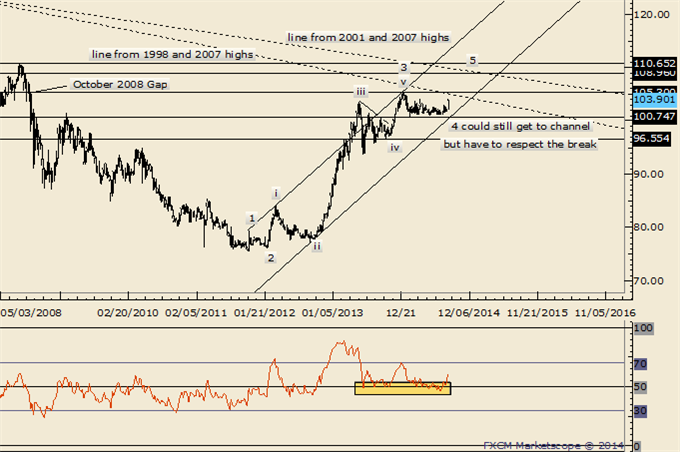

USDJPY Weekly Technicals - forget the Elliott channel for now and treat wave 4

“The miserable trading conditions in USDJPY are probably explained by its long term Elliott wave position. That is, the rate has been mired in a corrective 4th wave all year. The good news is that wave 4 probably ends soon. Keep focused on the Elliott channel. The line crosses from about 100 to 100.75 for the remainder of August.” Forget the Elliott channel for now and treat wave 4 as complete as long as price is above 102.50 (103.00/30 is support). That means new highs in wave 5 (then risk of a major decline but don’t forget that ‘5ths’ can extend). 104.75 is a near term target.

Forecast for 25th of August:

The USD/JPY pair went back and forth during the course of the day on Friday, essentially showing that it is a very confused market. We don’t really believe that wholeheartedly, but would rather anticipate that we are probably going to drift a little bit lower in order to build enough pressure to the upside to break out above 104. We like buying supportive candles on dips, and also like buying a break above the aforementioned 104 level on a daily close. We think that the 103 level will be a bit of a “floor” in this market.