You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

How to Start with Metatrader 5

newdigital, 2013.09.20 08:21

Summaries :

====

Forum on trading, automated trading systems and testing trading strategies

How to run a paid indicator from the Market in your Strategy Tester

Rosh, 2014.03.20 12:09

Now you can test any indicator simplier - https://www.metatrader5.com/en/terminal/help/startworking/interface

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Forum on trading, automated trading systems and testing trading strategies

Gold is Reaching at 1270

newdigital, 2013.07.01 21:04

How can we know: correction, or bullish etc (in case of using indicator for example)?

well ... let's take AbsoluteStrength indicator from MT5 CodeBase.

bullish (Bull market) :

bearish (Bear market) :

ranging (choppy market - means: buy and sell on the same time) :

flat (sideways market - means: no buy and no sell) :

correction :

correction in a bear market (Bear Market Rally) :

MQL5 Cookbook: Multi-Currency Expert Advisor - Simple, Neat and Quick Approach

This article will describe an implementation of a simple approach suitable for a multi-currency Expert Advisor. This means that you will be able to set up the Expert Advisor for testing/trading under identical conditions but with different parameters for each symbol. As an example, we will create a pattern for two symbols but in such a way so as to be able to add additional symbols, if necessary, by making small changes to the code.

A multi-currency pattern can be implemented in MQL5 in a number of ways:

We can use a pattern where an Expert Advisor is guided by time, being capable of performing more accurate checks at the time intervals specified in the OnTimer() function.

Alternatively, as in all the Expert Advisors introduced in the previous articles of the series, the check can be done in the OnTick() function in which case the Expert Advisor will depend on ticks for the current symbol it works on. So if there is a completed bar on another symbol, whereas there is yet no tick for the current symbol, the Expert Advisor will only perform a check once there is a new tick for the current symbol.

There is yet another interesting option suggested by its author Konstantin Gruzdev (Lizar). It employs an event model: using the OnChartEvent() function, an Expert Advisor gets events that are reproduced by indicator agents located on the symbol charts involved in testing/trading. Indicator agents can reproduce new bar and tick events of the symbols they are attached to. This kind of indicator (EventsSpy.mq5) can be downloaded at the end of the article. We will need it for the operation of the Expert Advisor.

MQL5 Cookbook: Developing a Multi-Currency Expert Advisor with Unlimited Number of Parameters

The multi-currency Expert Advisor considered in the previous article "MQL5 Cookbook: Multi-Currency Expert Advisor - Simple, Neat and Quick Approach", can be very useful if the number of symbols and trading strategy parameters used is small. However, there is a restriction on the number of input parameters of an Expert Advisor in MQL5: they should be no more than 1024.

And even though this number will very often be sufficient, it is very inconvenient to use such a huge list of parameters. Every time a change or optimization of parameters for a given symbol is required, you have to search parameters for that specific symbol in the long parameter list.

In this article, we will create a pattern that uses a single set of parameters for optimization of a trading system, while allowing for unlimited number of parameters. The list of symbols will be created in a standard text file (*.txt). Input parameters for each symbol will also be stored in files.

It needs to be mentioned here that the Expert Advisor will work on one symbol in the normal operation mode but you will be able to test it in the Strategy Tester on a variety of selected symbols (on each symbol separately).

It would, in fact, be even more convenient to create the symbol list directly in the Market Watch window, considering that it even allows for saving ready made symbol sets. We could even make the Expert Advisor to get the symbol list in the Market Watch window directly from the Strategy Tester. But unfortunately, it is currently not possible to access the Market Watch window from the Strategy Tester, so we will have to create the symbol list manually in advance or using a script.

Social Trading with the MetaTrader 4 and MetaTrader 5 Trading Platforms

What is social trading? It is a mutually beneficial cooperation of traders and investors whereby successful traders allow monitoring of their trading and potential investors take the opportunity to monitor their performance and copy trades of those who look more promising.

You monitor real-time trading of a number of traders, connect to the most successful ones and copy their trades in automatic mode - that's what social trading is about. For novice and inexperienced traders who have just turned to financial markets for additional income, it is probably the best opportunity to actually start trading.

You do not need to be a professional trader with a great bundle of knowledge and skills in order to trade professionally. Nor do you need to follow and analyze the news from financial markets, work out and implement trading strategies and be prepared to change the ones that fail to keep monitoring their performance in the new market conditions. Thanks to social trading it all becomes unnecessary since you can simply copy trades of all those who follow the news, analyze markets and create profitable strategies.Another MQL5 OOP Class

Building a complete object-oriented EA that actually works is in my humble opinion a challenging task which requires many skills all put together: logical reasoning, divergent thinking, capacity for analysis and synthesis, imagination, etc. Let's say that if the automated trading system that we have to solve was a game of chess, its trading idea would be the chess strategy. And the execution of the chess strategy through tactics would be the programming of the robot through the use of technical indicators, chart figures, fundamental economic ideas and conceptual axioms.

The Implementation of Automatic Analysis of the Elliott Waves in MQL5

One of the most popular methods of market analysis is the Elliott Wave Principle. However, this process is quite complicated, which leads us to the use of additional instruments. One of such instruments is the automatic marker.

This article describes the creation of an automatic analyzer of Elliott Waves in the MQL5 language. It is assumed that the reader is already familiar with the wave theory, if not, you need to refer to the appropriate sources.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.26 14:17

What is the ’Best’ Time Frame to Trade? (based on dailyfx article)

One of the most important aspects of a trader’s success is the approach being utilized to speculate in markets. Sometimes, certain approaches just don’t work for certain traders. Maybe its personality or risk characteristics; or perhaps the approach is just un-workable to begin with.

When using multiple time frame analysis, traders will look to use a longer-term chart to grade trends and investigate the general nature of the current technical setup; while utilizing a shorter-term chart to ‘trigger’ or enter positions in consideration of that longer-term setup. We looked at one of the more common entry triggers in the article, MACD as an Entry Trigger; but many others can be used since the longer-term chart is doing the bulk of the ‘big picture’ analysis

The Long-Term Approach

Optimal Time Frames: Weekly, and Daily Chart

For some reason, many new traders do everything they can to avoid this approach. This is likely because new, uninformed traders think that a longer-term approach means it takes a lot longer to find profitability.

In most cases, this couldn’t be further from the truth.

By many accounts, trading with a shorter-term approach is quite a bit more difficult to do profitably, and it often takes traders considerably longer to develop their strategy to actually find profitability.

There are quite a few reasons for this, but the shorter the term, the less information that goes into each and every candlestick. Variability increases the shorter our outlooks get because we’re adding the limiting factor of time.

There aren’t many successful scalpers that don’t know what to do on the longer-term charts; and in many cases, day-traders are using the longer-term charts to plot their shorter-term strategies.

All new traders should begin with a long-term approach; only getting shorter-term as they see success with a longer-term strategy. This way, as the margin of error increases with shorter-term charts and more volatile information, the trader can dynamically make adjustments to risk and trade management.

Traders utilizing a longer-term approach can look to use the weekly chart to grade trends, and the daily chart to enter into positions.

The ‘Swing-Trader’ Approach

Optimal Time Frames: Daily, and Four-Hour Charts

After a trader has gained comfort on the longer-term chart they can then look to move slightly shorter in their approach and desired holding times. This can introduce more variability into the trader’s approach, so risk and money management should absolutely be addressed before moving down to shorter time frames.

The Swing-Trader’s approach is a happy medium between a longer-term approach, and a shorter-term, scalping-like approach. One of the large benefits of swing-trading is that traders can get the benefits of both styles without necessarily taking on all of the down-sides.

Swing-Traders will often look at the chart throughout the day in an effort to take advantage of ‘big’ moves in the marketplace; and this affords them the benefit of not having to watch markets continuously while they’re trading. Once they find an opportunity or a setup that matches their criteria for triggering a position, they place the trade with a stop attached; and they then check back later to see the progress of the trade.

In between trades (or checking the chart), these traders can go about living their lives.

A large benefit of this approach is that the trader is still looking at charts often enough to seize opportunities as they exist; and this eliminates one of the down-sides of longer-term trading in which entries are generally placed on the daily chart.

For this approach, the daily chart is often used for determining trends or general market direction; and the four-hour chart is used for entering trades and placing positions.

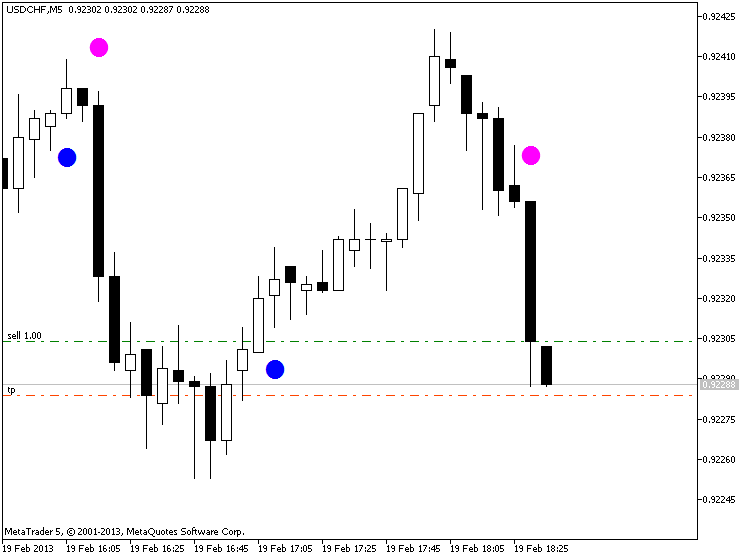

The Short-Term Approach (Scalping or Day-Trading)

Optimal Time Frames: Hourly, 15 minutes, and 5 minutes

this is probably the most difficult way of finding profitability; and for the new trader, so many factors of complexity are introduced that finding success as a scalper or day-trader can be daunting.

The scalper or day-trader is in the unenviable position of needing the move(s) with which they are speculating to take place very quickly; and trying to ‘force’ a market to make a move isn’t usually going to work out that well. The shorter-term approach also affords a smaller margin of error. Since less profit potential is generally available, tighter stops need to be utilized; meaning failure will generally happen quite a bit more often, or else the trader is opening themselves up to The Number One Mistake that Forex Traders Make.

To trade with a very short-term approach, it’s advisable for a trader to first get comfortable with a longer-term, and swing-trading approach before moving down to the very fast time frames. But, once a trader is comfortable there, it’s time to start building out the strategy.

Scalpers can look to the hourly chart to grade trends, and the 5 or 15 minute charts for entries