SAR Ichimoku retracement

- Experts

- Sylvestre Setufa Djagbavi

- Versione: 1.0

- Attivazioni: 5

General Idea of the Strategy

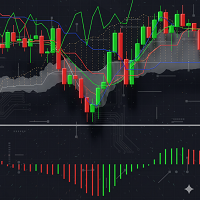

The robot is built on an elegant combination of three powerful technical concepts:

the Ichimoku Cloud, the Parabolic SAR, and the concept of price elasticity.Its goal is simple:

to identify the most reliable trend reversals by waiting for the market to reach a sufficient level of tension before confirming a new direction.The robot does not attempt to trade every movement, but only high-probability signals, when price, trend, and momentum align perfectly.

Operating Logic

The strategy analyzes the position of the price relative to the Ichimoku Cloud, then waits for confirmation from the SAR before acting.This dual confirmation avoids premature entries and focuses on situations where the market shows a genuine intention to move.

Buy Conditions

- The price is located below the Ichimoku Cloud, indicating potential for a bullish rebound.

- The SAR gives a clear buy signal.

- A strong elasticity is observed between the price and the cloud, suggesting an extreme deviation and a possible upcoming correction.The robot opens a buy position, taking advantage of a high-probability reversal signal.

Sell Conditions

- The price is above the Ichimoku Cloud, indicating an overextended market zone.

- The SAR gives a sell signal.

- A strong elasticity is observed between the price and the cloud, suggesting a likely return toward the mean.The robot opens a sell position, aligned with a natural market correction.

Integrated Risk Management

The robot uses no martingale and no grid.It operates on a rational, clean, and controlled logic:

- Configurable Stop Loss and Take Profit,

- Dynamic Trailing Stop to protect profits,

- Filtered entries to avoid unnecessary overtrading.

Each trade results from a structured algorithmic analysis, not from randomness.

About the Backtest

No backtest is provided with the robot.

Why? Because results vary from one broker to another, depending on:spread,commissions,swap.A robot can therefore be profitable with one broker and less effective with another.That’s why you should perform your own backtests with your preferred broker and instruments.Doing so will help you:

- Understand the robot’s exact behavior,

- Adjust parameters to your actual market conditions,

- And most importantly, strengthen your psychology during drawdown periods. A trader who understands the logic behind their strategy remains calm even when the market corrects.

If you don’t know how to perform a backtest, simply search on YouTube: “How to perform an automatic backtest using the MQL5 Strategy Tester.”

An Essential Reminder

Automated trading is not a shortcut to easy wealth.If someone wants to make money without investing time or effort, that is simply unrealistic.

But if you’re looking for a robot built on a clear, technical, and disciplined logic, one that waits for genuine signals before acting, then this robot deserves a place in your trading arsenal.