Martin Boy

- Experts

- Jie Lin Wang

- 버전: 1.1

- 활성화: 5

Martin Boy – Dual-Directional Martingale Grid Trading Strategy Documentation

All parameters are based on the GBPJPY currency pair. Parameters for other currency pairs must be backtested separately. Historical maximum and minimum prices must be entered; otherwise, the strategy may result in one-sided trades or fail to trade.

This Expert Advisor (EA) implements a pure mathematical Martingale trading model designed for long-term stability and profitability:

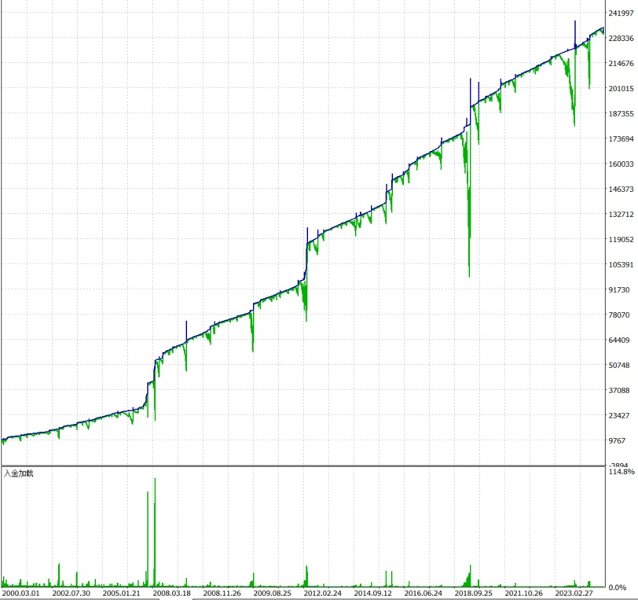

25-Year Backtest Stability: The strategy is designed to survive extensive backtesting over decades without account blow-ups.

Market-Independent: Works independently of trends or ranging markets; no technical indicators or market condition filters are required.

Finite Risk Control: Uses a mathematically defined risk management framework to cap potential losses while allowing controlled exposure.

Adaptive Risk-Reward Scaling: Risk can be dynamically adjusted, and as risk tolerance increases, potential returns scale proportionally.

Fully Automated: The EA manages position sizing, risk scaling, and trade execution automatically, ensuring disciplined adherence to the strategy.

Key Advantages:

Purely mathematical and systematic, eliminating discretionary errors.

Can operate in any market condition.

Flexible risk-reward balance, adaptable to different account sizes and risk appetites.

Designed for robust long-term performance.

1. Strategy Overview

This strategy is a Dual-Directional Martingale Grid Trading System, designed specifically for MT5 Hedging Accounts. It captures trading opportunities during price fluctuations by combining Stochastic indicator signals with dynamic grid spacing calculations, and reduces average position cost through a Martingale position-adding mechanism.

Core Features

✅ Dual-Directional Trading: Supports simultaneous long and short grid trading

✅ Smart Grid: Dynamically adjusts grid spacing based on price and counterparty positions

✅ Dynamic Lot Size: Calculates trading lots intelligently based on account balance, price level, and position status

✅ Risk Control: Multiple risk limitation mechanisms, including price range and maximum lot restrictions

✅ Flexible Martingale: Adjusts the position-adding strategy based on market conditions

2. Strategy Principles

2.1 Basic Trading Logic

The strategy uses a grid trading + Martingale hybrid approach:

Initial Entry: Determined by the Stochastic indicator

Long signal: %K crosses above %D, and %D > buy zone (default 10)

Short signal: %K crosses below %D, and %D < sell zone (default 90)

Grid Position-Adding: When the price moves unfavorably, positions are added at preset grid intervals

Each additional lot increases by a multiplier (default 1.52)

Grid spacing adjusts dynamically according to the number of orders and price level

Take Profit Closing: When all positions in the same direction are profitable, they are closed once the target is reached

2.2 Grid Spacing Calculation

The strategy’s innovation lies in dynamic grid spacing, which considers:

Price Position Effect

Buy Grid Spacing = (Current Price / Historical High / Price Distance %) ^ Step Power × Base Step

Sell Grid Spacing = (Historical Low / Current Price / Price Distance %) ^ Step Power × Base Step

When the price approaches historical highs/lows, grid spacing narrows → more frequent trades

When the price is far from extremes, grid spacing widens → fewer trades

Step power (default 3.0) amplifies this effect

Order Quantity Effect

Actual Grid Spacing = Base Grid Step × (Grid Power - Price Power) ^ (Order Count × Opposite Side Coefficient) + Additional Step

As the number of orders increases, grid spacing gradually widens

Considers opposite-side positions to prevent excessive scaling in extreme conditions

2.3 Lot Calculation

Base Lot

Buy Base Lot = (Account Balance / BaseLotPercent / 1000) / (Current Price / Historical High / Price Multiplier %) ^ Lot Power + 0.01

Sell Base Lot = (Account Balance / BaseLotPercent / 1000) / (Historical Low / Current Price / Price Multiplier %) ^ Lot Power + 0.01

Base lot is proportional to account balance

Lot size decreases when price approaches extremes → risk control

Lot adjustments are smoothed using a power function

Position-Adding Lot (Martingale)

Initial Phase (first N orders): Base Lot × Initial Phase Multiplier (default 1.0)

Flexible Martingale Phase:

Opposite side strong: Previous Lot × Lot Multiplier × Opposite Side Multiplier (default 1.15)

Opposite side weak: Previous Lot × Lot Multiplier

2.4 Flexible Martingale Mechanism

The strategy uses three Martingale approaches based on counterparty positions:

Case 1: Initial Phase (Order Count ≤ Initial Threshold)

Use slower grid spacing (Initial Grid Slow × Base Grid Step)

Smaller lot multiplier (default 1.0)

Suitable for small fluctuations at market opening

Case 2: Opposite Side Strong (Opposite Lot ≥ Own Lot × Split Multiplier)

Narrower grid spacing (Opposite Side Step Discount, default 0.8)

Increased lot size (Opposite Side Multiplier, default 1.15)

Quickly balance positions and reduce risk exposure

Case 3: Opposite Side Weak (Opposite Lot < Own Lot × Split Multiplier)

Wider grid spacing (Split Threshold Offset, default 3.0)

Normal lot multiplier for continued scaling in favorable direction

2.5 Take Profit Mechanism

Buy TP Price = Last Buy Price + (Buy Order Count × TakeProfitPoints × Point Value)

Sell TP Price = Last Sell Price - (Sell Order Count × TakeProfitPoints × Point Value)

More orders → larger TP target

Triggered only when all same-direction positions are profitable

Closes all positions in that direction at once to lock profits

3. Key Parameters

3.1 Price Range

MaxPriceForBuy: 250 → no buys above this price

MinPriceForSell: 90 → no sells below this price

3.2 Base Trading Settings

BaseGridStep: 2.26 (range 2.0–3.8)

BaseLotPercent: 7500 (range 4500–125000)

LotMultiplier: 1.52 (range 1.50–1.75, >1.35)

GridPower: 1.232 (range 1.22–1.24, >1)

3.3 Initial Phase

InitialOrdersThreshold: 2

InitialGridSlow: 2.1

FirstPhaseMultiplier: 1.0

3.4 Flexible Martingale

AdditionalStep: 2.0

OppositeSideCoefficient: 2.2

OppositeSidePercent: 0.5

SplitThresholdOffset: 3.0

OppositeSideStepDiscount: 0.8

OppositeSideMultiplier: 1.15

3.5 Take Profit

TakeProfitPoints: 16 (recommended 10–70)

3.6 Limits

BaseLotLimit: 3.7

SplitMultiplier: 1.7

MaxTotalLots: 22 (recommended 6–18)

3.7 Main Unit

PriceDistancePercent: 0.7

PriceMultiplierPercent: 0.7

StepPowerMultiplier: 3.0

LotPowerMultiplier: 1.0

PriceRangePowerPercent: 100

3.8 Stochastic

StochasticPeriodK: 200

StochasticPeriodD: 20

StochasticSlowing: 20

StochasticBuyZone: 10

StochasticSellZone: 90

4. Risk Control

Only trade within preset price range

BaseLotLimit: restrict single-side lots relative to counterparty

MaxTotalLots: restrict total lots to prevent excessive scaling

PositionExpirationHours: 72000 → auto-close expired positions

Hedging account required

5. Trading Flow

5.1 Initialization

Verify account type (must be Hedging)

Initialize trading objects and indicators

Calculate base grid step and TP points

Create Stochastic indicator handle

5.2 Tick Handling

Check expired positions

Compute dynamic parameters (grid spacing, base lot)

Count current positions (long/short lots, orders, P/L)

Grid position-adding logic

Initial entry check via Stochastic signal

Take profit check

5.3 Trading Events

OnTradeTransaction: update last open price and lot

Reset variables when all positions closed

6. Strategy Advantages

Dual-Directional Profit

Smart Parameter Adjustment

Controllable Risk

Flexible Martingale

Fully Automated Execution

7. Usage Notes

⚠️ Must use a Hedging account

Adjust grid step, base lot %, and total lots according to volatility and account size

Test on demo accounts before live trading

Monitor total lots, price extremes, margin usage, and Stochastic signals

8. Technical Implementation

8.1 Key Functions

TotalPositions(), LotCheck(), RefreshRates(), iStochasticGet(), CloseAllBuy() / CloseAllSell()

8.2 Precision Handling

Automatically adjusts point values for 3- or 5-digit symbols

Normalizes lots according to broker requirements

9. Summary

This strategy is a highly intelligent dual-direction Martingale grid system, dynamically adjusting grid spacing and lot size to manage risk while aiming for stable profits. It is especially suited for sideways markets.

Key Advantages:

Smart dynamic parameter adjustment

Comprehensive risk control

Flexible Martingale strategy

Fully automated trading

Suitable For:

Sideways/oscillating markets

Hedging accounts

Traders with sufficient funds

Investors who can tolerate some drawdown

Strategy Version: 1.001

Document Updated: 2024