You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

2013-03-06 00:30 GMT (or 01:30 MQ MT5 time) | [AUD - Trade Balance]

if actual > forecast = good for currency (for AUD in our case)

==========

Australia Has A$1.43 Billion Trade Surplus

Australia posted a merchandise trade surplus of A$1.433 billion in January, the Australian Bureau of Statistics said on Thursday - up 142 percent on the surplus from December.

That blew away forecasts for a surplus of A$100 million following the upwardly revised surplus of A$591 million in the previous month (originally A$468 million).

Trading the News: European Central Bank Interest Rate Decision (based on dailyfx article)

According to a Bloomberg News survey, 40 of the 54 economists polled see the European Central Bank (ECB) retaining its current policy in March, but the broad range of market speculation (rate cut, negative deposit rates, verbal intervention, unsterilized bond purchases, Long-Term Refinancing Operation) may produce increased volatility around the interest rate decision as market participants weigh the outlook for monetary policy.

What’s Expected:

Time of release: 03/06/2014 12:45 GMT, 7:45 EST

Primary Pair Impact: EURUSD

Expected: 0.25%

Previous: 0.25%

Forecast: 0.25%

Why Is This Event Important:

Despite expectations of seeing the ECB further embark on its easing cycle, the central bank’s 2016 economic projects may set the tone for the Euro should the figures highlight a greater threat for deflation, and an inflation forecast below 1.3% may trigger a sharp selloff in the EURUSD as it heightens bets for additional monetary support.

How To Trade This Event Risk

Trading the ECB interest rate decision may not be as clear cut as some of our other trade setups as the press conference with President Draghi ends with a Q&A session

Bearish EUR Trade: ECB Loosens Policy and/or Highlights Greater Risk for Deflation

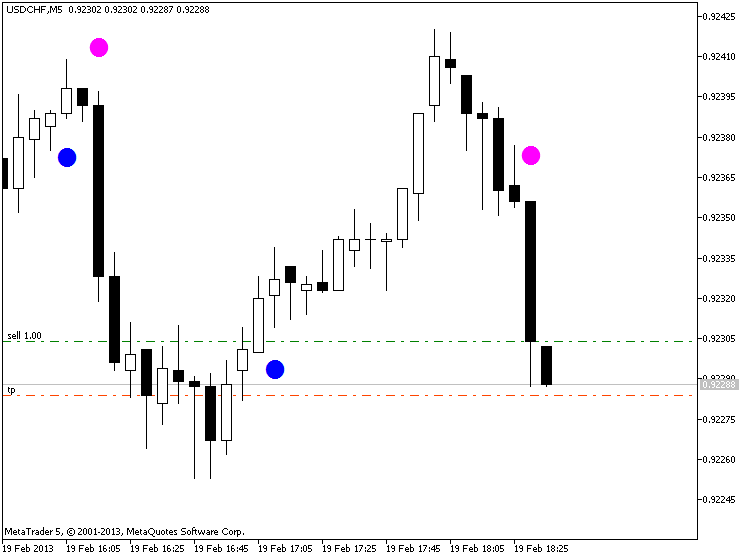

- Need red, five-minute candle following the decision/statement to consider a short Euro trade

- If market reaction favors a short trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Sticks to Current PolicyPotential Price Targets For The Rate Decision

EURUSD M5 : 15 pips price movement by EUR - Interest Rate news event :

2013-03-06 12:00 GMT (or 13:00 MQ MT5 time) | [GBP - Interest Rate]

if actual > forecast = good for currency (for GBP in our case)

==========

BoE Leaves Key Rate Unchanged At 0.50%; QE At GBP 375 Bln

The Bank of England decided to retain its historic-low interest rate and the size of quantitative easing at GBP 375 billion on Thursday.

The nine-member Monetary Policy Committee led by Mark Carney voted to keep the key bank rate unchanged at 0.50 percent.

2013-03-06 15:00 GMT (or 16:00 MQ MT5 time) | [CAD - Ivey PMI]

if actual > forecast = good for currency (for CAD in our case)

==========

Canadian Ivey PMI rises to 4-month high of 57.2 in February

Canada's Ivey purchasing managers’ index expanded at a faster rate than expected in February, easing concerns over the country’s economic outlook, industry data showed on Thursday.

In a report, the Richard Ivey School of Business said its purchasing managers’ index rose to 57.2 last month from a reading of 56.8 in January. Analysts had expected the index to decline to 54.0 in February.

2013-03-06 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

if actual < forecast = good for currency (for USD in our case)

==========

U.S. Weekly Jobless Claims Drop To Three-Month Low

In an upbeat sign for the labor market ahead of tomorrow's monthly jobs report, the Labor Department released a report on Thursday showing that first-time claims for U.S. unemployment benefits fell by more than expected in the week ended March 1st.

The report said initial jobless claims dropped to 323,000, a decrease of 26,000 from the previous week's revised figure of 349,000. Economists had expected jobless claims to dip to 338,000 from the 348,000 originally reported for the previous week.

With the bigger than expected decrease, jobless claims fell to their lowest level since hitting 305,000 in the last week of November.

BOE Official Gets Sacked Amidst Forex Scandal Probe (based on forexminute article)

The Bank of England showed the exit door to a staff member for playing a vital role in foreign exchange market manipulation.

Wednesday brought a disgrace to the Bank of England’s long-standing reputation, as one of its officials was found to be involved in a recent forex scandal. The bank straightforwardly suspended the employee from his duties, after an internal investigation manifested that the person was acting against the bank’s policies on administering internal records.

2013-03-06 23:00 GMT (or 00:00 MQ MT5 time) | [USD - Fed's Lockhart speech]

==========

The Challenge of Estimating Full Employment

Dennis Lockhart

President and Chief Executive Officer

Federal Reserve Bank of Atlanta

Key points

USDJPY Technical Analysis (based on dailyfx article)

- USD/JPY Technical Strategy: Flat

- Support: 102.93 (23.6% Fib exp.)

- Resistance 102.98 (38.2% Fib exp.)

The Japanese Yen has dropped to a five-week low against the US Dollar as prices broke above resistance at 102.93, the 23.6% Fibonacci expansion. Buyers are now testing falling trend line with a break above that exposing the 38.2% level at 102.98.Prices are too close to relevant resistance at this point to justify a long position on risk/reward grounds. On the other hand, attempting to re-enter short without a defined downward reversal signal seems premature.

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Trading the News: U.S. Non-Farm Payrolls (based on dailyfx article)

The U.S. Non-Farm Payrolls report may prop up the dollar as the economy is expected to add another 150K jobs in February, and a pickup in employment may instill a bullish outlook for the greenback as the Federal Reserve is widely anticipated to discuss another $10B taper at the March 19 meeting.

What’s Expected:

Time of release: 03/07/2014 13:30 GMT, 8:30 EST

Primary Pair Impact: EURUSD

Expected: 150K

Previous: 113K

Forecast: 100K to 150K

Why Is This Event Important:

However, the recent slowdown in economic activity certainly raises the risk of seeing another weaker-than-expected NFP print, and a dismal result may heighten the bearish sentiment surrounding the reserve currency as it limits the Fed’s scope to normalize monetary policy sooner rather than later.

How To Trade This Event Risk

Bullish USD Trade: NFP Increases 155K+; Unemployment Holds at 6.6%

- Need to see red, five-minute candle following the print to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bearish USD Trade: February Job Growth Falls Short of Market ExpectationsJanuary 2014 U.S. Non-Farm Payrolls :