Levels with Alerts

- 지표

- Mitchell Dean Ede

- 버전: 1.0

- 활성화: 20

Overview

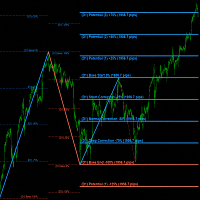

This indicator automatically plots and labels major price levels from different timeframes and trading sessions—specifically, it draws horizontal lines for the high and low of the:

-

Asia session

-

London session

-

Previous day

-

Weekly and monthly periods

It features strong visual and functional customization—each level group can be toggled on or off, colored or styled differently, and, uniquely, each type of level can trigger real-time price alerts when price approaches or crosses these key areas.

Key Features

1. Multi-Timeframe Level Plotting

-

Sessions: Automatically identifies and draws highs and lows for Asia and London sessions based on user-defined times.

-

Higher Timeframes: Plots high/low lines for previous day, week, and month.

-

Complete Control: Users can enable or disable each set of levels independently for a clutter-free chart.

2. Smart Labeling and Readability

-

Labeled Lines: Every plotted line includes an on-chart text label with the session/timeframe and the precise price.

-

Dynamic Label Placement: If multiple levels are at nearly the same price (“clash”), labels are automatically staggered up or down so all remain readable.

3. Full Customization

-

Colors and Styles: Every type of level (Asia, London, etc.) has its own settings for color and line style (dotted, dashed, solid, etc.).

-

Lookback Settings: Users can set how many days, weeks, or months to plot, supporting both current and historical analysis.

4. Real-Time Alerts

-

Flexible Alerts: Each level group has its own option to enable alerts.

-

Configurable Notifications: Get notified by popup, sound, or email when the price is within a defined distance (in points) of any enabled level.

-

One-Per-Bar Guarantee: Alerts are only triggered once per bar per level, preventing spam.

5. Universal Utility

-

Works on all timeframes and instruments (forex, indices, commodities, crypto).

-

Ideal for day traders and swing traders who rely on session psychology, support/resistance, and liquidity concepts.

Example Use Cases

-

Asia/London Session Sweep: Wait for price to hit a session high/low, then look for reversal setups as taught in ICT concepts12.

-

Daily/Weekly High/Low Reactions: Identify potential breakout or reversal points by watching how price interacts with previous high/low levels345.

-

HTF Liquidity: Mark monthly highs/lows for large swing points and confluence on lower timeframes.

Why It's Effective

-

Markets frequently react to previous session/high timeframe levels—these are zones where institutional liquidity is placed and where major moves tend to begin or end134.

-

Automated plotting saves time and reduces human error, removing the need to manually mark up charts25.

-

Custom alerts allow for hands-off monitoring—you only need to watch when price is near your predefined interest areas.

Summary Table

| Level Type | Toggle On/Off | Custom Color | Custom Style | Alerts | Auto-Staggered Labels | Lookback |

|---|---|---|---|---|---|---|

| Asia | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| London | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Previous Day | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Weekly | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Monthly | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Who Benefits Most

-

Traders wanting a liquidity/SMC edge—see price hunt or reverse at institutional levels.

-

Day and swing traders who use session-based entries or high/low breaks.

-

Anyone who wants a mo dern, customizable, and easy-to-read support/resistance mapping tool for any market.

In short:

This indicator makes support/resistance trading powerful, clean, and fully automated—revealing the same levels professional traders, market makers, and algorithms are watching every day