All about Automated Trading Championship: Interviews with the Participants'07

The published interviews of Championship 2007 bear the stamp of the results obtained during the preceding contest. The first Championship evoked a wide response on the internet and in printings. The leading developer of the MetaQuotes Software Corp. tells about changes made to the forthcoming Automated Trading Championship 2007. We put our questions to the developer of a well-known indicating complex ZUP, Eugeni Neumoin (nen) and spoke to an equity trader, Alexander Pozdnishev (AlexSilver).

From Basic to Intermediate: IF ELSE

In this article we will discuss how to work with the IF operator and its companion ELSE. This statement is the most important and significant of those existing in any programming language. However, despite its ease of use, it can sometimes be confusing if we have no experience with its use and the concepts associated with it. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

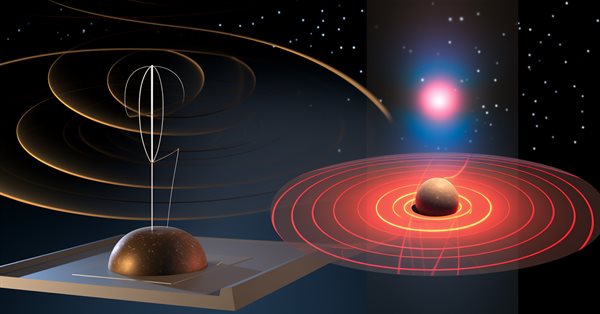

Population optimization algorithms: Spiral Dynamics Optimization (SDO) algorithm

The article presents an optimization algorithm based on the patterns of constructing spiral trajectories in nature, such as mollusk shells - the spiral dynamics optimization (SDO) algorithm. I have thoroughly revised and modified the algorithm proposed by the authors. The article will consider the necessity of these changes.

Market Simulation (Part 04): Creating the C_Orders Class (I)

In this article, we will start creating the C_Orders class to be able to send orders to the trading server. We'll do this little by little, as our goal is to explain in detail how this will happen through the messaging system.

Most notable Artificial Cooperative Search algorithm modifications (ACSm)

Here we will consider the evolution of the ACS algorithm: three modifications aimed at improving the convergence characteristics and the algorithm efficiency. Transformation of one of the leading optimization algorithms. From matrix modifications to revolutionary approaches regarding population formation.

From Basic to Intermediate: Struct (I)

Today we will begin to study structures in a simpler, more practical, and comfortable way. Structures are among the foundations of programming, whether they are structured or not. I know many people think of structures as just collections of data, but I assure you that they are much more than just structures. And here we will begin to explore this new universe in the most didactic way.

Requesting in Connexus (Part 6): Creating an HTTP Request and Response

In this sixth article of the Connexus library series, we will focus on a complete HTTP request, covering each component that makes up a request. We will create a class that represents the request as a whole, which will help us bring together the previously created classes.

Developing a Replay System (Part 33): Order System (II)

Today we will continue to develop the order system. As you will see, we will be massively reusing what has already been shown in other articles. Nevertheless, you will receive a small reward in this article. First, we will develop a system that can be used with a real trading server, both from a demo account or from a real one. We will make extensive use of the MetaTrader 5 platform, which will provide us with all the necessary support from the beginning.

Developing a Replay System (Part 69): Getting the Time Right (II)

Today we will look at why we need the iSpread feature. At the same time, we will understand how the system informs us about the remaining time of the bar when there is not a single tick available for it. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Feature Engineering With Python And MQL5 (Part III): Angle Of Price (2) Polar Coordinates

In this article, we take our second attempt to convert the changes in price levels on any market, into a corresponding change in angle. This time around, we selected a more mathematically sophisticated approach than we selected in our first attempt, and the results we obtained suggest that our change in approach may have been the right decision. Join us today, as we discuss how we can use Polar coordinates to calculate the angle formed by changes in price levels, in a meaningful way, regardless of which market you are analyzing.

From Basic to Intermediate: Array (IV)

In this article, we'll look at how you can do something very similar to what's implemented in languages like C, C++, and Java. I am talking about passing a virtually infinite number of parameters inside a function or procedure. While this may seem like a fairly advanced topic, in my opinion, what will be shown here can be easily implemented by anyone who has understood the previous concepts. Provided that they were really properly understood.

Mastering Log Records (Part 4): Saving logs to files

In this article, I will teach you basic file operations and how to configure a flexible handler for customization. We will update the CLogifyHandlerFile class to write logs directly to the file. We will conduct a performance test by simulating a strategy on EURUSD for a week, generating logs at each tick, with a total time of 5 minutes and 11 seconds. The result will be compared in a future article, where we will implement a caching system to improve performance.

Price Action Analysis Toolkit Development (Part 61): Structural Slanted Trendline Breakouts with 3-Swing Validation

We present a slanted trendline breakout tool that relies on three‑swing validation to generate objective, price‑action signals. The system automates swing detection, trendline construction, and breakout confirmation using crossing logic to reduce noise and standardize execution. The article explains the strategy rules, shows the MQL5 implementation, and reviews testing results; the tool is intended for analysis and signal confirmation, not automated trading.

From Basic to Intermediate: Passing by Value or by Reference

In this article, we will practically understand the difference between passing by value and passing by reference. Although this seems like something simple and common and not causing any problems, many experienced programmers often face real failures in working on the code precisely because of this small detail. Knowing when, how, and why to use pass by value or pass by reference will make a huge difference in our lives as programmers. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Post-Factum trading analysis: Selecting trailing stops and new stop levels in the strategy tester

We continue the topic of analyzing completed deals in the strategy tester to improve the quality of trading. Let's see how using different trailing stops can change our existing trading results.

From Basic to Intermediate: Template and Typename (III)

In this article, we will discuss the first part of the topic, which is not so easy for beginners to understand. In order not to get even more confused and to explain this topic correctly, we will divide the explanation into stages. We will devote this article to the first stage. However, although at the end of the article it may seem that we have reached the deadlock, in fact we will take a step towards another situation, which will be better understood in the next article.

All about Automated Trading Championship: Additional Materials of Championships 2006-2007

We present to you a selection of these materials that are divided into several parts. The present one contains additional materials about automated trading, Expert Advisors development, etc.

From Basic to Intermediate: Arrays and Strings (II)

In this article I will show that although we are still at a very basic stage of programming, we can already implement some interesting applications. In this case, we will create a fairly simple password generator. This way we will be able to apply some of the concepts that have been explained so far. In addition, we will look at how solutions can be developed for some specific problems.

Anarchic Society Optimization (ASO) algorithm

In this article, we will get acquainted with the Anarchic Society Optimization (ASO) algorithm and discuss how an algorithm based on the irrational and adventurous behavior of participants in an anarchic society (an anomalous system of social interaction free from centralized power and various kinds of hierarchies) is able to explore the solution space and avoid the traps of local optimum. The article presents a unified ASO structure applicable to both continuous and discrete problems.

Self Optimizing Expert Advisor With MQL5 And Python (Part VI): Taking Advantage of Deep Double Descent

Traditional machine learning teaches practitioners to be vigilant not to overfit their models. However, this ideology is being challenged by new insights published by diligent researches from Harvard, who have discovered that what appears to be overfitting may in some circumstances be the results of terminating your training procedures prematurely. We will demonstrate how we can use the ideas published in the research paper, to improve our use of AI in forecasting market returns.

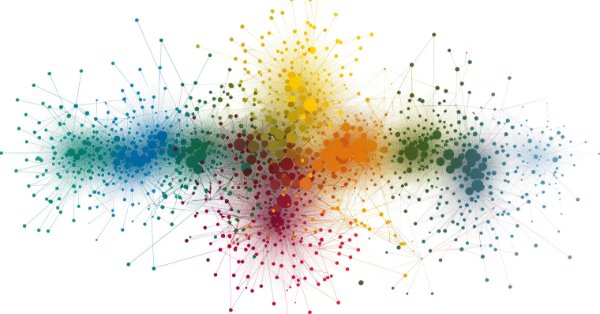

Hybridization of population algorithms. Sequential and parallel structures

Here we will dive into the world of hybridization of optimization algorithms by looking at three key types: strategy mixing, sequential and parallel hybridization. We will conduct a series of experiments combining and testing relevant optimization algorithms.

Creating a Trading Administrator Panel in MQL5 (Part XI): Modern feature communications interface (I)

Today, we are focusing on the enhancement of the Communications Panel messaging interface to align with the standards of modern, high-performing communication applications. This improvement will be achieved by updating the CommunicationsDialog class. Join us in this article and discussion as we explore key insights and outline the next steps in advancing interface programming using MQL5.

An introduction to Receiver Operating Characteristic curves

ROC curves are graphical representations used to evaluate the performance of classifiers. Despite ROC graphs being relatively straightforward, there exist common misconceptions and pitfalls when using them in practice. This article aims to provide an introduction to ROC graphs as a tool for practitioners seeking to understand classifier performance evaluation.

Creating a Trading Administrator Panel in MQL5 (Part X): External resource-based interface

Today, we are harnessing the capabilities of MQL5 to utilize external resources—such as images in the BMP format—to create a uniquely styled home interface for the Trading Administrator Panel. The strategy demonstrated here is particularly useful when packaging multiple resources, including images, sounds, and more, for streamlined distribution. Join us in this discussion as we explore how these features are implemented to deliver a modern and visually appealing interface for our New_Admin_Panel EA.

Causal analysis of time series using transfer entropy

In this article, we discuss how statistical causality can be applied to identify predictive variables. We will explore the link between causality and transfer entropy, as well as present MQL5 code for detecting directional transfers of information between two variables.

Ordinal Encoding for Nominal Variables

In this article, we discuss and demonstrate how to convert nominal predictors into numerical formats that are suitable for machine learning algorithms, using both Python and MQL5.

All about Automated Trading Championship: Interviews with the Participants'06

Interviews with the Participants of Automated Trading Championship 2006 demonstrated a great variety of views of automated trading and trading as a whole. You can see yourselves which ideas turned out to work better during the Championship and which of them could not pass the critical verification through a three-month long "test-drive" on a contest account.

Overcoming The Limitation of Machine Learning (Part 1): Lack of Interoperable Metrics

There is a powerful and pervasive force quietly corrupting the collective efforts of our community to build reliable trading strategies that employ AI in any shape or form. This article establishes that part of the problems we face, are rooted in blind adherence to "best practices". By furnishing the reader with simple real-world market-based evidence, we will reason to the reader why we must refrain from such conduct, and rather adopt domain-bound best practices if our community should stand any chance of recovering the latent potential of AI.

Visual assessment and adjustment of trading in MetaTrader 5

The strategy tester allows you to do more than just optimize your trading robot's parameters. I will show how to evaluate your account's trading history post-factum and make adjustments to your trading in the tester by changing the stop-losses of your open positions.

From Basic to Intermediate: Variables (II)

Today we will look at how to work with static variables. This question often confuses many programmers, both beginners and those with some experience, because there are several recommendations that must be followed when using this mechanism. The materials presented here are intended for didactic purposes only. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

The MQL5 Standard Library Explorer (Part 2): Connecting Library Components

Today, we take an important step toward helping every developer understand how to read class structures and quickly build Expert Advisors using the MQL5 Standard Library. The library is rich and expandable, yet it can feel like being handed a complex toolkit without a manual. Here we share and discuss an alternative integration routine—a concise, repeatable workflow that shows how to connect classes reliably in real projects.

Method of Determining Errors in Code by Commenting

The article describes a method of searching the errors in the MQL4 code that is based on commenting. This method is found to be a useful one in case of problems occuring during the compilation caused by the errors in a reasonably large code.

From Basic to Intermediate: Arrays and Strings (III)

This article considers two aspects. First, how the standard library can convert binary values to other representations such as octal, decimal, and hexadecimal. Second, we will talk about how we can determine the width of our password based on the secret phrase, using the knowledge we have already acquired.

Overcoming The Limitation of Machine Learning (Part 9): Correlation-Based Feature Learning in Self-Supervised Finance

Self-supervised learning is a powerful paradigm of statistical learning that searches for supervisory signals generated from the observations themselves. This approach reframes challenging unsupervised learning problems into more familiar supervised ones. This technology has overlooked applications for our objective as a community of algorithmic traders. Our discussion, therefore, aims to give the reader an approachable bridge into the open research area of self-supervised learning and offers practical applications that provide robust and reliable statistical models of financial markets without overfitting to small datasets.

Developing a Replay System (Part 68): Getting the Time Right (I)

Today we will continue working on getting the mouse pointer to tell us how much time is left on a bar during periods of low liquidity. Although at first glance it seems simple, in reality this task is much more difficult. This involves some obstacles that we will have to overcome. Therefore, it is important that you have a good understanding of the material in this first part of this subseries in order to understand the following parts.

Brain Storm Optimization algorithm (Part I): Clustering

In this article, we will look at an innovative optimization method called BSO (Brain Storm Optimization) inspired by a natural phenomenon called "brainstorming". We will also discuss a new approach to solving multimodal optimization problems the BSO method applies. It allows finding multiple optimal solutions without the need to pre-determine the number of subpopulations. We will also consider the K-Means and K-Means++ clustering methods.

Overcoming The Limitation of Machine Learning (Part 2): Lack of Reproducibility

The article explores why trading results can differ significantly between brokers, even when using the same strategy and financial symbol, due to decentralized pricing and data discrepancies. The piece helps MQL5 developers understand why their products may receive mixed reviews on the MQL5 Marketplace, and urges developers to tailor their approaches to specific brokers to ensure transparent and reproducible outcomes. This could grow to become an important domain-bound best practice that will serve our community well if the practice were to be widely adopted.

Reimagining Classic Strategies (Part 14): High Probability Setups

High probability Setups are well known in our trading community, but regrettably they are not well-defined. In this article, we will aim to find an empirical and algorithmic way of defining exactly what is a high probability setup, identifying and exploiting them. By using Gradient Boosting Trees, we demonstrated how the reader can improve the performance of an arbitrary trading strategy and better communicate the exact job to be done to our computer in a more meaningful and explicit manner.

Integrating MQL5 with data processing packages (Part 3): Enhanced Data Visualization

In this article, we will perform Enhanced Data Visualization by going beyond basic charts by incorporating features like interactivity, layered data, and dynamic elements, enabling traders to explore trends, patterns, and correlations more effectively.

Applying Localized Feature Selection in Python and MQL5

This article explores a feature selection algorithm introduced in the paper 'Local Feature Selection for Data Classification' by Narges Armanfard et al. The algorithm is implemented in Python to build binary classifier models that can be integrated with MetaTrader 5 applications for inference.