Guarda i video tutorial del Market su YouTube

Come acquistare un Robot di Trading o un indicatore

Esegui il tuo EA

hosting virtuale

hosting virtuale

Prova un indicatore/robot di trading prima di acquistarlo

Vuoi guadagnare nel Market?

Come presentare un prodotto per venderlo con successo

Sfortunatamente, "ICT Donchian Smart Mony Structure Indicator in MT4" non è più disponibile per l'acquisto.

Se hai già acquistato questo prodotto in precedenza, puoi continuare a utilizzarlo senza alcuna limitazione e installare nuove copie finché hai ancora attivazioni:

- Apri il tuo terminale Metatrader 4.

- Specifica le credenziali dell'account MQL5.community nelle impostazioni: menu Strumenti\Opzioni\Community.

- Vai alla scheda "Market" e poi alla scheda "Acquistati".

- Fai clic sul pulsante "Installa" situato a destra del nome del prodotto.

Per maggiori informazioni, consultare la documentazione.

Scopri altre app MetaTrader 4

Aura Neuron è un Expert Advisor distintivo che continua la serie di sistemi di trading Aura. Sfruttando reti neurali avanzate e strategie di trading classiche all'avanguardia, Aura Neuron offre un approccio innovativo con eccellenti prestazioni potenziali. Completamente automatizzato, questo Expert Advisor è progettato per negoziare coppie di valute XAUUSD (GOLD). Ha dimostrato una stabilità costante su queste coppie dal 1999 al 2023. Il sistema evita pericolose tecniche di gestione del denaro,

Vortex - il vostro investimento nel futuro

L'expert advisor Vortex Gold EA è stato creato appositamente per il trading sull'oro (XAU/USD) sulla piattaforma Metatrader. Costruito utilizzando indicatori proprietari e algoritmi segreti dell'autore, questo EA impiega una strategia di trading completa progettata per catturare movimenti redditizi nel mercato dell'oro. I componenti chiave della sua strategia includono indicatori classici come il CCI e l'indicatore parabolico, che lavorano insieme per

EA Gold Algo is a professional Expert Advisor specifically designed for Gold (XAUUSD) trading. It is engineered to capture extremely fast price movements that occur when price escapes key structural zones with momentum. Gold is known for sharp expansions and aggressive volatility. EA Gold Algo is built to operate in these conditions with high-precision execution, strict risk control, and fast reaction speed .

The EA does not use grid or martingale techniques . Each trade is executed independe

AI Forex Robot - The Future of Automated Trading. AI Forex Robot is powered by a next-generation Artificial Intelligence system based on a hybrid LSTM Transformer neural network, specifically designed for analyzing XAUUSD, EURUSD and BTCUSD price movements on the Forex market. The system analyzes complex market structures, adapts its strategy in real time and makes data-driven decisions with a high level of precision. AI Forex Robot is a modern, fully automated system powered by ar

Gann Made Easy è un sistema di trading Forex professionale e facile da usare che si basa sui migliori principi del trading utilizzando la teoria di mr. WD Gann. L'indicatore fornisce segnali ACQUISTA e VENDI accurati, inclusi i livelli di Stop Loss e Take Profit. Puoi fare trading anche in movimento utilizzando le notifiche PUSH. CONTATTATEMI DOPO L'ACQUISTO PER RICEVERE CONSIGLI DI TRADING, BONUS E L'ASSISTENTE EA GANN MADE EASY GRATUITAMENTE! Probabilmente hai già sentito parlare molte volte d

We proudly present our cutting-edge robot, the Big Forex Players EA designed to maximize your trading potential, minimize emotional trading, and make smarter decisions powered by cutting-edge technology. The whole system in this EA took us many months to build, and then we spent a lot of time testing it. This unique EA includes three distinct strategies that can be used independently or in together. The robot receives the positions of the biggest Banks (positions are sent from our database t

XIRO Robot is a professional trading system created to operate on two of the most popular and liquid instruments on the market: XAUUSD and GBPUSD . We combined two proven and well tested systems, enhanced them with multiple new improvements, optimizations and additional protective mechanisms, and integrated everything into one advanced and unified solution. As a result of this development process, XIRO Robot was created. Robot was designed for traders who are looking for a reliable and str

Limited stock at the current price!

Final price: $1999 --> PROMO: From $299 --> The price will go up every 5 purchases, next price : $399 Golden Mirage is a robust gold trading robot designed for traders who value reliability, simplicity, and professional-grade performance. Powered by a proven combination of RSI, Moving Average, ADX, and High/Low Level indicators, Golden Mirage delivers high-quality signals and fully automated trading on the M5 timeframe for XAUUSD (GOLD) . It features a robu

Game Change EA è un sistema di trading trend following basato sull'indicatore Game Changer. Vende automaticamente ogni volta che si forma un punto rosso e continua nella direzione di vendita fino alla comparsa di una X gialla, che segnala una potenziale fine del trend. La stessa logica si applica alle operazioni di acquisto. Quando appare un punto blu, l'EA inizia ad acquistare e chiuderà il ciclo di acquisto non appena viene rilevata una X gialla.

Questo EA è adatto a qualsiasi coppia di valute

Sperimenta una copia di trading eccezionalmente veloce con il Local Trade Copier EA MT4 . Con la sua facile configurazione in 1 minuto, questo copiatore di trading ti consente di copiare i trades tra diversi terminali di MetaTrader sullo stesso computer Windows o su Windows VPS con velocità di copia ultra veloci inferiori a 0.5 secondi. Che tu sia un trader principiante o professionista, Local Trade Copier EA MT4 offre una vasta gamma di opzioni per personalizzarlo alle tue esigenze specifiche.

Presentazione Quantum Emperor EA , l'innovativo consulente esperto MQL5 che sta trasformando il modo in cui fai trading sulla prestigiosa coppia GBPUSD! Sviluppato da un team di trader esperti con esperienza di trading di oltre 13 anni.

IMPORTANT! After the purchase please send me a private message to receive the installation manual and the setup instructions.

***Acquista Quantum Emperor EA e potresti ottenere Quantum StarMan gratis!*** Chiedi in privato per maggiori dettagli

Segn

It helps to calculate the risk per trade, the easy installation of a new order, order management with partial closing functions, trailing stop of 7 types and other useful functions.

Additional materials and instructions

Installation instructions - Application instructions - Trial version of the application for a demo account

Line function - shows on the chart the Opening line, Stop Loss, Take Profit. With this function it is easy to set a new order and see its additional characteris

Tecnologia basata sull'intelligenza artificiale con ChatGPT Turbo Infinity EA è un Expert Advisor di trading avanzato progettato per GBPUSD e XAUUSD. Si concentra su sicurezza, rendimenti costanti e redditività infinita. A differenza di molti altri EA, che si basano su strategie ad alto rischio come martingala o trading a griglia. Infinity EA impiega una strategia di scalping disciplinata e redditizia basata su reti neurali integrate su apprendimento automatico, tecnologia basata su intelligenz

EA Gold Stuff è un Expert Advisor progettato specificamente per il trading di oro. L'operazione si basa sull'apertura degli ordini utilizzando l'indicatore Gold Stuff, quindi l'EA lavora secondo la strategia "Trend Follow", che significa seguire la tendenza.

I risultati in tempo reale possono essere visualizzati qui. Puoi ottenere una copia gratuita del nostro indicatore Strong Support e Trend Scanner, per favore scrivi in privato. M Contattami subito dopo l'acquisto per avere le impostazio

Vortex Turbo — “Scambia la tempesta, controlla il Vortice”

Vortex Turbo rappresenta la prossima fase evolutiva del trading intelligente: uno sviluppo unico che unisce un'architettura di intelligenza artificiale all'avanguardia, una logica di mercato adattiva e un controllo preciso del rischio. Basato su comprovati principi algoritmici, integra molteplici strategie in un ecosistema unificato ad alta velocità, alimentato da un nuovo livello di intelligenza predittiva. Progettato come esperto di s

El indicador "MR BEAST ALERTAS DE LIQUIDEZ" es una herramienta avanzada diseñada para proporcionar señales y alertas sobre la liquidez del mercado basándose en una serie de indicadores técnicos y análisis de tendencias. Ideal para traders que buscan oportunidades de trading en función de la dinámica de precios y los niveles de volatilidad, este indicador ofrece una visualización clara y detallada en la ventana del gráfico de MetaTrader. Características Principales: Canal ATR Adaptativo: Calcula

Game Changer è un indicatore di tendenza rivoluzionario, progettato per essere utilizzato su qualsiasi strumento finanziario, per trasformare il tuo MetaTrader in un potente analizzatore di trend. Funziona su qualsiasi intervallo temporale e aiuta a identificare i trend, segnala potenziali inversioni, funge da meccanismo di trailing stop e fornisce avvisi in tempo reale per risposte tempestive del mercato. Che tu sia un professionista esperto o un principiante in cerca di un vantaggio, questo st

The XG Gold Robot MT4 is specially designed for Gold. We decided to include this EA in our offering after extensive testing . XG Gold Robot and works perfectly with the XAUUSD, GOLD, XAUEUR pairs. XG Gold Robot has been created for all traders who like to Trade in Gold and includes additional a function that displays weekly Gold levels with the minimum and maximum displayed in the panel as well as on the chart, which will help you in manual trading. It’s a strategy based on Price

L'Expert Advisor è un sistema pensato per recuperare posizioni non redditizie. L'algoritmo dell'autore blocca una posizione perdente, la divide in molte parti separate e chiude ciascuna di esse separatamente. La facile configurazione, il lancio ritardato in caso di drawdown, il blocco, la disabilitazione di altri Expert Advisor, la media con il filtraggio delle tendenze e la chiusura parziale di una posizione in perdita sono integrati in un unico strumento. È l'uso della chiusura delle perdit

M1 SNIPER è un sistema di indicatori di trading facile da usare. Si tratta di un indicatore a freccia progettato per l'intervallo temporale M1. L'indicatore può essere utilizzato come sistema autonomo per lo scalping sull'intervallo temporale M1 e come parte del tuo sistema di trading esistente. Sebbene questo sistema di trading sia stato progettato specificamente per il trading sull'intervallo temporale M1, può comunque essere utilizzato anche con altri intervalli temporali. Inizialmente ho pro

WINTER SALE — LIMITED TIME!

Get Forex GOLD Investor with a huge –60% discount AND receive News Scope EA PRO as a FREE BONUS ! Special Winter Price: $217

(Regular Price: $547 — You Save $330!) FREE BONUS: News Scope EA PRO

A powerful multi-symbol strategy packed with advanced features, supporting 5 trading pairs — real value: $397! After completing your purchase, simply contact me and I will send you your BONUS EA immediately. Don’t miss this once-a-year opportunity!

Forex GOLD Investor is o

Bazooka EA – Expert Advisor di Trend e Momentum per MT4 MT5: https://www.mql5.com/en/market/product/163078 Importante: Pubblichiamo regolarmente file .set aggiornati nella sezione Commenti . Assicuratevi di utilizzare la versione più recente per i vostri backtest e per il trading reale, al fine di garantire prestazioni ottimali con l'attuale volatilità del mercato. Bazooka EA è un Expert Advisor completamente automatizzato per MetaTrader 4 , progettato per operare sui movimenti direzionali

AGGIORNAMENTO — DICEMBRE 2025

Alla fine di novembre 2024, l’Expert Advisor Aurum è stato ufficialmente messo in vendita.

Da allora ha operato in condizioni reali di mercato — senza filtro news, senza protezioni aggiuntive e senza limitazioni complesse — mantenendo una stabilità costante. Live Signal

Un anno completo di trading reale ha dimostrato chiaramente l’affidabilità del sistema di trading.

E solo dopo questa esperienza, basandoci su dati reali e statistiche concrete, abbiamo rilasciato

PRO Renko System è un sistema di trading altamente accurato appositamente progettato per il trading di grafici RENKO.

Questo è un sistema universale che può essere applicato a vari strumenti di trading. Il sistema neutralizza efficacemente il cosiddetto rumore di mercato che consente di accedere a segnali di inversione accurati.

L'indicatore è molto facile da usare e ha un solo parametro responsabile della generazione del segnale. Puoi facilmente adattare lo strumento a qualsiasi strumento di

An exclusive indicator that utilizes an innovative algorithm to swiftly and accurately determine the market trend. The indicator automatically calculates opening, closing, and profit levels, providing detailed trading statistics. With these features, you can choose the most appropriate trading instrument for the current market conditions. Additionally, you can easily integrate your own arrow indicators into Scalper Inside Pro to quickly evaluate their statistics and profitability. Scalper Inside

Recommended: it's better to use in accounts with lower swap or swap-free accounts. SEE AND COMPARE WITH OTHER EA's , Real monitoring signals link on my profile. Contact me after payment to send you the user manual PDF file See the real monitoring signal in my profile. Use only on gold and on the BUY direction. Trading gold is attractive to many traders due to the high volatility and depth of the market. Should we invest in gold or just scalp it? Answering this question is a big challenge for

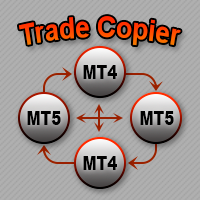

Copiatore commerciale per MetaTrader 4. Copia le operazioni, le posizioni e gli ordini forex da qualsiasi conto. È uno dei migliori copiatori commerciali MT4 - MT4, MT5 - MT4 per il COPYLOT MT4 versione (o MT4 - MT5 MT5 - MT5 per il COPYLOT MT5 versione). Versione MT5

Descrizione completa +DEMO +PDF Come comprare

Come installare

Come ottenere i file di registro Come testare e ottimizzare Tutti i prodotti di Expforex Versione

L'EA Trend Ai è progettato per funzionare con l'indicatore Trend Ai, che eseguirà la propria analisi di mercato combinando l'identificazione del trend con punti di ingresso e avvisi di inversione attivabili, e acquisirà tutti i segnali dell'indicatore in modo completamente automatico! L'EA contiene una serie di parametri esterni completamente regolabili che consentono al trader di personalizzare l'expert in base alle proprie preferenze.

Non appena appare il punto verde, l'EA si preparerà per u

Indicatore Miraculous – Strumento Forex e Binario 100% Non-Repaint Basato sul Quadrato di Nove di Gann Questo video presenta l' Indicatore Miraculous , uno strumento di trading altamente accurato e potente, sviluppato specificamente per i trader di Forex e Opzioni Binarie . Ciò che rende unico questo indicatore è la sua base sul leggendario Quadrato di Nove di Gann e sulla Legge della Vibrazione di Gann , rendendolo uno degli strumenti di previsione più precisi disponibili nel trading moderno. L

Indicatore di tendenza, soluzione unica rivoluzionaria per il trading di tendenze e il filtraggio con tutte le importanti funzionalità di tendenza integrate in un unico strumento! È un indicatore multi-timeframe e multi-valuta al 100% non ridipingibile che può essere utilizzato su tutti i simboli/strumenti: forex, materie prime, criptovalute, indici e azioni. OFFERTA A TEMPO LIMITATO: l'indicatore di screening di supporto e resistenza è disponibile a soli 50$ e a vita. (Prezzo originale 250$) (o

Exorcist Bot is a multi-currency, multi-functional advisor that works on any time frame and in any market conditions. - The robot’s operation is based on an averaging system with a non-geometric progression of constructing a trading grid. - Built-in protection systems: special filters, spread control, internal trading time limitation. - Construction of a trading network taking into account important internal levels. - Ability to customize the aggressiveness of trading. - Working with pending

Javier Gold Scalper: La nostra tecnologia al tuo fianco!

Manuale e file di configurazione: contattami dopo l'acquisto per ricevere il manuale e i file di configurazione. Prezzo: il prezzo aumenta in base al numero di licenze vendute. Copie disponibili: 5 Fare trading sull'oro, uno degli asset più volatili del mercato finanziario, richiede elevata precisione, un'analisi accurata e una gestione del rischio estremamente efficace. Il Javier Gold Scalper è stato sviluppato proprio per integrare ques

Benvenuto a Trade Manager EA, lo strumento definitivo per la gestione del rischio , progettato per rendere il trading più intuitivo, preciso ed efficiente. Non è solo uno strumento per l'esecuzione degli ordini, ma una soluzione completa per la pianificazione delle operazioni, la gestione delle posizioni e il controllo del rischio. Che tu sia un principiante, un trader avanzato o uno scalper che necessita di esecuzioni rapide, Trade Manager EA si adatta alle tue esigenze, offrendo flessibilità s

Real monitoring : XAUUSD__BTCUSD__ M30__SL3 Real monitoring : XAUUSD M30 SL2 For more information, please contact us via private message or in the mql5 group. THERE ARE ONLY 5 OUT OF 10 COPIES LEFT AT A PRICE OF 450 USD !

AFTER THAT , THE PRICE WILL BE INCREASED TO 649 USD . Imagine that you have an experienced trader who monitors the market every day, waits for the price to break through an important level, and instantly opens a deal. That's exactl

WINTER SALE — LIMITED TIME!

Get GOLD Scalper PRO with a huge –60% discount AND receive News Scope EA PRO as a FREE BONUS ! Special Winter Sale Price: $177

(Regular Price: $447 — You Save $270!) FREE BONUS: News Scope EA PRO

A powerful multi-symbol strategy packed with advanced features, supporting 5 trading pairs — real value: $397! After completing your purchase, simply contact me and I will send you your BONUS EA immediately. Don’t miss this once-a-year opportunity! Live Results: https:/

An advanced Expert Advisor powered by artificial intelligence and machine learning, specifically designed for analyzing FOREX . It adapts to price movements and market fluctuations to detect potential trading opportunities. Artificial Intelligence Integration: At the heart of this EA les a sophisticated AI engine capable of recognizing complex patterns in FOREX price data. The system continuously processes historical and live FOREX price feeds to identify potential entry and exit points

L'indicatore mostra accuratamente i punti di inversione e le zone di ritorno dei prezzi in cui il Principali attori . Vedi dove si formano le nuove tendenze e prendi decisioni con la massima precisione, mantenendo il controllo su ogni operazione. VERSION MT5 - Rivela il suo massimo potenziale se combinato con l'indicatore TREND LINES PRO Cosa mostra l'indicatore:

Strutture di inversione e livelli di inversione con attivazione all'inizio di un nuovo trend. Visualizzazione dei l

Aura Black Edition è un EA completamente automatizzato progettato per negoziare solo ORO. L'esperto ha mostrato risultati stabili su XAUUSD nel periodo 2011-2020. Non sono stati utilizzati metodi pericolosi di gestione del denaro, nessuna martingala, nessuna griglia o scalping. Adatto a qualsiasi condizione di brokeraggio. EA addestrato con un perceptron multistrato La rete neurale (MLP) è una classe di rete neurale artificiale (ANN) feedforward. Il termine MLP è usato in modo ambiguo, a volte l

Volatility Trend System - un sistema di trading che fornisce segnali per le voci. Il sistema di volatilità fornisce segnali lineari e puntuali nella direzione del trend, nonché segnali per uscirne, senza ridisegnare e ritardi.

L'indicatore di tendenza monitora la direzione della tendenza a medio termine, mostra la direzione e il suo cambiamento. L'indicatore di segnale si basa sui cambiamenti della volatilità e mostra gli ingressi nel mercato.

L'indicatore è dotato di diversi tipi di avvisi.

Pu

Precautions for subscribing to indicator This indicator only supports the computer version of MT4 Does not support MT5, mobile phones, tablets The indicator only shows the day's entry arrow The previous history arrow will not be displayed (Live broadcast is for demonstration) The indicator is a trading aid Is not a EA automatic trading No copy trading function

The indicator only indicates the entry position No exit (target profit)

The entry stop loss point is set at 30-50 PIPS Or the front hi

Copy Cat More Trade Copier MT4 (Copia Gatto MT4) non è solo un semplice copiatore locale di operazioni; è un quadro completo di gestione del rischio ed esecuzione, progettato per le sfide del trading moderno. Dai challenge delle prop firm alla gestione dei conti personali, si adatta a ogni situazione grazie a una combinazione di esecuzione robusta, protezione del capitale, configurazione flessibile e gestione avanzata delle operazioni. Il copiatore funziona sia in modalità Master (mittente) che

Last copy at 399$ -> next price 499$ Dark Algo is a fully automatic Expert Advisor for Scalping Trading on Eurusd and Gbpusd . This Expert Advisor is based on the latest generation of algorithm and is highly customizable to suit your trading needs. If you Buy this Expert Advisor you can write a feedback at market and get a second EA for Free , for More info contact me The basic strategy of this EA is built on a sophisticated algorithm that allows it to identify and follow market

Trade Copier è un'utilità professionale progettata per copiare e sincronizzare le transazioni tra conti di trading. La copiatura avviene dal conto/terminale del fornitore al conto/terminale del destinatario, che sono installati sullo stesso computer o vps. Prima di acquistare, puoi testare la versione demo su un account demo. Versione demo qui . Istruzioni complete qui . Funzionalità e vantaggi principali: Supporta la copia degli ordini: MT4> MT4, MT4> MT5, MT5> MT4, inclusi i conti di compensaz

Attualmente 40% di sconto!

La soluzione migliore per ogni principiante o trader esperto!

Questo software per cruscotti funziona su 28 coppie di valute. Si basa su 2 dei nostri indicatori principali (Advanced Currency Strength 28 e Advanced Currency Impulse). Offre un'ottima panoramica dell'intero mercato Forex. Mostra i valori di forza delle valute avanzate, la velocità di movimento delle valute e i segnali per 28 coppie Forex in tutti i (9) timeframe. Immaginate come migliorerà il vostro tra

Il Market Reversal Alerts EA è alimentato dall'indicatore omonimo (disponibile qui) e opera in base ai cambiamenti della struttura del mercato.

Per impostazione predefinita, l'EA effettuerà uno scambio ogni volta che un avviso di inversione di mercato viene inviato dall'indicatore e scambierà tali avvisi in base alle condizioni e ai filtri impostati nelle impostazioni dell'EA.

Disegna rettangoli di supporto mentre il prezzo si muove nella sua attuale direzione di tendenza e viene scambiato q

Quantum strategy is a combination of quantum superposition and trading signal model. EA Quantum Dark Gold determines Buy and Sell positions simultaneously for each signal and simultaneously places 2 orders Buy Stop and Sell Stop. Then the momentum determines which order position is executed and cancels the remaining pending order. This interesting idea forms the Quantum Dark Gold with a unique entry method. Open positions are then managed by Trailing, Stop Loss and position balancing strategies

PairMaster Buy Sell Arrow Indicator for MT4 Trade Reversals Like a Pro — Catch Every Swing Point with Precision The PairMaster Buy Sell Arrow Indicator is a powerful MetaTrader 4 tool built to identify high-probability swing trading opportunities . Designed for traders who value accuracy, clarity, and simplicity, PairMaster detects key market turning points and plots intuitive buy and sell arrows directly on your chart. Key Features Accurate Swing Point Detection – Automatically identifies ma

Speciale Trading- SCONTO DEL 40%

La soluzione migliore per qualsiasi trader principiante o esperto!

Questo indicatore è uno strumento di trading unico, di alta qualità e conveniente, perché abbiamo incorporato una serie di funzionalità proprietarie e una nuova formula. Con questo aggiornamento, potrai visualizzare doppie zone di timeframe. Non solo potrai visualizzare un TF più alto, ma anche entrambi, il TF del grafico e il TF più alto: MOSTRA ZONE ANNIDATE. Tutti i trader che operano con Of

Dynamic Forex28 Navigator - Lo strumento di trading Forex di nuova generazione.

ATTUALMENTE SCONTATO DEL 49%. Dynamic Forex28 Navigator è l'evoluzione dei nostri indicatori popolari di lunga data, che combinano la potenza di tre in uno: Advanced Currency Strength28 Indicator (695 recensioni) + Advanced Currency IMPULSE con ALERT (520 recensioni) + CS28 Combo Signals (Bonus). Dettagli sull'indicatore https://www.mql5.com/en/blogs/post/758844

Cosa offre l'indicatore di forza di nuova generazione?

Super Signal – Skyblade Edition

Sistema professionale di segnali di tendenza senza repaint / senza ritardo con tasso di vincita eccezionale | Per MT4 / MT5 Funziona meglio su timeframe più bassi, come 1 minuto, 5 minuti e 15 minuti.

Caratteristiche principali: Super Signal – Skyblade Edition è un sistema intelligente di segnali progettato specificamente per il trading di tendenza.

Utilizza una logica di filtraggio multilivello per identificare esclusivamente i movimenti direzionali forti, supp

Come funziona Quando l'EA è attivo, analizzerà il grafico in base al parametro Modalità di esecuzione. Se non ci sono posizioni esistenti sul grafico, l'EA aprirà un trade in base al parametro. Se il trend è rialzista, aprirà un trade di acquisto, mentre se è ribassista, aprirà un trade di vendita. Imposterà anche un ordine di stop loss a una certa distanza dal prezzo di apertura del trade se la variabile stop loss è maggiore di 0. 0 significa nessun stop loss. Se ci sono posizioni esistenti s

EA Black Dragon funziona con l'indicatore Black Dragon. L'EA apre uno scambio in base al colore dell'indicatore, quindi è possibile aumentare la rete di ordini o lavorare con uno stop loss.

IMPORTANTE! Contattami subito dopo l'acquisto per ricevere istruzioni e un bonus!

Il monitoraggio del lavoro reale, così come i miei altri sviluppi, possono essere visualizzati qui: https://www.mql5.com/en/users/mechanic/seller

Tutte le impostazioni possono essere trovate qui!

Parametri in entrata:

·

Jesko EA – Jesko è un Expert Advisor (EA) speciale , costruito su una strategia comprovata che è stata ottimizzata e testata per anni.

È stato testato su conti reali e ha dimostrato costantemente prestazioni redditizie e a basso rischio . Ora abbiamo deciso di renderlo disponibile al pubblico.

Signal live Quattro mesi di conto reale Qui è disponibile la versione MetaTrader 5. Dopo l’acquisto , ----------------------------------------- Login MT5 23982567 ————— Password MT5 Aa123123! ————— S

Trasforma qualsiasi strategia di trading in una strategia di trading di posizione o scambia le comprovate strategie di trading di posizione basate su RSI e ADR, incluso il sistema di controllo automatizzato del prelievo per le posizioni che si muovono contro di te. Questo EA è un'evoluzione e una semplificazione dell'MRA EA che è stato utilizzato per molti anni per le strategie di trading di posizione insegnate sul sito web Market Structure Trader. Vedi il mio profilo per un collegamento al sit

Gold Scalper Super is an easy-to-use trading system. The indicator can be used as a standalone scalping system on the M1 time frame, as well as part of your existing trading system. Bonus: when purchasing an indicator, Trend Arrow Super is provided free of charge, write to us after purchase. The indicator 100% does not repaint!!! If a signal appears, it does not disappear! Unlike indicators with redrawing, which lead to the loss of a deposit, because they can show a signal and then remove it.

EA Aurum Trader combina un breakout e una strategia trend-following con un massimo di due operazioni al giorno. Contattami subito dopo l'acquisto per ottenere bonus personali! È possibile ottenere una copia gratuita del nostro forte supporto e Trend Scanner indicatore, si prega di pm. Io! Si prega di notare che non vendo i miei EA o set speciali su telegram, è disponibile solo su Mql5 e i miei file set sono disponibili solo sul mio blog qui. Fai attenzione ai truffatori e non comprare a

ATTUALMENTE SCONTATO DEL 40%

La soluzione migliore per ogni principiante o trader esperto!

Questo indicatore è uno strumento di trading unico, di alta qualità e conveniente perché abbiamo incorporato una serie di caratteristiche proprietarie e una nuova formula. Con un solo grafico è possibile leggere la forza delle valute per 28 coppie Forex! Immaginate come migliorerà il vostro trading perché sarete in grado di individuare l'esatto punto di innesco di una nuova tendenza o di un'opportunità

ORIX System — un robot di trading sviluppato specificamente per la coppia di valute GBPUSD sul timeframe M5 . L’Expert Advisor si basa sull’analisi del comportamento del prezzo e degli elementi della struttura di mercato e non utilizza indicatori tecnici standard. Il robot non utilizza martingala, griglie di trading, mediazioni contro il mercato, hedging, apertura di operazioni senza stop loss, né trading ad alta frequenza o caotico.

Requisiti e raccomandazioni principali Coppia di valute: GBPU

Apollo Secret Trend è un indicatore di tendenza professionale che può essere utilizzato per trovare le tendenze su qualsiasi coppia e intervallo di tempo. L'indicatore può facilmente diventare il tuo indicatore di trading principale che puoi utilizzare per rilevare le tendenze del mercato, indipendentemente dalla coppia o dal periodo di tempo che preferisci negoziare. Utilizzando un parametro speciale nell'indicatore puoi adattare i segnali al tuo stile di trading personale. L'indicatore fornisc

Se acquisti questo indicatore, riceverai il mio Trade Manager Professionale + EA GRATUITAMENTE.

Innanzitutto è importante sottolineare che questo sistema di trading è un indicatore Non-Repainting, Non-Redrawing e Non-Lagging, il che lo rende ideale sia per il trading manuale che per quello automatico. Corso online, manuale e download di preset. Il "Sistema di Trading Smart Trend MT5" è una soluzione completa pensata sia per i trader principianti che per quelli esperti. Combina oltre 10 indic

Uno strumento avanzato per lo swing trading sui movimenti correttivi dei prezzi. Funziona sui rollback dei trend nella direzione della sua continuazione, l'entità della correzione richiesta è determinata dalla volatilità attuale dello strumento o manualmente dal trader. Dopo aver rilevato una correzione lungo il trend attuale, l'EA attende un segnale per completare la correzione e continuare il trend, dopodiché apre una posizione. Istruzioni su come funziona l'advisor -> QUI / MT5 version

Buy Sell Signal Pro — Market Structure & Pivot based Indicator Looking for a powerful yet lightweight market structure indicator designed to accurately detect swing turning points and visualize trend behavior with clarity . Built for traders who demand precision without chart clutter , it identifies key structural levels and delivers reliable buy/sell signals across any timeframe and instrument . By confirming pivot points before plotting signals, the indicator ensures consistent, non-repaintin

Titan AI — Sistema di trading automatizzato di nuova generazione Titan AI è un sistema di trading automatizzato di nuova generazione sviluppato dal team di esperti di MX Robots , che combina tecnologie avanzate di Intelligenza Artificiale con una profonda conoscenza dei mercati finanziari.

Questo EA è stato addestrato con dati di mercato di alta qualità, inclusi Real Tick , MBP (Market by Price) e MBO (Market by Order) — gli stessi utilizzati dai sistemi di trading istituzionali — garantendo dec

Quantum King EA: potenza intelligente, raffinata per ogni trader

IMPORTANT! After the purchase please send me a private message to receive the installation manual and the setup instructions.

Prezzo di lancio speciale Segnale in diretta: CLICCA QUI

Versione MT5: CLICCA QUI

Canale Quantum King: Clicca qui

***Acquista Quantum King MT4 e potresti ottenere Quantum StarMan gratis!*** Chiedi in privato per maggiori dettagli!

Regola il tuo trading con precisione e discipli