Simplify Your Trading with Deer Ma: The Expert Advisor for All Levels of Traders

I am thrilled to introduce you to Deer Ma, an Expert Advisor that I developed as a computer engineer and a passionate trader. Trading has been a long-standing interest of mine, and I have spent countless hours analyzing charts, reading trading books, and trying out different trading strategies. Over the years, I have come to realize the power of automation and how it can help traders improve their trading performance.

With my technical background, I have always been drawn to the idea of creating an automated trading system. I wanted to design a system that could help me trade more efficiently and effectively, with less time and effort on my part. I started working on Deer Ma as a personal project, and after weeks of hard work and testing, I created an Expert Advisor that I am proud of.

Deer Ma is the result of my passion for trading and programming, and it is designed to help traders take advantage of market opportunities while minimizing their risk. The content of this article will cover the strategy behind the Deer Ma expert advisor, the results I achieved, the process I used to optimize those results, an explanation of the parameters and the library that bring Deer Ma to life. Whether you are an experienced trader/programmer or just starting out, my hope is that the information and insights I provide will be helpful in your own trading journey.

Results :

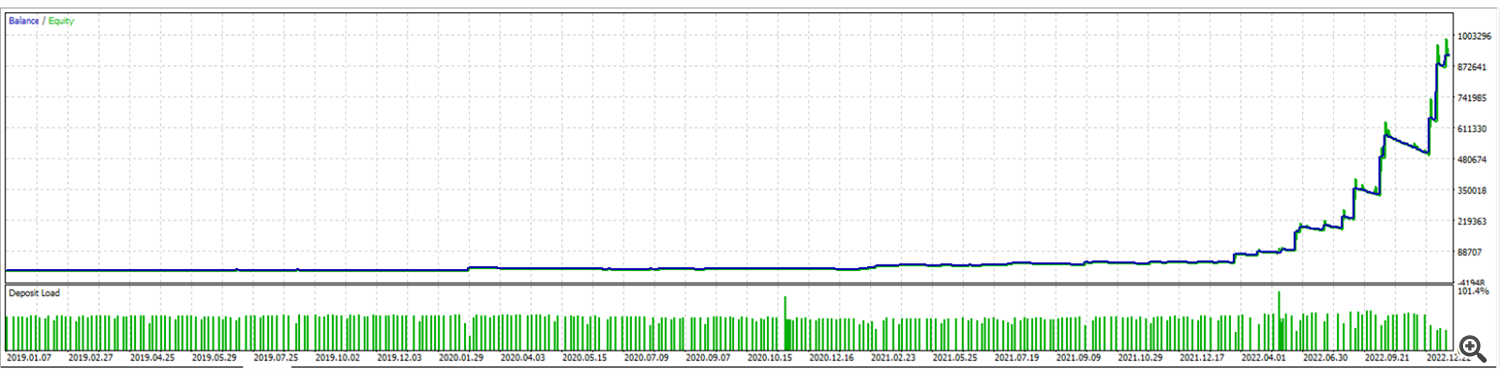

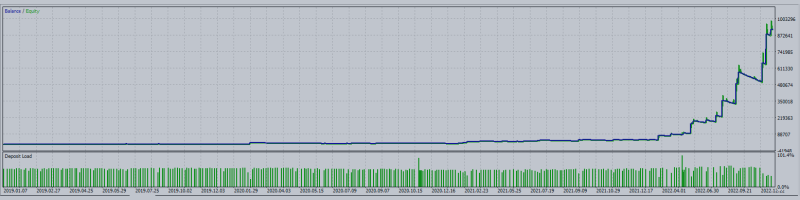

Once the Deer Ma robot is properly set up for the desired market, the results are very interesting. As shown in the graph below, which covers the period from January 2019 to February 2023, an initial investment of $10,000 grew to $910,000. It's important to note that the basic parameters are optimized for USDJPY on a 1-hour chart, and therefore the same results may not be seen in other markets or charts without adjusting the parameters accordingly. A paragraph below will explain how to find the optimal settings for other markets.

The performance of the Deer Ma robot from January 2019 to January 2022 might appear stagnant at first glance, but that couldn't be further from the truth. The robot's money management algorithm gradually and exponentially increases the gains over time, which can create the impression of a slow start. But once the momentum picks up, the results are staggering. Here, the time sequence :

I highly encourage everyone to try the free demo of Deer Ma and see the results for themselves. By testing the strategy on their own preferred market and chart, they can optimize the parameters for their desired performance.

Let's take a look at the results :

It's often thought that high profits come with the price of high risk and drawdowns, but that's not always the case. In the case of Deer Ma, the strategy and risk management allow for significant gains while keeping drawdowns low. As can be seen on the performance chart, where there is a net profit of $900,000, there is only a 13% drawdown. This is a testament to the effectiveness of the strategy and the importance of proper risk management. With Deer Ma, traders can experience high profits without exposing themselves to excessive risk.

Deer Ma's trading strategy is not about winning every trade, but rather about managing risks and maximizing profits. As you can see from the trading results, there are a lot more losing trades than winning trades, which can be challenging for some traders to handle emotionally. However, the key to Deer Ma's success lies in its advanced risk management system and the ability to generate larger profits on winning trades than the losses on losing trades. This allows the overall net profit to increase despite a higher percentage of losing trades.

Strategy :

The Deer Ma expert advisor is built on a powerful trading strategy that has proven to be highly effective with the good settings. The strategy is based on a combination of two moving averages and a position-taking algorithm that ensures the EA enters the market with the best possible trade opportunities.

The first moving average used in the strategy is a fast-moving average with a relatively short period. This MA is used to identify short-term trends in the market, allowing the EA to capitalize on market movements that may last only a few minutes or hours.

The second moving average used in the strategy is a slow-moving average with a longer period. This MA is used to identify long-term trends in the market, allowing the EA to hold positions for longer periods and capture larger market movements. The combination of these two MAs ensures the EA is positioned to take advantage of both short and long-term market trends.

To determine the best entry and exit points for each trade, the position-taking algorithm analyzes a range of market factors, including price and volume data, the number of candles that have formed, and the position of the moving averages relative to the current price. This analysis is used to determine the optimal entry and exit points for each trade, ensuring the EA is always positioned to take advantage of the best trading opportunities in the market.

Trailing stops :

Trailing stops are an essential component of the Deer Ma trading strategy. They allow for automated position management by setting a stop-loss order that moves with the market, protecting profits while minimizing losses. In Deer Ma, we use a variety of trailing stop types to optimize our positions and manage risk.

First, there's the fixed trailing stop, which is the simplest type of trailing stop. It sets a fixed distance from the current market price at which the stop-loss order is placed. If the market moves against the position, the stop-loss order will trigger when the fixed distance is reached, closing the position and limiting the loss.

The MA1_FOLLOWING trailing stop type uses the first moving average as a reference point to trail the stop loss. If the market moves in the desired direction, the stop loss follows the MA1 line. If the market moves against the position, the stop loss is triggered when the price crosses the stop loss.

The MA2_FOLLOWING trailing stop type works in the same way as the MA1_FOLLOWING trailing stop but uses the second moving average as a reference point. If the market moves in the desired direction, the stop loss follows the MA2 line. If the market moves against the position, the stop loss is triggered when the price crosses the stop loss.

The QUICK_SECURITY trailing stop is designed to quickly secure a position as soon as the price reaches a certain level, minimizing potential losses. This type of trailing stop is particularly useful in volatile markets where price movements can be sudden and sharp.

The MEAN_MOVING stop loss, on the other hand, is considered to be the most crucial element of the Deer Ma strategy. Its distance is determined by the volume of the price, which means that the stop loss will be larger for higher volumes and smaller for lower volumes. As a result, this stop loss adapts to the market conditions, ensuring that the position is protected adequately.

Finally, the INCREASING trailing stop type is a complex combination of price and time-based trailing stops. It allows the stop loss to adjust the distance of the stop loss over time.

By offering a range of trailing stop options, Deer Ma allows traders to customize their approach based on their preferred trading style. Those who are more inclined towards scalping strategies might opt for the quick security stop or the increasing stop, while those who favor trend-based strategies could choose the mean moving or ma2_following stops. The flexibility of Deer Ma's trailing stops gives traders the freedom to choose the approach that best suits their personal preferences, which ultimately can lead to a more successful trading experience.

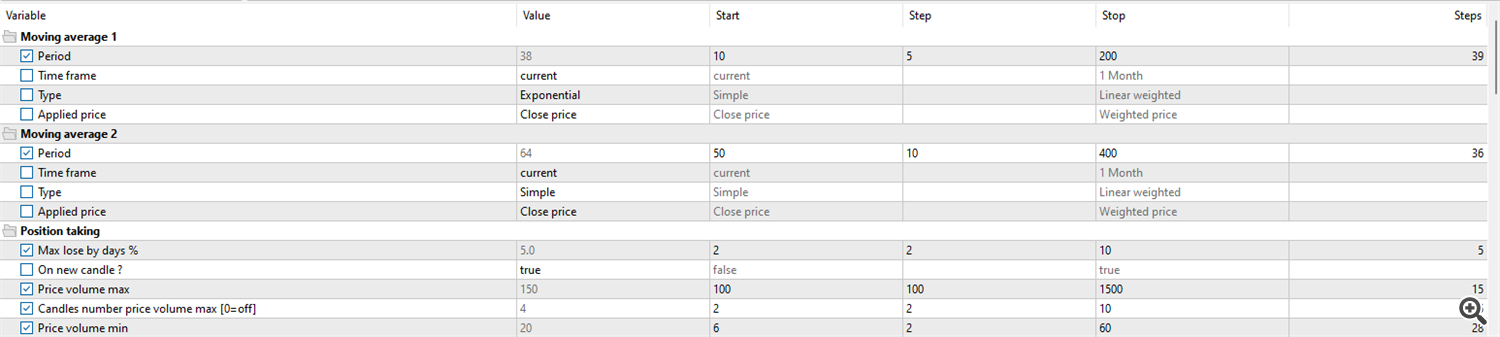

Optimization of parameters :

Deer Ma's performance is largely attributed to its specific optimization for the USDJPY on a 1-hour chart. It's essential to note that the parameters will need to be re-optimized to suit other markets and timeframes. Traders should, therefore, conduct extensive backtesting before deploying Deer Ma on any new chart to optimize its parameters for maximum efficiency.

To do this effectively, here are my tips:

Select the parameters you want to optimize, a starting value, the value to add to each test to achieve.

I advise you to test one trailing stop at a time and not all at the same time because otherwise many tests will be useless and will make you lose a lot of time.

The main parameters to optimise are :

- M1 period

- M2 period

- Max loss by days %

- Price volume max

- Candles number price volume max

- Price volume min

- Candles number price volume min

- MA above for buy, bellow for sell

- Chikun ?

- Take profit (depending of the Trailing stop)

- Stop loss

- Trailing stop type

- The different parameters of the trailing stop depending on the one chosen.

Parameters :

1. Moving average 1 and 2. Moving average 2

- Period : Number of periods used to calculate the moving average

- Time frame : Time interval used for the price data

- Type : Type of moving average (e.g. Simple, Exponential, etc.)

- Applied price : Type of price used in the calculation (e.g. Close, Open, etc.)

3. Position taking

- Max lose by days % : Maximum percentage loss allowed per day

- On new candle ? : Whether to open a new position on a new candle or not

- Price volume max : Maximum price and volume allowed to open a new position

- Candles number price volume max [0=off] : Number of candles used to check for the maximum price and volume

- Price volume min : Minimum price and volume allowed to open a new position

- Candles number price volume min [0=off] : Number of candles used to check for the minimum price and volume

- MA above for buy, bellow for sell : Moving average position with the current price for opening a position

- Money managment ? : Whether to use a specific money management strategy or not

- Fixed lot : Fixed lot size used for each position

- Chikun confirmation ? : Whether to use Chikun confirmation or not (Chikun is an indicator used in technical analysis)

- Period : Number of periods used in the Chikun confirmation indicator calculation

- Lag : Lag time used in the Chikun confirmation indicator calculation

- Time frame : Time interval used for the price data in the Chikun confirmation indicator calculation

- Type : Type of chikun (e.g. Simple, Exponential, etc.)

- Applied price : Type of price used in the calculation (e.g. Close, Open, etc.)

4. Position management

- Risk : Maximum risk allowed per position

- Take profit : Take profit level for each position

- Stop loss : Stop loss level for each position

- Trailling stop ? : Whether to use a trailing stop or not

- Trailling stop type : Type of trailing stop used (e.g. Fixed, Quick_security, etc.)

- Close the positions if contrary signal ? : Whether to close all positions if a contrary signal is detected

5. Stop loss QUICK_SECURITY

- Trailling stop loss : Trailing stop loss level used for quick security

- Trailling stop loss start : Distance between the current price and the open price position where the stop loss starts

6. Stop loss MEAN_MOVING

- Stop loss for a mean of 100 : Stop loss level calculated as the mean of the last 100 periods

- Number candle_buf for the mean : Number of periods used in the calculation of the mean

7. Stop loss INCREASING

- Trailling stop loss : Trailing stop loss level used for increasing stop loss

- Trailling stop loss start : Distance between the current price and the open price position where the stop loss starts

- Number point to increase/decrease : Number of points to increase or decrease the stop loss level

- Max increase : Maximum increase allowed for the stop loss level

- Min decrease : Minimum decrease allowed for the stop loss level

- Increase all the n candle_buf : Number of periods used to check for stop loss level increase

8. Trading hours

- Time filter ? : Whether to filter trades based on specific times or not

- Start hour : Starting hour for trading

- Start minute : Starting minute for trading

- End hour : Ending hour for trading

- End minute : Ending minute for trading

9. Trading days

- Monday trade ? : Whether to trade on Mondays or not

- Tuesday trade ? : Whether to trade on Tuesdays or not

- Wednesday trade ? : Whether to trade on Wednesdays or not

- Thursday trade ? : Whether to trade on Thursdays or not

- Friday trade ? : Whether to trade on Fridays or not

10. Friday

- Close trades Friday ? : Whether to close all trades on Fridays or not

- Close hour : The hour to close trades on Fridays

- Close minute : The minute to close trades on Fridays

11. Global settings

- Magic number : A unique identifier for each EA that is used to distinguish its trades from those of other EAs on the same account

- Comment ? : Whether print the EA comment or not

Library :

This part is mainly for expert advisor developers but if you are curious about the world of programming, I invite you to read it ^^

Deer Ma's development relied heavily on the EA Toolkit library, which is a robust set of tools for developing expert advisors. The library provides an extensive collection of resources and features, enabling developers to create efficient and effective trading robots. One of the most significant benefits of the library is that it is constantly evolving, with new features being added based on customer feedback. The flexibility and power of this library helped in the creation of Deer Ma, and it continues to serve as a valuable resource for expert advisor development.

EA Toolkit : https://www.mql5.com/en/market/product/94130

If you're interested in using the Deer Ma expert advisor for your own trading strategy, you can purchase it here :

Thank you for taking the time to read this article on Deer Ma. I hope that you found the information presented here to be useful and informative. If you have any questions or would like to learn more about this expert advisor, please don't hesitate to send me a private message. I'll be happy to provide you with more information or answer any questions you may have. Once again, thank you for reading, and I wish you the best of luck in your trading.