MetaTrader 5 features hedging position accounting system

The MetaTrader 5 platform was originally designed for trading within the netting position accounting system. The netting system allows having only one position per financial instrument meaning that all further operations at that instrument lead only to closing, reversal or changing the volume of the already existing position. In order to expand possibilities of retail Forex traders, we have added the second accounting system — hedging. Now, it is possible to have multiple positions per symbol, including oppositely directed ones. This paves the way to implementing trading strategies based on the so-called "locking" — if the price moves against a trader, they can open a position in the opposite direction.

Since the new system is similar to the one used in MetaTrader 4, it will be familiar to traders. At the same time, traders will be able to enjoy all the advantages of the fifth platform version — filling orders using multiple deals (including partial fills), multicurrency and multithreaded tester with support for MQL5 Cloud Network, and much more.

Now, you can use one account to trade the markets that adhere to the netting system and allow having only one position per instrument, and use another account in the same platform to trade Forex and apply hedging.

This article describes the netting and hedging systems in details, as well as sheds light on the changes related to the implementation of the second accounting system.

Position accounting depends on a trading account

A position accounting system is set at an account level and displayed in the terminal window header and the Journal:

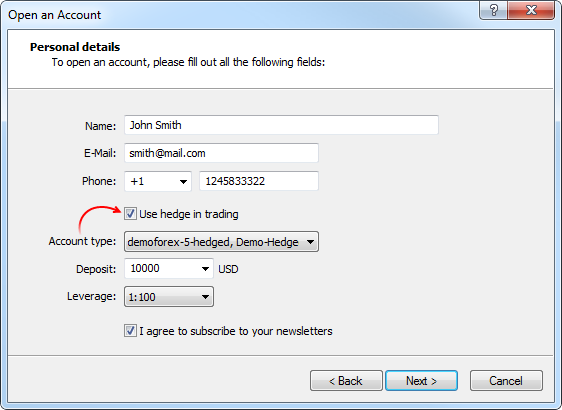

To open a demo account with hedging, enable the appropriate option:

To open a real account with hedging, contact your broker.

Netting system

With this system, you can have only one common position for a symbol at the same time:

- If there is an open position for a symbol, executing a deal in the same direction increases the volume of this position.

- If a deal is executed in the opposite direction, the volume of the existing position can be decreased, the position can be closed (when the deal volume is equal to the position volume) or reversed (if the volume of the opposite deal is greater than the current position).

It does not matter, what has caused the opposite deal — an executed market order or a triggered pending order.

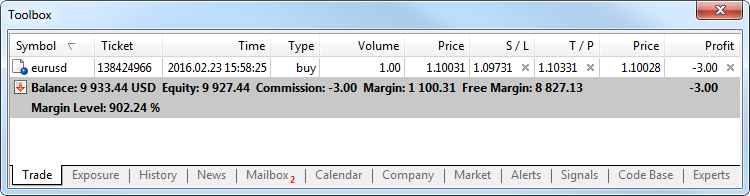

The below example shows execution of two EURUSD Buy deals 0.5 lots each:

Execution of both deals resulted in one common position of 1 lot.

Hedging system

With this system, you can have multiple open positions of one and the same symbol, including opposite positions.

If you have an open position for a symbol, and execute a new deal (or a pending order triggers), a new position is additionally opened. Your current position does not change.

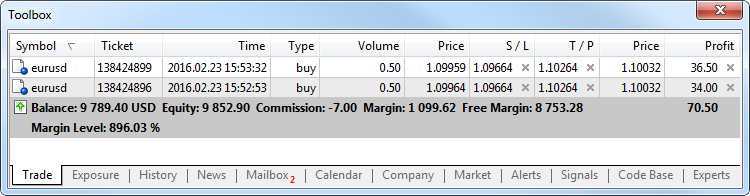

The below example shows execution of two EURUSD Buy deals 0.5 lots each:

Execution of these deals resulted in opening two separate positions.

Impact of the system selected

Depending on the position accounting system, some of the platform functions may have different behavior:

- Stop Loss and Take Profit inheritance rules change.

- To close a position in the netting system, you should perform an opposite trading operation for the same symbol and the same volume. To close a position in the hedging system, explicitly select the "Close Position" command in the context menu of the position.

- A position cannot be reversed in the hedging system. In this case, the current position is closed and a new one with the remaining volume is opened.

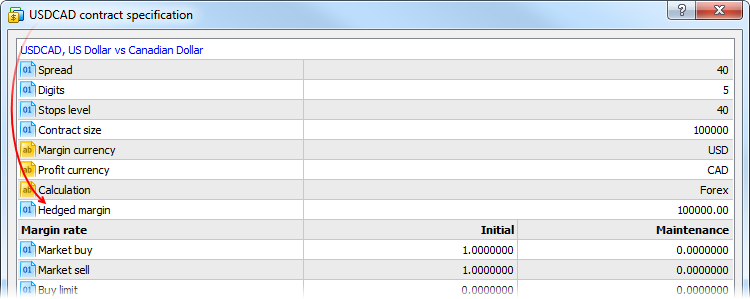

- In the hedging system, a new condition for margin calculation is available — Hedged margin.

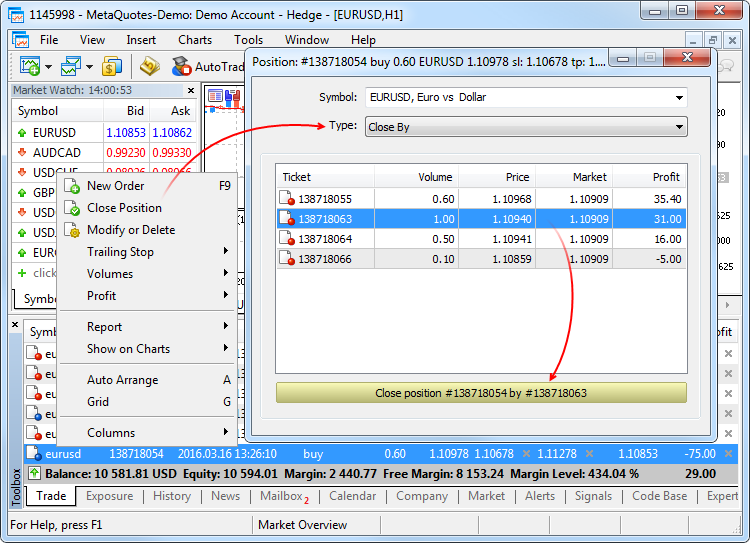

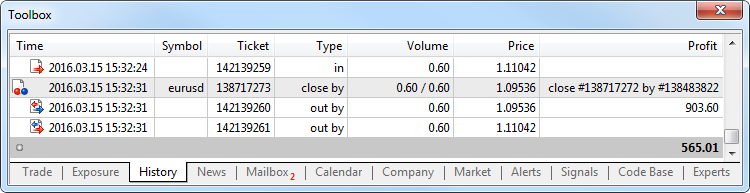

New trade operation type - Close By

The new trade operation type has been added for hedging accounts — closing a position by an opposite one. This operation allows closing two oppositely directed positions at a single symbol. If the opposite positions have different numbers of lots, only one order of the two remains open. Its volume will be equal to the difference of lots of the closed positions, while the position direction and open price will match (by volume) the greater of the closed positions.

Compared with a single closure of the two positions, the closing by an opposite position allows traders to save one spread:

- In case of a single closing, traders have to pay a spread twice: when closing a buy position at a lower price (Bid) and closing a sell position at a higher one (Ask).

- When using an opposite position, an open price of the second position is used to close the first one, while an open price of the first position is used to close the second one.

In the latter case, a "close by" order is placed. Tickets of closed positions are specified in its comment. A pair of opposite positions is closed by two "out by" deals. Total profit/loss resulting from closing the both positions is specified only in one deal.

Margin calculation in the hedging system of position accounting

If the hedging position accounting system is used, the margin is calculated using the same formulas and principles as described above. However, there are some additional features for multiple positions of the same symbol.

Positions/orders open in the same direction

Their volumes are summed up and the weighted average open price is calculated for them. The resulting values are used for calculating margin by the formula corresponding to the symbol type.

For pending orders (if the margin ratio is non-zero), margin is calculated separately.

Opposite positions/orders

Oppositely directed open positions of the same symbol are considered hedged or covered. Two margin calculation methods are possible for such positions. The calculation method is determined by the broker.

| Basic calculation | Using the larger leg |

|---|---|

| Used if "calculate using larger leg" is not specified in the "Hedged margin" field of contract specification. The calculation consists of several steps:

Calculation for uncovered volume

Calculation for covered volume Used if the "Hedged margin" value is specified in a contract specification. In this case margin is charged for hedged, as well as uncovered volume. If the initial margin is specified for a symbol, the hedged margin is specified as an absolute value (in monetary terms). If the initial margin is not specified (equal to 0), the contract size is specified in the "Hedged" field. The margin is calculated by the appropriate formula in accordance with the type of the financial instrument, using the specified contract size. For example, we have two positions Buy EURUSD 1 lot and Sell EURUSD 1 lot, the contract size is 100,000. If the value of 100,000 is specified in the "Hedged field", the margin for the two positions will be calculated as per 1 lot. If you specify 0, no margin is charged for the hedged (covered) volume. Per each hedged lot of a position, the margin is charged in accordance with the value specified in the "Hedged Margin" field in the contract specification:

Calculation for pending orders

| Used if "calculate using larger leg" is specified in the "Hedged margin" field of contract specification.

|

Changes in MQL5

Now, each position has its unique ticket. It usually corresponds to the ticket of an order used to open the position. A ticket is assigned automatically to all available positions after the terminal update.

MqlTradeRequest

MqlTradeRequest features two new fields:

- position — position ticket. Fill it when changing and closing a position for its clear identification. It usually matches the ticket of an order used to open the position.

- position_by — opposite position ticket. It is used when closing a position by an opposite one (opened at the same symbol but in the opposite direction).

struct MqlTradeRequest { ENUM_TRADE_REQUEST_ACTIONS action; // Performed action type ulong magic; // Expert Advisor magic number ulong order; // Order ticket string symbol; // Symbol name double volume; // Requested deal volume in lots double price; // Price double stoplimit; // Stop Limit order level double sl; // Stop Loss order level double tp; // Take Profit order level ulong deviation; // Maximum allowable deviation from the requested price ENUM_ORDER_TYPE type; // Order type ENUM_ORDER_TYPE_FILLING type_filling; // Order filling type ENUM_ORDER_TYPE_TIME type_time; // Order time type datetime expiration; // Order expiration date (for ORDER_TIME_SPECIFIED type orders) string comment; // Order comment ulong position; // Position ticket ulong position_by; // Opposite position ticket };

MqlTradeTransaction

MqlTradeTransaction also features the two similar fields:

- position — ticket of a position affected by transaction. It is filled for transactions related to handling market orders (TRADE_TRANSACTION_ORDER_* except TRADE_TRANSACTION_ORDER_ADD, where a position ticket is not assigned yet) and order history (TRADE_TRANSACTION_HISTORY_*).

- position_by — opposite position ticket. It is used when closing a position by an opposite one (opened at the same symbol but in the opposite direction). It is filled only for orders closing a position by an opposite one (close by) and deals closing by an opposite one (out by).

struct MqlTradeTransaction { ulong deal; // Deal ticket ulong order; // Order ticket string symbol; // Symbol name ENUM_TRADE_TRANSACTION_TYPE type; // Transaction type ENUM_ORDER_TYPE order_type; // Order type ENUM_ORDER_STATE order_state; // Order state ENUM_DEAL_TYPE deal_type; // Deal type ENUM_ORDER_TYPE_TIME time_type; // Order time type datetime time_expiration; // Order expiration date double price; // Price double price_trigger; // Stop limit order trigger price double price_sl; // Stop Loss level double price_tp; // Take Profit level double volume; // Volume in lots ulong position; // Position tickets ulong position_by; // Opposite position tickets };

PositionGetTicket

The new PositionGetTicket function returns a position ticket by an index in the list of open positions and automatically selects that position for further work using the PositionGetDouble, PositionGetInteger, and PositionGetString functions.

ulong PositionGetTicket( int index // index in the list of positions );

PositionSelectByTicket

The new PositionSelectByTicket function selects an open position for further work by a specified ticket.

bool PositionSelectByTicket( ulong ticket // position ticket );

PositionSelect

PositionSelect selects a position by a symbol name for further work using the PositionGetDouble, PositionGetInteger, and PositionGetString functions. In the hedging system (where there can be multiple positions at a single symbol), the function selects a position with the lowest ticket.

ACCOUNT_MARGIN_MODE

The new property ACCOUNT_MARGIN_MODE allows receiving the mode of margin calculation and position accounting on a trading account:

| Identifier | Description |

|---|---|

| ACCOUNT_MARGIN_MODE_RETAIL_NETTING | Used for the over-the-counter market when accounting positions in the netting mode (one position per symbol). Margin calculation is based on a symbol type (SYMBOL_TRADE_CALC_MODE). |

| ACCOUNT_MARGIN_MODE_EXCHANGE | Used on the exchange markets. Margin calculation is based on the discounts specified in symbol settings. Discounts are set by the broker, however they cannot be lower than the exchange set values. |

| ACCOUNT_MARGIN_MODE_RETAIL_HEDGING | Used for the over-the-counter market with independent position accounting (hedging, there can be multiple positions at a single symbol). Margin calculation is based on a symbol type (SYMBOL_TRADE_CALC_MODE). The presence of multiple positions at a single symbol is considered. |

SYMBOL_MARGIN_HEDGED

The new property SYMBOL_MARGIN_HEDGED allows receiving the value of a hedged margin by a trading symbol. Margin calculation in the hedging system of position accounting has been described above.

New trading constants

Due to the addition of the new Close By operation type, the new trading properties have appeared as well:

- TRADE_ACTION_CLOSE_BY — new trading operation type — close a position by an opposite one.

- ORDER_TYPE_CLOSE_BY — new order type — close a position by an opposite one.

- ORDER_POSITION_BY_ID — new order propertiy — ticket of an opposite position used for closing the current one.

- DEAL_ENTRY_OUT_BY — new deal type — close a position by an opposite one.

Extra bonus — hedging and MQL5 Cloud Network

Now, you can use MetaTrader 5 to trade both stock markets and the popular retail Forex with hedging. Developers of the automated systems applying hedging have received another important advantage. Apart from the multithreaded tester, the entire computing capacity of the MQL5 Cloud Network is at their disposal now.

Update your platform and try the new features!

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/2299

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

Graphical Interfaces II: Setting Up the Event Handlers of the Library (Chapter 3)

Graphical Interfaces II: Setting Up the Event Handlers of the Library (Chapter 3)

Universal Expert Advisor: the Event Model and Trading Strategy Prototype (Part 2)

Universal Expert Advisor: the Event Model and Trading Strategy Prototype (Part 2)

Universal Expert Advisor: Custom Strategies and Auxiliary Trade Classes (Part 3)

Universal Expert Advisor: Custom Strategies and Auxiliary Trade Classes (Part 3)

Area method

Area method

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

There is a dependence on which trade server you log in to. Connect to MetaQuotes-Demo.

Help who knows, can't find the information on my own. The broker has hedging accounts. My robot is written for non-hedging accounts. How can I close a position on a hedging account using MQL5? There is no OrderClose() function in MQL5. The opposite position, as in a netting account, does not close the open position.

Maybe TRADE_ACTION_CLOSE_BY should be set in the trade request on a hedging account ?

or is there a more correct solution?

Help who knows, can't find the information on my own. The broker has hedging accounts. My robot is written for non-hedging accounts. How can I close a position on a hedging account using MQL5? There is no OrderClose() function in MQL5. The opposite position, as in a netting account, does not close the open position.

Use the universal code for position traversal - it works on both netting and hedge accounts. Example in the GalacticExplosion code - CloseAllPositions function

What about the commission?

If I have two open positions, one buy, one sell, and close the 'sell' by the 'buy' I have paid twice the commission. But I would have paid only once the commission if I just close the buy, isn't it?

But what if a broker isn't asking for a commission but has increased the spread? Don't I pay the spread twice as well?