You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Scalping

Also a very infiormative ebook I read a week ago about scalping. I forgot the name of the author but the ebook, you can google it, the title is "Uncharted Stratagems - Unknown Depths of Forex Trading"

Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read May 2016

Muhammad Syamil Bin Abdullah, 2016.05.27 09:45

Forex Price Action Scalping: an in-depth look into the field of professional scalping

Forex Price Action Scalping provides a unique look into the field of professional scalping. Packed with countless charts, this extensive guide on intraday tactics takes the reader straight into the heart of short-term speculation. The book is written to accommodate all aspiring traders who aim to go professional and who want to prepare themselves as thoroughly as possible for the task ahead. Few books have been published, if any, that take the matter of scalping to such a fine and detailed level as does Forex Price Action Scalping. Hundreds of setups, entries and exits (all to the pip) and price action principles are discussed in full detail, along with the notorious issues on the psychological side of the job, as well as the highly important but often overlooked aspects of clever accounting. The book, counting 358 pages, opens up a wealth of information and shares insights and techniques that are simply invaluable to any scalper who is serious about his trading.

Scalp All - script for MetaTrader 5

Hello traders: I tell you that I am on demo and when I place an order it tells me that I have insufficient balance, I am with the FX PRO broker. Someone did the same? Anyone have any answers :)

Hi, I am currently searching for a broker that is good for scalping ?

Lower spreads and fast execution, even if it has low commission would be great.

Hi, I am currently searching for a broker that is good for scalping ?

Lower spreads and fast execution, even if it has low commission would be great.

Discussion and/or suggestions about brokers are not allowed in the forum.

You should make your own search.

Scalping

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

The term scalping elicits different preconceived connotations to different traders. Despite what you may already think, scalping can be a viable short term trading methodology for anyone. So today we will look at what exactly is scalping, and who can be successful with a scalping based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone that takes one or more positions throughout a trading day. Normally these positions are based around short term market fluctuations as price gathers momentum during a particular trading session. Scalpers look to enter the market, and preferably exit positions prior to the market close.

Normally scalpers employ technical trading strategies utilizing short term support and resistance levels for entries. While normally fundamentals don’t factor into a scalpers trading plan, it is important to keep an eye on the economic calendar to see when news may increase the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency traders. So how many trades a day does it take to be considered a scalper? Even though high frequency traders ARE scalpers, in order for you to qualify as a scalper you only need to take 1 position a day! That is one of the benefits of scalping. You can trade as much or as little as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short term, long term, or any kind of trader in between any time you open a position you should work on managing your risk. This is especially true for scalpers. If the market moves against you suddenly due to news or another factor, you need to have a plan of action for limiting your losses.

There are other misconceptions that scalpers are very aggressive traders prone to large losses. One way to help combat this is to make scalping a mechanical process. This means that all of your decisions regarding entries, exits, trade size, leverage and other factors should be written down and finalized before approaching the charts. Most scalpers look to risk 1% or even less of their account balance on any one position taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Forum on trading, automated trading systems and testing trading strategies

PriceChannel Parabolic system

newdigital, 2013.03.22 14:04

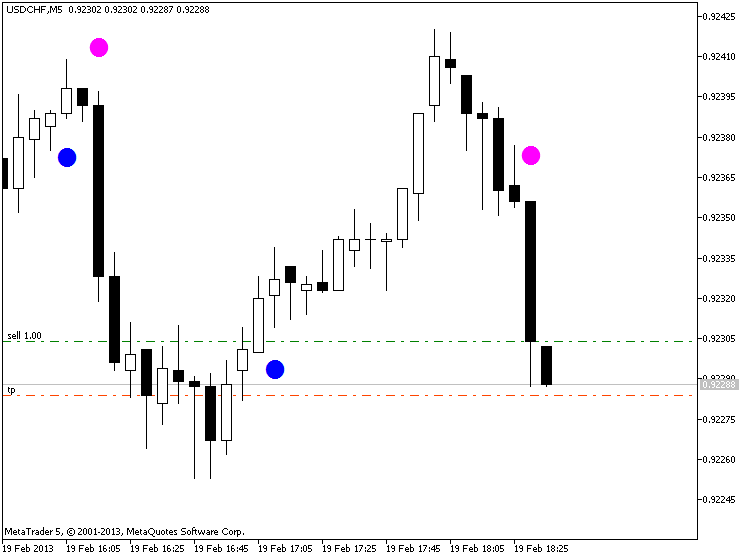

PriceChannel Parabolic system

PriceChannel Parabolic system basic edition

Latest version of the system with latest EAs to download

How to trade

The settingas for EAs: optimization and backtesting

Trading examples

Metaquotes demo

GoMarkets broker, initial deposit is 1,000

Alpari UK broker initial deposit is 1,000

RoboForex broker initial deposit is 1,000

Forum on trading, automated trading systems and testing trading strategies

Indicators: Moving Average of Oscillator (OsMA)

newdigital, 2014.03.21 07:04

Scalping with MACD (based on dailyfx article)

When a scalper begins their day, there are usually quite a few questions that need to be answered before ever placing a trade.

What’s moving the market this morning?

Which markets are most active?

What drivers (or news) might come out to push the market further?

Is my coffee ready yet?

These are just a few examples… but suffice it to say that those who are day-trading in markets have quite a bit on their mind every single trading day.

The Setup

Before a scalper ever triggers a position they need to first find the appropriate market environment.

For fundamental-based traders, Multiple Time Frame Analysis can be helpful; but more important is their outlook or opinion and the fact that that outlook or opinion should mesh with the ‘bigger picture’ view of what’s going on at the moment.

For scalpers, the hourly and 4-hour charts carry special importance, as those are the ideal timeframes for seeing the bigger picture.

After that, traders should look to diagnose the trend (or lack thereof).

A great indicator for investigating trend strength is the Average Directional Index (ADX). Also popular for investigating trends is the Moving Average Indicator.

The Entry

After the day-trader has found a promising setup, they then need to decide how to trigger into positions, and MACD can be a very relevant option for such situations.

Because the trader already knows the direction they want to trade in, they merely need to wait for a corresponding signal via MACD to initiate the position.

When MACD crosses up and over the signal line, the trader can look to go long.

After a long position is triggered, the trader can look to close the position when MACD moves down and under the signal line (which is usually looked at as a sell signal, but because you did the ‘bigger picture analysis’ with the longer-term chart, this is merely a ‘close the long signal.’)

Scalpers can trigger positions when MACD Signal takes place in direction of their bias

On the other side of this equation: If the trader had determined the trend to be down on the longer-term chart or if their fundamental bias is pointing lower, they can look for MACD to cross down and under the signal line to trigger their short position.

And once MACD crosses up and over the signal line, the trader can look to cover their short position.

Scalpers can close positions when opposing MACD Signal takes place

The Context

The aforementioned approach can work phenomenally in a day-trading/scalping approach. But the fact-of-the-matter is that scalping profitably entails a lot more than just a trading plan, and an entry strategy.

Risk management is the undoing of most new traders; and day-traders and scalpers fall victim to this susceptibility even more so than most.

Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video June 2013

newdigital, 2013.06.11 06:55

Scalping the forex market

All the ins and outs on scalping the Forex market. May Chris dives into the world of Scalping where he explains in great detail how this style of trading can be accomplished in the Forex market. This live webinar not only clarifies how a trader can scalp but also provides every Forex trader with a great guidance and extra tips.

Discussion and/or suggestions about brokers are not allowed in the forum.

You should make your own search.