Digy Dig

- Experts

- Vinutthapon Bumroong

- Version: 1.0

- Activations: 5

SMC_LiquidityGrab_EA - Smart Money Concept (SMC) Ai Automated Trading Expert Advisor (EA) Sale 75% First 10 Order!!!!!!!

You Can Tracking All EA Status and Update in This Link https://www.notion.so/Kaws-Ea-Tracking-25e8e514bbfe8003b336ce3c2f27fe85

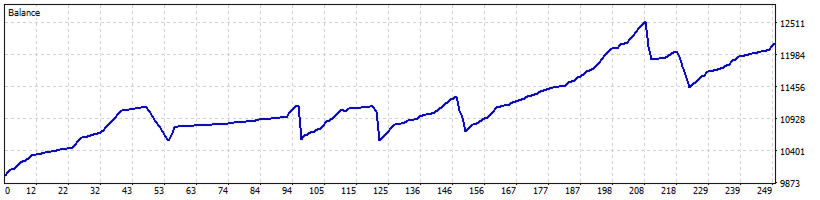

In Screenshot Tester is XAUUSD TF M5 Default Config

Overview:

The SMC_LiquidityGrab_EA is an Expert Advisor (EA) developed for the MetaTrader 5 (MT5) platform, aiming to detect and capitalize on trading opportunities based on Smart Money Concept (SMC) principles. This EA is designed to analyze Market Structure, identify Liquidity Levels, Fair Value Gaps (FVG), and Order Blocks (OB) across multiple timeframes to pinpoint potential entry and exit points. It features flexible risk management, sophisticated position management, and a real-time dashboard for status monitoring.

Key Features:

-

Market Structure Analysis:

-

Utilizes Higher Timeframe (HTF) and Lower Timeframe (LTF) to establish market bias and confirm Break of Structure (BOS).

-

Identifies Swing Highs and Swing Lows to understand trend direction.

-

-

Liquidity Identification:

-

Detects Equal Highs (EH) and Equal Lows (EL), crucial liquidity targets.

-

Includes Round Numbers (RN) as additional liquidity levels.

-

-

Fair Value Gaps (FVG):

-

Identifies FVGs, which are price inefficiencies in the market.

-

Uses a configurable minimum FVG size to filter signals.

-

-

Order Blocks (OB):

-

Locates Order Blocks, areas where large institutional orders are likely to reside.

-

Considers Displacement Bars to confirm the strength of an OB.

-

-

Diverse Trading Strategies:

-

Reversal after Liquidity Sweep: Seeks price reversals after significant liquidity sweeps.

-

Continuation after BOS: Detects trend continuations after a Break of Structure and pullbacks to Order Blocks (further development ongoing).

-

Asian Range Breakout: Analyzes the Asian session range and looks for breakouts during the London session.

-

-

Robust Risk Management:

-

Risk per Trade (%): Defines the percentage of capital to risk per individual trade.

-

Max Daily Risk (%): Limits the maximum percentage of daily loss.

-

Max Daily Losses: Sets a maximum number of losing trades per day before stopping.

-

Max Concurrent Positions: Restricts the number of open positions at any given time.

-

-

Position Management:

-

Multiple Take Profit (TP) Levels: Manages positions with up to three TP levels (TP1, TP2, TP3) with customizable Risk:Reward Ratios.

-

Partial Close: Closes a percentage of the position at each TP.

-

Stop Loss (SL) Management: Moves SL to breakeven or previous TP levels after partial closes.

-

-

Portfolio Management:

-

Portfolio TP/SL Percent: Configures the closing of all positions based on a percentage gain or loss across the entire portfolio.

-

Daily P&L Limit: Sets a daily P&L limit as a percentage to control overall performance.

-

-

Real-time Dashboard:

-

Displays crucial information directly on the chart, such as HTF Bias, LTF Structure, Current Session, counts of Liquidity Levels, FVGs, OBs, Daily P&L, Win Rate, and Asian Range data.

-

Includes a convenient "Close All" button on the dashboard.

-

Important Warning:

The default values set in this EA are NOT optimized or ideal for all market conditions or your specific portfolio. These settings are merely a starting point.

Please conduct thorough backtesting and optimization across different market conditions and meticulously adjust all Input Parameters to suit your trading strategy, currency pair, timeframe, and acceptable risk levels. Failure to properly configure these settings may lead to undesirable trading results or significant losses.

The responsibility for proper setup and risk management lies solely with the user.