Gold Scalper Queen Ai

- Experts

- Mike Wilson Namaru

- 버전: 1.0

- 활성화: 10

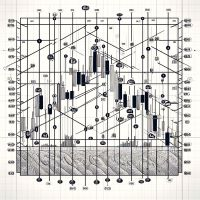

GoldScalperQueen Ai is a next-generation Expert Advisor engineered for XAUUSD (Gold).

It fuses multiple professional trading techniques — technical indicators, price action, candle & chart patterns, divergence, and multi-timeframe confirmation — into a single intelligent and configurable decision engine.

Designed for serious traders, GoldScalperQueen Ai adapts dynamically to market volatility using ATR-based Stop Loss and Take Profit, while offering optional recovery/martingale scaling, session filters, and risk-based or fixed-lot sizing.

It’s built for robust backtesting and live ECN/RAW execution

Why Traders Choose GoldScalperQueen Ai

Precision Entries: Signals must pass layered confirmations (indicators, price/candle patterns, MA crossovers, support/resistance, multi-timeframe context).

Trend-Aware: Filters align trades with the dominant trend (MA200 and configurable main trend period).

Smart Recovery: Dual protection with a global martingale option and one-trade recovery mode after a loss.

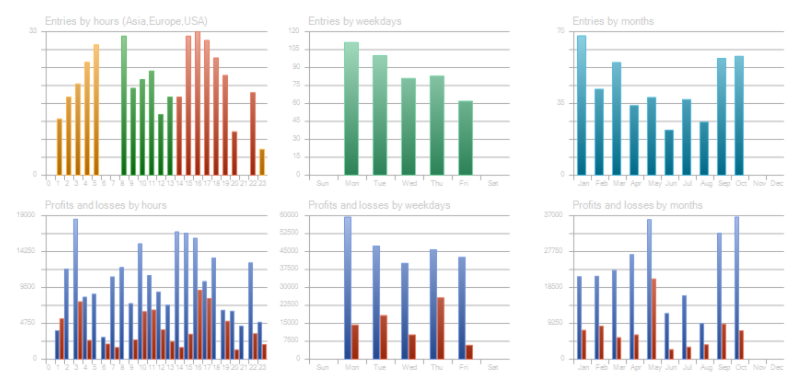

Session Control: Trades only during your chosen market sessions (London, New York, Tokyo, Sydney), with weekend and overnight handling.

Risk First: Dynamic ATR-based SL/TP or fixed pips, broker stops-level validation, margin checks, volume caps, and trade throttling.

How It Trades

Multi-Strategy Confirmations:

- Indicators (RSI, MACD, ADX, Stochastic, Bollinger) form the fast first layer.

- Candle/price/chart patterns deepen conviction when needed.

- Support/Resistance, Moving Average crossovers, Divergences, Pivot Points, and Multi-Timeframe analysis contribute additional weight until `Min_Confirmations` is met.

Market Filters:

- Main trend alignment (optional), tilt/bias check over recent candles, and a “bad day” filter that screens out high-risk conditions (e.g., extreme volatility, NFP Friday, holiday proximity).

Execution Discipline:

- Trade rate limits per candle and time spacing between trades.

- Position volume and count caps to prevent overexposure.

- Session gating in GMT for precise control.

Key Features

Powerful Confirmation Engine: Weighted scoring across multiple modules; only trades when signal quality is high.

Adaptive Risk Management:

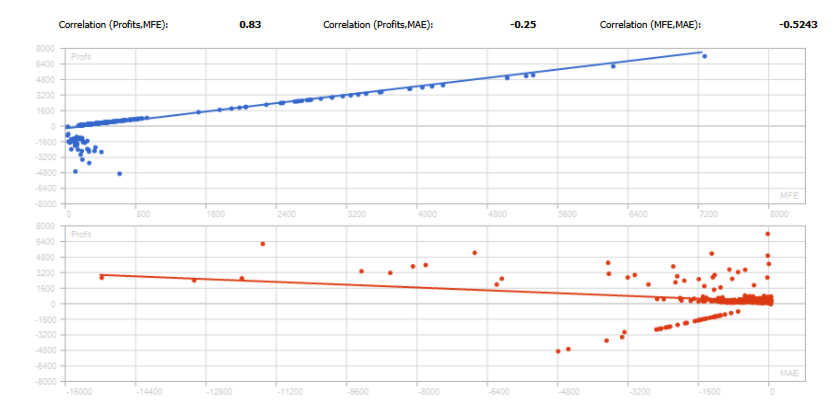

- Dynamic SL/TP via ATR with configurable multipliers.

- Fixed pips alternative for structured targets.

- Broker stops-level and margin checks before sending orders.

Recovery Logic:

- Global martingale (configurable multiplier/levels).

- One-trade recovery lot after a losing closed trade on the symbol.

Performance-Friendly:

- Efficient buffer updates, smart throttling, and graceful degradation when volume data is unavailable.

Clean Diagnostics:

- Optional debug output, quick indicator status, and clear messages for transparency.

Inputs You Control

Symbol/Timeframe: `XAUUSD` on `H1` recommended (supports other TFs via modules).

Risk Settings: `Risk_Percent`, `Fixed_Lot_Size`, `Max_Lot_Size`, `Max_Position_Volume`, `Max_Positions`.

Recovery & Martingale: `Enable_Martingale`, `Martingale_Multiplier`, `Max_Martingale_Levels`, `Recovery_Lot_Size`.

Trade Filters: `Min_Confirmations`, `Require_MainTrend_Alignment`, `Use_Main_Trend_Filter`, `MA_Trend_Period`.

SL/TP Style: `Use_Dynamic_StopLoss` with `ATR_Period`, `ATR_StopLoss_Multiplier`, `ATR_TakeProfit_Multiplier`, or fixed `StopLoss_Pips`/`TakeProfit_Pips`.

Sessions: London/NY/Tokyo/Sydney windows (GMT), with overnight handling.

Strategy Toggles: Enable/disable modules (Indicators, Candle Patterns, Price Action, Chart Patterns, S/R, MA Crossovers, Divergences, Pivots, Multi-Timeframe, Volume, etc.).

Weights: Tune each module’s impact to match your trading philosophy.

Recommended Settings (H1 XAUUSD)

- `Min_Confirmations`: 7 (balanced rigor)

- `Use_Dynamic_StopLoss`: true; `ATR_StopLoss_Multiplier`: 6.0; `ATR_TakeProfit_Multiplier`: 0.3

- `Fixed_Lot_Size`: 0.01 (or use `Risk_Percent` if preferred)

- `Enable_Martingale`: true with `Martingale_Multiplier`: 2.0 and `Max_Martingale_Levels`: 3

- Sessions: London + New York enabled

Setup & Use

- Attach to `XAUUSD` H1 chart; input Magic Number if running multiple EAs.

- Configure session hours (GMT) and risk preferences.

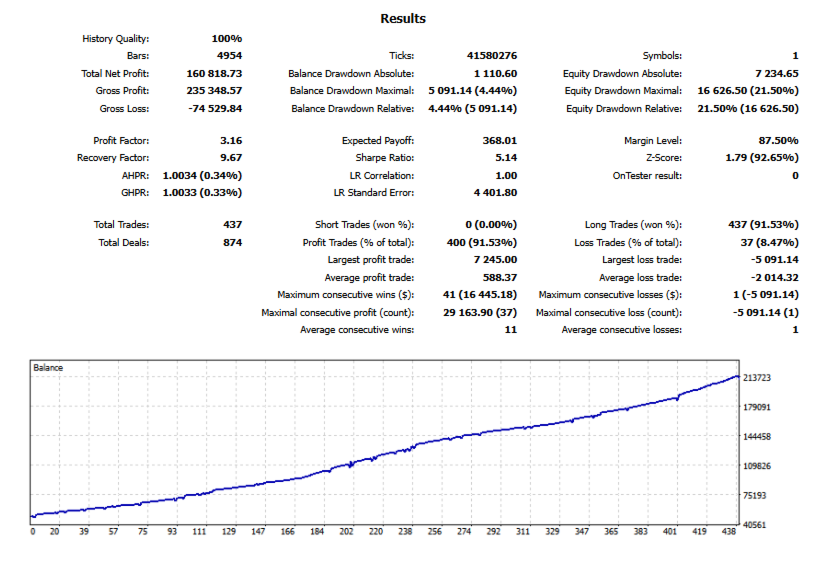

- Start in Strategy Tester to calibrate ATR multipliers, confirmations, and weights to your broker’s conditions.

- Go live with moderate lot size and confirm broker `SYMBOL_TRADE_STOPS_LEVEL` compatibility.

Best Practices

- Forward-test on a demo before live deployment.

- Avoid overlapping EAs on the same symbol/magic.

- Review equity curves when using martingale; set conservative max levels.

- Consider raising `Min_Confirmations` during high-impact news weeks.

Important Notes

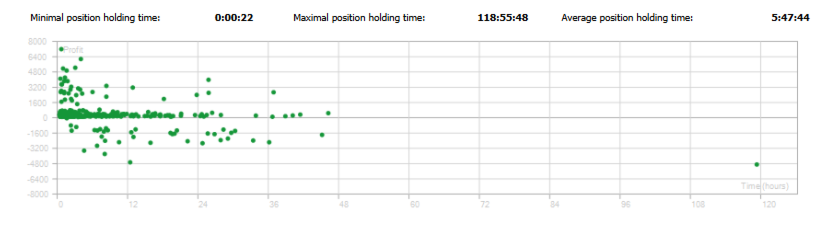

- This EA targets high-quality setups and disciplined risk — not constant trading. Expect fewer but more selective entries.

- Recovery and martingale tools are optional; use them prudently and within your risk tolerance.

Disclaimer ⚠

No system can guarantee profits or eliminate risk. Performance depends on market conditions, broker parameters, execution, and your configuration. Test thoroughly and trade responsibly.