Precision Breakout Pro

- Indicators

- James Patrick D Artanion Grieves

- Version: 10.8

- Updated: 11 August 2025

- Activations: 10

- How It Works

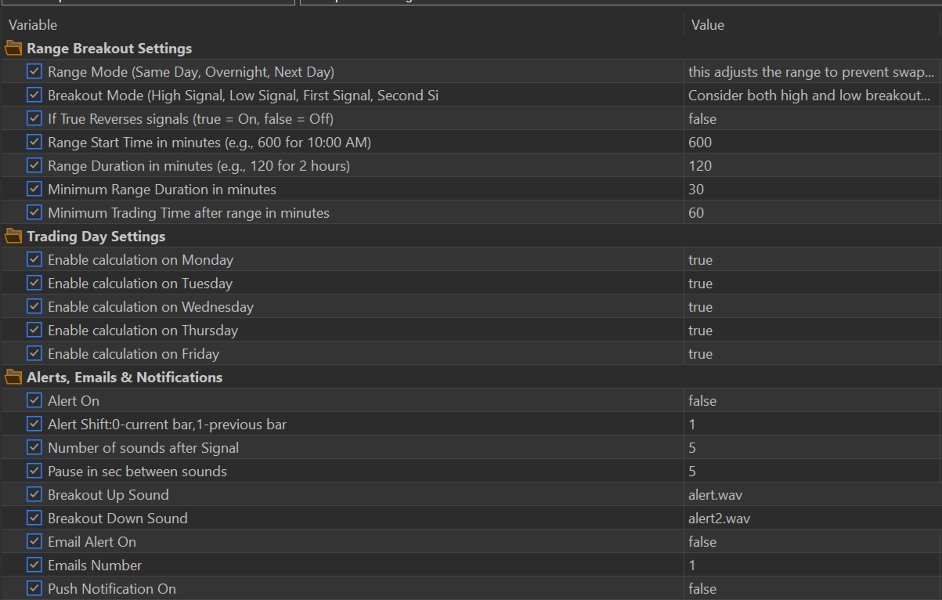

Core Concept

This is a range breakout trading indicator that identifies consolidation periods (ranges) and generates signals when price breaks above or below those ranges. It can operate in both trending and mean reversion modes.

Key Components:

1. Range Identification

- Range Period: Defines a specific time window each trading day (e.g., 10:00 AM - 12:00 PM)

- Range Calculation: During this period, the indicator tracks the highest high and lowest low prices

- Trading Days: Configurable for Monday through Friday

2. Range Modes

- SAME_DAY: Range and trading occur on the same day

- OVER_NIGHT: Range can extend overnight

- NEXT_DAY: Range is set one day, trading signals occur the next day

3. Signal Generation

The indicator generates 4 types of signals:

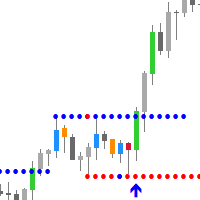

- Trending Buy (Green/Lime arrows): Buy when price breaks above range high

- Trending Sell (Red arrows): Sell when price breaks below range low

- Mean Reversion Buy (Blue arrows): Buy when price breaks below range low (expecting bounce back)

- Mean Reversion Sell (Orange arrows): Sell when price breaks above range high (expecting pullback)

4. Breakout Modes

- HIGH_SIGNAL: Only signals on upward breakouts

- LOW_SIGNAL: Only signals on downward breakouts

- BOTH_SIGNALS: Signals on both directions (default)

- FIRST_SIGNAL: Only the first breakout per range

- SECOND_SIGNAL: Only the second breakout per range

5. Mean Reversion Toggle

- Off (default): Standard breakout strategy - buy high breakouts, sell low breakouts

- On: Reverses signals - sell high breakouts, buy low breakouts (expecting price to return to range)

Visual Elements:

- Blue solid lines: Current range high/low during range period

- Blue dotted lines: Extended range lines after range period ends

- Blue vertical lines: Range start and end times

- Green vertical line: Midnight transition (NEXT_DAY mode)

- Gray dashed lines: Historical ranges from previous days

- Colored arrows: Signal indicators positioned above/below price

Alert System:

- Sound alerts: Customizable sounds for breakout signals

- Popup alerts: Visual alerts on screen

- Email notifications: Sends emails when signals occur

- Push notifications: Mobile notifications

Security Features:

- Account authorization: Only works on authorized trading accounts

- Demo account access: Always works on demo accounts

- Strategy tester access: Always works in MT5 strategy tester

Typical Trading Workflow:

- Range Formation: Each trading day, during the specified time window, the indicator identifies support/resistance levels

- Range Completion: After the range period ends, the indicator monitors for breakouts

- Signal Generation: When price breaks above/below the range, it generates both trending and mean reversion signals

- Alert Delivery: Notifications are sent via sound, popup, email, or mobile push

- Historical Tracking: Previous ranges are preserved as gray reference lines

Practical Use Cases:

- Day Trading: Identify intraday breakout opportunities

- Session Trading: Trade London/New York session breakouts

- Mean Reversion: Fade false breakouts expecting price to return to range

- Trend Following: Follow genuine breakouts in the breakout direction

This indicator is particularly useful for traders who want to systematically identify and trade range breakouts with built-in risk management through dual signal types (trending vs mean reversion).