MAM Ultimate

- Experts

- Matei-Alexandru Mihai

- Versione: 4.0

- Attivazioni: 5

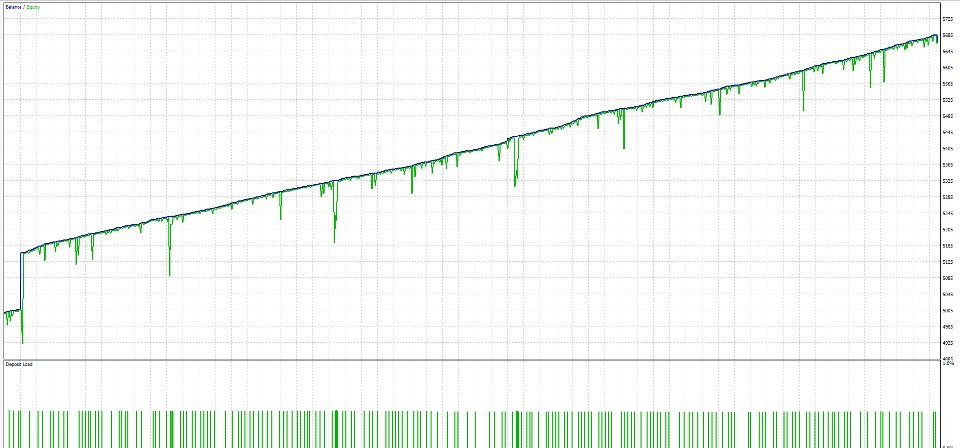

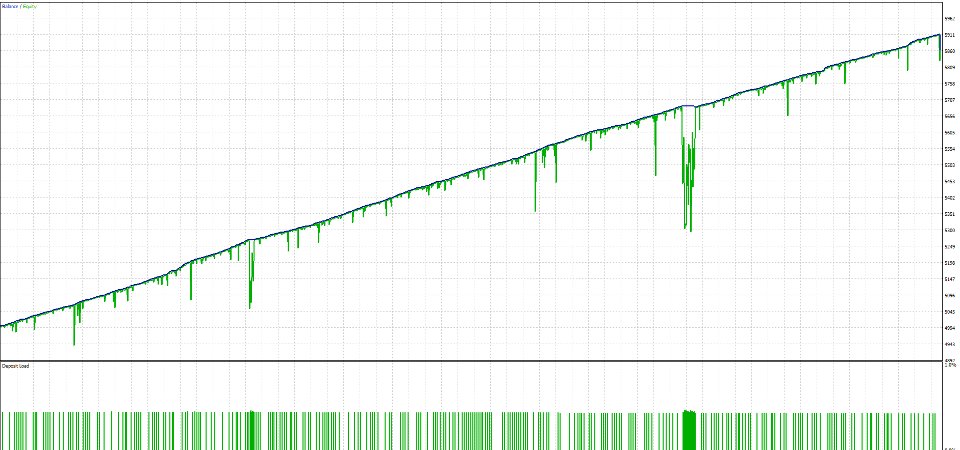

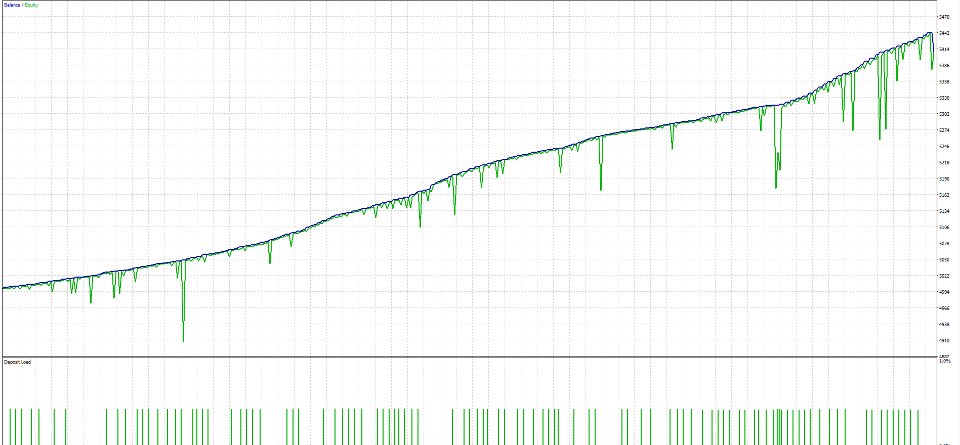

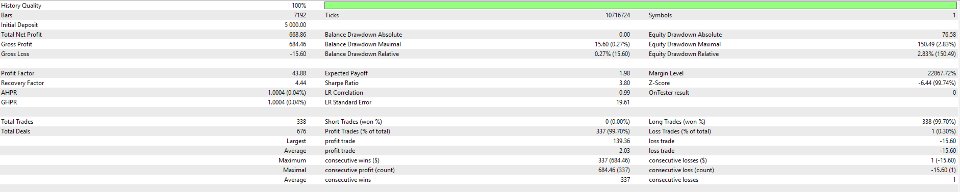

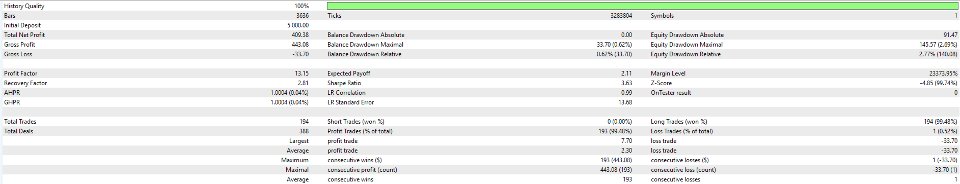

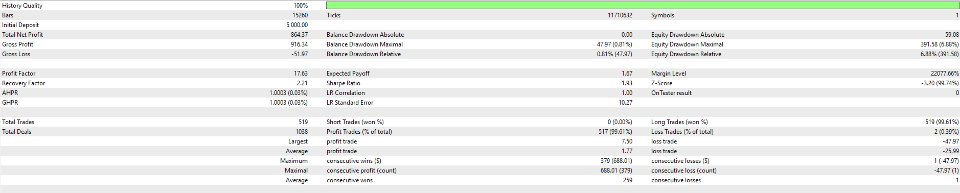

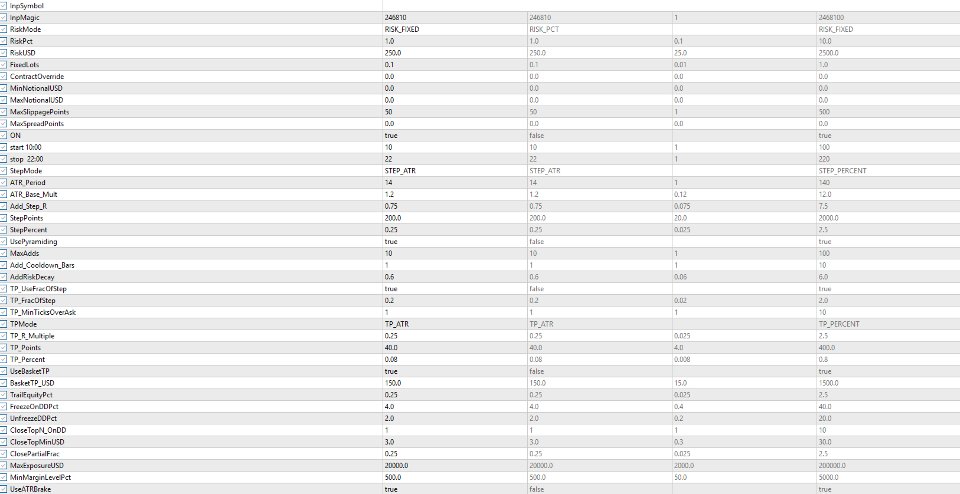

MAM Ultimate is my best work to date. Out of everything I’ve built, this EA is the one I trust the most. It buys only in up-moves and scales in only above the highest existing entry. It doesn’t average into dips, it doesn’t martingale, and it doesn’t chase every tick. Every position gets a tight take-profit placed close to entry, so profits are clipped quickly and risk doesn’t linger.

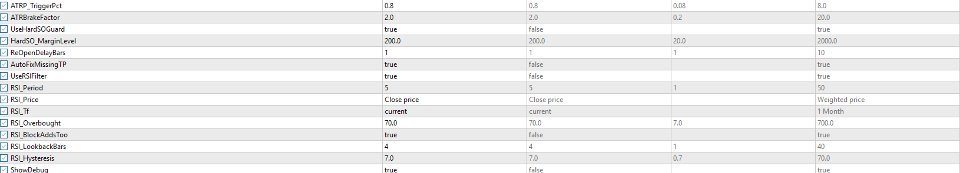

An RSI guard prevents chasing obvious tops, and a fixed trading window (10:00–22:00 terminal time) keeps it out of thin, choppy hours.

It’s also deliberately flexible: it can trade any instrument (FX, indices, commodities, crypto, stocks/CFDs) on any timeframe—from fast scalping charts to higher-timeframe swings—provided the symbol is liquid and your settings fit the market.

What it does

-

Buys strength, not weakness. Adds the next small layer only after price pushes higher.

-

Takes money fast. Each layer has its own near-entry TP, closing green trades quickly and often.

-

Stays selective. When RSI is overheated, it waits.

-

Works only in the main session. No new trades at night; it focuses on hours that usually move.

-

Runs on anything, any timeframe. Tune it to the character of your market—majors, metals, indices, crypto—M1 to Daily.

Safety, by design

-

Exposure cap & margin headroom to keep overall size sensible.

-

Drawdown freeze that pauses new entries if floating loss grows, with gentle optional de-risking.

-

ATR “volatility brake” that widens spacing when markets get jumpy.

-

Basket take-profit with trailing lock-in (optional) to cash out the whole book on good streaks.

-

Hard stopout guard that exits everything if margin gets tight.

-

Auto TP re-attach in case a broker reject drops a take-profit.

How it behaves day-to-day

-

Opens the first long when conditions are calm (RSI not overbought) and the time window is open.

-

Adds only if price makes a new push higher by a sensible step.

-

Closes each layer at its near-entry TP; the book stays light and tidy.

-

If volatility spikes or drawdown rises, it slows down or pauses until conditions improve.

Quick start

-

Drop the EA on a liquid symbol and timeframe you like—it works on any market, any TF.

-

Keep the defaults for spacing and near-entry TP to start; they’re tuned for frequent small wins.

-

Begin with modest lot size and a conservative exposure cap, then adjust as you learn your symbol’s rhythm.

-

Let it work during 10:00–22:00 and review weekly rather than tick-by-tick.

Good to know

-

Built to be robust rather than flashy; it prefers many small wins over “home runs.”

-

VPS recommended for stable execution.

-

Works on both hedging and netting; partial-close logic adapts.