Ultimate Boom and Crash Spike Indicator

- Indicators

- Hendrik Lodewyk Coetsee

- Version: 2.2

- Updated: 18 August 2025

- Activations: 10

Ultimate Boom and Crash Indicator

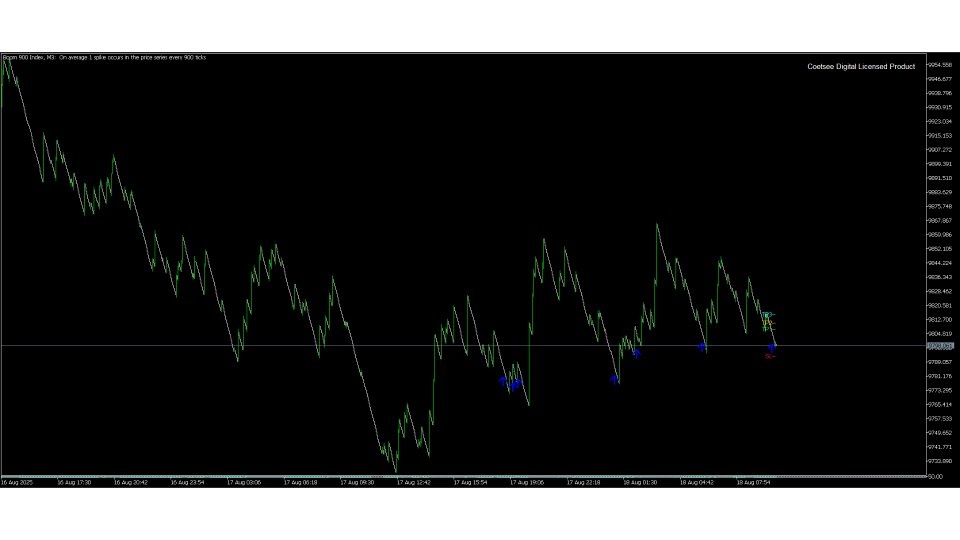

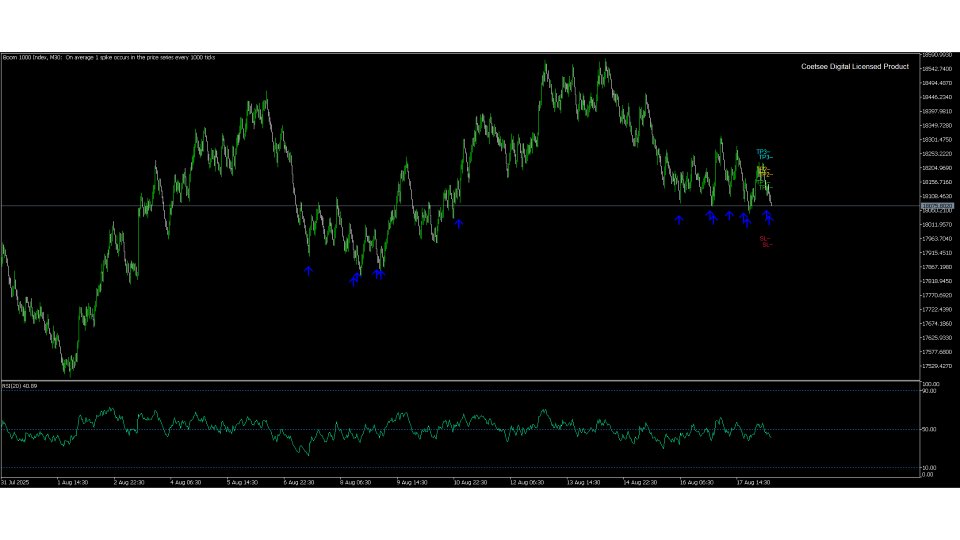

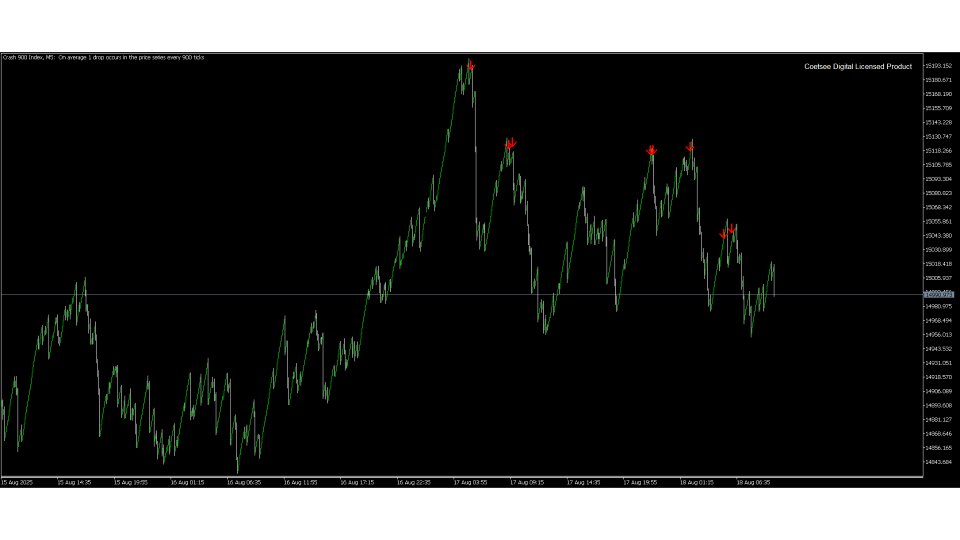

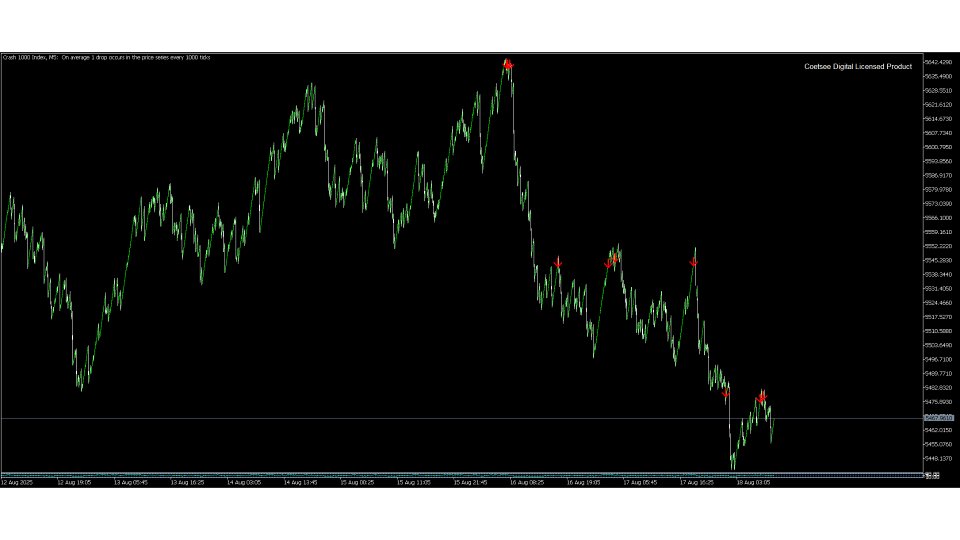

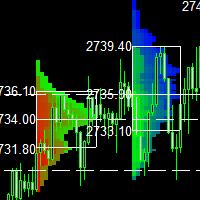

The Ultimate Boom and Crash Indicator is a cutting-edge tool developed by Coetsee Digital, designed to identify potential spike opportunities in the market. Crafted for traders focusing on Deriv and Weltrade synthetic markets, this indicator is optimized to operate exclusively on the 3-minute (M3), 5-minute (M5), 15-minute (M15), 30-minute (M30), and 1-hour (H1) timeframes and supports only the following pairs: PainX 1200, PainX 999, PainX 800, PainX 600, PainX 400, GainX 1200, GainX 999, GainX 800, GainX 600, GainX 400, BreakX 600, BreakX 1200, BreakX 1800, SwitchX 600, SwitchX 1200, SwitchX 1800, Crash 1000 Index, Crash 900 Index, Crash 600 Index, Crash 500 Index, Crash 300 Index, Boom 1000 Index, Boom 900 Index, Boom 600 Index, Boom 500 Index, Boom 300 Index, Vol over Boom 400, Vol over Boom 550, Vol over Boom 750, Vol over Crash 400, Vol over Crash 550, Vol over Crash 750. Signals will not display on any other symbols or timeframes, ensuring precision for these specific markets.

Key Features

Customizable Signals: Choose to display Buy arrows, Sell arrows, or both.

Flexible Arrow Styling: Customize arrow Wingdings codes and colors, with default Buy arrows in Blue and Sell arrows in Red.

Adjustable Arrow Offset: Fine-tune the vertical offset of Buy and Sell arrows (in points) to optimize placement.

Timeframe Flexibility: Select a specific timeframe (M3, M5, M15, M30, or H1) or use the current timeframe.

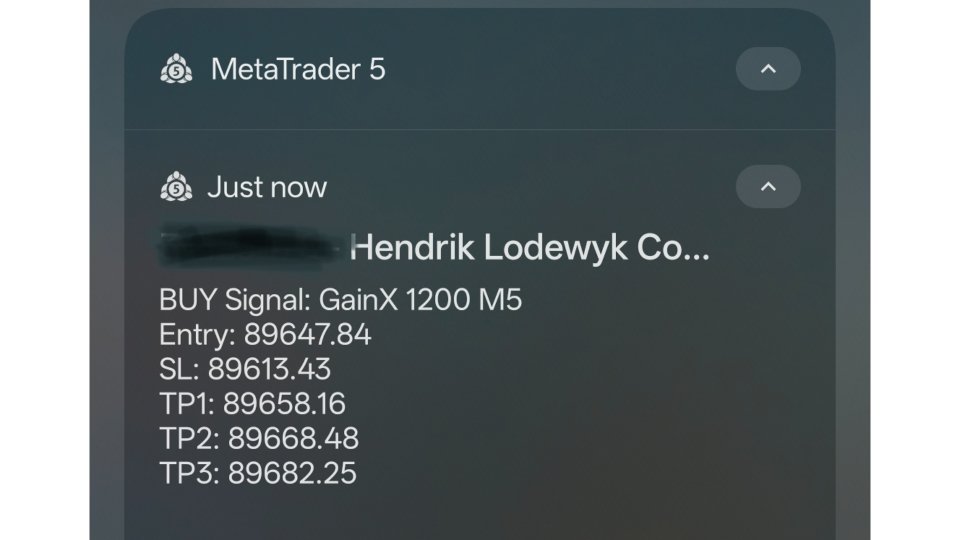

SL/TP Levels: Option to display Stop Loss (SL) and up to three Take Profit (TP) levels, with customizable ATR multipliers and line styles.

Alerts: Enable audible alerts and push notifications to stay informed of potential spike signals in real time.

Usage Guidelines

Timeframe and Symbols: Use exclusively on the listed timeframes and pairs. The indicator will not display signals on other pairs or timeframes.

Confirmation Tool: Use as a confirmation tool alongside other technical analysis.

Recommended Stop-Loss: Consider setting a stop-loss based on the range of 10 candles of the selected timeframe.

Risk Management: Always use proper position sizing and risk-reward ratios.

Important Notes

No Strategy Guarantee: This indicator highlights potential spike entries but does not guarantee trading outcomes, so always combine with market analysis.

Elevate your trading on Deriv Boom and Crash markets and Weltrade PainX, GainX, BreakX, SwitchX, and Volatility over Boom/Crash pairs with the Ultimate Boom and Crash Indicator. Use disciplined risk management and sound analysis to maximize trading success.