Forex and Cryptocurrency Forecast for January 12–16, 2026

Macroeconomic data published in the US last week did not signal any sharp deterioration in economic conditions. ISM PMI indicators and labour market data, including the ADP report, weekly jobless claims, and the December non-farm payrolls, confirmed stable conditions in the US labour market. In the eurozone, inflation data came close to forecasts and did not change expectations regarding ECB policy. Taken together, these factors increased investor caution and supported the US dollar.

💶 EUR/USD

EUR/USD ended the week at 1.1633, continuing its corrective decline from the December highs. The pair remains highly sensitive to US macroeconomic data and changes in interest rate expectations. At the same time, cautious market sentiment continues to limit the euro’s ability to regain upward momentum. An attempt to rise towards the 1.1700-1.1720 resistance area cannot be ruled out. Failure to consolidate above this zone may lead to renewed selling pressure, with a move towards 1.1575-1.1615. If bearish momentum strengthens, a deeper decline towards 1.1540 and further to 1.1470-1.1510 is possible. A confident breakout and consolidation above 1.1720 would cancel the bearish scenario and open the way towards 1.1780-1.1820, with a potential extension to 1.1900.

₿ BTC/USD

Bitcoin continues to ignore the stronger US dollar, trading near the 90,000 pivot point within a consolidation range of 83,800-94,500. Another attempt to break above the upper boundary of this range failed, and BTC/USD ended Friday’s session at 90,430. If bitcoin reacts to the stronger dollar and lower risk appetite, a decline towards the 86,600 support level may follow, with a further move towards the lower boundary of the range at 83,800-85,100. A break below 83,800 would open the way to the next bearish target at 80,540. A breakout above 95,000 would signal renewed bullish momentum and open the way towards 98,000-100,000.

🛢️ Brent

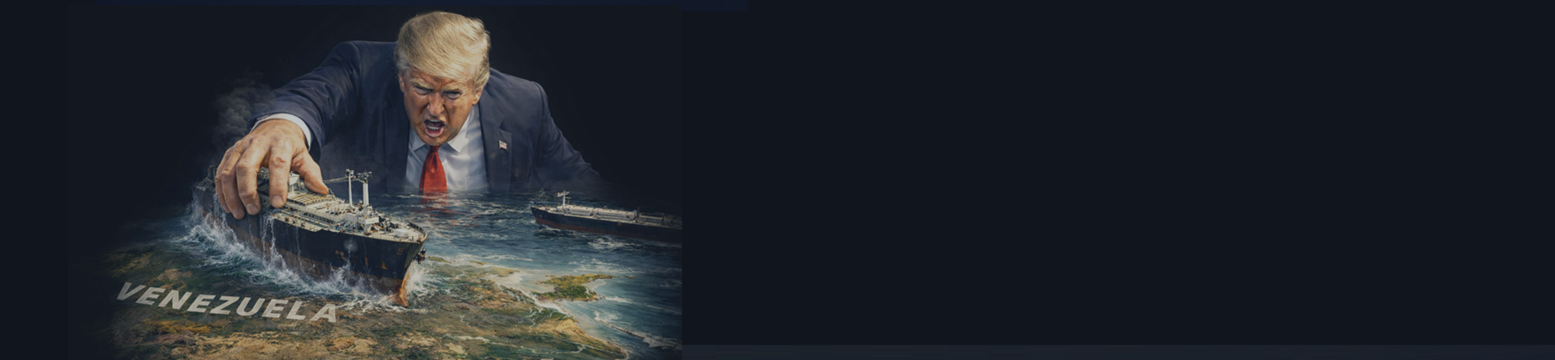

Brent crude oil closed the week at 62.71 USD per barrel, reaching a weekly high near the upper boundary of the descending channel at 63.60. Prices were supported by geopolitical tensions, including the situation around Venezuelan President Nicolas Maduro and the maritime blockade of the country. Additional support came from reports of arrests of Russian oil tankers by the United States. At the same time, many analysts point to a significant oil surplus expected this year, which could push prices down to 50–52 USD and potentially even to 30–40 USD per barrel. In the new trading week, Brent may test the 63.90–65.00 resistance area, which would open the way towards 66.80–68.00. If bullish momentum weakens, a decline towards 60.10–61.00 and further to 59.60 cannot be ruled out.

🥇 XAU/USD

Gold ended Friday at 4,509, returning to historical highs and continuing to benefit from strong safe-haven demand. The nearest upside target for buyers is 4,550. A breakout above this level would open the way towards 4,600-4,680. At the same time, a temporary correction towards the 4,400-4,450 area cannot be excluded. The next support levels are located at 4,350 and 4,300-4,250.

🧭 Conclusion

In the coming week, the key event will be the publication of US inflation data. On Tuesday, the Consumer Price Index (CPI) for December will be released. On Wednesday, Producer Price Index (PPI) data will follow. On Thursday, market attention will focus on US retail sales and labour market statistics.

Baseline scenarios: EUR/USD – neutral to bearish while the pair remains below 1.1720, with downside risks increasing if 1.1575 is broken. BTC/USD – neutral. Brent – neutral to bullish while prices remain above 61.80, with key resistance at 63.90-65.00. XAU/USD – bullish, with buy-on-dips strategy while gold remains above 4,450.

P.S. Attention traders: do you want to get extra money from every trade – even losing ones? Trade as usual and receive cashback. There are no limits on withdrawals.

Details here:

https://www.globalfinance.pro