 (Part 41): Candle Range Theory (CRT) – Accumulation, Manipulation, Distribution (AMD)

In this article, we develop a Candle Range Theory (CRT) trading system in MQL5 that identifies accumulation ranges on a specified timeframe, detects breaches with manipulation depth filtering, and confirms reversals for entry trades in the distribution phase. The system supports dynamic or static stop-loss and take-profit calculations based on risk-reward ratios, optional trailing stops, and limits on positions per direction for controlled risk management.

Automating Black-Scholes Greeks: Advanced Scalping and Microstructure Trading

Gamma and Delta were originally developed as risk-management tools for hedging options exposure, but over time they evolved into powerful instruments for advanced scalping, order-flow modeling, and microstructure trading. Today, they serve as real-time indicators of price sensitivity and liquidity behavior, enabling traders to anticipate short-term volatility with remarkable precision.

Building AI-Powered Trading Systems in MQL5 (Part 6): Introducing Chat Deletion and Search Functionality

In Part 6 of our MQL5 AI trading system series, we advance the ChatGPT-integrated Expert Advisor by introducing chat deletion functionality through interactive delete buttons in the sidebar, small/large history popups, and a new search popup, allowing traders to manage and organize persistent conversations efficiently while maintaining encrypted storage and AI-driven signals from chart data.

Neural Networks in Trading: Hierarchical Dual-Tower Transformer (Hidformer)

We invite you to get acquainted with the Hierarchical Double-Tower Transformer (Hidformer) framework, which was developed for time series forecasting and data analysis. The framework authors proposed several improvements to the Transformer architecture, which resulted in increased forecast accuracy and reduced computational resource consumption.

Automating Trading Strategies in MQL5 (Part 40): Fibonacci Retracement Trading with Custom Levels

In this article, we build an MQL5 Expert Advisor for Fibonacci retracement trading, using either daily candle ranges or lookback arrays to calculate custom levels like 50% and 61.8% for entries, determining bullish or bearish setups based on close vs. open. The system triggers buys or sells on price crossings of levels with max trades per level, optional closure on new Fib calcs, points-based trailing stops after a min profit threshold, and SL/TP buffers as percentages of the range.

Building AI-Powered Trading Systems in MQL5 (Part 5): Adding a Collapsible Sidebar with Chat Popups

In Part 5 of our MQL5 AI trading system series, we enhance the ChatGPT-integrated Expert Advisor by introducing a collapsible sidebar, improving navigation with small and large history popups for seamless chat selection, while maintaining multiline input handling, persistent encrypted chat storage, and AI-driven trade signal generation from chart data.

Neural Networks in Trading: Memory Augmented Context-Aware Learning for Cryptocurrency Markets (Final Part)

The MacroHFT framework for high-frequency cryptocurrency trading uses context-aware reinforcement learning and memory to adapt to dynamic market conditions. At the end of this article, we will test the implemented approaches on real historical data to assess their effectiveness.

MQL5 Trading Tools (Part 10): Building a Strategy Tracker System with Visual Levels and Success Metrics

In this article, we develop an MQL5 strategy tracker system that detects moving average crossover signals filtered by a long-term MA, simulates or executes trades with configurable TP levels and SL in points, and monitors outcomes like TP/SL hits for performance analysis.

Risk-Based Trade Placement EA with On-Chart UI (Part 2): Adding Interactivity and Logic

Learn how to build an interactive MQL5 Expert Advisor with an on-chart control panel. Know how to compute risk-based lot sizes and place trades directly from the chart.

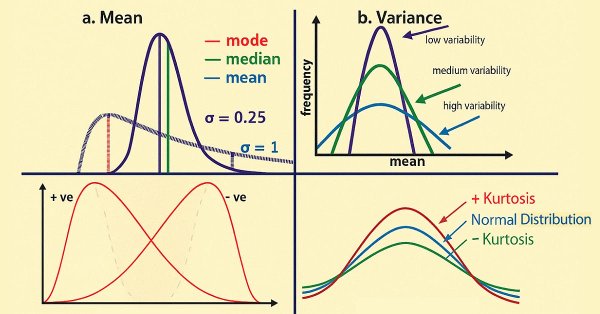

Automating Trading Strategies in MQL5 (Part 39): Statistical Mean Reversion with Confidence Intervals and Dashboard

In this article, we develop an MQL5 Expert Advisor for statistical mean reversion trading, calculating moments like mean, variance, skewness, kurtosis, and Jarque-Bera statistics over a specified period to identify non-normal distributions and generate buy/sell signals based on confidence intervals with adaptive thresholds

How can century-old functions update your trading strategies?

This article considers the Rademacher and Walsh functions. We will explore ways to apply these functions to financial time series analysis and also consider various applications for them in trading.