Stock Trader Hedge MT5

- Experts

- Ivan Pochta

- Versão: 1.6

- Atualizado: 2 maio 2022

- Ativações: 10

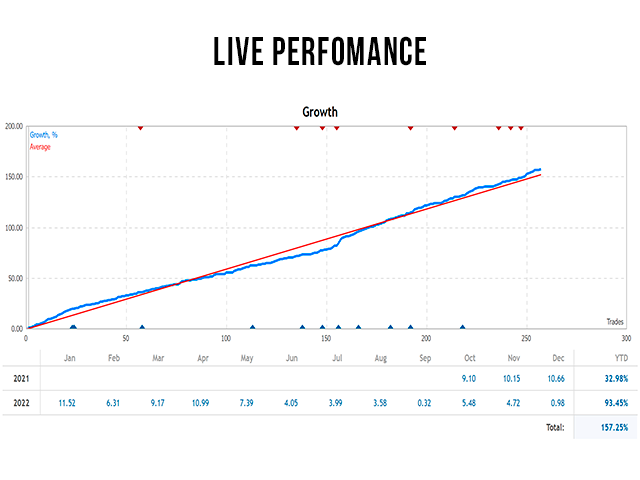

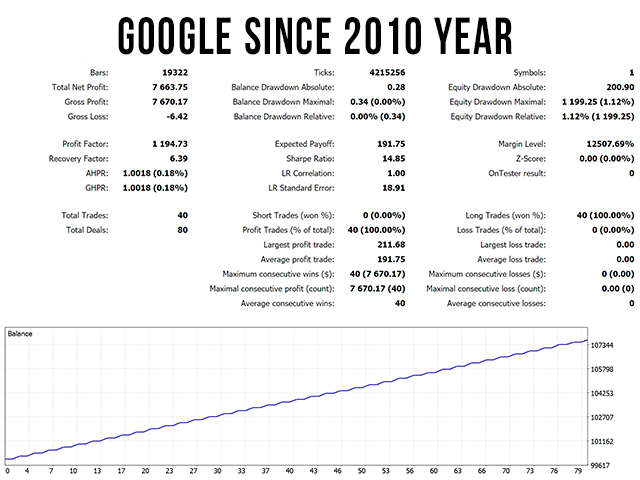

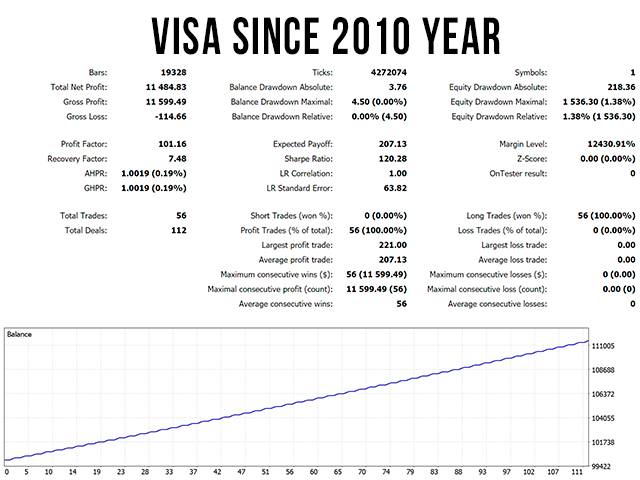

==== Live Results ====

Stock Trader Hedge - CFD Mode: here >> (Admiral Markets Live)

> Stock Trader Hedge v.1.6 Presets: Download >>

> Stock Trader Hedge v.1.2 Backtests: Download >>

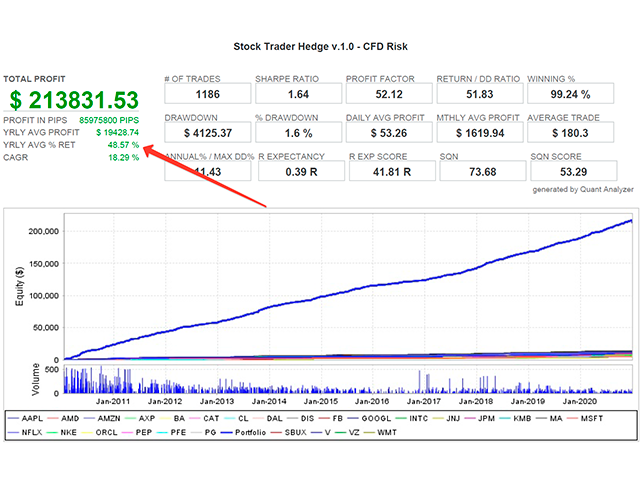

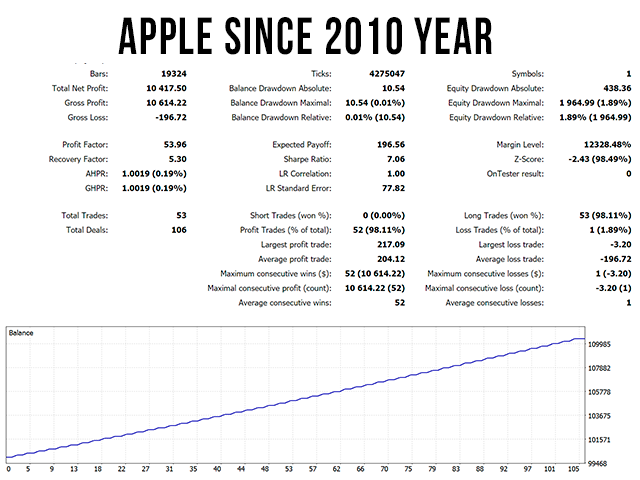

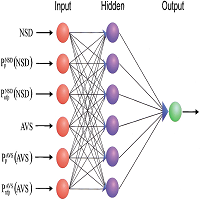

Stock Trader Hedge is a fully automated trading advisor designed to work at US Stock Market. The system is based on the author’s trading strategy. Unlike Forex systems, Stock Trader Hedge opens only LONG positions by the global direction of trend on price on price falls (dips), analyzing data from several timeframes at the same time. The trading strategy is based on technical analysis and uses a number of indicators, including: Moving Average, ATR, CCI, Stochastic, RSI and others. The type of trade is Conservative with a low number of trades, which make system safe.

The system is based on Stock Trader Pro strategy (product page: https://www.mql5.com/en/market/product/36161), but unlike the Pro version, Stock Trader Hedge is designed to work on the Buy and Hold principle, similar to the work of Hedge Funds and professional investors. The system can be used on accounts without leverage. In this case, there are no risk of capital loss! If trade is not closed by Take Profit and is open for a long period, you will get Dividends Payouts. You will get a profit anyway! Using this approach is more profitable than buying and holding outright shares in order to make a profit from Dividends only.

If you use the Stock Trader Hedge for trading CFD of Shares with the leverage, it is recommended to double the risks (use Money Management Value 10 instead default 4) in presets to increase profits!

Stock Trader Hedge has 2 types of trading:

1. Leveraged CFD trading on stocks (classic account type for most brokers). For this type of account, the Hedge function has been implemented: if after opening a deal the price per share drops by 5-10% (depending on the company), an additional order is opened with a Take Profit of 5%.

Thus, if the first trade is in a drawdown for a significant period of time, trading in the company's shares continues and there may be quite a few profitable trades during this period. This mechanism prevents periods of stagnation.

This is the optimal solution for the periods of the Medium-term market correction and its collapses - in such cases the system will receive the maximum profit.

There are 39 stocks available for СFD Mode:

- AAPL, ABBV, AMD, AXP, CAT, CL, EMR, FB, GPC, INTC, JNJ, JPM, KMB, KO, LEG, LMT, MA, MCD, MS, MSFT, NKE, O, OKE, ORCL, ORI, PBA, PEP, PFE, PG, QCOM, SBUX, SYY, TWTR, V, VLO, VZ, WMB, WMT

2. Direct Share Trading without leverage to receive Dividend Payments (you are a share holder). This type of trading is intended for long-term investment: if trades are in drawdown, you receive dividend payments.

The portfolio consists of 57 stocks, most of which are dividend aristocrats:

- AAPL, ABBV, AMD, AXP, BG, BOKF, CAH, CAT, CL, CVX, EMR, ENB, EPD, FB, GILD, GPC, HRB, IBM, INTC, JNJ, JPM, KMB, KO, LEG, LMT, MA, MCD, MMM, MO, MS, MSFT, NKE, O, OHI, OKE, OMC, ORCL, ORI, PBA, PBCT, PEP, PFE, PG, QCOM, SBUX, SJI, SON, SYY, T, TWTR, UGI, UVV, V, VLO, VZ, WMB, WMT

This type of trading is absolutely safe and risk-free, since these are non-CFD accounts and you are a direct shareholder. There is no margin call probability.

Stock Trader Hedge is a system for long-term investment and capital accumulation. The minimum recommended deposit for CFD Mode is $1500, for Dividends Mode is $3000.

Settings

- Comment

- Slippage

- MagicNumber

- from Balance

- from Equity

- from Free Margin

- Type of Money Management

- Balance Loading

- Fixed Size of Contract

- Percent of Loss

- Money Management Value

- TimeFrame - TF for trading

- Take Profit (Percentage of the current value of a share)

- HedgeTrade - true - enable hedge trade, when first in DD;

- HedgeTotal - Number of Hedge trades;

- HedgeDistance - Distance between trades (percent of share cost)

- RSI Period

- RSI Level

- Stochastic Period

- Stochastic Level

- CCI Period

- CCI Level

- Slow_CCI_TF

- Slow_CCI_Period

- Slow_CCI_Level

I’ve been using Stock Trader Hedge for quite some time now, and I can honestly say this EA really works. The EA includes a hedging function, but in my case I run it without hedge, since I’m trading real stocks (not CFDs). Even without using the hedge feature, the EA performs extremely well and follows a clear, disciplined logic. I personally run it with 1:1 position sizing and target moves above 5% and up to 8%, depending on market conditions. The strategy is particularly effective during strong bullish phases, where it captures solid, clean moves. What I like most is the simplicity and reliability of the system. No grid, no martingale, no risky averaging — just structured entries, good timing, and proper risk control. Execution is smooth and the EA behaves exactly as expected in live trading. After testing many EAs over the years, this one stands out as a serious and consistent stock trading tool. The hedge functionality is there for those who trade CFDs, but even without it, the EA delivers real results. If you’re looking for a robust stock EA that actually performs, Stock Trader Hedge is a great choice. Highly recommended ⭐⭐⭐⭐⭐