PROFESSIONAL ADVISOR

- 专家

- Lilita Bogachkova

- 版本: 3.79

- 更新: 18 十一月 2021

- 激活: 5

专业交易最大限度地减少损失。 考虑到这一点,专业顾问 EA 设计了附加功能,以最大限度地减少交易损失,从而为您赚取利润。

EA 的设置适用于 USDCHN M5、GBPNZD M15、USDHKD M15、AUDUSD М30、AUDCAD M30、AUDPLN M30、CADCHF M30、NZDUSD M30、EURCHF H1、NZDUSD H1、AUDPLN H1、USDJPY H4、EURCAD H4 、EURUSD H4 、GBPUSD H4 货币工具的金融交易。

其他工具和时间表需要额外优化!

重要的:

EA 被设计为“多重顾问”*。 它由十个独立的 EA 组成,这些 EA 使用流行的 MACD(移动平均收敛散度)、AO(很棒的振荡器)和 MA(移动平均)指标。 这是一种在一个 EA 中练习十种不同策略的能力。 如果您使用 MetaQuotes Software Corp. 的虚拟服务器进行连续交易,这也是一个最佳选择!

*根据多种策略做出投资决策,为您提供全面的投资机会。

特征:

- 专家顾问设计用于在您选择的多个工具和时间范围内同时交易(推荐)。

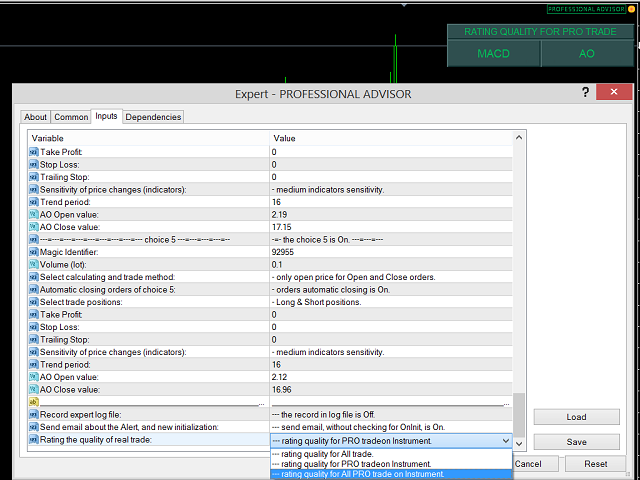

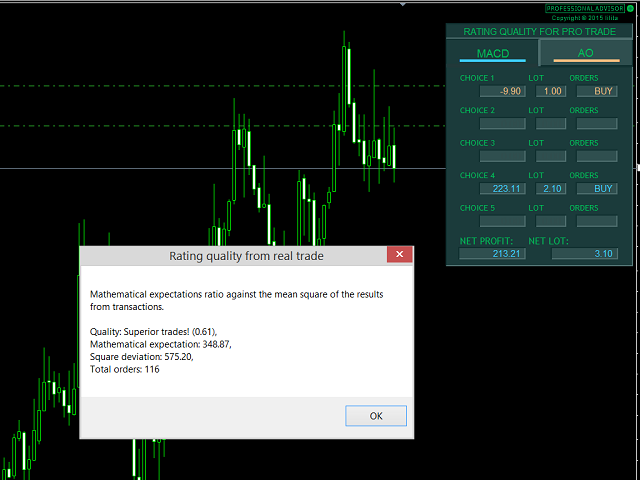

- 选定交易期的账户历史用于根据策略优化标准对真实账户之前的交易进行定性评估(参见第 4 条)。 它提供了对先前策略和交易的质量水平进行真实评估的机会。

- 改进了基因优化和自定义参数; 包括从规定的最小交易次数(推荐)中对 OnTester 选项的最大结果进行排序的可能性。

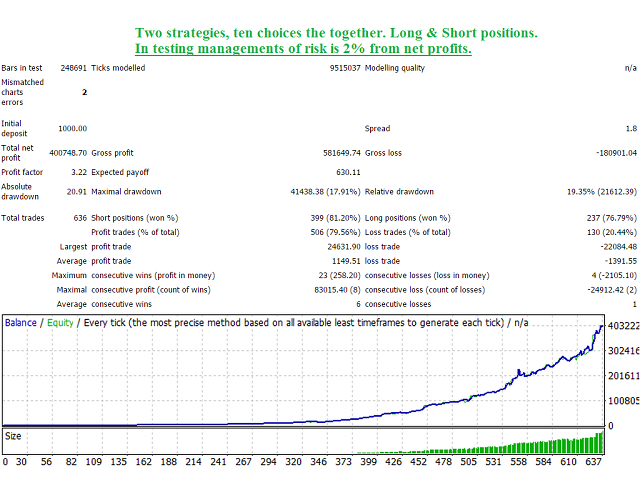

- 通过计算数学期望与交易结果均方偏差的比值来优化交易策略(推荐)。

- 通过计算“净利润”和“毛损失”(“自定义”)之间的百分比差异来优化交易策略。

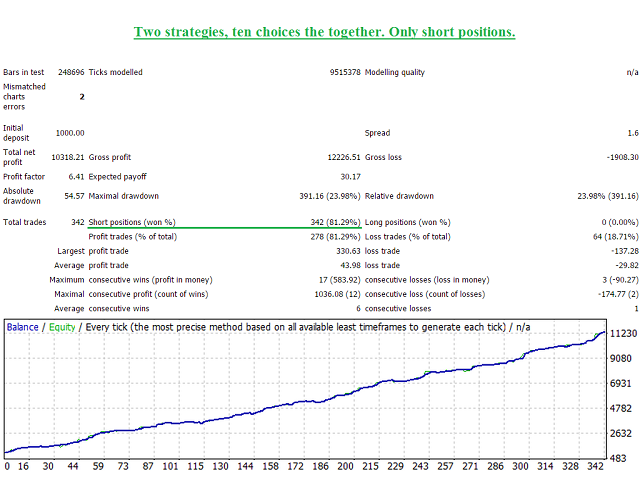

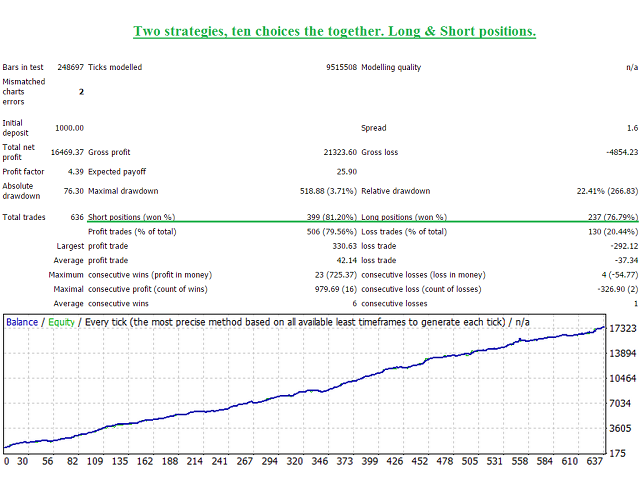

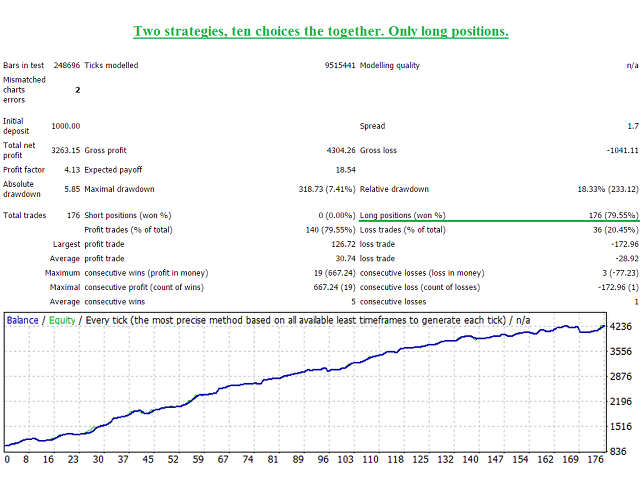

- 使用两种策略,您可以为每个策略选择五个最佳优化结果(推荐)。

- 能够在开仓交易前检查开仓订单损失的发生,而不是根据价格变动开仓交易。

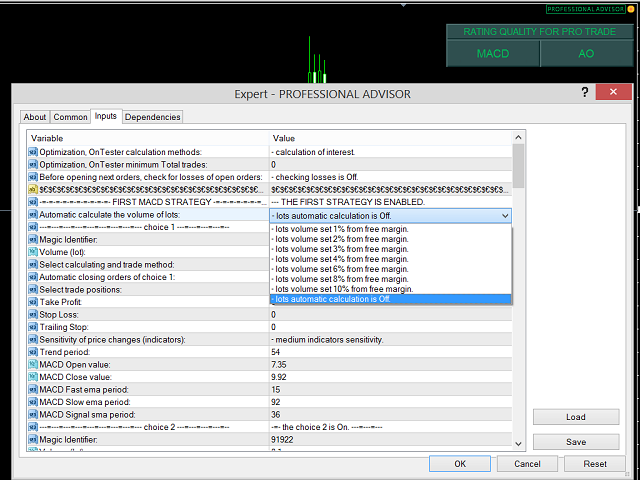

- 自动以可用保证金的百分比计算交易量(手数)。

- 唯一的魔法标识符被分配给每个时间段,这保证了在时间段更改时标识符的唯一特性。

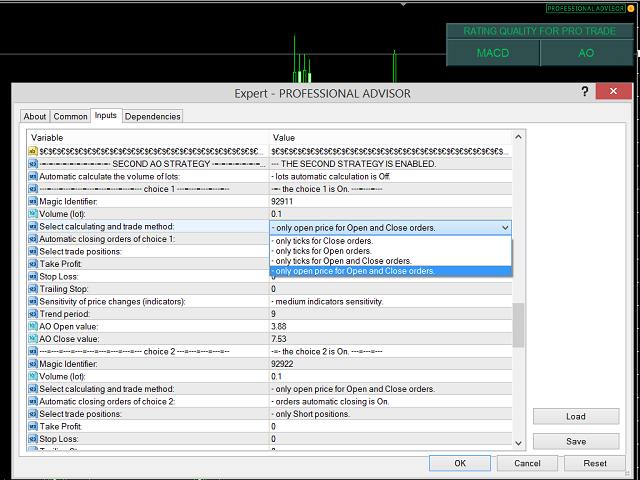

- 能够在不同的交易模型中进行选择:只是开盘价、开盘价和每个分时,或者只是分时价格。

- 根据指标读数自动关闭交易。 交易中心看不到您的盈利水平或亏损限制。 在某些情况下它可能很重要。

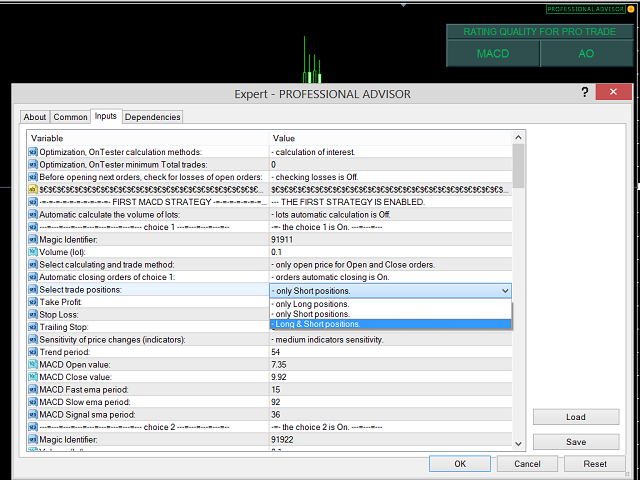

- 能够为每个选择设置要打开的头寸类型。 头寸名称(多头/空头)表明它们不对称,需要不同的参数。

- 能够改变衡量工具价格波动的指标的敏感性; 指标的价格读数(2;4 和 3;5 个小数位数)不同。

- 将打开、修改、订单关闭错误和类似信息记录到专家日志。 警报通知被强制记录。

- 能够将有关所有警报事件和专家初始化的电子邮件发送到您的邮箱。 如果您使用虚拟服务器 (VPS),这一点很重要。 无论是否预先安排,您都将始终了解服务器重新启动的关键事件和时间。 但首先必须在 Meta Trader 4 设置中允许和设置邮件功能。

货币交易是世界上最大的金融市场。 根据国际清算银行 (BIS) 的数据,每天有 5 万亿美元易手。

如果您因提前获利而亏损,并且没有在适当的时间将损失降至最低,您就会知道找到合适的方法的重要性和难度。 不是每个人都可以进行交易操作。 在这种情况下,您应该选择自动交易,它会妥善保管您的存款并防止收益损失。