MA Fibo Retracement

- Эксперты

- Sylvestre Setufa Djagbavi

- Версия: 1.0

- Активации: 5

General idea of the strategy

This robot does not use a Grid or a Martingale system. It just uses a simple strategy based on 2 indicators: Moving Average and Fibonacci retracement.

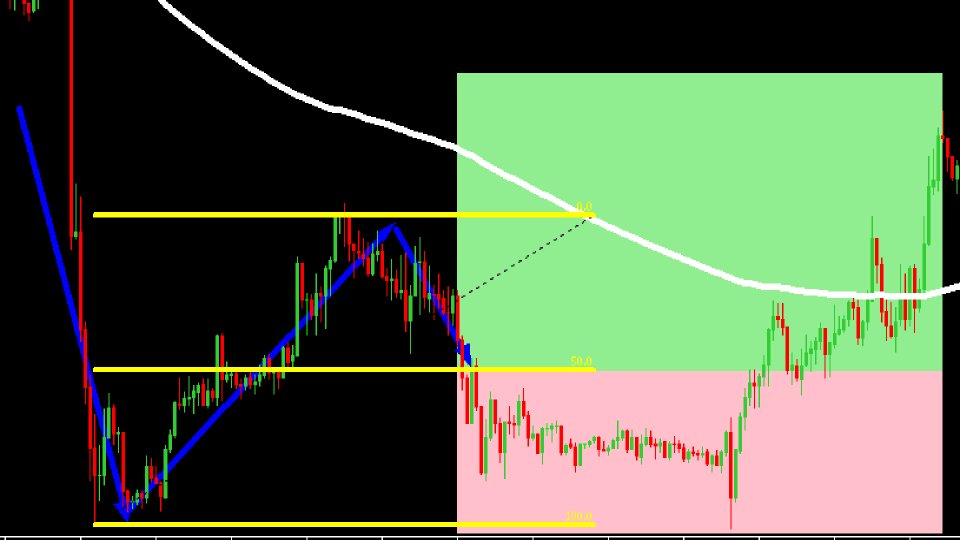

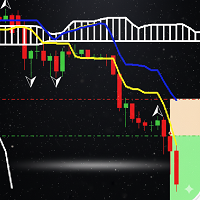

Buy Signal:

When the price is below the moving average, it indicates that the market is in a downtrend. In a downtrend, the market never falls in a straight line. It alternates between:

- Bearish impulses (the main downward movement)

- Bullish retracements (small upward bounces before the next decline)

The robot, on the other hand, will seek to trade these bullish retracements. Based on Fibonacci retracement levels, it identifies key areas where the price could temporarily rebound before returning to the main trend. Thus, the robot makes strategic purchases during these retracements to capture rapid upward movements without going against the overall trend. In short, even in a downtrend, there are buying opportunities, if you know where and when to enter. And that's where the robot's logic comes into its own.

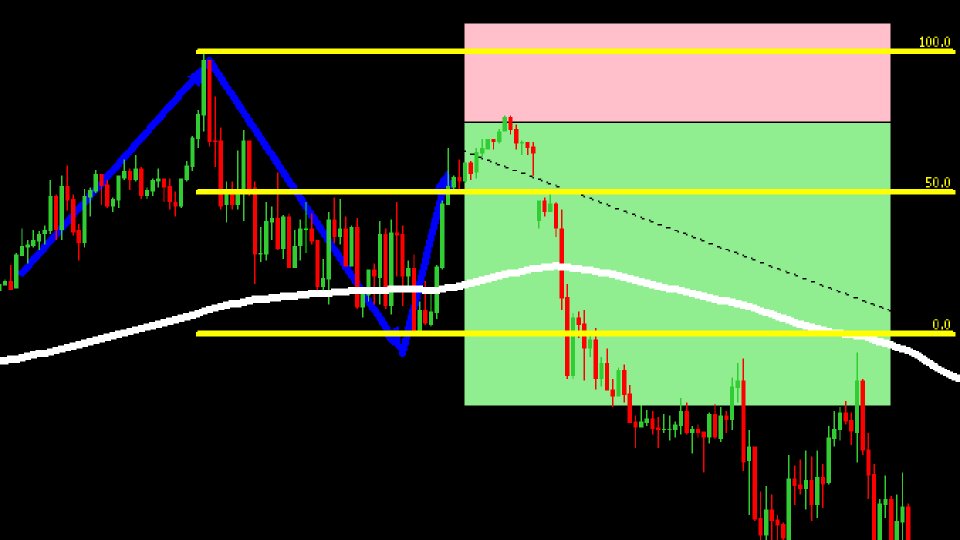

Sell Signal:

When the price is above the moving average, it indicates that the market is in an uptrend. In an uptrend, the market never rises in a straight line. It alternates between:

- Bullish impulses (the main upward movement)

- Bearish retracements (small downward bounces before the next uptrend)

The robot, on the other hand, will seek to trade these bullish retracements. Based on Fibonacci retracement levels, it identifies key areas where the price could temporarily rebound before returning to the main trend. Thus, the robot enters into strategic trading during these retracements to capture rapid downward movements without going against the overall trend. In summary, even in an uptrend, there are opportunities to sell if you know where and when to enter. And that's where the robot's logic comes into its own.