Neuro Abigail

- Experts

- Olena Sadamon

- Version: 1.0

- Activations: 20

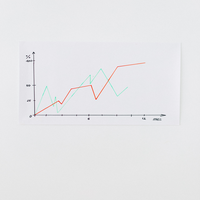

Concept: a portfolio of independent strategies built on candlestick patterns — both trend-following and counter-trend — across multiple currency pairs.

The goal is to achieve maximum profit with minimal risk through non-correlated systems.

The profit from some strategies compensates for the losses of others, so that in the end you gain consistent growth of your deposit.

How It Works

-

Multi-Currency. Each pair has its own parameters and filters.

-

Multi-Strategy. The advisor integrates several independent trading systems.

-

Flexible Architecture. New pairs and strategies can be added and optimized without breaking the existing code.

Risk Management

-

Every position has a Stop Loss and Take Profit, with a minimum ratio of 1 : 1.5.

-

Adjustable risk per trade (% of the deposit). Recommended — 1%.

Backtests show that with this risk setting, drawdown over the test period did not exceed ~10%.

(Past results do not guarantee future performance.)

Settings (kept minimal — to avoid breaking the logic)

-

Advisor Identifier (Magic).

-

Risk % per trade. Higher risk = potentially higher profit, but also deeper drawdowns.

-

Symbol Parameters. If your broker uses prefixes/suffixes (e.g., GBPUSDm , EURUSD.z ), adjust them without changing the order of pairs.

-

News Filter. Set how many minutes before/after news the advisor should not trade, and specify event dates/times from the calendar.

Upgrade: Neural Network Module

You can connect a fully autonomous Neural Network module (Python) to this advisor, which will:

-

take trading signals from the advisor,

-

filter and enhance them,

-

reduce the share of losing trades.

This module is deployed separately on your VPS where the terminal is installed.

If you need a budget VPS and assistance with setup — I can guide you through it.

Support and Updates

We constantly improve Neuro Abigail: adding new pairs and strategies, releasing updates and extensions.

Important: as the number of subscribers grows, the rental price will increase.

How to Start in 3 Steps

-

Install the demo and make sure the required pairs are available in your Market Watch window. Adjust their spelling (prefix/suffix) if needed.

-

Set the risk = 1%. For conservative trading, reduce to 0.5% or even 0.2%. For aggressive trading, you may raise it to 5%, but this is not recommended without connecting the Neural Network module in Python.

-

If needed, activate the News Filter by specifying the date and time of upcoming news events.

Run the advisor on your historical data and demo account. See how independent strategies perform together.

Ready to test how this advisor works in its “pure” form, without the Neural Network module?

Download the Neuro Abigail demo and see for yourself.