About:

Keltner Channels Buy Sell Alerts on MT5: https://www.mql5.com/en/market/product/162461

Keltner Channels are a popular technical analysis tool developed by Chester Keltner in the 1960s, often used by traders to gauge market volatility and identify potential breakout or reversal points. They consist of a central moving average line flanked by upper and lower bands based on the Average True Range (ATR), which helps spot overbought or oversold conditions. Traders typically use them for trend following, where a price breakout above the upper band signals buying strength, or below the lower band indicates selling pressure, making it easier to time entries and exits in volatile markets like forex, commodities, or stocks.

This indicator, "Keltner Channels Buy Sell Alerts," builds on the classic Keltner concept to provide clear visual signals and notifications for trading decisions. It's designed for MT5 charts and can be easily added via the Navigator panel or by dragging it onto your chart.

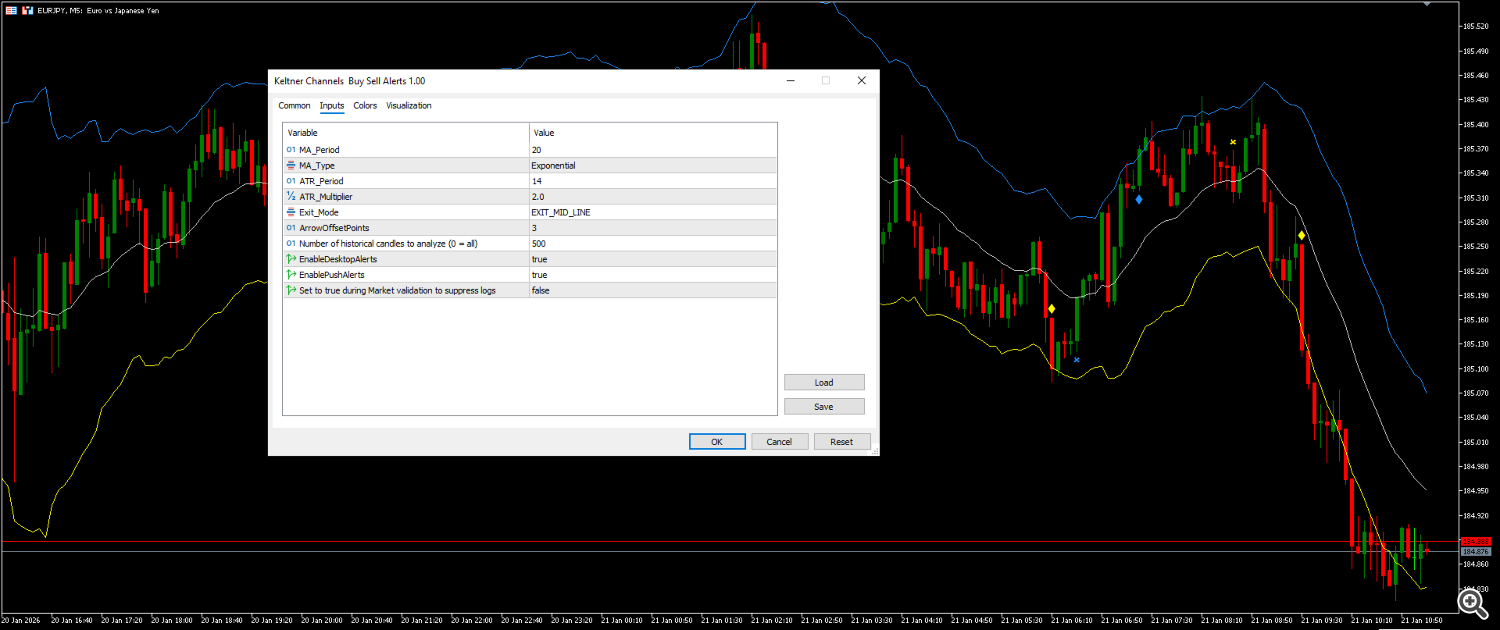

The indicator menu is simple and intuitive as you can see bellow.

When attaching it, you'll see these input parameters, which you can customize to fit your trading style:

- MA_Period (default 20): The period for the central moving average line.

- MA_Type (default EMA): The type of moving average, such as SMA, EMA, SMMA, or LWMA.

- ATR_Period (default 14): The period for calculating the Average True Range used in the bands.

- ATR_Multiplier (default 2.0): The multiplier applied to the ATR to set the band width.

- Exit_Mode (default EXIT_OPPOSITE_BAND): Choose how positions close. Options include closing on opposite band cross, mid-line cross, or return inside the channel.

- ArrowOffsetPoints (default 300): Adjusts the visual spacing of signal arrows from the candles. For smaller timeframes try values like 3 on M5.

- HistoryLookback (default 500): Limits historical signal analysis to the last specified number of candles (set to 0 for all available history).

- EnableDesktopAlerts (default true): Turns on pop-up alerts on your MT5 terminal.

- EnablePushAlerts (default true): Enables push notifications to your mobile device via the MT5 app.

On the chart, the indicator draws three lines: a light gray middle line (the moving average), a dodger blue upper band, and a yellow lower band. Signals appear as small arrows. Dodger blue diamonds below candles for buy opportunities when price closes above the upper band, and yellow diamonds above candles for sell signals when price closes below the lower band. For closures, it uses X-cross marks: yellow ones above candles to close longs, and dodger blue ones below to close shorts. These visuals help you spot entries and exits at a glance without cluttering the chart.

Alerts are straightforward and come in two forms: desktop pop-ups and mobile push notifications. They follow a simple format like "XAUUSD D1 place BUY order" or "EURUSD D1 place SELL order," triggered only on new signals to keep things timely and relevant. The indicator focuses on breakout and reversion logic, but remember to combine it with your own risk management, as no tool guarantees results in trading.

This setup makes the indicator suitable for beginners and experienced traders alike, offering flexibility while keeping the focus on practical use. Feel free to explore the inputs, test on a demo account first and leave a review.

FAQ: Why the indicator doesn't incorporate squeeze, multi timeframe, or other extra features?

Because adding those things like squeeze detection, MTF alignment, extra filters, confirmations, etc.—almost always hurts more than it helps in the long run.

Most traders (even experienced ones) pile on layers like that because they’re secretly chasing certainty in something that is never certain. Trading is probabilistic: markets are messy, random, full of news shocks and liquidity surprises. No amount of indicators can remove that uncertainty, they only create the illusion of control.

In practice, these additions usually cause exactly the problems you want to avoid:

Fewer trades — Good setups get filtered out just because they don’t meet all the extra rules and you miss the best moves and kill compounding.

Over optimization / curve fitting — The system looks fantastic in backtests (high win rate, smooth equity curve), but falls apart live when the market regime changes or normal variance hits.

Analysis paralysis — Too many conditions = hesitation, skipped trades, or forcing entries to “satisfy the checklist”.

Psychological comfort at the expense of profits — It feels safer to wait for “triple confirmation,” but that safety usually means lower expectancy and worse real results.

Simple edges with clean triggers + strict risk management (1-2% per trade, clear exits) outperform complicated systems in the long term, precisely because they actually get traded consistently.

That’s why the indicator stays minimal: one core signal (e.g. close outside the band), no extra “safety blankets” that reduce execution and profitability. Less is deliberately more here.