Continuation Guard EA

- エキスパート

- Cristian-bogdan Buzatu

- バージョン: 1.0

- アクティベーション: 5

Institutional Continuation Trading • Portfolio-Ready • Capital-Preserving

🔹 What is Continuation Guard?

Continuation Guard EA is not a typical retail trading robot.

It is a market-structure–driven continuation system, designed to trade price itself, not indicators, not repainting signals, and not delayed confirmations.

This EA is built around the same logic professional traders use:

-

Market structure

-

Continuation vs. failure

-

Risk-controlled participation, not prediction

No martingale.

No grid.

No averaging down.

No curve-fitted tricks.

🔹 What makes it different from most EAs on the market?

Most robots:

-

Chase entries

-

Stack indicators

-

Overtrade

-

Collapse in real market conditions

Continuation Guard does the opposite.

It is designed to:

-

Enter only when continuation is statistically justified

-

Protect capital when continuation fails

-

Let profitable trades breathe instead of cutting them early

-

Cut stagnating trades that silently damage equity over time

This is institutional-style trade management, automated.

🔹 Core Trading Philosophy

Trade continuation. Guard against failure. Preserve capital.

Continuation Guard focuses on:

-

Price action & market structure

-

Continuation after break / reclaim / retest logic

-

Intelligent invalidation instead of blind stop-outs

-

Strict risk logic with asymmetric reward potential

No repainting.

No future data.

No hindsight indicators.

Drawdown Philosophy

Continuation Guard is designed to control drawdown by invalidating failed continuation early, rather than averaging into loss or forcing recovery.

When continuation does not materialize, risk is reduced decisively.

When continuation holds, the system allows asymmetric reward to develop.

🔹 Advanced Trade Management (Key Advantage)

This is where Continuation Guard separates itself from most breakout or continuation EAs.

This EA includes professional-level position management rarely found in retail robots:

✔ Smart Break-Even logic (configurable)

✔ Partial profit protection (optional)

✔ Volatility-aware trade evaluation

✔ Zombie Exit (ZE) system:

-

Identifies trades that consume time without progress

-

Closes only when multiple conditions align

-

Optional cooldown to avoid over-management

-

Fully customizable or completely disabled

This means:

-

Profitable trades are not suffocated

-

Bad trades are not allowed to linger for weeks

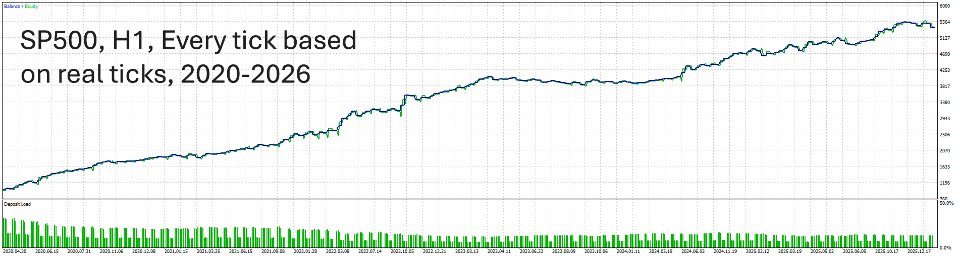

🔹 Portfolio-Based Trading (Major Strength)

Continuation Guard is portfolio-ready by design.

This product includes:

-

10 validated presets for different instruments

-

Designed to be traded together, not in isolation

-

Low correlation logic across instruments

-

Smooth equity behavior when combined

This is how professionals trade:

When some instruments rest, others work.

🔹 What instruments does it work on?

Continuation Guard performs best on:

-

Major FX pairs

-

JPY crosses

-

Gold (XAUUSD)

-

Indices (e.g. NDX, DAX, NI225)

The included presets already cover a diversified mix.

🔹 Fully Customizable – You Stay in Control

Every major component can be:

-

Enabled / disabled

-

Adjusted to your risk profile

-

Tuned per instrument

You can trade:

-

Conservative

-

Balanced

-

Or more aggressive

— without changing the core logic

🔹 Who is this EA for?

✅ Traders who value capital preservation

✅ Traders building long-term portfolios

✅ Traders tired of indicator clutter

✅ Traders who understand structure, not prediction

❌ Not for gamblers

❌ Not for martingale users

❌ Not for “get rich quick” seekers

🔹 What you get

✔ Continuation Guard EA

✔ 10 ready-to-use portfolio presets

✔ Clear setup instructions

✔ Transparent logic (no black box tricks)

🔹 Recommended Settings

-

Timeframes: H1 / H4

-

Broker: ECN / low-spread preferred

-

Risk: fixed lot or conservative %

-

Portfolio trading strongly recommended

⚠ Risk Disclaimer

Trading involves risk.

Past performance does not guarantee future results.

Continuation Guard is designed to manage risk intelligently, not eliminate it.

Final note

Continuation Guard is built to survive real markets.

If you are looking for a robot that trades price, structure, and continuation — not indicators and illusions — this EA belongs in your portfolio.