Prop Firm Hedging Explained: The Simple Strategy Behind $500K in Payouts

Prop Firm Hedging Explained: The Simple Strategy Behind $500K in Payouts

I'm going to explain the exact strategy I've used to pass 300+ prop firm challenges and collect over $500K in verified payouts.

It's not a secret indicator. It's not a magic timeframe. It's not some complex algorithm that only works in backtests.

It's hedging. And it's simpler than you think.

What Is Hedging? (The Plain English Version)

Hedging means placing two opposite trades at the same time on two different accounts.

That's it. That's the core concept.

When your challenge account opens a buy, your personal live account opens a sell. Same pair. Same time. Opposite direction.

One of those trades will win. One will lose. That's guaranteed — because they're pointing in opposite directions.

The key is understanding what happens on each account when one side wins and the other loses. That's where the strategy lives.

Why Two Accounts?

You need two accounts for this to work:

Account 1: Prop firm challenge account

This is where you're trying to pass the challenge. It has rules — drawdown limits, profit targets, time limits. You paid a fee to access it.

Account 2: Your personal live account

This is your own account, with your own money. No rules. No limits. No one watching. You control it completely.

The challenge account runs the trading strategy. The live account runs the hedge — opposite trades that mirror everything the challenge does, but in reverse.

Important: These two accounts should be at two different brokers. If they're at the same broker — or if the challenge firm and your live broker share the same liquidity provider — there's a risk of the trades being linked and flagged. Different brokers, different infrastructure.

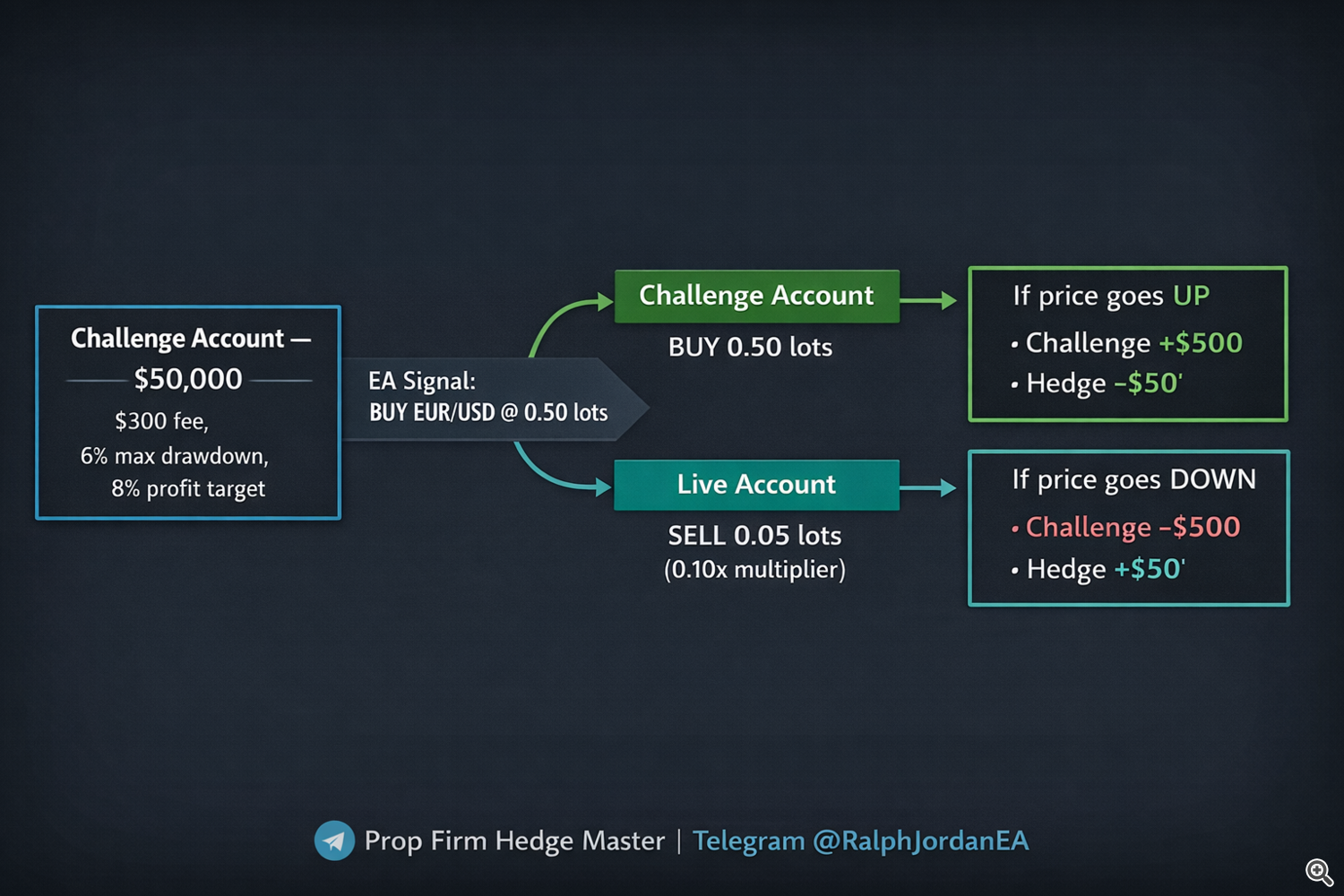

A Step-by-Step Example With Real Numbers

Let's walk through a complete example. No theory — just numbers.

Setup:

- Prop firm challenge: $50,000 account (1-step/phase)

- Challenge fee: $300

- Max drawdown: 6% ($3,000)

- Profit target: 8% ($4,000)

- Your live account balance: $2,000

- Hedge recovery mode: Break even (recover the $300 fee)

The trade:

The EA identifies a setup on EUR/USD and opens a BUY on the challenge account at 0.50 lots.

Simultaneously, the hedge EA opens a SELL on your live account. The lot size is calculated based on your recovery settings — let's say 0.05 lots for this example.

Now we wait.

Scenario 1: The Challenge Trade Wins

EUR/USD goes up. The challenge trade hits take profit.

- Challenge account: +$500 profit. You're 12.5% of the way to your profit target.

- Live account: -$50 loss on the hedge. That's the cost of insurance.

Your challenge is progressing toward passing. The $50 loss on the live account is a small, controlled cost — much less than the $300 fee you'd lose if the challenge failed without a hedge.

Over many winning trades: The challenge account builds toward the profit target. The live account takes small hedge losses along the way. When you pass the challenge, those hedge losses are the "price" you paid for the safety net. And you now have a funded account worth far more than what the hedge cost you.

Scenario 2: The Challenge Trade Loses

EUR/USD goes down. The challenge trade hits stop loss.

- Challenge account: -$500 loss. Drawdown increases.

- Live account: +$50 profit on the hedge (adjusted by the lot multiplier).

The challenge took a hit. But your live account profited from the same move.

If the challenge eventually fails (hits max drawdown):

Let's say the challenge account slowly draws down and eventually breaches the 6% max drawdown limit. The challenge is terminated. Your $300 fee is gone.

But over the course of all those losing trades on the challenge, your live account was profiting from the hedge. Depending on your recovery settings, your live account gained enough to cover that $300 fee — or more.

Net result: You lost the challenge but recovered your fee. The failure cost you nothing.

The Lot Multiplier: How to Calculate Your Hedge Size

This is the most important number in the entire system.

The lot multiplier determines how large the hedge trades are on your live account relative to the challenge trades. It answers the question: "How much do I need to make on the hedge to recover my fee if the challenge fails?"

Here's the math:

- Challenge fee: $300

- Challenge max drawdown: 6% of $50,000 = $3,000

If the challenge fails, it will have lost up to $3,000 before being terminated. Your hedge — trading opposite — will have gained close to $3,000 (minus spread and execution differences).

But you don't need $3,000 in hedge profit. You only need $300 to break even on the fee.

So the hedge only needs to capture 10% of the challenge's movement to recover the fee.

Lot multiplier: 0.10x (10% of the challenge lot size)

If the challenge trades 0.50 lots, the hedge trades 0.05 lots.

This is the break-even multiplier. It keeps your live account risk small while still recovering the full fee if the challenge fails.

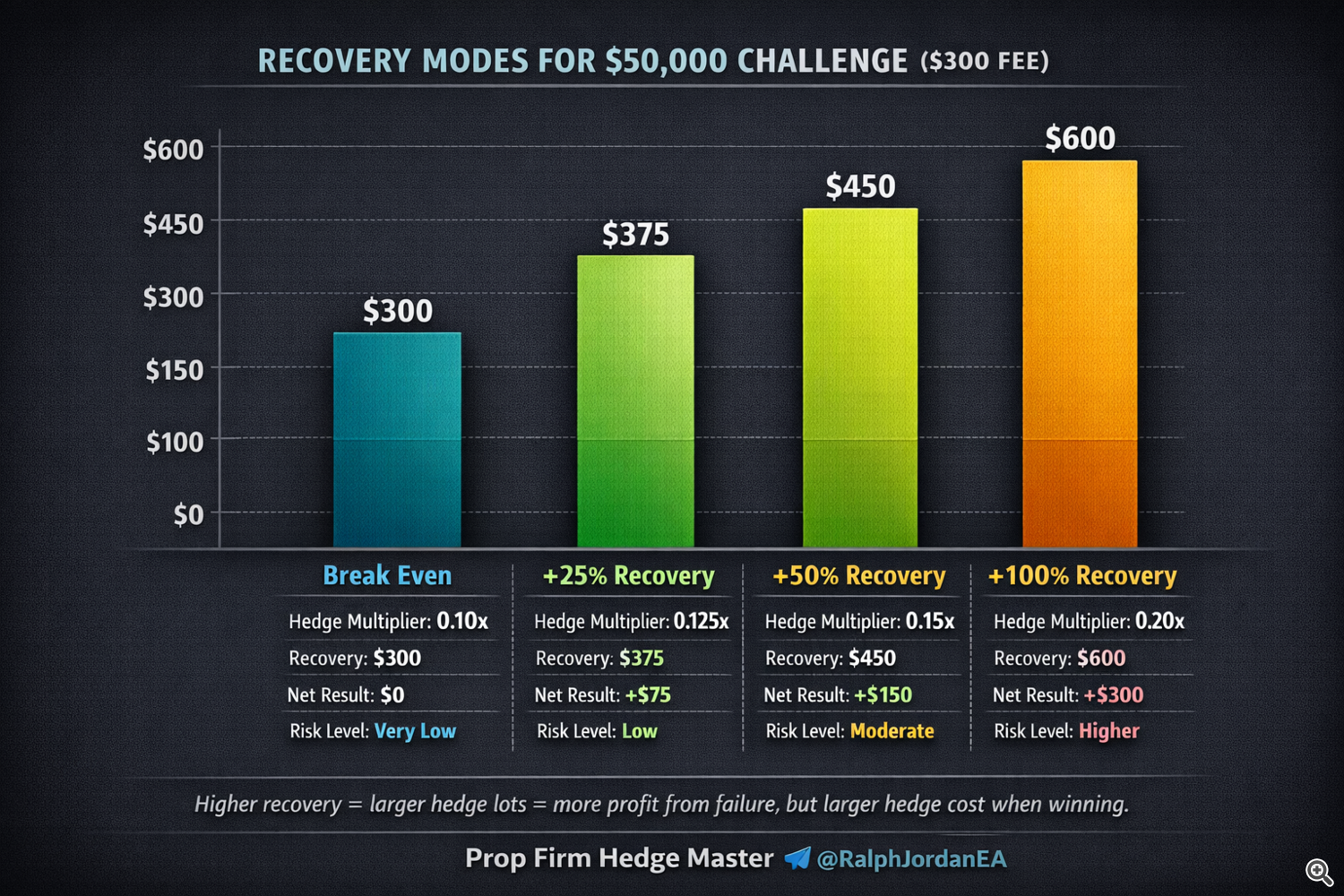

Recovery Modes: Choosing How Much You Want Back

Break even is just one option. You can adjust the multiplier to recover more:

Break Even (1x fee recovery)

- Hedge multiplier: ~0.10x

- If challenge fails, you recover the $300 fee

- Net result: $0 (fee fully covered)

- Live account risk: Very low

+25% Recovery

- Hedge multiplier: ~0.125x

- If challenge fails, you recover $375

- Net result: +$75 profit from failing

- Live account risk: Low

+50% Recovery

- Hedge multiplier: ~0.15x

- If challenge fails, you recover $450

- Net result: +$150 profit from failing

- Live account risk: Moderate

+100% Recovery (Double Fee)

- Hedge multiplier: ~0.20x

- If challenge fails, you recover $600

- Net result: +$300 profit from failing (you made back double the fee)

- Live account risk: Higher

The tradeoff is simple: higher recovery = larger hedge lots = more profit when the challenge fails, but also larger losses on the hedge when the challenge is winning.

Most traders start with break even or +25%. It keeps the hedge cost low during winning periods while fully protecting the fee.

The Full Picture: Pass vs. Fail

Let's put it all together with a complete scenario.

$50,000 challenge. $300 fee. Break-even hedge.

If you pass:

- Challenge account: Hit 8% target = $4,000 in profit

- You receive a funded $50,000 account (typical 80/20 split on profits)

- Live account hedge losses during the challenge: ~$300

- Net: Funded account minus $300 in hedge costs. Massive win.

Why this is still a massive win — even with the hedge cost.

Let's say you take 2 challenges and pass 1.

- Challenge 1: Failed. Fee was $300, but the hedge recovered it. Cost: $0.

- Challenge 2: Passed. Fee was $300 + ~$300 hedge insurance. Cost: $600.

Total cost to acquire a funded $50,000 account: $600.

Your usable capital is the max drawdown — 6% of $50,000 = $3,000. You just turned $600 into $3,000 in trading capital. That's 5:1.

Now compare that to the industry standard — a 10% pass rate. The average trader needs 10 attempts at $300 each. That's $3,000 in fees to get the same $3,000 in usable capital. 1:1.

| Without Hedge | With Hedge (1 pass out of 2) | |

|---|---|---|

| Total fees spent | $3,000 (10 attempts) | $600 (2 attempts) |

| Fees lost on failures | $2,700 | $0 (recovered) |

| Usable capital (6% DD) | $3,000 | $3,000 |

| Cost-to-capital ratio | 1:1 | 1:5 |

If you fail:

- Challenge account: Breached drawdown. Fee lost ($300).

- Live account hedge profits: ~$300

- Net: $0. Fee recovered. You try again with no financial loss.

Compare this to trading without a hedge:

- If you pass: Funded account. Same result.

- If you fail: -$300. Gone. Nothing to show for it.

Pass the challenge and the hedge cost turns into multiplied capital. Fail, and it saves you everything.

Common Misconceptions About Hedging

Let me clear up the questions I hear most often.

"Doesn't the hedge cancel out all your profits?"

No. The hedge lots are much smaller than the challenge lots. When the challenge wins a trade, the hedge loss is a fraction of the win. Over a successful challenge, the total hedge cost is roughly equal to the challenge fee — which is the entire point. You're trading the fee for certainty.

"Isn't this just breaking even on everything?"

No. When you pass the challenge, you get a funded account worth tens of thousands in potential payouts. The hedge only costs you during the challenge period. Once you're funded, you trade normally without a hedge.

"Can't I just do this manually?"

Technically, yes. Practically, no. Manual hedging means watching two platforms simultaneously, opening trades at the exact same time, calculating lot sizes on the fly, and never missing a single trade. One missed hedge — one trade that goes unprotected — and the math falls apart. I tried manual hedging early on. It was exhausting, error-prone, and unsustainable. That's why I automated it.

"Won't the prop firm detect it?"

This is a real concern, and it's why the system needs to be designed carefully. If your challenge trades look identical to thousands of other accounts — same entries, same exits, same timing — you'll get flagged. The system needs randomization: random strategy selection from a large pool, varied entry timing, different magic numbers, unique trade patterns per account. This is something I spent a long time getting right.

"Do I need a big account for the hedge?"

Not at all. Because the hedge lots are much smaller than the challenge lots, you don't need much capital. For a $50,000 challenge with break-even hedging, a live account with $1,000-$2,000 is typically sufficient. The exact amount depends on your recovery mode and the lot multiplier.

"What about the spread cost on both sides?"

Yes, you're paying spread twice — once on the challenge, once on the hedge. But the total spread cost across a challenge is typically a few dollars to a few tens of dollars. Compared to losing a $300 fee entirely, the spread cost is negligible.

Why You Need Two Different Brokers

This comes up every time, so let me be direct:

Your challenge account and your hedge account must be at different brokers.

If they're at the same broker, the broker can see both accounts. They can see that your trades are mirrored. They can flag it, investigate it, and potentially void your challenge.

Even if they're at different brokers but those brokers share the same liquidity provider or back-end platform, there's a risk. The closer the infrastructure relationship between the two brokers, the higher the chance of detection.

Best practice:

- Challenge account: at the prop firm's designated broker

- Hedge account: at a completely independent retail broker with no relationship to the prop firm

This is non-negotiable. Cutting corners here puts everything at risk.

Why Automation Matters

I want to be honest about something: hedging works without automation. The math is the math. If you can successfully place opposite trades on two accounts at the same time, every time, with the correct lot sizes, you'll get the same result whether a robot does it or you do.

But in practice, manual hedging fails for three reasons:

1. Speed

The hedge trade needs to open within seconds of the challenge trade. Any delay means a different price, which changes the math. Markets move fast. Your fingers don't.

2. Consistency

You need to hedge every single trade. Not most trades. Every trade. Miss one, and if that's the one where the challenge takes a big loss, you're unprotected when it matters most. It's easy to hedge when you're at your desk. It's impossible when you're sleeping, working, or just living your life.

3. Precision

The lot sizes need to be calculated correctly every time. The multiplier needs to account for different pip values across different pairs. Mental math under time pressure leads to mistakes. One miscalculated lot size can mean the difference between full recovery and partial recovery.

Automation solves all three problems. The EA opens the hedge trade in milliseconds, never misses a signal, calculates lot sizes precisely, and runs 24/5 without needing you at the screen.

Can you hedge manually? Yes. Should you? Not if you want to do this consistently across multiple challenges.

How I've Used This System

I'm going to keep this simple because the numbers speak for themselves.

I've been running this hedging system for years. I've completed over 300 prop firm challenges. I've collected more than $500,000 in verified payouts from funded accounts.

Not every challenge passed. That's the point — they don't all need to.

When I pass, I get a funded account and start earning payouts. When I fail, the hedge recovers my fee. Sometimes I set recovery higher and actually profit from failing.

The result is a system where I can take challenge after challenge, with zero financial risk on the fee, and every pass adds a new funded account to my portfolio.

It took years to refine. Getting the strategy pool right. Getting the anti-detection features working. Getting the hedge timing precise. Getting the recovery math accurate across different account sizes and prop firm rules.

Eventually I packaged the whole thing into two EAs and released them so other traders could use the same system without spending years building it themselves.

The Bottom Line

Prop firm hedging isn't complicated. It's two accounts, opposite trades, and basic math.

- When you win the challenge, you pay a small hedge cost and get a funded account

- When you lose the challenge, the hedge recovers your fee

- The lot multiplier controls exactly how much you recover

- Recovery modes let you choose: break even, +25%, +50%, or +100%

- Automation makes it consistent, precise, and hands-free

- Different brokers keep it clean

This is how I turned prop firm challenges from a gamble into a business. And it's available to anyone willing to learn the system.

The two EAs that run this system — Prop Firm Hedge Master (for the challenge account) and Prop Firm Hedge Live (for the hedge account) — are available on MQL5 Market. Hedge Master runs over 1,000 strategy combinations with built-in anti-detection features. Hedge Live automatically mirrors the opposite trades on your personal account with precise lot calculation.

If you have questions about the setup or want to see how the math works for your specific challenge size, feel free to reach out.