Building A Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (II)

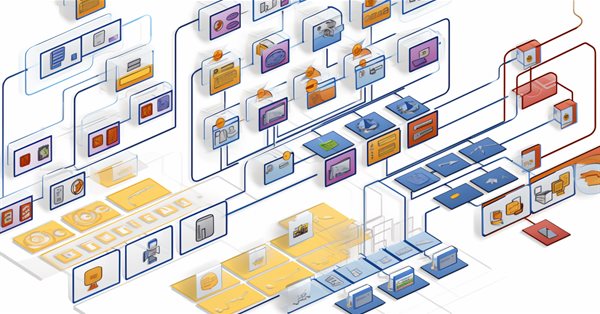

Think about an independent Expert Advisor. Previously, we discussed an indicator-based Expert Advisor that also partnered with an independent script for drawing risk and reward geometry. Today, we will discuss the architecture of an MQL5 Expert Advisor, that integrates, all the features in one program.

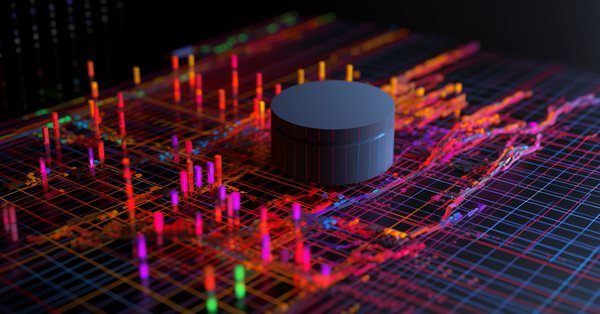

Developing a multi-currency Expert Advisor (Part 8): Load testing and handling a new bar

As we progressed, we used more and more simultaneously running instances of trading strategies in one EA. Let's try to figure out how many instances we can get to before we hit resource limitations.

Developing a Replay System (Part 45): Chart Trade Project (IV)

The main purpose of this article is to introduce and explain the C_ChartFloatingRAD class. We have a Chart Trade indicator that works in a rather interesting way. As you may have noticed, we still have a fairly small number of objects on the chart, and yet we get the expected functionality. The values present in the indicator can be edited. The question is, how is this possible? This article will start to make things clearer.

Developing a Replay System (Part 44): Chart Trade Project (III)

In the previous article I explained how you can manipulate template data for use in OBJ_CHART. In that article, I only outlined the topic without going into details, since in that version the work was done in a very simplified way. This was done to make it easier to explain the content, because despite the apparent simplicity of many things, some of them were not so obvious, and without understanding the simplest and most basic part, you would not be able to truly understand the entire picture.

Developing a multi-currency Expert Advisor (Part 7): Selecting a group based on forward period

Previously, we evaluated the selection of a group of trading strategy instances, with the aim of improving the results of their joint operation, only on the same time period, in which the optimization of individual instances was carried out. Let's see what happens in the forward period.

Building a Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (I)

In this discussion, we will create our first Expert Advisor in MQL5 based on the indicator we made in the prior article. We will cover all the features required to make the process automatic, including risk management. This will extensively benefit the users to advance from manual execution of trades to automated systems.

Population optimization algorithms: Boids Algorithm

The article considers Boids algorithm based on unique examples of animal flocking behavior. In turn, the Boids algorithm serves as the basis for the creation of the whole class of algorithms united under the name "Swarm Intelligence".

Developing a multi-currency Expert Advisor (Part 6): Automating the selection of an instance group

After optimizing the trading strategy, we receive sets of parameters. We can use them to create several instances of trading strategies combined in one EA. Previously, we did this manually. Here we will try to automate this process.

Price-Driven CGI Model: Advanced Data Post-Processing and Implementation

In this article, we will explore the development of a fully customizable Price Data export script using MQL5, marking new advancements in the simulation of the Price Man CGI Model. We have implemented advanced refinement techniques to ensure that the data is user-friendly and optimized for animation purposes. Additionally, we will uncover the capabilities of Blender 3D in effectively working with and visualizing price data, demonstrating its potential for creating dynamic and engaging animations.

Developing a Replay System (Part 43): Chart Trade Project (II)

Most people who want or dream of learning to program don't actually have a clue what they're doing. Their activity consists of trying to create things in a certain way. However, programming is not about tailoring suitable solutions. Doing it this way can create more problems than solutions. Here we will be doing something more advanced and therefore different.

Role of random number generator quality in the efficiency of optimization algorithms

In this article, we will look at the Mersenne Twister random number generator and compare it with the standard one in MQL5. We will also find out the influence of the random number generator quality on the results of optimization algorithms.

Developing a multi-currency Expert Advisor (Part 5): Variable position sizes

In the previous parts, the Expert Advisor (EA) under development was able to use only a fixed position size for trading. This is acceptable for testing, but is not advisable when trading on a real account. Let's make it possible to trade using variable position sizes.

From Novice to Expert: The Essential Journey Through MQL5 Trading

Unlock your potential! You're surrounded by opportunities. Discover 3 top secrets to kickstart your MQL5 journey or take it to the next level. Let's dive into discussion of tips and tricks for beginners and pros alike.

Developing a Replay System (Part 42): Chart Trade Project (I)

Let's create something more interesting. I don't want to spoil the surprise, so follow the article for a better understanding. From the very beginning of this series on developing the replay/simulator system, I was saying that the idea is to use the MetaTrader 5 platform in the same way both in the system we are developing and in the real market. It is important that this is done properly. No one wants to train and learn to fight using one tool while having to use another one during the fight.

Population optimization algorithms: Whale Optimization Algorithm (WOA)

Whale Optimization Algorithm (WOA) is a metaheuristic algorithm inspired by the behavior and hunting strategies of humpback whales. The main idea of WOA is to mimic the so-called "bubble-net" feeding method, in which whales create bubbles around prey and then attack it in a spiral motion.

Hybridization of population algorithms. Sequential and parallel structures

Here we will dive into the world of hybridization of optimization algorithms by looking at three key types: strategy mixing, sequential and parallel hybridization. We will conduct a series of experiments combining and testing relevant optimization algorithms.

Population optimization algorithms: Resistance to getting stuck in local extrema (Part II)

We continue our experiment that aims to examine the behavior of population optimization algorithms in the context of their ability to efficiently escape local minima when population diversity is low and reach global maxima. Research results are provided.

GIT: What is it?

In this article, I will introduce a very important tool for developers. If you are not familiar with GIT, read this article to get an idea of what it is and how to use it with MQL5.

Developing a Replay System (Part 41): Starting the second phase (II)

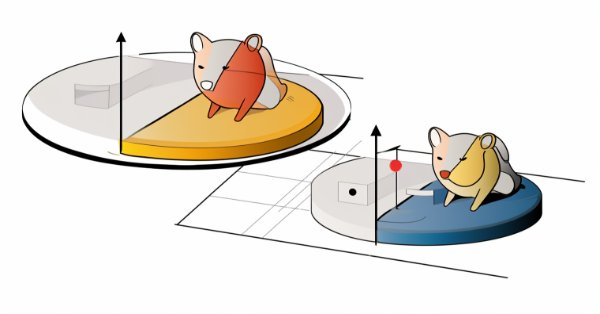

If everything seemed right to you up to this point, it means you're not really thinking about the long term, when you start developing applications. Over time you will no longer need to program new applications, you will just have to make them work together. So let's see how to finish assembling the mouse indicator.

Developing a Replay System (Part 40): Starting the second phase (I)

Today we'll talk about the new phase of the replay/simulator system. At this stage, the conversation will become truly interesting and quite rich in content. I strongly recommend that you read the article carefully and use the links provided in it. This will help you understand the content better.

Automated Parameter Optimization for Trading Strategies Using Python and MQL5

There are several types of algorithms for self-optimization of trading strategies and parameters. These algorithms are used to automatically improve trading strategies based on historical and current market data. In this article we will look at one of them with python and MQL5 examples.

Developing a Replay System (Part 39): Paving the Path (III)

Before we proceed to the second stage of development, we need to revise some ideas. Do you know how to make MQL5 do what you need? Have you ever tried to go beyond what is contained in the documentation? If not, then get ready. Because we will be doing something that most people don't normally do.

Population optimization algorithms: Resistance to getting stuck in local extrema (Part I)

This article presents a unique experiment that aims to examine the behavior of population optimization algorithms in the context of their ability to efficiently escape local minima when population diversity is low and reach global maxima. Working in this direction will provide further insight into which specific algorithms can successfully continue their search using coordinates set by the user as a starting point, and what factors influence their success.

The base class of population algorithms as the backbone of efficient optimization

The article represents a unique research attempt to combine a variety of population algorithms into a single class to simplify the application of optimization methods. This approach not only opens up opportunities for the development of new algorithms, including hybrid variants, but also creates a universal basic test stand. This stand becomes a key tool for choosing the optimal algorithm depending on a specific task.

MQL5 Wizard Techniques you should know (Part 23): CNNs

Convolutional Neural Networks are another machine learning algorithm that tend to specialize in decomposing multi-dimensioned data sets into key constituent parts. We look at how this is typically achieved and explore a possible application for traders in another MQL5 wizard signal class.

Using optimization algorithms to configure EA parameters on the fly

The article discusses the practical aspects of using optimization algorithms to find the best EA parameters on the fly, as well as virtualization of trading operations and EA logic. The article can be used as an instruction for implementing optimization algorithms into an EA.

Population optimization algorithms: Artificial Multi-Social Search Objects (MSO)

This is a continuation of the previous article considering the idea of social groups. The article explores the evolution of social groups using movement and memory algorithms. The results will help to understand the evolution of social systems and apply them in optimization and search for solutions.

Bill Williams Strategy with and without other indicators and predictions

In this article, we will take a look to one the famous strategies of Bill Williams, and discuss it, and try to improve the strategy with other indicators and with predictions.

Modified Grid-Hedge EA in MQL5 (Part IV): Optimizing Simple Grid Strategy (I)

In this fourth part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Grid EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

Population optimization algorithms: Binary Genetic Algorithm (BGA). Part I

In this article, we will explore various methods used in binary genetic and other population algorithms. We will look at the main components of the algorithm, such as selection, crossover and mutation, and their impact on the optimization. In addition, we will study data presentation methods and their impact on optimization results.

MQL5 Wizard Techniques you should know (Part 18): Neural Architecture Search with Eigen Vectors

Neural Architecture Search, an automated approach at determining the ideal neural network settings can be a plus when facing many options and large test data sets. We examine how when paired Eigen Vectors this process can be made even more efficient.

Developing a Replay System (Part 38): Paving the Path (II)

Many people who consider themselves MQL5 programmers do not have the basic knowledge that I will outline in this article. Many people consider MQL5 to be a limited tool, but the actual reason is that they do not have the required knowledge. So, if you don't know something, don't be ashamed of it. It's better to feel ashamed for not asking. Simply forcing MetaTrader 5 to disable indicator duplication in no way ensures two-way communication between the indicator and the Expert Advisor. We are still very far from this, but the fact that the indicator is not duplicated on the chart gives us some confidence.

Developing a Replay System (Part 37): Paving the Path (I)

In this article, we will finally begin to do what we wanted to do much earlier. However, due to the lack of "solid ground", I did not feel confident to present this part publicly. Now I have the basis to do this. I suggest that you focus as much as possible on understanding the content of this article. I mean not simply reading it. I want to emphasize that if you do not understand this article, you can completely give up hope of understanding the content of the following ones.

Developing a Replay System (Part 36): Making Adjustments (II)

One of the things that can make our lives as programmers difficult is assumptions. In this article, I will show you how dangerous it is to make assumptions: both in MQL5 programming, where you assume that the type will have a certain value, and in MetaTrader 5, where you assume that different servers work the same.

Population optimization algorithms: Micro Artificial immune system (Micro-AIS)

The article considers an optimization method based on the principles of the body's immune system - Micro Artificial Immune System (Micro-AIS) - a modification of AIS. Micro-AIS uses a simpler model of the immune system and simple immune information processing operations. The article also discusses the advantages and disadvantages of Micro-AIS compared to conventional AIS.

Developing a Replay System (Part 35): Making Adjustments (I)

Before we can move forward, we need to fix a few things. These are not actually the necessary fixes but rather improvements to the way the class is managed and used. The reason is that failures occurred due to some interaction within the system. Despite attempts to find out the cause of such failures in order to eliminate them, all these attempts were unsuccessful. Some of these cases make no sense, for example, when we use pointers or recursion in C/C++, the program crashes.

Population optimization algorithms: Bacterial Foraging Optimization - Genetic Algorithm (BFO-GA)

The article presents a new approach to solving optimization problems by combining ideas from bacterial foraging optimization (BFO) algorithms and techniques used in the genetic algorithm (GA) into a hybrid BFO-GA algorithm. It uses bacterial swarming to globally search for an optimal solution and genetic operators to refine local optima. Unlike the original BFO, bacteria can now mutate and inherit genes.

Developing a Replay System (Part 34): Order System (III)

In this article, we will complete the first phase of construction. Although this part is fairly quick to complete, I will cover details that were not discussed previously. I will explain some points that many do not understand. Do you know why you have to press the Shift or Ctrl key?

Population optimization algorithms: Evolution Strategies, (μ,λ)-ES and (μ+λ)-ES

The article considers a group of optimization algorithms known as Evolution Strategies (ES). They are among the very first population algorithms to use evolutionary principles for finding optimal solutions. We will implement changes to the conventional ES variants and revise the test function and test stand methodology for the algorithms.

Developing a Replay System (Part 33): Order System (II)

Today we will continue to develop the order system. As you will see, we will be massively reusing what has already been shown in other articles. Nevertheless, you will receive a small reward in this article. First, we will develop a system that can be used with a real trading server, both from a demo account or from a real one. We will make extensive use of the MetaTrader 5 platform, which will provide us with all the necessary support from the beginning.