Developing a Replay System — Market simulation (Part 21): FOREX (II)

We will continue to build a system for working in the FOREX market. In order to solve this problem, we must first declare the loading of ticks before loading the previous bars. This solves the problem, but at the same time forces the user to follow some structure in the configuration file, which, personally, does not make much sense to me. The reason is that by designing a program that is responsible for analyzing and executing what is in the configuration file, we can allow the user to declare the elements he needs in any order.

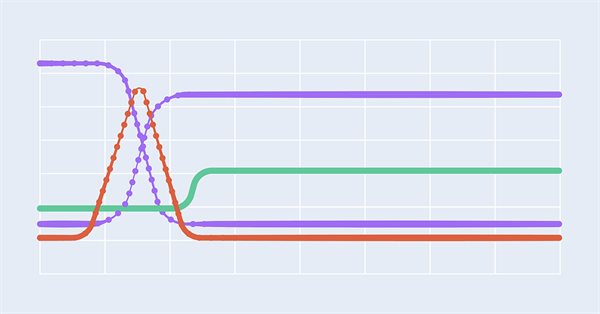

Data Science and Machine Learning (Part 21): Unlocking Neural Networks, Optimization algorithms demystified

Dive into the heart of neural networks as we demystify the optimization algorithms used inside the neural network. In this article, discover the key techniques that unlock the full potential of neural networks, propelling your models to new heights of accuracy and efficiency.

Developing a Replay System — Market simulation (Part 06): First improvements (I)

In this article, we will begin to stabilize the entire system, without which we might not be able to proceed to the next steps.

Deep Learning GRU model with Python to ONNX with EA, and GRU vs LSTM models

We will guide you through the entire process of DL with python to make a GRU ONNX model, culminating in the creation of an Expert Advisor (EA) designed for trading, and subsequently comparing GRU model with LSTM model.

Population optimization algorithms: Fish School Search (FSS)

Fish School Search (FSS) is a new optimization algorithm inspired by the behavior of fish in a school, most of which (up to 80%) swim in an organized community of relatives. It has been proven that fish aggregations play an important role in the efficiency of foraging and protection from predators.

Developing a Replay System — Market simulation (Part 20): FOREX (I)

The initial goal of this article is not to cover all the possibilities of Forex trading, but rather to adapt the system so that you can perform at least one market replay. We'll leave simulation for another moment. However, if we don't have ticks and only bars, with a little effort we can simulate possible trades that could happen in the Forex market. This will be the case until we look at how to adapt the simulator. An attempt to work with Forex data inside the system without modifying it leads to a range of errors.

Developing a Replay System (Part 38): Paving the Path (II)

Many people who consider themselves MQL5 programmers do not have the basic knowledge that I will outline in this article. Many people consider MQL5 to be a limited tool, but the actual reason is that they do not have the required knowledge. So, if you don't know something, don't be ashamed of it. It's better to feel ashamed for not asking. Simply forcing MetaTrader 5 to disable indicator duplication in no way ensures two-way communication between the indicator and the Expert Advisor. We are still very far from this, but the fact that the indicator is not duplicated on the chart gives us some confidence.

Artificial Algae Algorithm (AAA)

The article considers the Artificial Algae Algorithm (AAA) based on biological processes characteristic of microalgae. The algorithm includes spiral motion, evolutionary process and adaptation, which allows it to solve optimization problems. The article provides an in-depth analysis of the working principles of AAA and its potential in mathematical modeling, highlighting the connection between nature and algorithmic solutions.

Cycles and trading

This article is about using cycles in trading. We will consider building a trading strategy based on cyclical models.

Developing a Replay System — Market simulation (Part 04): adjusting the settings (II)

Let's continue creating the system and controls. Without the ability to control the service, it is difficult to move forward and improve the system.

Developing a Replay System — Market simulation (Part 15): Birth of the SIMULATOR (V) - RANDOM WALK

In this article we will complete the development of a simulator for our system. The main goal here will be to configure the algorithm discussed in the previous article. This algorithm aims to create a RANDOM WALK movement. Therefore, to understand today's material, it is necessary to understand the content of previous articles. If you have not followed the development of the simulator, I advise you to read this sequence from the very beginning. Otherwise, you may get confused about what will be explained here.

Introduction to MQL5 (Part 9): Understanding and Using Objects in MQL5

Learn to create and customize chart objects in MQL5 using current and historical data. This project-based guide helps you visualize trades and apply MQL5 concepts practically, making it easier to build tools tailored to your trading needs.

Testing and optimization of binary options strategies in MetaTrader 5

In this article, I will check and optimize binary options strategies in MetaTrader 5.

Population optimization algorithms: Shuffled Frog-Leaping algorithm (SFL)

The article presents a detailed description of the shuffled frog-leaping (SFL) algorithm and its capabilities in solving optimization problems. The SFL algorithm is inspired by the behavior of frogs in their natural environment and offers a new approach to function optimization. The SFL algorithm is an efficient and flexible tool capable of processing a variety of data types and achieving optimal solutions.

Python, ONNX and MetaTrader 5: Creating a RandomForest model with RobustScaler and PolynomialFeatures data preprocessing

In this article, we will create a random forest model in Python, train the model, and save it as an ONNX pipeline with data preprocessing. After that we will use the model in the MetaTrader 5 terminal.

Modified Grid-Hedge EA in MQL5 (Part IV): Optimizing Simple Grid Strategy (I)

In this fourth part, we revisit the Simple Hedge and Simple Grid Expert Advisors (EAs) developed earlier. Our focus shifts to refining the Simple Grid EA through mathematical analysis and a brute force approach, aiming for optimal strategy usage. This article delves deep into the mathematical optimization of the strategy, setting the stage for future exploration of coding-based optimization in later installments.

Population optimization algorithms: ElectroMagnetism-like algorithm (ЕМ)

The article describes the principles, methods and possibilities of using the Electromagnetic Algorithm in various optimization problems. The EM algorithm is an efficient optimization tool capable of working with large amounts of data and multidimensional functions.

ALGLIB library optimization methods (Part II)

In this article, we will continue to study the remaining optimization methods from the ALGLIB library, paying special attention to their testing on complex multidimensional functions. This will allow us not only to evaluate the efficiency of each algorithm, but also to identify their strengths and weaknesses in different conditions.

Developing a Replay System (Part 53): Things Get Complicated (V)

In this article, we'll cover an important topic that few people understand: Custom Events. Dangers. Advantages and disadvantages of these elements. This topic is key for those who want to become a professional programmer in MQL5 or any other language. Here we will focus on MQL5 and MetaTrader 5.

Category Theory in MQL5 (Part 8): Monoids

This article continues the series on category theory implementation in MQL5. Here we introduce monoids as domain (set) that sets category theory apart from other data classification methods by including rules and an identity element.

Population optimization algorithms: Monkey algorithm (MA)

In this article, I will consider the Monkey Algorithm (MA) optimization algorithm. The ability of these animals to overcome difficult obstacles and get to the most inaccessible tree tops formed the basis of the idea of the MA algorithm.

William Gann methods (Part II): Creating Gann Square indicator

We will create an indicator based on the Gann's Square of 9, built by squaring time and price. We will prepare the code and test the indicator in the platform on different time intervals.

Multilayer perceptron and backpropagation algorithm (Part 3): Integration with the Strategy Tester - Overview (I).

The multilayer perceptron is an evolution of the simple perceptron which can solve non-linear separable problems. Together with the backpropagation algorithm, this neural network can be effectively trained. In Part 3 of the Multilayer Perceptron and Backpropagation series, we'll see how to integrate this technique into the Strategy Tester. This integration will allow the use of complex data analysis aimed at making better decisions to optimize your trading strategies. In this article, we will discuss the advantages and problems of this technique.

Category Theory in MQL5 (Part 15) : Functors with Graphs

This article on Category Theory implementation in MQL5, continues the series by looking at Functors but this time as a bridge between Graphs and a set. We revisit calendar data, and despite its limitations in Strategy Tester use, make the case using functors in forecasting volatility with the help of correlation.

Building a Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (I)

In this discussion, we will create our first Expert Advisor in MQL5 based on the indicator we made in the prior article. We will cover all the features required to make the process automatic, including risk management. This will extensively benefit the users to advance from manual execution of trades to automated systems.

Developing a Replay System — Market simulation (Part 05): Adding Previews

We have managed to develop a way to implement the market replay system in a realistic and accessible way. Now let's continue our project and add data to improve the replay behavior.

Developing a multi-currency Expert Advisor (Part 13): Automating the second stage — selection into groups

We have already implemented the first stage of the automated optimization. We perform optimization for different symbols and timeframes according to several criteria and store information about the results of each pass in the database. Now we are going to select the best groups of parameter sets from those found at the first stage.

Population optimization algorithms: Artificial Bee Colony (ABC)

In this article, we will study the algorithm of an artificial bee colony and supplement our knowledge with new principles of studying functional spaces. In this article, I will showcase my interpretation of the classic version of the algorithm.

Developing a multi-currency Expert Advisor (Part 17): Further preparation for real trading

Currently, our EA uses the database to obtain initialization strings for single instances of trading strategies. However, the database is quite large and contains a lot of information that is not needed for the actual EA operation. Let's try to ensure the EA's functionality without a mandatory connection to the database.

Population optimization algorithms: Stochastic Diffusion Search (SDS)

The article discusses Stochastic Diffusion Search (SDS), which is a very powerful and efficient optimization algorithm based on the principles of random walk. The algorithm allows finding optimal solutions in complex multidimensional spaces, while featuring a high speed of convergence and the ability to avoid local extrema.

Developing a robot in Python and MQL5 (Part 2): Model selection, creation and training, Python custom tester

We continue the series of articles on developing a trading robot in Python and MQL5. Today we will solve the problem of selecting and training a model, testing it, implementing cross-validation, grid search, as well as the problem of model ensemble.

Bill Williams Strategy with and without other indicators and predictions

In this article, we will take a look to one the famous strategies of Bill Williams, and discuss it, and try to improve the strategy with other indicators and with predictions.

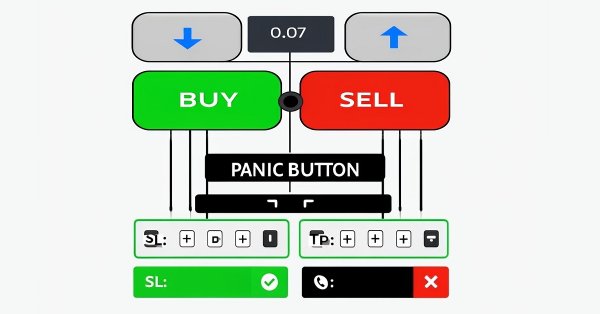

Manual Backtesting Made Easy: Building a Custom Toolkit for Strategy Tester in MQL5

In this article, we design a custom MQL5 toolkit for easy manual backtesting in the Strategy Tester. We explain its design and implementation, focusing on interactive trade controls. We then show how to use it to test strategies effectively

Population optimization algorithms: Cuckoo Optimization Algorithm (COA)

The next algorithm I will consider is cuckoo search optimization using Levy flights. This is one of the latest optimization algorithms and a new leader in the leaderboard.

Fast trading strategy tester in Python using Numba

The article implements a fast strategy tester for machine learning models using Numba. It is 50 times faster than the pure Python strategy tester. The author recommends using this library to speed up mathematical calculations, especially the ones involving loops.

Developing a multi-currency Expert Advisor (Part 19): Creating stages implemented in Python

So far we have considered the automation of launching sequential procedures for optimizing EAs exclusively in the standard strategy tester. But what if we would like to perform some handling of the obtained data using other means between such launches? We will attempt to add the ability to create new optimization stages performed by programs written in Python.

Building A Candlestick Trend Constraint Model (Part 8): Expert Advisor Development (II)

Think about an independent Expert Advisor. Previously, we discussed an indicator-based Expert Advisor that also partnered with an independent script for drawing risk and reward geometry. Today, we will discuss the architecture of an MQL5 Expert Advisor, that integrates, all the features in one program.

Population optimization algorithms: Saplings Sowing and Growing up (SSG)

Saplings Sowing and Growing up (SSG) algorithm is inspired by one of the most resilient organisms on the planet demonstrating outstanding capability for survival in a wide variety of conditions.

Developing a Replay System (Part 27): Expert Advisor project — C_Mouse class (I)

In this article we will implement the C_Mouse class. It provides the ability to program at the highest level. However, talking about high-level or low-level programming languages is not about including obscene words or jargon in the code. It's the other way around. When we talk about high-level or low-level programming, we mean how easy or difficult the code is for other programmers to understand.

Developing a Trading System Based on the Order Book (Part I): Indicator

Depth of Market is undoubtedly a very important element for executing fast trades, especially in High Frequency Trading (HFT) algorithms. In this series of articles, we will look at this type of trading events that can be obtained through a broker on many tradable symbols. We will start with an indicator, where you can customize the color palette, position and size of the histogram displayed directly on the chart. We will also look at how to generate BookEvent events to test the indicator under certain conditions. Other possible topics for future articles include how to store price distribution data and how to use it in a strategy tester.