Nexus Stock Trader

Nexus Stock Trader Live Signal ( trading 3% Account Balance Risk)

Nexus EA mql5 public channel: Nexus Community Public Chat

About Nexus Stock Trader:

Nexus Stock Trader is a MT5 Expert Advisor trading US Stocks. The strategy will attempt to ride the long term multi-week trends of the largest market cap stocks in the US market. The EA limits risk by a tight but effective trailing stop.

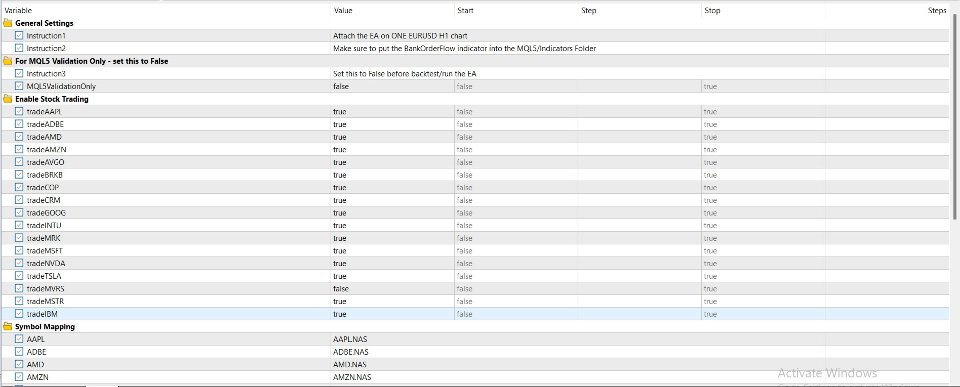

Stock list: AAPL, ADBE, AMD, AMZN, AVGO, BRK-B, COP, CRM, GOOG, INTU, MRK, MSFT, NVDA, TSLA, MVRS, MSTR, IBM

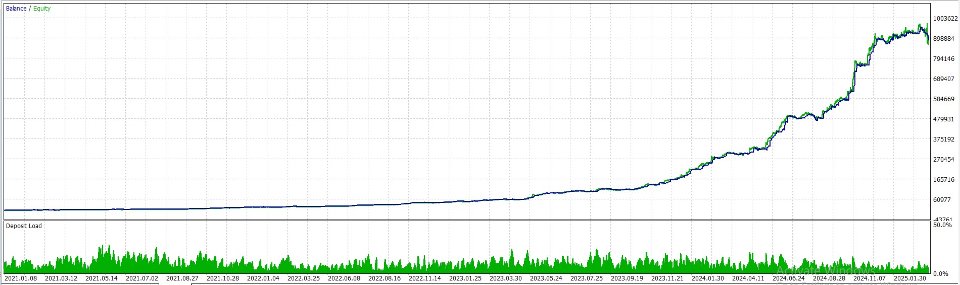

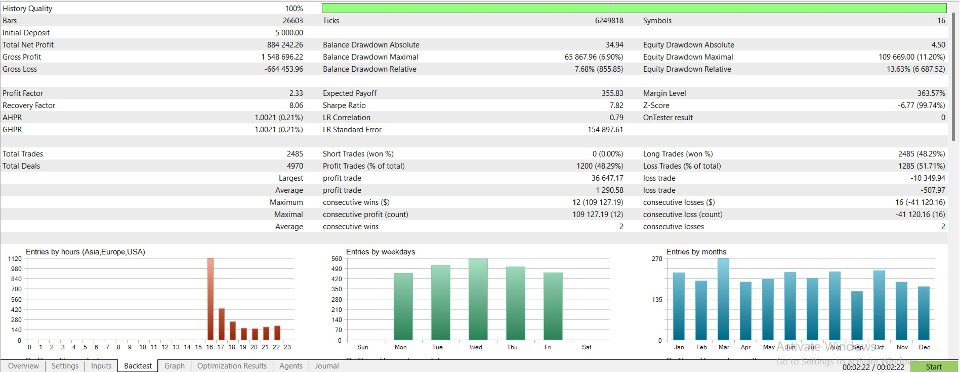

The strategy is optimized on IC Markets data from 2018-2025.

This EA is part of Nexus Portfolio - a combination of the best long term EAs I created for my personal trading as well as private fund management.

Looking for a fully diversified portfolio solution across multiple assets and timeframes ? Check out Nexus Portfolio for the best long term diversified portfolio. This portfolio runs 90+ strategies across 20+ assets and 7+ timeframes.

EAs included in Nexus Portfolio:

- Gold Trend X (Gold Only) [Signal] +310% return in 18 months with only 20% Drawdown

- Market Cycles Order Flow (selected USDJPY, XAUJPY systems) [Signal] +110% return in 6 months with only 20% Drawdown

- Nexus Stock Index Scalper ( trading stock Indices: US500, US30, USTEC, JP225, DE40) [Signal] +70% return in 12 months

- Nexus Scalper (short term scalping XAUUSD, GBPJPY, US500, BTCUSD) [Signal] +20% return in 6 weeks since inception

- Nexus Stock Trader (trading US Stock such as APPL, NVDA, TSLA etc.) [Signal]

- Nexus Commodity (trading Silver and Oil) [Signal]

- Nexus Bitcoin Scalper (selected systems) [Signal]

Why choose my EAs ?

- Excellent long term stable backtest, no grid martingale or manipulation

- Real trades match backtest in execution (90% EAs fail at this!)

- Live performance is similar to backtest (another 90% EAs fail at this - the moment they trade in real life, they perform poorly nothing like backtest)

- Higher return and less risky than any other martingale/grid/increasing lot size after loss EAs

- Diversification through a large number of stocks traded in the portfolio

Backtest & Setup Guide:

- To backtest and run the EA correctly you'll need the BankOrderFlow_update indicator. PM me to receive the indicator and put it in MQL5\Indicators folder.

- Set Mql5ValidationOnly to False

- Make sure supported stocks ( AAPL, ADBE etc. ) are in Market Watch. Map the symbols to the correct corresponding symbols of your brokers.

- Attach/backtest the EA on ONE EURUSD H1chart

- Choose your Risk ( Live Signal trading with 3% Account Balance Risk Percent per trade)

- Best is to use IC Markets platform to test from 2018. You'll get the same backtest result as mine.

- Important Note: If stocks don't have enough data then the EA may return errors if the data is not enough. Try to disable these stocks or backtest them individually within their correct data period. If your brokers don't have certain stocks then disable them within the EA settings.

- Warning: CFD datafeeds and trading conditions may vary among different brokers. Backtest has limitations and may not be indicative of future results.

- No Martingale, grid or holding on losses to infinity. This algorithm is used for private funds and clients with strict risk management guidelines.

- Supported pairs: AAPL, ADBE, AMD, AMZN, AVGO, BRK-B, COP, CRM, GOOG, INTU, MRK, MSFT, NVDA, TSLA, MVRS, MSTR, IBM

- Multi assets - Multi Timeframes - Multi Strategies

- Safe and long term stable

- Losses can and will happen as with any other normal trading strategies. It will have periods of drawdowns but it is a tradeoff for long term capital safety. Estimated Max Drawdown with 3% Balance Risk is 25-30% from backtest

- Requires hedging account and standard New York close brokers time zone( GMT+2 +3)