How Much Do You Actually Need to Start Hedging Prop Firm Challenges?

How Much Do You Actually Need to Start Hedging Prop Firm Challenges?

It's the first question everyone asks.

Not "how does hedging work?" Not "is it safe?" Not "will I get detected?"

"How much money do I need in my live account to start hedging?"

And it makes sense that this is the first question. Because if the answer is "you need $50,000 to hedge a $50,000 challenge," then hedging doesn't make sense for most traders. The whole point of prop firms is trading with someone else's capital because you don't have enough of your own.

Here's the good news: you need far less than you think.

What Determines the Amount

The capital you need in your live hedge account depends on four things:

1. Challenge fee

This is the most important factor. Your live account capital is based on the challenge fee — not the challenge size.

2. Maximum drawdown percentage

The max drawdown on your challenge (typically 6-12%) determines the worst-case loss scenario. This affects how the hedge multiplier is calculated.

3. Recovery mode setting

This is the setting on Prop Firm Hedge Live that determines how much the hedge should recover:

- Break even mode: Recover just the challenge fee. Lowest capital requirement.

- Fee + 50% recovery: Recover the fee plus 50% extra profit. Moderate capital.

- Fee + 100% recovery: Recover the fee and double it. Highest capital requirement.

4. Broker leverage on your live account

With high leverage (1:1000), margin is negligible. The capital you need isn't for margin — it's for covering the hedge's floating loss when the challenge is winning, plus a buffer to avoid margin calls.

The Real Numbers: What You Actually Need

The capital calculation is simpler than you think. It's based on the challenge fee, not the challenge size.

The formula:

- Break Even mode: 2x the challenge fee (1x for hedge cost + 1x margin buffer)

- +100% Profit mode: 3x the challenge fee (2x for hedge cost + 1x margin buffer)

The margin buffer (1x) is a reserve to prevent your broker from auto-closing your hedge trades when they're in a floating loss. When the challenge is winning, the hedge is losing — and you need enough balance to keep that position open until the trade closes.

| Challenge | Fee | Break Even (2x fee) | +100% Profit (3x fee) |

|---|---|---|---|

| $10,000 | $100 | $200 | $300 |

| $25,000 | $200 | $400 | $600 |

| $50,000 | $300 | $600 | $900 |

| $100,000 | $500 | $1,000 | $1,500 |

| $200,000 | $800 | $1,600 | $2,400 |

That's it. A $50K challenge needs $600 in your live account for break even. Not $3,000. Not $5,000. $600.

Even a $200K challenge — the largest common size — only needs $1,600 to $2,400. That's 0.8-1.2% of the challenge value.

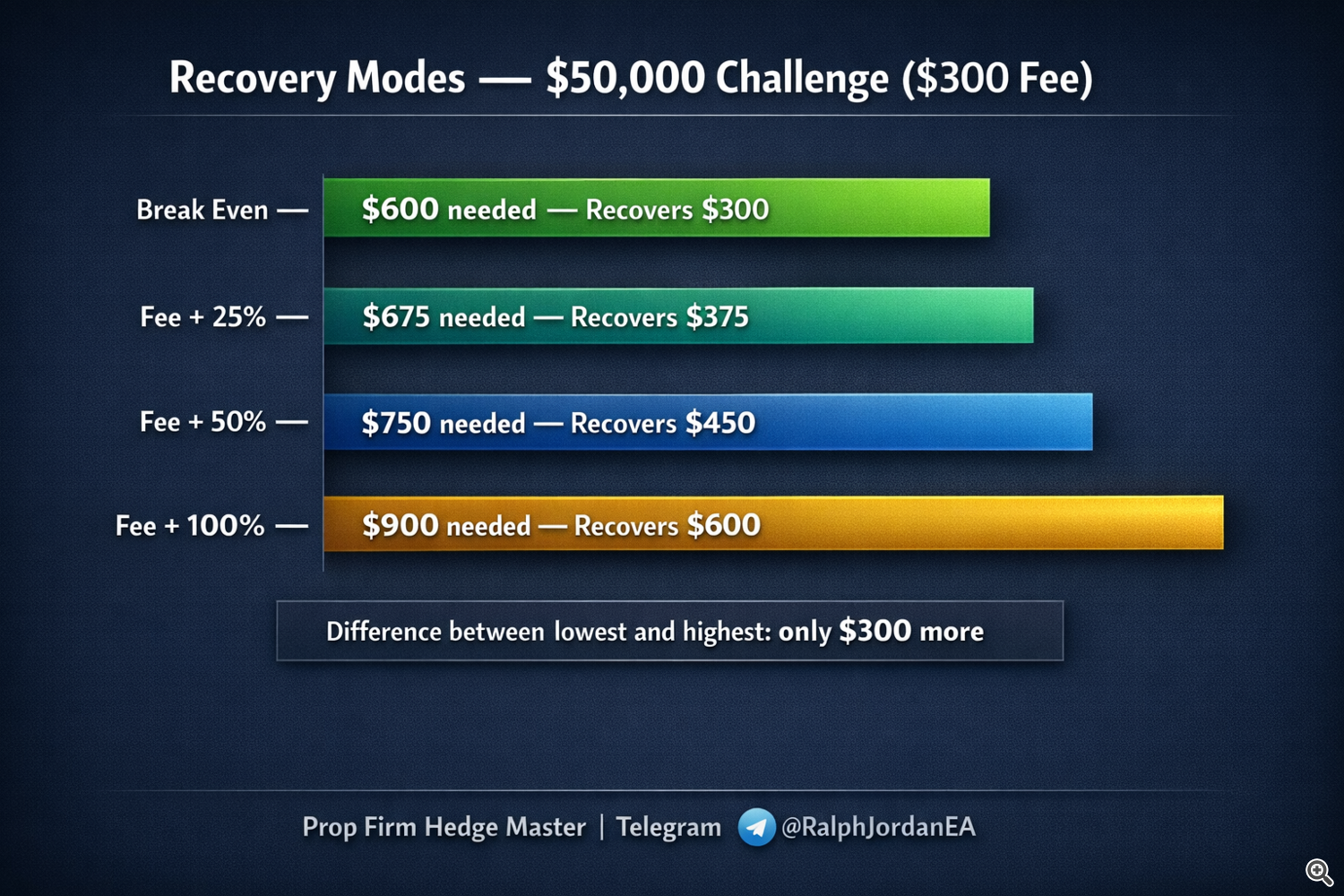

How Recovery Mode Affects Capital Requirements

The numbers above show break even and +100%. Here's the full breakdown for a $50,000 challenge:

| Recovery Mode | What It Recovers | Fee Multiplier | Live Account Needed |

|---|---|---|---|

| Break Even | Fee only ($300) | 2x | $600 |

| Fee + 25% | $300 + $75 = $375 | ~2.25x | $675 |

| Fee + 50% | $300 + $150 = $450 | ~2.5x | $750 |

| Fee + 100% | $300 + $300 = $600 | 3x | $900 |

The difference between break even and +100% profit is only $300 more in your live account. For most traders, starting with break even makes sense — protect the fee first, then increase recovery as you get comfortable.

A Note on Broker Leverage

With 1:1000 leverage, margin per trade is almost nothing. The capital you need is for covering floating losses, not margin. This is why the formula is based on the fee, not lot sizes or margin calculations.

If your broker offers lower leverage (1:100 or 1:30), you'll need more capital because the margin per trade eats into your buffer. But with 1:1000, the numbers above are accurate.

Recommendation: Use a broker with at least 1:500 leverage on your live hedge account. This keeps your margin requirements low and lets your capital work as a floating loss buffer — which is what it's actually for.

The EA Does the Math for You

One of the features I built into Prop Firm Hedge Live is an automatic capital recommendation.

When you set up the EA on your live account, the dashboard shows you:

- Recommended minimum balance based on your challenge size, recovery mode, and broker leverage

- Current margin usage so you can see how much buffer you have

- Commission allowance automatically calculated so your hedge profits aren't eaten by trading costs

- Real-time hedge status showing whether your current balance can support the active hedge

You don't need to do these calculations manually. The EA reads your account conditions and tells you exactly what you need. If your balance drops below the recommended level, you'll see a warning before the system takes on trades it can't properly support.

You Don't Need as Much as You Think

Let me put this in perspective.

If you're running a $50,000 challenge with a $300 fee, you need $600 in your live account to hedge with break even recovery.

$600. That's it.

For $600, you get:

- Zero risk on the challenge fee — if you fail, the hedge covers the $300

- A funded account if you pass — the challenge profit far exceeds the small hedge cost

- The ability to take unlimited attempts — because failure never costs you anything

Compare that to what most traders do: spend $300 per attempt, fail 7-8 out of 10 times, and burn through $2,100-$2,400 per year with nothing to show for it.

With $600 in a live account, you'd never lose a challenge fee again. And that $600 stays in your account — it's not spent, it's working for you.

Start Small, Scale Up

If you're new to hedging, here's the approach I recommend:

Step 1: $10K challenges — Testing & Learning

Capital needed: $200-$300. Learn how the system works. See the hedge open, close, and recover fees in real time.

Step 2: $30K-$50K challenges — Mastery

Capital needed: $600-$900. You understand the system. Now build consistency and confidence with mid-size challenges.

Step 3: $100K challenges — Most Optimal

Capital needed: $1,000-$1,500. The sweet spot. Best cost-to-capital ratio. This is where the system pays for itself.

Step 4: $200K challenges — Scaling Up

Capital needed: $1,600-$2,400. Once you've mastered the system, scale to maximum challenge sizes.

The Bottom Line

The capital requirement for hedging prop challenges is far lower than most traders expect.

- A $10K challenge needs $200-$300

- A $50K challenge needs $600-$900

- A $100K challenge needs $1,000-$1,500

- A $200K challenge needs $1,600-$2,400

The formula is simple: 2x the challenge fee for break even, 3x for +100% profit. Half goes to hedge cost, the other portion is your margin buffer.

You don't need to match the challenge size. You don't need thousands of dollars. You need 2-3x the challenge fee — and that's a fraction of what most people assume.

Stop guessing. Start with the numbers. Pick a challenge size you can hedge comfortably, prove the system works, and scale from there.

The capital calculations above are based on real numbers from 300+ challenges with over $500K in verified payouts. Prop Firm Hedge Master runs on your challenge account, and Prop Firm Hedge Live runs on your personal account to handle the hedge — including automatic balance recommendations and commission calculations.

Both EAs are available on MQL5 Market. If you want help calculating the right setup for your situation, check the product page or send me a message.