MACD Ichimoku retracement

- Experts

- Sylvestre Setufa Djagbavi

- Versione: 1.0

- Attivazioni: 5

General Idea of the Strategy

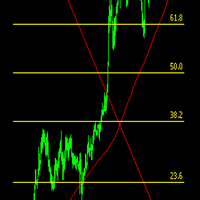

This robot combines the precision of the Ichimoku Cloud and the power of the MACD to identify high-probability trend reversals. The idea is simple: detect moments when the market moves too far from its equilibrium zone (extreme elasticity), then confirm this imbalance through the MACD structure before a real reversal occurs. Thus, the robot does not anticipate it waits for technical proof of the reversal before acting.

Operating Logic

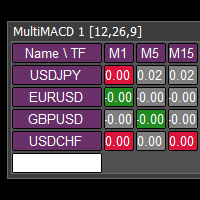

The strategy is based on two levels of analysis:

- The Ichimoku Cloud identifies areas of price excess (above or below the cloud).

- The MACD confirms the reversal momentum through the formation of a peak and the signal line crossing out of the histogram. The combination of these two conditions allows the robot to take positions only when the market clearly shows signs of trend exhaustion.

Sell Conditions

- The price is above the Ichimoku Cloud, indicating an overextended bullish situation.

- There is strong elasticity between the price and the cloud, signaling an excessive gap.

- The MACD (histogram and signal line) is above the zero line, forming a peak.

- The signal line exits the histogram, confirming a loss of bullish momentum. The robot then executes a sell, anticipating a high-probability bearish reversal.

Buy Conditions

- The price is below the Ichimoku Cloud, indicating an overextended bearish situation.

- Strong elasticity exists between the price and the cloud, signaling an excessive downward deviation.

- The MACD (histogram and signal line) is below the zero line, forming a trough.

- The signal line exits the histogram, confirming a loss of bearish momentum. The robot then executes a buy, anticipating a high-potential bullish reversal.

Integrated Risk Management

The robot uses no martingale and no grid.

It relies on a clear, clean, and measured logic, focused on reading price and momentum:

- Adjustable Stop Loss and Take Profit,

- Dynamic Trailing Stop to secure profits,

- Filtered entries to avoid weak signals.

About the Backtest

No backtest is provided with the robot, and that is intentional.

Backtest results can vary significantly from one broker to another due to parameters such as: spread, commissions, swap.That’s why you should perform your own backtests with your preferred broker and assets. Doing so will allow you to:

- Understand the robot’s exact logic,

- valuate its performance under your real trading conditions,

- And strengthen your confidence during drawdown phases.

A Final Reminder

Automated trading does not replace learning or discipline. If someone expects to make money without investing time or effort, they are on the wrong path.