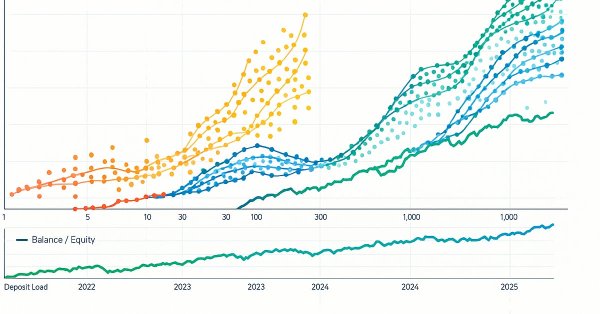

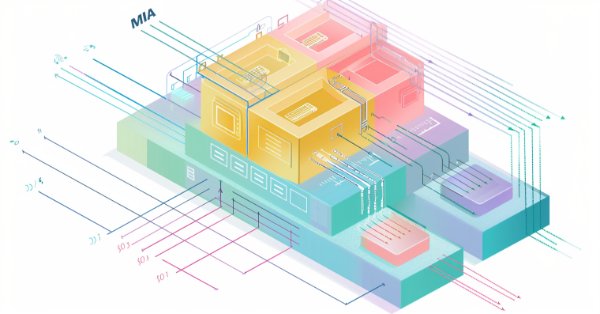

Visualizing Strategies in MQL5: Laying Out Optimization Results Across Criterion Charts

In this article, we write an example of visualizing the optimization process and display the top three passes for the four optimization criteria. We will also provide an opportunity to select one of the three best passes for displaying its data in tables and on a chart.

From Basic to Intermediate: Operator Precedence

This is definitely the most difficult question to be explained purely theoretically. That is why you need to practice everything that we're going to discuss here. While this may seem simple at first, the topic of operators can only be understood in practice combined with constant education.

From Basic to Intermediate: Overload

Perhaps this article will be the most confusing for novice programmers. As a matter of fact, here I will show that it is not always that all functions and procedures have unique names in the same code. Yes, we can easily use functions and procedures with the same name — and this is called overload.

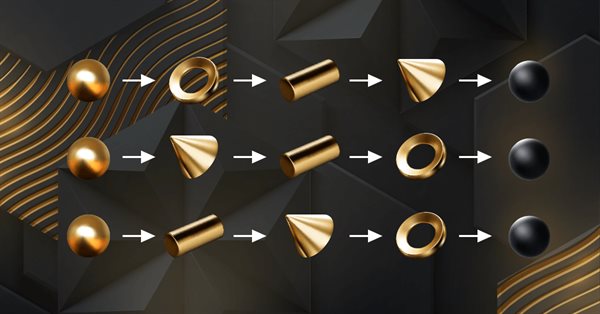

Population optimization algorithms: Whale Optimization Algorithm (WOA)

Whale Optimization Algorithm (WOA) is a metaheuristic algorithm inspired by the behavior and hunting strategies of humpback whales. The main idea of WOA is to mimic the so-called "bubble-net" feeding method, in which whales create bubbles around prey and then attack it in a spiral motion.

From Novice to Expert: Market Periods Synchronizer

In this discussion, we introduce a Higher-to-Lower Timeframe Synchronizer tool designed to solve the problem of analyzing market patterns that span across higher timeframe periods. The built-in period markers in MetaTrader 5 are often limited, rigid, and not easily customizable for non-standard timeframes. Our solution leverages the MQL5 language to develop an indicator that provides a dynamic and visual way to align higher timeframe structures within lower timeframe charts. This tool can be highly valuable for detailed market analysis. To learn more about its features and implementation, I invite you to join the discussion.

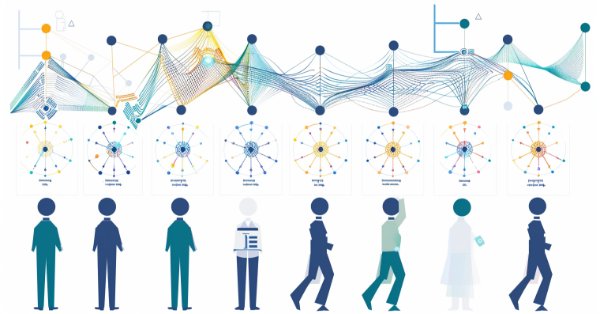

Artificial Tribe Algorithm (ATA)

The article provides a detailed discussion of the key components and innovations of the ATA optimization algorithm, which is an evolutionary method with a unique dual behavior system that adapts depending on the situation. ATA combines individual and social learning while using crossover for explorations and migration to find solutions when stuck in local optima.

Population optimization algorithms: Evolution of Social Groups (ESG)

We will consider the principle of constructing multi-population algorithms. As an example of this type of algorithm, we will have a look at the new custom algorithm - Evolution of Social Groups (ESG). We will analyze the basic concepts, population interaction mechanisms and advantages of this algorithm, as well as examine its performance in optimization problems.

DoEasy. Controls (Part 33): Vertical ScrollBar

In this article, we will continue the development of graphical elements of the DoEasy library and add vertical scrolling of form object controls, as well as some useful functions and methods that will be required in the future.

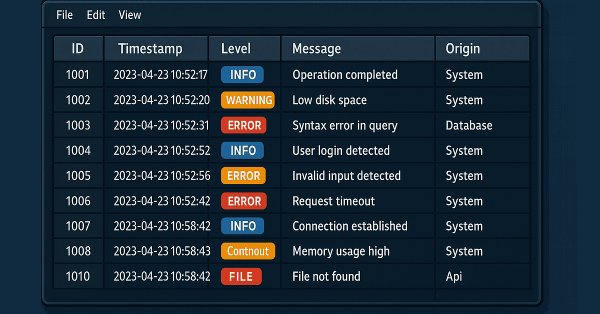

Mastering Log Records (Part 6): Saving logs to database

This article explores the use of databases to store logs in a structured and scalable way. It covers fundamental concepts, essential operations, configuration and implementation of a database handler in MQL5. Finally, it validates the results and highlights the benefits of this approach for optimization and efficient monitoring.

Developing a Replay System (Part 65): Playing the service (VI)

In this article, we will look at how to implement and solve the mouse pointer issue when using it in conjunction with a replay/simulation application. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Formulating Dynamic Multi-Pair EA (Part 6): Adaptive Spread Sensitivity for High-Frequency Symbol Switching

In this part, we will focus on designing an intelligent execution layer that continuously monitors and evaluates real-time spread conditions across multiple symbols. The EA dynamically adapts its symbol selection by enabling or disabling trading based on spread efficiency rather than fixed rules. This approach allows high-frequency multi-pair systems to prioritize cost-effective symbols.

Developing a Replay System (Part 52): Things Get Complicated (IV)

In this article, we will change the mouse pointer to enable the interaction with the control indicator to ensure reliable and stable operation.

Category Theory in MQL5 (Part 11): Graphs

This article is a continuation in a series that look at Category Theory implementation in MQL5. In here we examine how Graph-Theory could be integrated with monoids and other data structures when developing a close-out strategy to a trading system.

From Basic to Intermediate: Arrays and Strings (I)

In today's article, we'll start exploring some special data types. To begin, we'll define what a string is and explain how to use some basic procedures. This will allow us to work with this type of data, which can be interesting, although sometimes a little confusing for beginners. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Developing an MQL5 RL agent with RestAPI integration (Part 4): Organizing functions in classes in MQL5

This article discusses the transition from procedural coding to object-oriented programming (OOP) in MQL5 with an emphasis on integration with the REST API. Today we will discuss how to organize HTTP request functions (GET and POST) into classes. We will take a closer look at code refactoring and show how to replace isolated functions with class methods. The article contains practical examples and tests.

Bacterial Chemotaxis Optimization (BCO)

The article presents the original version of the Bacterial Chemotaxis Optimization (BCO) algorithm and its modified version. We will take a closer look at all the differences, with a special focus on the new version of BCOm, which simplifies the bacterial movement mechanism, reduces the dependence on positional history, and uses simpler math than the computationally heavy original version. We will also conduct the tests and summarize the results.

Overcoming The Limitation of Machine Learning (Part 4): Overcoming Irreducible Error Using Multiple Forecast Horizons

Machine learning is often viewed through statistical or linear algebraic lenses, but this article emphasizes a geometric perspective of model predictions. It demonstrates that models do not truly approximate the target but rather map it onto a new coordinate system, creating an inherent misalignment that results in irreducible error. The article proposes that multi-step predictions, comparing the model’s forecasts across different horizons, offer a more effective approach than direct comparisons with the target. By applying this method to a trading model, the article demonstrates significant improvements in profitability and accuracy without changing the underlying model.

Multiple Symbol Analysis With Python And MQL5 (Part II): Principal Components Analysis For Portfolio Optimization

Managing trading account risk is a challenge for all traders. How can we develop trading applications that dynamically learn high, medium, and low-risk modes for various symbols in MetaTrader 5? By using PCA, we gain better control over portfolio variance. I’ll demonstrate how to create applications that learn these three risk modes from market data fetched from MetaTrader 5.

Market Simulation (Part 03): A Matter of Performance

Often we have to take a step back and then move forward. In this article, we will show all the changes necessary to ensure that the Mouse and Chart Trade indicators do not break. As a bonus, we'll also cover other changes that have occurred in other header files that will be widely used in the future.

From Basic to Intermediate: Indicator (IV)

In this article, we will explore how to easily create and implement an operational approach for coloring candles. This concept is highly valued by traders. When implementing such things, care must be taken to ensure that the bars or candles retain their original appearance and do not hinder reading candle by candle.

Developing a Replay System (Part 64): Playing the service (V)

In this article, we will look at how to fix two errors in the code. However, I will try to explain them in a way that will help you, beginner programmers, understand that things don't always go as you expect. Anyway, this is an opportunity to learn. The content presented here is intended solely for educational purposes. In no way should this application be considered as a final document with any purpose other than to explore the concepts presented.

Population optimization algorithms: Binary Genetic Algorithm (BGA). Part I

In this article, we will explore various methods used in binary genetic and other population algorithms. We will look at the main components of the algorithm, such as selection, crossover and mutation, and their impact on the optimization. In addition, we will study data presentation methods and their impact on optimization results.

Population optimization algorithms: Micro Artificial immune system (Micro-AIS)

The article considers an optimization method based on the principles of the body's immune system - Micro Artificial Immune System (Micro-AIS) - a modification of AIS. Micro-AIS uses a simpler model of the immune system and simple immune information processing operations. The article also discusses the advantages and disadvantages of Micro-AIS compared to conventional AIS.

From Basic to Intermediate: Template and Typename (IV)

In this article, we will take a very close look at how to solve the problem posed at the end of the previous article. There was an attempt to create a template of such type so that to be able to create a template for data union.

Creating a Trading Administrator Panel in MQL5 (Part VII): Trusted User, Recovery and Cryptography

Security prompts, such as those triggered every time you refresh the chart, add a new pair to the chat with the Admin Panel EA, or restart the terminal, can become tedious. In this discussion, we will explore and implement a feature that tracks the number of login attempts to identify a trusted user. After a set number of failed attempts, the application will transition to an advanced login procedure, which also facilitates passcode recovery for users who may have forgotten it. Additionally, we will cover how cryptography can be effectively integrated into the Admin Panel to enhance security.

From Basic to Intermediate: Definitions (I)

In this article we will do things that many will find strange and completely out of context, but which, if used correctly, will make your learning much more fun and interesting: we will be able to build quite interesting things based on what is shown here. This will allow you to better understand the syntax of the MQL5 language. The materials provided here are for educational purposes only. It should not be considered in any way as a final application. Its purpose is not to explore the concepts presented.

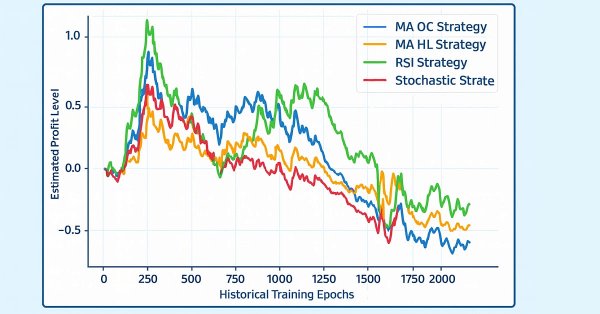

Overcoming The Limitation of Machine Learning (Part 7): Automatic Strategy Selection

This article demonstrates how to automatically identify potentially profitable trading strategies using MetaTrader 5. White-box solutions, powered by unsupervised matrix factorization, are faster to configure, more interpretable, and provide clear guidance on which strategies to retain. Black-box solutions, while more time-consuming, are better suited for complex market conditions that white-box approaches may not capture. Join us as we discuss how our trading strategies can help us carefully identify profitable strategies under any circumstance.

MQL5 Wizard Techniques you should know (Part 18): Neural Architecture Search with Eigen Vectors

Neural Architecture Search, an automated approach at determining the ideal neural network settings can be a plus when facing many options and large test data sets. We examine how when paired Eigen Vectors this process can be made even more efficient.

Market Simulation (Part 07): Sockets (I)

Sockets. Do you know what they are for or how to use them in MetaTrader 5? If the answer is no, let's start by studying them. In today's article, we'll cover the basics. Since there are several ways to do the same thing, and we are always interested in the result, I want to show that there is indeed a simple way to transfer data from MetaTrader 5 to other programs, such as Excel. However, the main idea is not to transfer data from MetaTrader 5 to Excel, but the opposite, that is, to transfer data from Excel or any other program to MetaTrader 5.

Gating mechanisms in ensemble learning

In this article, we continue our exploration of ensemble models by discussing the concept of gates, specifically how they may be useful in combining model outputs to enhance either prediction accuracy or model generalization.

MQL5 Trading Toolkit (Part 5): Expanding the History Management EX5 Library with Position Functions

Discover how to create exportable EX5 functions to efficiently query and save historical position data. In this step-by-step guide, we will expand the History Management EX5 library by developing modules that retrieve key properties of the most recently closed position. These include net profit, trade duration, pip-based stop loss, take profit, profit values, and various other important details.

Market Simulation (Part 09): Sockets (III)

Today's article is a continuation of the previous one. We will look at the implementation of an Expert Advisor, focusing mainly on how the server code is executed. The code given in the previous article is not enough to make everything work as expected, so we need to dig a little deeper into it. Therefore, it is necessary to read both articles to better understand what will happen.

The Group Method of Data Handling: Implementing the Multilayered Iterative Algorithm in MQL5

In this article we describe the implementation of the Multilayered Iterative Algorithm of the Group Method of Data Handling in MQL5.

Market Simulation (Part 08): Sockets (II)

How about creating something practical using sockets? In today's article, we'll start creating a mini-chat. Let's look together at how this is done - it will be very interesting. Please note that the code provided here is for educational purposes only. It should not be used for commercial purposes or in ready-made applications, as it does not provide data transfer security and the content transmitted over the socket can be accessed.

From Basic to Intermediate: Events (I)

Given everything that has been shown so far, I think we can now start implementing some kind of application to run some symbol directly on the chart. However, first we need to talk about a concept that can be rather confusing for beginners. Namely, it's the fact that applications developed in MQL5 and intended for display on a chart are not created in the same way as we have seen so far. In this article, we'll begin to understand this a little better.

Client in Connexus (Part 7): Adding the Client Layer

In this article we continue the development of the connexus library. In this chapter we build the CHttpClient class responsible for sending a request and receiving an order. We also cover the concept of mocks, leaving the library decoupled from the WebRequest function, which allows greater flexibility for users.

Market Simulation (Part 05): Creating the C_Orders Class (II)

In this article, I will explain how Chart Trade, together with the Expert Advisor, will process a request to close all of the users' open positions. This may sound simple, but there are a few complications that you need to know how to manage.

Eigenvectors and eigenvalues: Exploratory data analysis in MetaTrader 5

In this article we explore different ways in which the eigenvectors and eigenvalues can be applied in exploratory data analysis to reveal unique relationships in data.

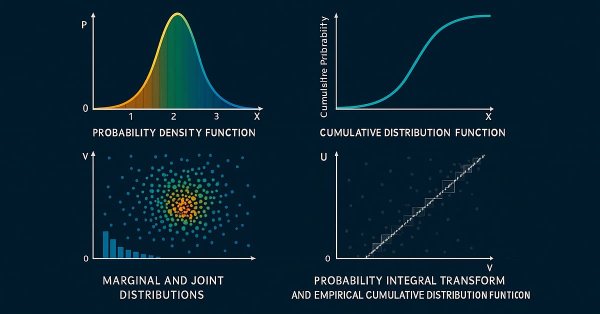

Bivariate Copulae in MQL5 (Part 1): Implementing Gaussian and Student's t-Copulae for Dependency Modeling

This is the first part of an article series presenting the implementation of bivariate copulae in MQL5. This article presents code implementing Gaussian and Student's t-copulae. It also delves into the fundamentals of statistical copulae and related topics. The code is based on the Arbitragelab Python package by Hudson and Thames.

Reimagining Classic Strategies (Part VIII): Currency Markets And Precious Metals on the USDCAD

In this series of articles, we revisit well-known trading strategies to see if we can improve them using AI. In today's discussion, join us as we test whether there is a reliable relationship between precious metals and currencies.