Automating Trading Strategies with Parabolic SAR Trend Strategy in MQL5: Crafting an Effective Expert Advisor

In this article, we will automate the trading strategies with Parabolic SAR Strategy in MQL5: Crafting an Effective Expert Advisor. The EA will make trades based on trends identified by the Parabolic SAR indicator.

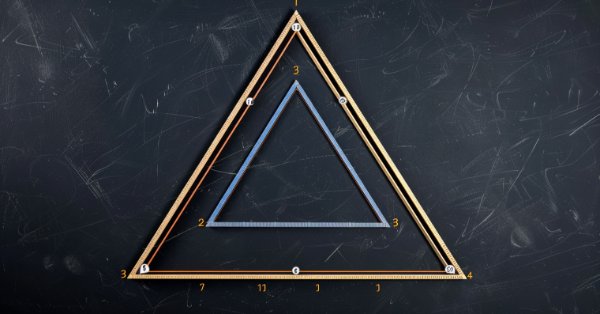

MQL5 Wizard Techniques you should know (Part 34): Price-Embedding with an Unconventional RBM

Restricted Boltzmann Machines are a form of neural network that was developed in the mid 1980s at a time when compute resources were prohibitively expensive. At its onset, it relied on Gibbs Sampling and Contrastive Divergence in order to reduce dimensionality or capture the hidden probabilities/properties over input training data sets. We examine how Backpropagation can perform similarly when the RBM ‘embeds’ prices for a forecasting Multi-Layer-Perceptron.

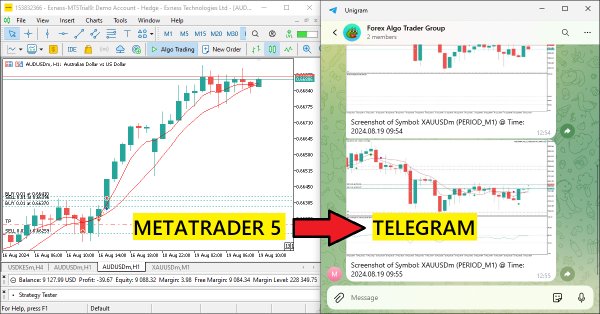

Creating an MQL5-Telegram Integrated Expert Advisor (Part 3): Sending Chart Screenshots with Captions from MQL5 to Telegram

In this article, we create an MQL5 Expert Advisor that encodes chart screenshots as image data and sends them to a Telegram chat via HTTP requests. By integrating photo encoding and transmission, we enhance the existing MQL5-Telegram system with visual trading insights directly within Telegram.

Reimagining Classic Strategies (Part VI): Multiple Time-Frame Analysis

In this series of articles, we revisit classic strategies to see if we can improve them using AI. In today's article, we will examine the popular strategy of multiple time-frame analysis to judge if the strategy would be enhanced with AI.

MQL5 Wizard Techniques you should know (Part 33): Gaussian Process Kernels

Gaussian Process Kernels are the covariance function of the Normal Distribution that could play a role in forecasting. We explore this unique algorithm in a custom signal class of MQL5 to see if it could be put to use as a prime entry and exit signal.

Reimagining Classic Strategies (Part V): Multiple Symbol Analysis on USDZAR

In this series of articles, we revisit classical strategies to see if we can improve the strategy using AI. In today's article, we will examine a popular strategy of multiple symbol analysis using a basket of correlated securities, we will focus on the exotic USDZAR currency pair.

MQL5 Wizard Techniques you should know (Part 32): Regularization

Regularization is a form of penalizing the loss function in proportion to the discrete weighting applied throughout the various layers of a neural network. We look at the significance, for some of the various regularization forms, this can have in test runs with a wizard assembled Expert Advisor.

MQL5 Integration: Python

Python is a well-known and popular programming language with many features, especially in the fields of finance, data science, Artificial Intelligence, and Machine Learning. Python is a powerful tool that can be useful in trading as well. MQL5 allows us to use this powerful language as an integration to get our objectives done effectively. In this article, we will share how we can use Python as an integration in MQL5 after learning some basic information about Python.

Building a Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (I)

In this discussion, we will create our first Expert Advisor in MQL5 based on the indicator we made in the prior article. We will cover all the features required to make the process automatic, including risk management. This will extensively benefit the users to advance from manual execution of trades to automated systems.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 2): Sending Signals from MQL5 to Telegram

In this article, we create an MQL5-Telegram integrated Expert Advisor that sends moving average crossover signals to Telegram. We detail the process of generating trading signals from moving average crossovers, implementing the necessary code in MQL5, and ensuring the integration works seamlessly. The result is a system that provides real-time trading alerts directly to your Telegram group chat.

Developing a multi-currency Expert Advisor (Part 6): Automating the selection of an instance group

After optimizing the trading strategy, we receive sets of parameters. We can use them to create several instances of trading strategies combined in one EA. Previously, we did this manually. Here we will try to automate this process.

MQL5 Wizard Techniques you should know (Part 31): Selecting the Loss Function

Loss Function is the key metric of machine learning algorithms that provides feedback to the training process by quantifying how well a given set of parameters are performing when compared to their intended target. We explore the various formats of this function in an MQL5 custom wizard class.

Integrate Your Own LLM into EA (Part 5): Develop and Test Trading Strategy with LLMs(I)-Fine-tuning

With the rapid development of artificial intelligence today, language models (LLMs) are an important part of artificial intelligence, so we should think about how to integrate powerful LLMs into our algorithmic trading. For most people, it is difficult to fine-tune these powerful models according to their needs, deploy them locally, and then apply them to algorithmic trading. This series of articles will take a step-by-step approach to achieve this goal.

Implementing the Deus EA: Automated Trading with RSI and Moving Averages in MQL5

This article outlines the steps to implement the Deus EA based on the RSI and Moving Average indicators for guiding automated trading.

Creating an MQL5-Telegram Integrated Expert Advisor (Part 1): Sending Messages from MQL5 to Telegram

In this article, we create an Expert Advisor (EA) in MQL5 to send messages to Telegram using a bot. We set up the necessary parameters, including the bot's API token and chat ID, and then perform an HTTP POST request to deliver the messages. Later, we handle the response to ensure successful delivery and troubleshoot any issues that arise in case of failure. This ensures we send messages from MQL5 to Telegram via the created bot.

Implementing a Bollinger Bands Trading Strategy with MQL5: A Step-by-Step Guide

A step-by-step guide to implementing an automated trading algorithm in MQL5 based on the Bollinger Bands trading strategy. A detailed tutorial based on creating an Expert Advisor that can be useful for traders.

Neural networks made easy (Part 82): Ordinary Differential Equation models (NeuralODE)

In this article, we will discuss another type of models that are aimed at studying the dynamics of the environmental state.

MQL5 Wizard Techniques you should know (Part 30): Spotlight on Batch-Normalization in Machine Learning

Batch normalization is the pre-processing of data before it is fed into a machine learning algorithm, like a neural network. This is always done while being mindful of the type of Activation to be used by the algorithm. We therefore explore the different approaches that one can take in reaping the benefits of this, with the help of a wizard assembled Expert Advisor.

Price-Driven CGI Model: Advanced Data Post-Processing and Implementation

In this article, we will explore the development of a fully customizable Price Data export script using MQL5, marking new advancements in the simulation of the Price Man CGI Model. We have implemented advanced refinement techniques to ensure that the data is user-friendly and optimized for animation purposes. Additionally, we will uncover the capabilities of Blender 3D in effectively working with and visualizing price data, demonstrating its potential for creating dynamic and engaging animations.

Developing a multi-currency Expert Advisor (Part 5): Variable position sizes

In the previous parts, the Expert Advisor (EA) under development was able to use only a fixed position size for trading. This is acceptable for testing, but is not advisable when trading on a real account. Let's make it possible to trade using variable position sizes.

From Novice to Expert: The Essential Journey Through MQL5 Trading

Unlock your potential! You're surrounded by opportunities. Discover 3 top secrets to kickstart your MQL5 journey or take it to the next level. Let's dive into discussion of tips and tricks for beginners and pros alike.

Creating a Dynamic Multi-Symbol, Multi-Period Relative Strength Indicator (RSI) Indicator Dashboard in MQL5

In this article, we develop a dynamic multi-symbol, multi-period RSI indicator dashboard in MQL5, providing traders real-time RSI values across various symbols and timeframes. The dashboard features interactive buttons, real-time updates, and color-coded indicators to help traders make informed decisions.

Practicing the development of trading strategies

In this article, we will make an attempt to develop our own trading strategy. Any trading strategy must be based on some kind of statistical advantage. Moreover, this advantage should exist for a long time.

Neural Networks Made Easy (Part 81): Context-Guided Motion Analysis (CCMR)

In previous works, we always assessed the current state of the environment. At the same time, the dynamics of changes in indicators always remained "behind the scenes". In this article I want to introduce you to an algorithm that allows you to evaluate the direct change in data between 2 successive environmental states.

MQL5 Wizard Techniques you should know (Part 29): Continuation on Learning Rates with MLPs

We wrap up our look at learning rate sensitivity to the performance of Expert Advisors by primarily examining the Adaptive Learning Rates. These learning rates aim to be customized for each parameter in a layer during the training process and so we assess potential benefits vs the expected performance toll.

Build Self Optimizing Expert Advisors With MQL5 And Python

In this article, we will discuss how we can build Expert Advisors capable of autonomously selecting and changing trading strategies based on prevailing market conditions. We will learn about Markov Chains and how they can be helpful to us as algorithmic traders.

MQL5 Trading Toolkit (Part 2): Expanding and Implementing the Positions Management EX5 Library

Learn how to import and use EX5 libraries in your MQL5 code or projects. In this continuation article, we will expand the EX5 library by adding more position management functions to the existing library and creating two Expert Advisors. The first example will use the Variable Index Dynamic Average Technical Indicator to develop a trailing stop trading strategy expert advisor, while the second example will utilize a trade panel to monitor, open, close, and modify positions. These two examples will demonstrate how to use and implement the upgraded EX5 position management library.

Neural networks made easy (Part 80): Graph Transformer Generative Adversarial Model (GTGAN)

In this article, I will get acquainted with the GTGAN algorithm, which was introduced in January 2024 to solve complex problems of generation architectural layouts with graph constraints.

Reimagining Classic Strategies (Part II): Bollinger Bands Breakouts

This article explores a trading strategy that integrates Linear Discriminant Analysis (LDA) with Bollinger Bands, leveraging categorical zone predictions for strategic market entry signals.

Combine Fundamental And Technical Analysis Strategies in MQL5 For Beginners

In this article, we will discuss how to integrate trend following and fundamental principles seamlessly into one Expert Advisors to build a strategy that is more robust. This article will demonstrate how easy it is for anyone to get up and running building customized trading algorithms using MQL5.

Data Science and ML (Part 27): Convolutional Neural Networks (CNNs) in MetaTrader 5 Trading Bots — Are They Worth It?

Convolutional Neural Networks (CNNs) are renowned for their prowess in detecting patterns in images and videos, with applications spanning diverse fields. In this article, we explore the potential of CNNs to identify valuable patterns in financial markets and generate effective trading signals for MetaTrader 5 trading bots. Let us discover how this deep machine learning technique can be leveraged for smarter trading decisions.

MQL5 Wizard Techniques you should know (Part 28): GANs Revisited with a Primer on Learning Rates

The Learning Rate, is a step size towards a training target in many machine learning algorithms’ training processes. We examine the impact its many schedules and formats can have on the performance of a Generative Adversarial Network, a type of neural network that we had examined in an earlier article.

Data Science and ML (Part 26): The Ultimate Battle in Time Series Forecasting — LSTM vs GRU Neural Networks

In the previous article, we discussed a simple RNN which despite its inability to understand long-term dependencies in the data, was able to make a profitable strategy. In this article, we are discussing both the Long-Short Term Memory(LSTM) and the Gated Recurrent Unit(GRU). These two were introduced to overcome the shortcomings of a simple RNN and to outsmart it.

Introduction to MQL5 (Part 8): Beginner's Guide to Building Expert Advisors (II)

This article addresses common beginner questions from MQL5 forums and demonstrates practical solutions. Learn to perform essential tasks like buying and selling, obtaining candlestick prices, and managing automated trading aspects such as trade limits, trading periods, and profit/loss thresholds. Get step-by-step guidance to enhance your understanding and implementation of these concepts in MQL5.

Developing an Expert Advisor (EA) based on the Consolidation Range Breakout strategy in MQL5

This article outlines the steps to create an Expert Advisor (EA) that capitalizes on price breakouts after consolidation periods. By identifying consolidation ranges and setting breakout levels, traders can automate their trading decisions based on this strategy. The Expert Advisor aims to provide clear entry and exit points while avoiding false breakouts

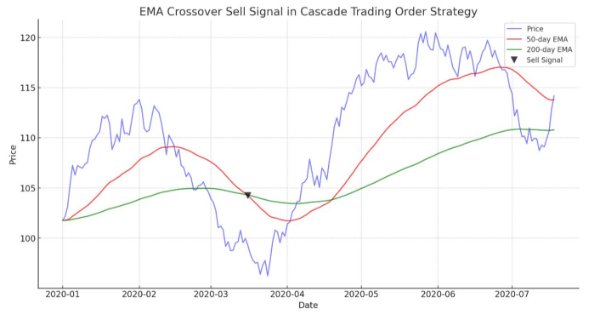

Cascade Order Trading Strategy Based on EMA Crossovers for MetaTrader 5

The article guides in demonstrating an automated algorithm based on EMA Crossovers for MetaTrader 5. Detailed information on all aspects of demonstrating an Expert Advisor in MQL5 and testing it in MetaTrader 5 - from analyzing price range behaviors to risk management.

Creating an Interactive Graphical User Interface in MQL5 (Part 2): Adding Controls and Responsiveness

Enhancing the MQL5 GUI panel with dynamic features can significantly improve the trading experience for users. By incorporating interactive elements, hover effects, and real-time data updates, the panel becomes a powerful tool for modern traders.

Using JSON Data API in your MQL projects

Imagine that you can use data that is not found in MetaTrader, you only get data from indicators by price analysis and technical analysis. Now imagine that you can access data that will take your trading power steps higher. You can multiply the power of the MetaTrader software if you mix the output of other software, macro analysis methods, and ultra-advanced tools through the API data. In this article, we will teach you how to use APIs and introduce useful and valuable API data services.

MQL5 Wizard Techniques you should know (Part 27): Moving Averages and the Angle of Attack

The Angle of Attack is an often-quoted metric whose steepness is understood to strongly correlate with the strength of a prevailing trend. We look at how it is commonly used and understood and examine if there are changes that could be introduced in how it's measured for the benefit of a trade system that puts it in use.

How to Integrate Smart Money Concepts (BOS) Coupled with the RSI Indicator into an EA

Smart Money Concept (Break Of Structure) coupled with the RSI Indicator to make informed automated trading decisions based on the market structure.