Rsi MA Breakout X

- Experts

- Sylvestre Setufa Djagbavi

- Versione: 1.0

- Attivazioni: 5

General Idea of the Strategy

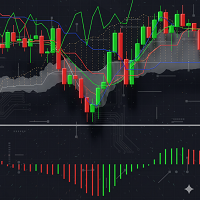

This robot is built on a simple yet powerful concept.Capturing high-probability trend reversals by combining three essential market elements:

- Moving Average (MA): to identify the dominant trend and areas of excess.

- Price Elasticity : to detect when the market moves too far from its natural balance.

- RSI (Relative Strength Index) : to confirm overbought or oversold zones before a potential reversal.

This combination allows the robot to enter trades only when conditions are clearly aligned, avoiding false signals and premature entries.

Operating Logic

The market behaves like an elastic band. The more it stretches, the more likely it is to snap back to equilibrium. The robot measures the distance between price and the moving average (elasticity) to detect market extremes. But it doesn’t rely on assumptions. It always waits for a confirmed technical breakout before opening a trade.

Sell Conditions

- The price is above the moving average, indicating an overextended bullish phase.

- A strong elasticity shows the market has deviated too far from its balance zone.

- The RSI is overbought, signaling weakening bullish momentum.

- The robot then waits for a bearish breakout below the moving average to confirm the reversal.

Once these conditions are met, the robot executes a SELL, taking advantage of the corrective phase of the market.

Buy Conditions

- The price is below the moving average, showing an overextended bearish situation.

- A strong elasticity reveals excessive deviation from the equilibrium.

- The RSI is oversold, indicating fading bearish pressure.

- The robot waits for a bullish breakout above the moving average to validate the reversal.

When these conditions align, the robot executes a BUY, anticipating a bullish rebound.

Risk Management and Discipline

The robot is designed with strict risk management, using no martingale and no grid system. Each trade follows a clear, measurable technical sequence.You can customize: Stop Loss, Take Profit, Trailing Stop, and the signal parameters based on your risk tolerance. Every trade is based on logic, not luck.

About the Backtest

No backtest is intentionally provided. Robot results vary depending on brokers because each one has different spreads, commissions, swaps, and execution quality. That’s why you should perform your own backtests on your preferred assets and broker. Doing so helps you:Understand the robot’s logic in depth, evaluate its real performance, strengthen your psychology during drawdown periods. If you don’t know how to perform a backtest, simply search on YouTube: “How to run an automatic backtest with the MT5 Strategy Tester.

In Summary

Automated trading is not a promise of easy money. It’s a powerful tool for traders who take the time to understand what they use. If you’re looking for a robot based on real market logic, one that waits for confirmed breakouts after price excess, then this robot is built for you.