Dialectic Search (DA)

The article introduces the dialectical algorithm (DA), a new global optimization method inspired by the philosophical concept of dialectics. The algorithm exploits a unique division of the population into speculative and practical thinkers. Testing shows impressive performance of up to 98% on low-dimensional problems and overall efficiency of 57.95%. The article explains these metrics and presents a detailed description of the algorithm and the results of experiments on different types of functions.

Building a Trading System (Part 5): Managing Gains Through Structured Trade Exits

For many traders, it's a familiar pain point: watching a trade come within a whisker of your profit target, only to reverse and hit your stop-loss. Or worse, seeing a trailing stop close you out at breakeven before the market surges toward your original target. This article focuses on using multiple entries at different Reward-to-Risk Ratios to systematically secure gains and reduce overall risk exposure.

MQL5 Wizard Techniques you should know (Part 84): Using Patterns of Stochastic Oscillator and the FrAMA - Conclusion

The Stochastic Oscillator and the Fractal Adaptive Moving Average are an indicator pairing that could be used for their ability to compliment each other within an MQL5 Expert Advisor. We introduced this pairing in the last article, and now look to wrap up by considering its 5 last signal patterns. In exploring this, as always, we use the MQL5 wizard to build and test out their potential.

Self Optimizing Expert Advisors in MQL5 (Part 15): Linear System Identification

Trading strategies may be challenging to improve because we often don’t fully understand what the strategy is doing wrong. In this discussion, we introduce linear system identification, a branch of control theory. Linear feedback systems can learn from data to identify a system’s errors and guide its behavior toward intended outcomes. While these methods may not provide fully interpretable explanations, they are far more valuable than having no control system at all. Let’s explore linear system identification and observe how it may help us as algorithmic traders to maintain control over our trading applications.

Risk Management (Part 1): Fundamentals for Building a Risk Management Class

In this article, we'll cover the basics of risk management in trading and learn how to create your first functions for calculating the appropriate lot size for a trade, as well as a stop-loss. Additionally, we will go into detail about how these features work, explaining each step. Our goal is to provide a clear understanding of how to apply these concepts in automated trading. Finally, we will put everything into practice by creating a simple script with an include file.

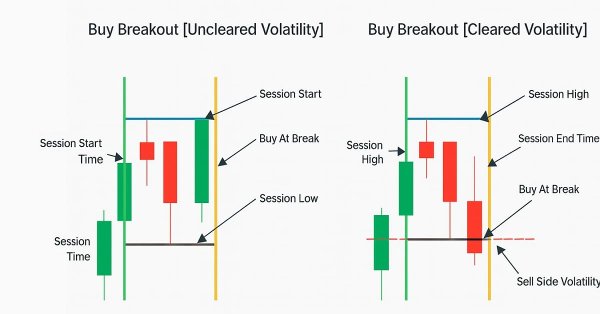

Introduction to MQL5 (Part 23): Automating Opening Range Breakout Strategy

This article explores how to build an Opening Range Breakout (ORB) Expert Advisor in MQL5. It explains how the EA identifies breakouts from the market’s initial range and opens trades accordingly. You’ll also learn how to control the number of positions opened and set a specific cutoff time to stop trading automatically.

MQL5 Wizard Techniques you should know (Part 83): Using Patterns of Stochastic Oscillator and the FrAMA — Behavioral Archetypes

The Stochastic Oscillator and the Fractal Adaptive Moving Average are another indicator pairing that could be used for their ability to compliment each other within an MQL5 Expert Advisor. We look at the Stochastic for its ability to pinpoint momentum shifts, while the FrAMA is used to provide confirmation of the prevailing trends. In exploring this indicator pairing, as always, we use the MQL5 wizard to build and test out their potential.

Price Action Analysis Toolkit Development (Part 45): Creating a Dynamic Level-Analysis Panel in MQL5

In this article, we explore a powerful MQL5 tool that let's you test any price level you desire with just one click. Simply enter your chosen level and press analyze, the EA instantly scans historical data, highlights every touch and breakout on the chart, and displays statistics in a clean, organized dashboard. You'll see exactly how often price respected or broke through your level, and whether it behaved more like support or resistance. Continue reading to explore the detailed procedure.

Neural Networks in Trading: An Agent with Layered Memory

Layered memory approaches that mimic human cognitive processes enable the processing of complex financial data and adaptation to new signals, thereby improving the effectiveness of investment decisions in dynamic markets.

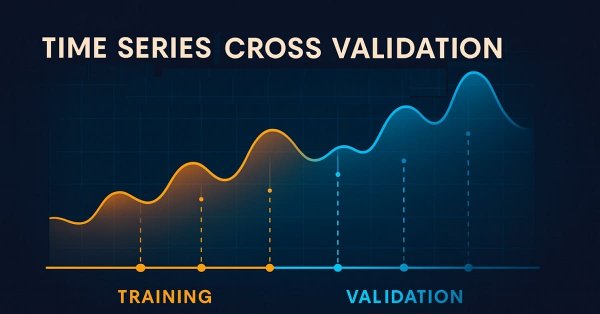

Overcoming The Limitation of Machine Learning (Part 5): A Quick Recap of Time Series Cross Validation

In this series of articles, we look at the challenges faced by algorithmic traders when deploying machine-learning-powered trading strategies. Some challenges within our community remain unseen because they demand deeper technical understanding. Today’s discussion acts as a springboard toward examining the blind spots of cross-validation in machine learning. Although often treated as routine, this step can easily produce misleading or suboptimal results if handled carelessly. This article briefly revisits the essentials of time series cross-validation to prepare us for more in-depth insight into its hidden blind spots.

Introduction to MQL5 (Part 22): Building an Expert Advisor for the 5-0 Harmonic Pattern

This article explains how to detect and trade the 5-0 harmonic pattern in MQL5, validate it using Fibonacci levels, and display it on the chart.

Reusing Invalidated Orderblocks As Mitigation Blocks (SMC)

In this article, we explore how previously invalidated orderblocks can be reused as mitigation blocks within Smart Money Concepts (SMC). These zones reveal where institutional traders re-enter the market after a failed orderblock, providing high-probability areas for trade continuation in the dominant trend.

Price Action Analysis Toolkit Development (Part 44): Building a VWMA Crossover Signal EA in MQL5

This article introduces a VWMA crossover signal tool for MetaTrader 5, designed to help traders identify potential bullish and bearish reversals by combining price action with trading volume. The EA generates clear buy and sell signals directly on the chart, features an informative panel, and allows for full user customization, making it a practical addition to your trading strategy.

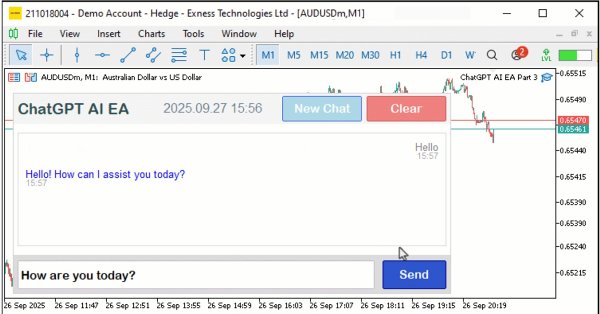

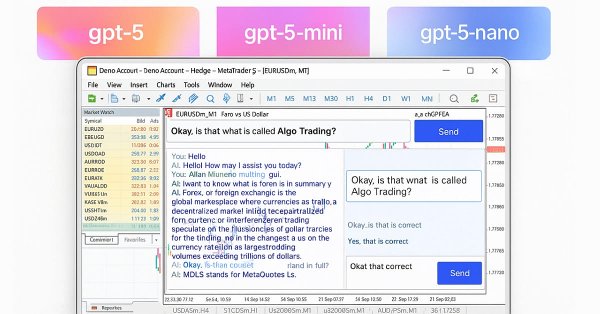

Building AI-Powered Trading Systems in MQL5 (Part 4): Overcoming Multiline Input, Ensuring Chat Persistence, and Generating Signals

In this article, we enhance the ChatGPT-integrated program in MQL5 overcoming multiline input limitations with improved text rendering, introducing a sidebar for navigating persistent chat storage using AES256 encryption and ZIP compression, and generating initial trade signals through chart data integration.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention (Final Part)

In the previous article, we explored the theoretical foundations and began implementing the approaches of the Multitask-Stockformer framework, which combines the wavelet transform and the Self-Attention multitask model. We continue to implement the algorithms of this framework and evaluate their effectiveness on real historical data.

Building a Trading System (Part 4): How Random Exits Influence Trading Expectancy

Many traders have experienced this situation, often stick to their entry criteria but struggle with trade management. Even with the right setups, emotional decision-making—such as panic exits before trades reach their take-profit or stop-loss levels—can lead to a declining equity curve. How can traders overcome this issue and improve their results? This article will address these questions by examining random win-rates and demonstrating, through Monte Carlo simulation, how traders can refine their strategies by taking profits at reasonable levels before the original target is reached.

Neural Networks in Trading: Models Using Wavelet Transform and Multi-Task Attention

We invite you to explore a framework that combines wavelet transforms and a multi-task self-attention model, aimed at improving the responsiveness and accuracy of forecasting in volatile market conditions. The wavelet transform allows asset returns to be decomposed into high and low frequencies, carefully capturing long-term market trends and short-term fluctuations.

From Novice to Expert: Demystifying Hidden Fibonacci Retracement Levels

In this article, we explore a data-driven approach to discovering and validating non-standard Fibonacci retracement levels that markets may respect. We present a complete workflow tailored for implementation in MQL5, beginning with data collection and bar or swing detection, and extending through clustering, statistical hypothesis testing, backtesting, and integration into an MetaTrader 5 Fibonacci tool. The goal is to create a reproducible pipeline that transforms anecdotal observations into statistically defensible trading signals.

Market Simulation (Part 02): Cross Orders (II)

Unlike what was done in the previous article, here we will test the selection option using an Expert Advisor. Although this is not a final solution yet, it will be enough for now. With the help of this article, you will be able to understand how to implement one of the possible solutions.

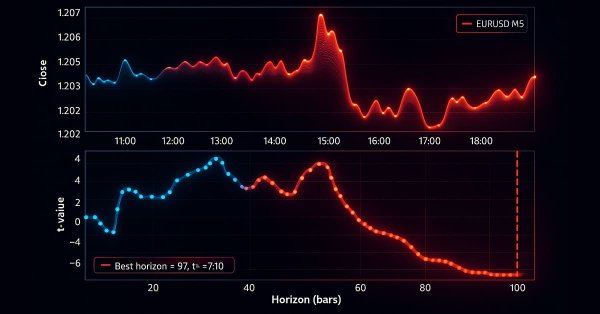

MetaTrader 5 Machine Learning Blueprint (Part 3): Trend-Scanning Labeling Method

We have built a robust feature engineering pipeline using proper tick-based bars to eliminate data leakage and solved the critical problem of labeling with meta-labeled triple-barrier signals. This installment covers the advanced labeling technique, trend-scanning, for adaptive horizons. After covering the theory, an example shows how trend-scanning labels can be used with meta-labeling to improve on the classic moving average crossover strategy.

Neural Networks in Trading: A Hybrid Trading Framework with Predictive Coding (Final Part)

We continue our examination of the StockFormer hybrid trading system, which combines predictive coding and reinforcement learning algorithms for financial time series analysis. The system is based on three Transformer branches with a Diversified Multi-Head Attention (DMH-Attn) mechanism that enables the capturing of complex patterns and interdependencies between assets. Previously, we got acquainted with the theoretical aspects of the framework and implemented the DMH-Attn mechanisms. Today, we will talk about the model architecture and training.

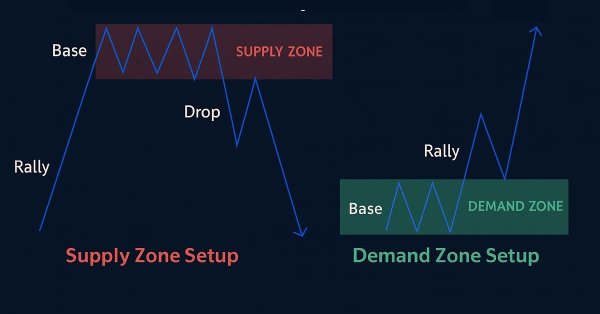

Automating Trading Strategies in MQL5 (Part 36): Supply and Demand Trading with Retest and Impulse Model

In this article, we create a supply and demand trading system in MQL5 that identifies supply and demand zones through consolidation ranges, validates them with impulsive moves, and trades retests with trend confirmation and customizable risk parameters. The system visualizes zones with dynamic labels and colors, supporting trailing stops for risk management.

Developing Advanced ICT Trading Systems: Implementing Signals in the Order Blocks Indicator

In this article, you will learn how to develop an Order Blocks indicator based on order book volume (market depth) and optimize it using buffers to improve accuracy. This concludes the current stage of the project and prepares for the next phase, which will include the implementation of a risk management class and a trading bot that uses signals generated by the indicator.

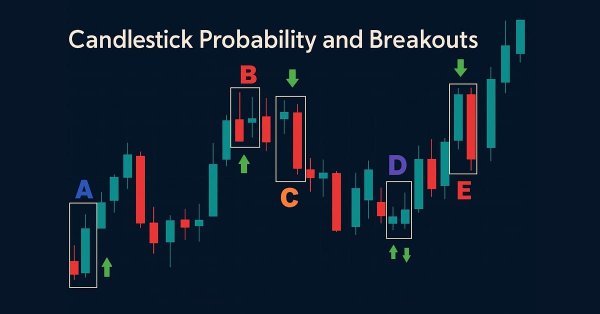

Price Action Analysis Toolkit Development (Part 43): Candlestick Probability and Breakouts

Enhance your market analysis with the MQL5-native Candlestick Probability EA, a lightweight tool that transforms raw price bars into real-time, instrument-specific probability insights. It classifies Pinbars, Engulfing, and Doji patterns at bar close, uses ATR-aware filtering, and optional breakout confirmation. The EA calculates raw and volume-weighted follow-through percentages, helping you understand each pattern's typical outcome on specific symbols and timeframes. On-chart markers, a compact dashboard, and interactive toggles allow easy validation and focus. Export detailed CSV logs for offline testing. Use it to develop probability profiles, optimize strategies, and turn pattern recognition into a measurable edge.

Building AI-Powered Trading Systems in MQL5 (Part 3): Upgrading to a Scrollable Single Chat-Oriented UI

In this article, we upgrade the ChatGPT-integrated program in MQL5 to a scrollable single chat-oriented UI, enhancing conversation history display with timestamps and dynamic scrolling. The system builds on JSON parsing to manage multi-turn messages, supporting customizable scrollbar modes and hover effects for improved user interaction.

Price movement discretization methods in Python

We will look at price discretization methods using Python + MQL5. In this article, I will share my practical experience developing a Python library that implements a wide range of approaches to bar formation — from classic Volume and Range bars to more exotic methods like Renko and Kagi. We will consider three-line breakout candles and range bars analyzing their statistics and trying to define how else the prices can be represented discretely.

Building a Professional Trading System with Heikin Ashi (Part 2): Developing an EA

This article explains how to develop a professional Heikin Ashi-based Expert Advisor (EA) in MQL5. You will learn how to set up input parameters, enumerations, indicators, global variables, and implement the core trading logic. You will also be able to run a backtest on gold to validate your work.

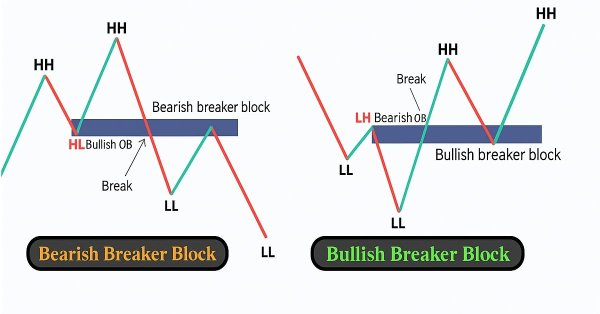

Automating Trading Strategies in MQL5 (Part 35): Creating a Breaker Block Trading System

In this article, we create a Breaker Block Trading System in MQL5 that identifies consolidation ranges, detects breakouts, and validates breaker blocks with swing points to trade retests with defined risk parameters. The system visualizes order and breaker blocks with dynamic labels and arrows, supporting automated trading and trailing stops.

From Novice to Expert: Backend Operations Monitor using MQL5

Using a ready-made solution in trading without concerning yourself with the internal workings of the system may sound comforting, but this is not always the case for developers. Eventually, an upgrade, misperformance, or unexpected error will arise, and it becomes essential to trace exactly where the issue originates to diagnose and resolve it quickly. Today’s discussion focuses on uncovering what normally happens behind the scenes of a trading Expert Advisor, and on developing a custom dedicated class for displaying and logging backend processes using MQL5. This gives both developers and traders the ability to quickly locate errors, monitor behavior, and access diagnostic information specific to each EA.

MQL5 Trading Tools (Part 9): Developing a First Run User Setup Wizard for Expert Advisors with Scrollable Guide

In this article, we develop an MQL5 First Run User Setup Wizard for Expert Advisors, featuring a scrollable guide with an interactive dashboard, dynamic text formatting, and visual controls like buttons and a checkbox allowing users to navigate instructions and configure trading parameters efficiently. Users of the program get to have insight of what the program is all about and what to do on the first run, more like an orientation model.

Price Action Analysis Toolkit Development (Part 42): Interactive Chart Testing with Button Logic and Statistical Levels

In a world where speed and precision matter, analysis tools need to be as smart as the markets we trade. This article presents an EA built on button logic—an interactive system that instantly transforms raw price data into meaningful statistical levels. With a single click, it calculates and displays mean, deviation, percentiles, and more, turning advanced analytics into clear on-chart signals. It highlights the zones where price is most likely to bounce, retrace, or break, making analysis both faster and more practical.

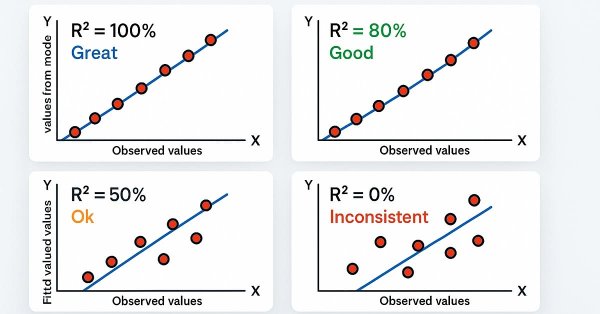

Automating Trading Strategies in MQL5 (Part 34): Trendline Breakout System with R-Squared Goodness of Fit

In this article, we develop a Trendline Breakout System in MQL5 that identifies support and resistance trendlines using swing points, validated by R-squared goodness of fit and angle constraints, to automate breakout trades. Our plan is to detect swing highs and lows within a specified lookback period, construct trendlines with a minimum number of touch points, and validate them using R-squared metrics and angle constraints to ensure reliability.

Statistical Arbitrage Through Cointegrated Stocks (Part 5): Screening

This article proposes an asset screening process for a statistical arbitrage trading strategy through cointegrated stocks. The system starts with the regular filtering by economic factors, like asset sector and industry, and finishes with a list of criteria for a scoring system. For each statistical test used in the screening, a respective Python class was developed: Pearson correlation, Engle-Granger cointegration, Johansen cointegration, and ADF/KPSS stationarity. These Python classes are provided along with a personal note from the author about the use of AI assistants for software development.

MQL5 Wizard Techniques you should know (Part 80): Using Patterns of Ichimoku and the ADX-Wilder with TD3 Reinforcement Learning

This article follows up ‘Part-74’, where we examined the pairing of Ichimoku and the ADX under a Supervised Learning framework, by moving our focus to Reinforcement Learning. Ichimoku and ADX form a complementary combination of support/resistance mapping and trend strength spotting. In this installment, we indulge in how the Twin Delayed Deep Deterministic Policy Gradient (TD3) algorithm can be used with this indicator set. As with earlier parts of the series, the implementation is carried out in a custom signal class designed for integration with the MQL5 Wizard, which facilitates seamless Expert Advisor assembly.

How to build and optimize a cycle-based trading system (Detrended Price Oscillator - DPO)

This article explains how to design and optimise a trading system using the Detrended Price Oscillator (DPO) in MQL5. It outlines the indicator's core logic, demonstrating how it identifies short-term cycles by filtering out long-term trends. Through a series of step-by-step examples and simple strategies, readers will learn how to code it, define entry and exit signals, and conduct backtesting. Finally, the article presents practical optimization methods to enhance performance and adapt the system to changing market conditions.

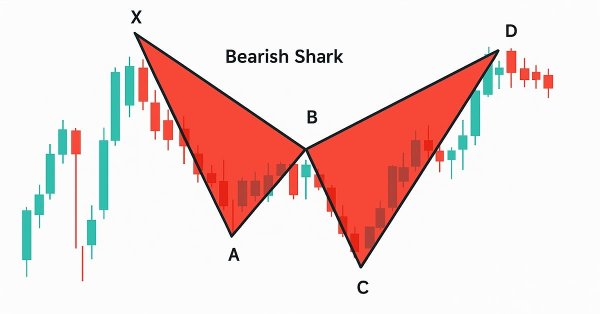

Automating Trading Strategies in MQL5 (Part 33): Creating a Price Action Shark Harmonic Pattern System

In this article, we develop a Shark pattern system in MQL5 that identifies bullish and bearish Shark harmonic patterns using pivot points and Fibonacci ratios, executing trades with customizable entry, stop-loss, and take-profit levels based on user-selected options. We enhance trader insight with visual feedback through chart objects like triangles, trendlines, and labels to clearly display the X-A-B-C-D pattern structure

The MQL5 Standard Library Explorer (Part 1): Introduction with CTrade, CiMA, and CiATR

The MQL5 Standard Library plays a vital role in developing trading algorithms for MetaTrader 5. In this discussion series, our goal is to master its application to simplify the creation of efficient trading tools for MetaTrader 5. These tools include custom Expert Advisors, indicators, and other utilities. We begin today by developing a trend-following Expert Advisor using the CTrade, CiMA, and CiATR classes. This is an especially important topic for everyone—whether you are a beginner or an experienced developer. Join this discussion to discover more.

Automating The Market Sentiment Indicator

In this article, we automate a custom market sentiment indicator that classifies market conditions into bullish, bearish, risk-on, risk-off, and neutral. The Expert Advisor delivers real-time insights into prevailing sentiment while streamlining the analysis process for current market trends or direction.

Building AI-Powered Trading Systems in MQL5 (Part 2): Developing a ChatGPT-Integrated Program with User Interface

In this article, we develop a ChatGPT-integrated program in MQL5 with a user interface, leveraging the JSON parsing framework from Part 1 to send prompts to OpenAI’s API and display responses on a MetaTrader 5 chart. We implement a dashboard with an input field, submit button, and response display, handling API communication and text wrapping for user interaction.

Developing a Volatility Based Breakout System

Volatility based breakout system identifies market ranges, then trades when price breaks above or below those levels, filtered by volatility measures such as ATR. This approach helps capture strong directional moves.