StringFormat(). Review and ready-made examples

The article continues the review of the PrintFormat() function. We will briefly look at formatting strings using StringFormat() and their further use in the program. We will also write templates to display symbol data in the terminal journal. The article will be useful for both beginners and experienced developers.

Price Action Analysis Toolkit Development (Part 5): Volatility Navigator EA

Determining market direction can be straightforward, but knowing when to enter can be challenging. As part of the series titled "Price Action Analysis Toolkit Development", I am excited to introduce another tool that provides entry points, take profit levels, and stop loss placements. To achieve this, we have utilized the MQL5 programming language. Let’s delve into each step in this article.

Example of Auto Optimized Take Profits and Indicator Parameters with SMA and EMA

This article presents a sophisticated Expert Advisor for forex trading, combining machine learning with technical analysis. It focuses on trading Apple stock, featuring adaptive optimization, risk management, and multiple strategies. Backtesting shows promising results with high profitability but also significant drawdowns, indicating potential for further refinement.

Two-Stage Modification of Opened Positions

The two-stage approach allows you to avoid the unnecessary closing and re-opening of positions in situations close to the trend and in cases of possible occurrence of divirgence.

Raw Code Optimization and Tweaking for Improving Back-Test Results

Enhance your MQL5 code by optimizing logic, refining calculations, and reducing execution time to improve back-test accuracy. Fine-tune parameters, optimize loops, and eliminate inefficiencies for better performance.

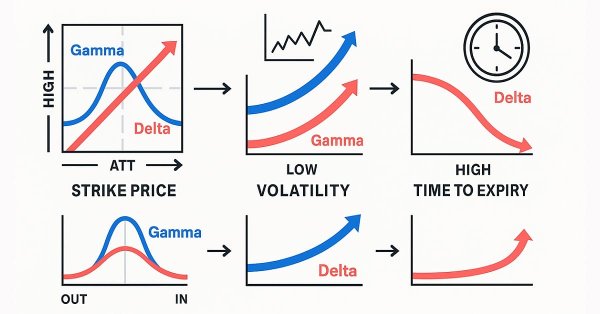

Black-Scholes Greeks: Gamma and Delta

Gamma and Delta measure how an option’s value reacts to changes in the underlying asset’s price. Delta represents the rate of change of the option’s price relative to the underlying, while Gamma measures how Delta itself changes as price moves. Together, they describe an option’s directional sensitivity and convexity—critical for dynamic hedging and volatility-based trading strategies.

MQL5 Trading Toolkit (Part 2): Expanding and Implementing the Positions Management EX5 Library

Learn how to import and use EX5 libraries in your MQL5 code or projects. In this continuation article, we will expand the EX5 library by adding more position management functions to the existing library and creating two Expert Advisors. The first example will use the Variable Index Dynamic Average Technical Indicator to develop a trailing stop trading strategy expert advisor, while the second example will utilize a trade panel to monitor, open, close, and modify positions. These two examples will demonstrate how to use and implement the upgraded EX5 position management library.

DoEasy. Controls (Part 23): Improving TabControl and SplitContainer WinForms objects

In this article, I will add new mouse events relative to the boundaries of the working areas of WinForms objects and fix some shortcomings in the functioning of the TabControl and SplitContainer controls.

Graphical Interfaces X: Updates for the Rendered table and code optimization (build 10)

We continue to complement the Rendered table (CCanvasTable) with new features. The table will now have: highlighting of the rows when hovered; ability to add an array of icons for each cell and a method for switching them; ability to set or modify the cell text during the runtime, and more.

Simplifying Databases in MQL5 (Part 1): Introduction to Databases and SQL

We explore how to manipulate databases in MQL5 using the language's native functions. We cover everything from table creation, insertion, updating, and deletion to data import and export, all with sample code. The content serves as a solid foundation for understanding the internal mechanics of data access, paving the way for the discussion of ORM, where we'll build one in MQL5.

Integrating ML models with the Strategy Tester (Conclusion): Implementing a regression model for price prediction

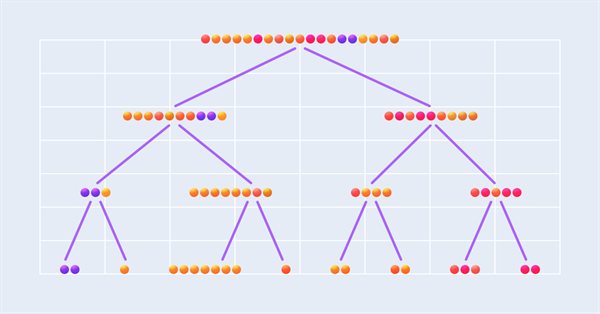

This article describes the implementation of a regression model based on a decision tree. The model should predict prices of financial assets. We have already prepared the data, trained and evaluated the model, as well as adjusted and optimized it. However, it is important to note that this model is intended for study purposes only and should not be used in real trading.

Price Action Analysis Toolkit Development (Part 20): External Flow (IV) — Correlation Pathfinder

Correlation Pathfinder offers a fresh approach to understanding currency pair dynamics as part of the Price Action Analysis Toolkit Development Series. This tool automates data collection and analysis, providing insight into how pairs like EUR/USD and GBP/USD interact. Enhance your trading strategy with practical, real-time information that helps you manage risk and spot opportunities more effectively.

Master MQL5 from beginner to pro (Part IV): About Arrays, Functions and Global Terminal Variables

The article is a continuation of the series for beginners. It covers in detail data arrays, the interaction of data and functions, as well as global terminal variables that allow data exchange between different MQL5 programs.

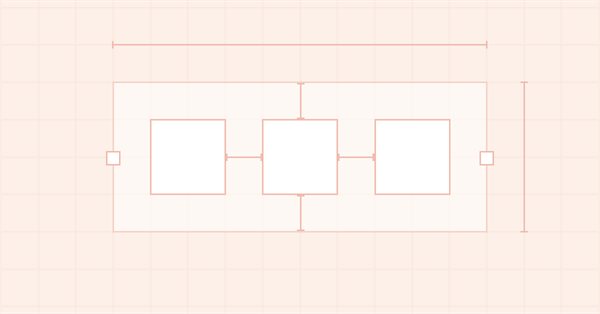

DoEasy. Controls (Part 5): Base WinForms object, Panel control, AutoSize parameter

In the article, I will create the base object of all library WinForms objects and start implementing the AutoSize property of the Panel WinForms object — auto sizing for fitting the object internal content.

Moving to MQL5 Algo Forge (Part 1): Creating the Main Repository

When working on projects in MetaEditor, developers often face the need to manage code versions. MetaQuotes recently announced migration to GIT and the launch of MQL5 Algo Forge with code versioning and collaboration capabilities. In this article, we will discuss how to use the new and previously existing tools more efficiently.

Self Optimizing Expert Advisor with MQL5 And Python (Part III): Cracking The Boom 1000 Algorithm

In this series of articles, we discuss how we can build Expert Advisors capable of autonomously adjusting themselves to dynamic market conditions. In today's article, we will attempt to tune a deep neural network to Deriv's synthetic markets.

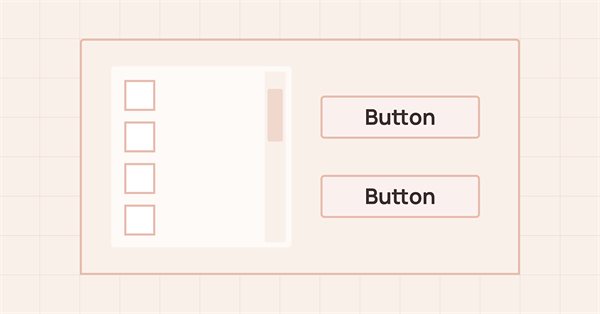

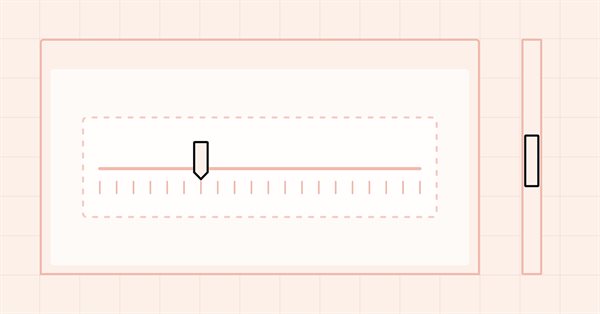

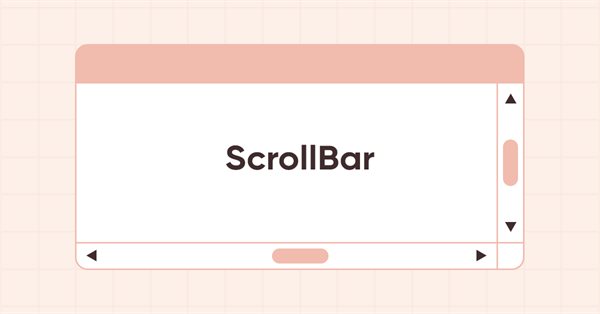

DoEasy. Controls (Part 29): ScrollBar auxiliary control

In this article, I will start developing the ScrollBar auxiliary control element and its derivative objects — vertical and horizontal scrollbars. A scrollbar is used to scroll the content of the form if it goes beyond the container. Scrollbars are usually located at the bottom and to the right of the form. The horizontal one at the bottom scrolls content left and right, while the vertical one scrolls up and down.

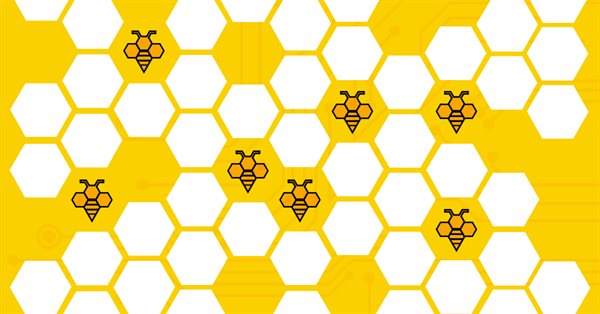

Population optimization algorithms: Artificial Bee Colony (ABC)

In this article, we will study the algorithm of an artificial bee colony and supplement our knowledge with new principles of studying functional spaces. In this article, I will showcase my interpretation of the classic version of the algorithm.

From Novice to Expert: Animated News Headline Using MQL5 (II)

Today, we take another step forward by integrating an external news API as the source of headlines for our News Headline EA. In this phase, we’ll explore various news sources—both established and emerging—and learn how to access their APIs effectively. We'll also cover methods for parsing the retrieved data into a format optimized for display within our Expert Advisor. Join the discussion as we explore the benefits of accessing news headlines and the economic calendar directly on the chart, all within a compact, non-intrusive interface.

Price Action Analysis Toolkit Development (Part 2): Analytical Comment Script

Aligned with our vision of simplifying price action, we are pleased to introduce another tool that can significantly enhance your market analysis and help you make well-informed decisions. This tool displays key technical indicators such as previous day's prices, significant support and resistance levels, and trading volume, while automatically generating visual cues on the chart.

Population optimization algorithms: Stochastic Diffusion Search (SDS)

The article discusses Stochastic Diffusion Search (SDS), which is a very powerful and efficient optimization algorithm based on the principles of random walk. The algorithm allows finding optimal solutions in complex multidimensional spaces, while featuring a high speed of convergence and the ability to avoid local extrema.

DRAW_ARROW drawing type in multi-symbol multi-period indicators

In this article, we will look at drawing arrow multi-symbol multi-period indicators. We will also improve the class methods for correct display of arrows showing data from arrow indicators calculated on a symbol/period that does not correspond to the symbol/period of the current chart.

Price Action Analysis Toolkit Development (Part 50): Developing the RVGI, CCI and SMA Confluence Engine in MQL5

Many traders struggle to identify genuine reversals. This article presents an EA that combines RVGI, CCI (±100), and an SMA trend filter to produce a single clear reversal signal. The EA includes an on-chart panel, configurable alerts, and the full source file for immediate download and testing.

Monitoring trading with push notifications — example of a MetaTrader 5 service

In this article, we will look at creating a service app for sending notifications to a smartphone about trading results. We will learn how to handle lists of Standard Library objects to organize a selection of objects by required properties.

Moving to MQL5 Algo Forge (Part 4): Working with Versions and Releases

We'll continue developing the Simple Candles and Adwizard projects, while also describing the finer aspects of using the MQL5 Algo Forge version control system and repository.

Understand and efficiently use OpenCL API by recreating built-in support as DLL on Linux (Part 1): Motivation and validation

Bulit-in OpenCL support in MetaTrader 5 still has a major problem especially the one about device selection error 5114 resulting from unable to create an OpenCL context using CL_USE_GPU_ONLY, or CL_USE_GPU_DOUBLE_ONLY although it properly detects GPU. It works fine with directly using of ordinal number of GPU device we found in Journal tab, but that's still considered a bug, and users should not hard-code a device. We will solve it by recreating an OpenCL support as DLL with C++ on Linux. Along the journey, we will get to know OpenCL from concept to best practices in its API usage just enough for us to put into great use later when we deal with DLL implementation in C++ and consume it with MQL5.

Timeseries in DoEasy library (part 50): Multi-period multi-symbol standard indicators with a shift

In the article, let’s improve library methods for correct display of multi-symbol multi-period standard indicators, which lines are displayed on the current symbol chart with a shift set in the settings. As well, let’s put things in order in methods of work with standard indicators and remove the redundant code to the library area in the final indicator program.

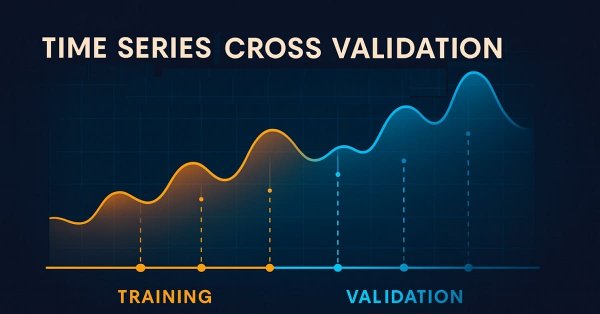

Overcoming The Limitation of Machine Learning (Part 5): A Quick Recap of Time Series Cross Validation

In this series of articles, we look at the challenges faced by algorithmic traders when deploying machine-learning-powered trading strategies. Some challenges within our community remain unseen because they demand deeper technical understanding. Today’s discussion acts as a springboard toward examining the blind spots of cross-validation in machine learning. Although often treated as routine, this step can easily produce misleading or suboptimal results if handled carelessly. This article briefly revisits the essentials of time series cross-validation to prepare us for more in-depth insight into its hidden blind spots.

Population optimization algorithms: Firefly Algorithm (FA)

In this article, I will consider the Firefly Algorithm (FA) optimization method. Thanks to the modification, the algorithm has turned from an outsider into a real rating table leader.

How to Use Crashlogs to Debug Your Own DLLs

25 to 30% of all crashlogs received from users appear due to errors occurring when functions imported from custom dlls are executed.

Deconstructing examples of trading strategies in the client terminal

The article uses block diagrams to examine the logic of the candlestick-based training EAs located in the Experts\Free Robots folder of the terminal.

Implementing the SHA-256 Cryptographic Algorithm from Scratch in MQL5

Building DLL-free cryptocurrency exchange integrations has long been a challenge, but this solution provides a complete framework for direct market connectivity.

How to view deals directly on the chart without weltering in trading history

In this article, we will create a simple tool for convenient viewing of positions and deals directly on the chart with key navigation. This will allow traders to visually examine individual deals and receive all the information about trading results right on the spot.

Developing a trading Expert Advisor from scratch (Part 25): Providing system robustness (II)

In this article, we will make the final step towards the EA's performance. So, be prepared for a long read. To make our Expert Advisor reliable, we will first remove everything from the code that is not part of the trading system.

Understand and Efficiently use OpenCL API by Recreating built-in support as DLL on Linux (Part 2): OpenCL Simple DLL implementation

Continued from the part 1 in the series, now we proceed to implement as a simple DLL then test with MetaTrader 5. This will prepare us well before developing a full-fledge OpenCL as DLL support in the following part to come.

Price Action Analysis Toolkit Development (Part 29): Boom and Crash Interceptor EA

Discover how the Boom & Crash Interceptor EA transforms your charts into a proactive alert system-spotting explosive moves with lightning-fast velocity scans, volatility surge checks, trend confirmation, and pivot-zone filters. With crisp green “Boom” and red “Crash” arrows guiding your every decision, this tool cuts through the noise and lets you capitalize on market spikes like never before. Dive in to see how it works and why it can become your next essential edge.

DoEasy. Controls (Part 30): Animating the ScrollBar control

In this article, I will continue the development of the ScrollBar control and start implementing the mouse interaction functionality. In addition, I will expand the lists of mouse state flags and events.

Using PSAR, Heiken Ashi, and Deep Learning Together for Trading

This project explores the fusion of deep learning and technical analysis to test trading strategies in forex. A Python script is used for rapid experimentation, employing an ONNX model alongside traditional indicators like PSAR, SMA, and RSI to predict EUR/USD movements. A MetaTrader 5 script then brings this strategy into a live environment, using historical data and technical analysis to make informed trading decisions. The backtesting results indicate a cautious yet consistent approach, with a focus on risk management and steady growth rather than aggressive profit-seeking.

Robustness Testing on Expert Advisors

In strategy development, there are many intricate details to consider, many of which are not highlighted for beginner traders. As a result, many traders, myself included, have had to learn these lessons the hard way. This article is based on my observations of common pitfalls that most beginner traders encounter when developing strategies on MQL5. It will offer a range of tips, tricks, and examples to help identify the disqualification of an EA and test the robustness of our own EAs in an easy-to-implement way. The goal is to educate readers, helping them avoid future scams when purchasing EAs as well as preventing mistakes in their own strategy development.

Population optimization algorithms: Cuckoo Optimization Algorithm (COA)

The next algorithm I will consider is cuckoo search optimization using Levy flights. This is one of the latest optimization algorithms and a new leader in the leaderboard.