Credit Suisse made a forecast for Non-Farm Employment Change for this week with detailed explanation about what to expect for example:

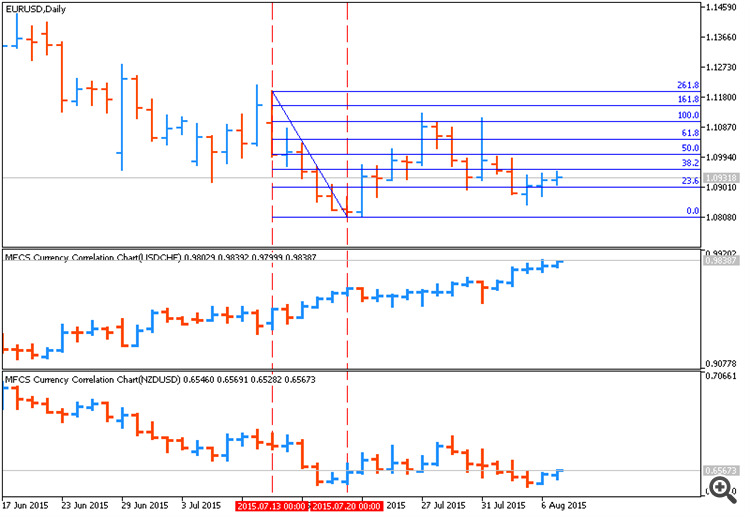

- "We continue to see an asymmetry in favor of the USD going into Friday’s US employment data."

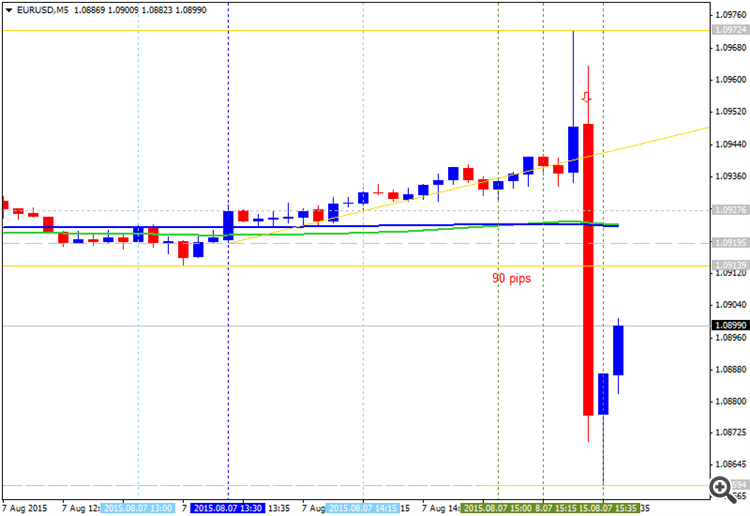

- "Some combination of payrolls numbers above 200k, an unemployment rate below 5.4% and/or hourly earnings growth back towards 2.3% would allow the market to again try to price in a September rate hike."

- "On the other hand, if the data are soft but not enough to take a 2015 Fed rate hike off the table completely, we suspect any USD sell-off would be as unrealistic as last week’s post ECI move."

- "Only data so weak as to push the market to completely give up on the idea of a 2015 rate hike would in our view stand any chance of reversing USD gains while conditions elsewhere are so gloomy (for example, 10-year German bond yields are back around two-month lows). Even in this case, we would expect more defensive currencies like EUR, CHF and JPY to outperform EM and commodity currencies."

Just to remind that previous NFP data was 223K, and forecasting for this Friday is around 224K for example:

| Data | NFP | Jobless Rate |

|---|---|---|

| Previous | 223K | 5.3% |

| Forecast | 222K - 225K | 5.3% |

| Actual | n/a | n/a |

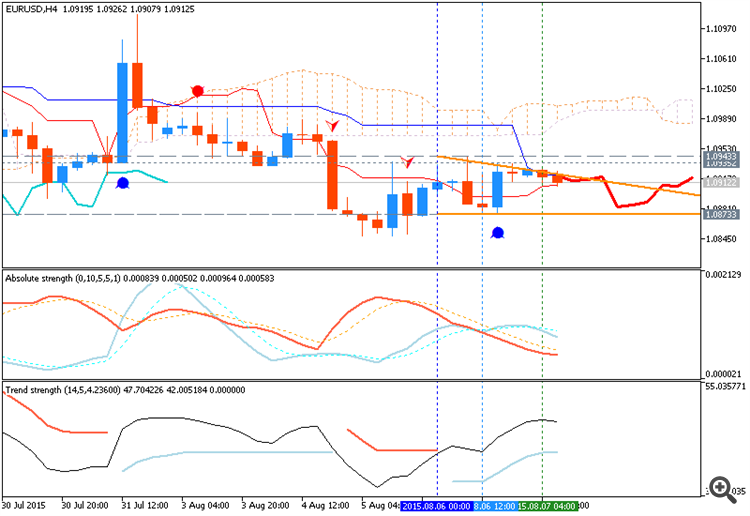

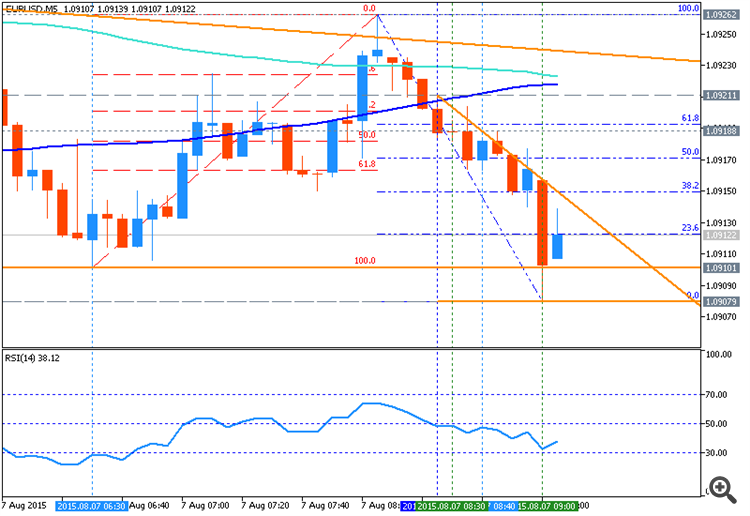

Thus, Credit Suisse expects payrolls numbers above 200k and jobless rate 5.4%, and it means - we can expect more bearish for EUR/USd for example.