Golden Zone Price Action

- 专家

- Alex Amuyunzu Raymond

- 版本: 1.4

- 激活: 5

Golden Price EA - Professional Pure Price Action Trading System

Golden Price is an advanced Expert Advisor for MetaTrader 5 that implements institutional-grade price action trading strategies without relying on any technical indicators, machine learning algorithms, or fundamental data feeds. Developed exclusively by Yunzuh Trading Systems, this EA represents a pure approach to market analysis using only raw OHLC data and optional tick volume confirmation.

Core Trading Philosophy

The EA operates on the principle that price action alone reveals all necessary market information. By identifying supply and demand zones across multiple timeframes and analyzing precise candle structures, Golden Price executes high-probability trades based on market geometry rather than lagging indicators.

Primary Features

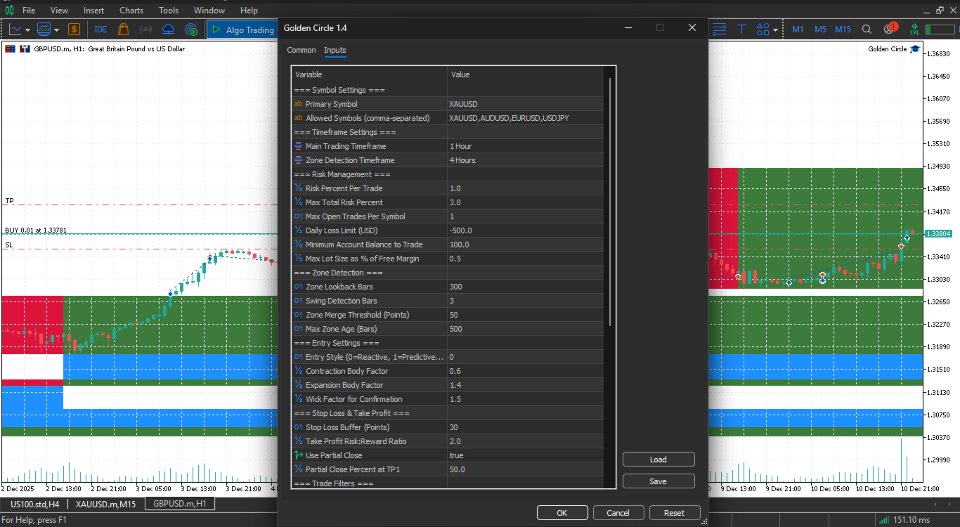

Golden Price specializes in trading XAUUSD (Gold) while maintaining full configurability for major currency pairs including AUD, EUR, and JPY crosses. The system employs a sophisticated multi-timeframe zone detection engine that identifies key supply and demand areas where institutional orders are likely concentrated.

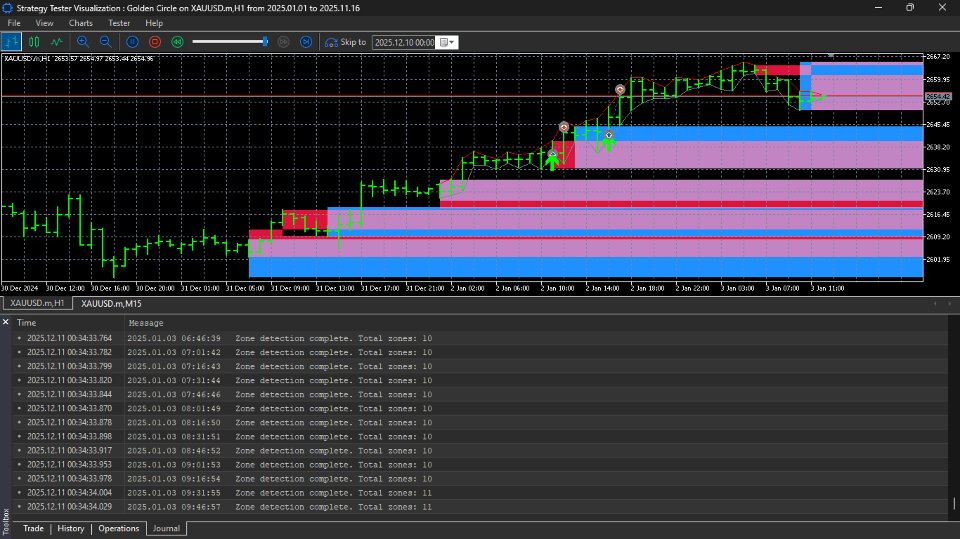

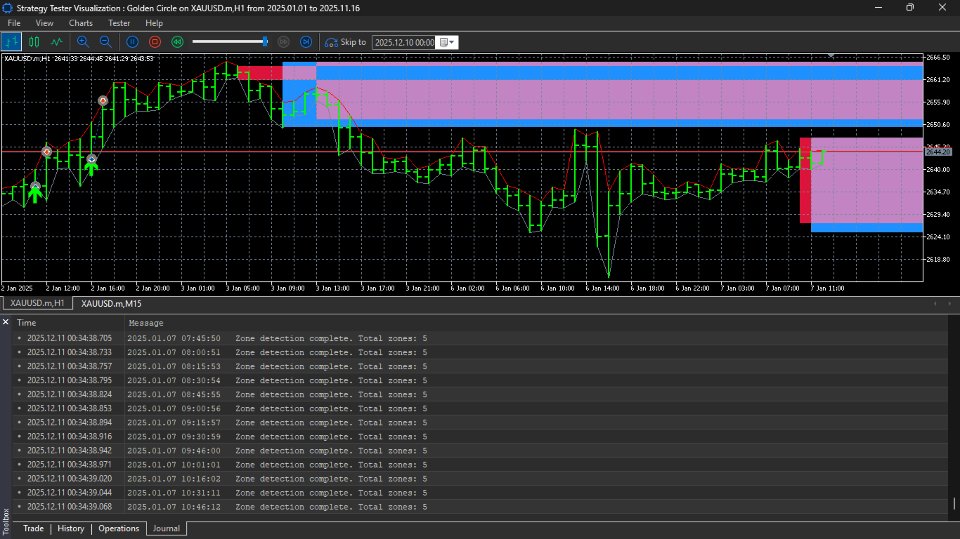

Zone Detection Methodology

The EA implements a deterministic algorithm for identifying trading zones using swing highs and lows on higher timeframes. Zones are created at price extremes where reversals have historically occurred, with each zone ranked by timeframe priority and historical touch count. The system automatically merges overlapping zones and prunes outdated areas to maintain a clean, relevant zone structure.

Supply zones represent areas of institutional selling pressure where price has previously reversed downward, while demand zones mark accumulation areas where buying pressure has historically dominated. The EA tracks zone integrity and adjusts trading decisions based on how price interacts with these critical levels.

Entry Strategies

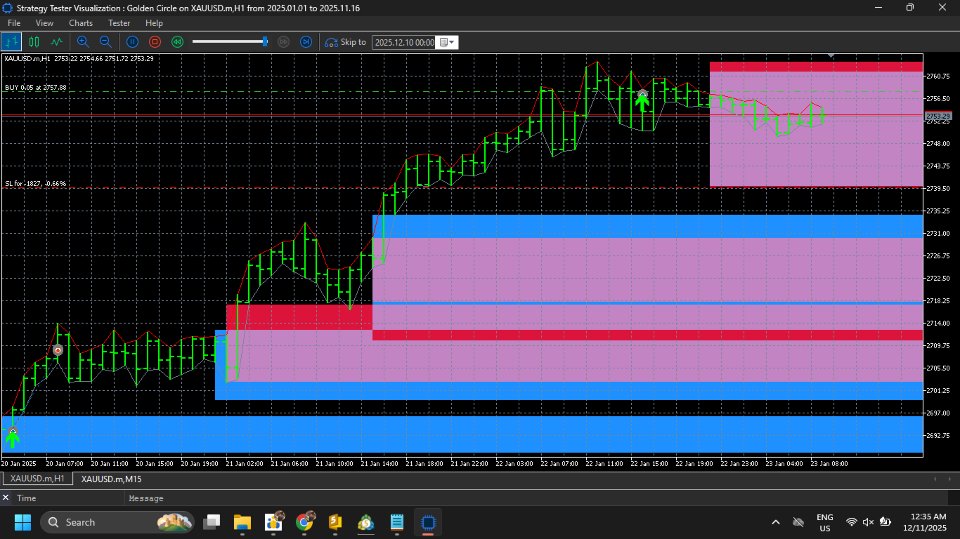

Golden Price offers two distinct entry methodologies. The rebound strategy capitalizes on mean reversion, entering trades when price returns to established zones and shows reversal characteristics through specific candle structures. The breakout strategy identifies momentum continuation when price decisively breaks through zone boundaries with proper confirmation.

Candle Structure Analysis

The EA employs precise definitions for candle classification. Contraction candles indicate consolidation and potential reversal points, characterized by smaller body sizes relative to recent average and prominent wicks in the direction of the anticipated move. Expansion candles signal strong momentum with larger bodies indicating committed directional movement.

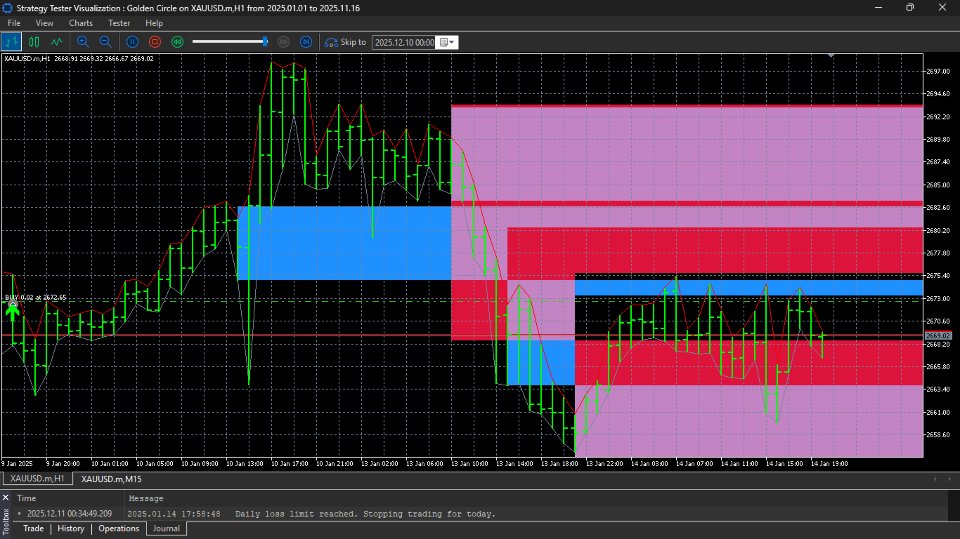

Multi-Timeframe Context

Every trade decision incorporates higher timeframe analysis to ensure alignment with broader market structure. The EA verifies that rebound trades do not conflict with dominant higher timeframe trends, providing an additional layer of probability enhancement.

Risk Management Architecture

Position sizing is calculated dynamically based on account equity and configured risk percentage per trade. Stop losses are placed beyond zone extremes with configurable buffers, while take profit targets utilize risk-reward ratios or identify opposite zones as natural profit objectives.

The system implements partial position closing, capturing 50% of the position at intermediate targets while trailing the remainder for extended moves. Break-even stop loss adjustments protect capital once trades move favorably, and trailing stops lock in profits as price continues in the intended direction.

Trade Management Controls

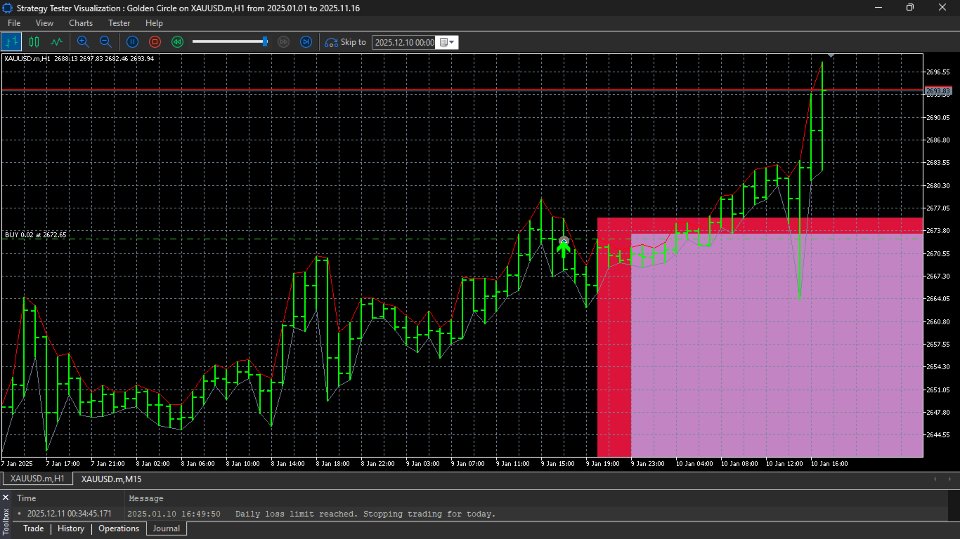

Golden Price enforces strict daily loss limits, automatically ceasing trading activity when predetermined thresholds are breached. Maximum open position limits prevent overexposure, while total risk calculations across all positions ensure portfolio-level risk constraints are maintained.

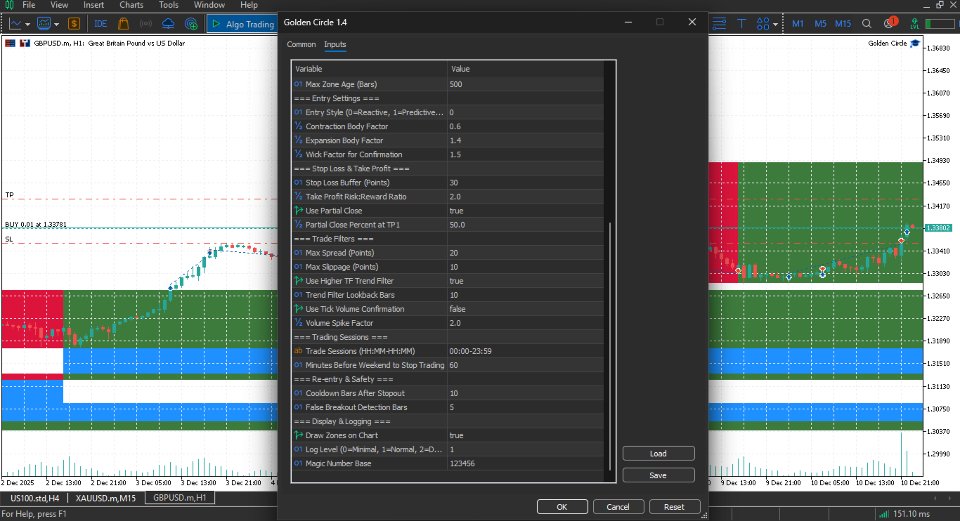

Spread filtering prevents execution during unfavorable market conditions, and configurable trading sessions allow focus on high-liquidity periods such as London-New York overlap for optimal execution quality.

Order Execution

The EA supports both market and pending order execution styles. Reactive entries execute immediately upon signal confirmation, while predictive entries place limit orders at optimal zone levels. Breakout entries can be configured for aggressive immediate execution or conservative retest confirmation.

Safety and Reliability

Slippage control mechanisms verify execution quality, canceling orders when price deviation exceeds acceptable parameters. The system includes cooldown periods after stopped trades to prevent revenge trading on the same zones. Volume spike detection pauses trading during abnormal market volatility often associated with news events.

Weekend and rollover protections prevent new position initiation during high-risk periods around market closes and daily settlements.

Performance Monitoring

The EA generates comprehensive trade logs documenting every decision point, including zone identification, entry triggers, candle analysis, and risk calculations. Optional CSV export functionality enables detailed post-trade analysis and strategy refinement.

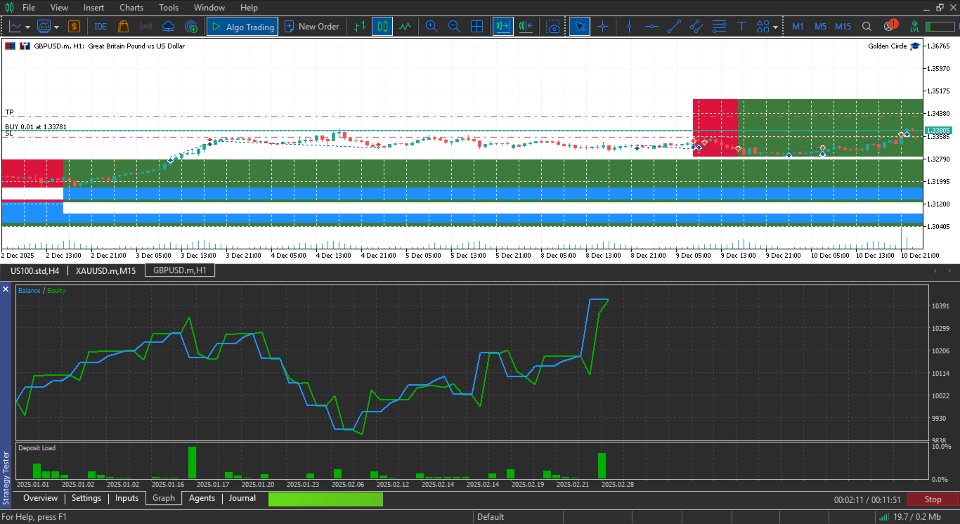

Visual chart overlays display active zones, entry markers, and stop loss/take profit levels for real-time monitoring and backtesting verification.

Backtesting Capabilities

Golden Price produces identical behavior in both live trading and strategy tester environments, ensuring backtesting results accurately reflect forward performance expectations. The deterministic zone detection algorithm with fixed lookback periods guarantees reproducible results across multiple test runs.

Configuration Flexibility

All critical parameters are exposed through the EA input interface, allowing traders to adjust risk tolerance, zone detection sensitivity, candle structure thresholds, and entry timing preferences. Configurable magic numbers enable multi-instance deployment across different symbols or strategy variations.

Technical Specifications

The EA is architected using modular classes including ZoneEngine for supply/demand identification, CandleAnalyzer for structure classification, EntryEngine for signal generation, RiskManager for position sizing, OrderManager for execution and modification, and TradeLogger for comprehensive record keeping.

Code is extensively commented following professional development standards, with clean separation of concerns enabling straightforward customization and maintenance.

Optimization and Testing

Golden Price is designed for walk-forward analysis, Monte Carlo simulation, and parameter sensitivity testing. The system maintains reasonable computational efficiency even when processing hundreds of bars for zone detection, ensuring smooth operation in both backtesting and live environments.

Copyright and Ownership

This Expert Advisor is the exclusive intellectual property of Yunzuh Trading Systems, protected by copyright law and international treaties. Multiple layers of code-level protection ensure ownership attribution remains intact, with integrity validation mechanisms preventing unauthorized modification.

Ideal User Profile

Golden Price is designed for traders who appreciate the purity of price action analysis and seek systematic execution of discretionary trading concepts. The EA suits both active traders monitoring real-time execution and those preferring fully automated operation within defined parameters.

Development Quality

Every aspect of Golden Price reflects professional software engineering practices, from robust error handling and comprehensive logging to clean code architecture and extensive inline documentation. The system is delivered as complete MQL5 source code, compiled executables, example parameter configurations, and sample backtest results.

Golden Price represents the convergence of classical price action trading principles and modern algorithmic execution precision, providing traders with a professional tool for capturing market opportunities across gold and major currency markets.