Developing A Custom Account Performace Matrix Indicator

This indicator acts as a discipline enforcer by tracking account equity, profit/loss, and drawdown in real-time while displaying a performance dashboard. It can help traders stay consistent, avoid overtrading, and comply with prop-firm challenge rules.

From Novice to Expert: Implementation of Fibonacci Strategies in Post-NFP Market Trading

In financial markets, the laws of retracement remain among the most undeniable forces. It is a rule of thumb that price will always retrace—whether in large moves or even within the smallest tick patterns, which often appear as a zigzag. However, the retracement pattern itself is never fixed; it remains uncertain and subject to anticipation. This uncertainty explains why traders rely on multiple Fibonacci levels, each carrying a certain probability of influence. In this discussion, we introduce a refined strategy that applies Fibonacci techniques to address the challenges of trading shortly after major economic event announcements. By combining retracement principles with event-driven market behavior, we aim to uncover more reliable entry and exit opportunities. Join to explore the full discussion and see how Fibonacci can be adapted to post-event trading.

Price Action Analysis Toolkit Development (Part 40): Market DNA Passport

This article explores the unique identity of each currency pair through the lens of its historical price action. Inspired by the concept of genetic DNA, which encodes the distinct blueprint of every living being, we apply a similar framework to the markets, treating price action as the “DNA” of each pair. By breaking down structural behaviors such as volatility, swings, retracements, spikes, and session characteristics, the tool reveals the underlying profile that distinguishes one pair from another. This approach provides more profound insight into market behavior and equips traders with a structured way to align strategies with the natural tendencies of each instrument.

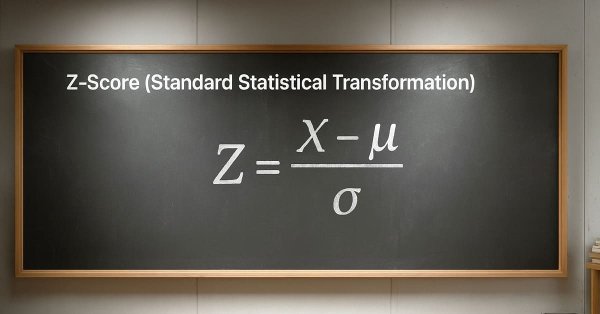

Self Optimizing Expert Advisors in MQL5 (Part 14): Viewing Data Transformations as Tuning Parameters of Our Feedback Controller

Preprocessing is a powerful yet quickly overlooked tuning parameter. It lives in the shadows of its bigger brothers: optimizers and shiny model architectures. Small percentage improvements here can have disproportionately large, compounding effects on profitability and risk. Too often, this largely unexplored science is boiled down to a simple routine, seen only as a means to an end, when in reality it is where signal can be directly amplified, or just as easily destroyed.

Developing a Custom Market Sentiment Indicator

In this article we are developing a custom market sentiment indicator to classify conditions into bullish, bearish, risk-on, risk-off, or neutral. Using multi-timeframe, the indicator can provide traders with a clearer perspective of overall market bias and short-term confirmations.

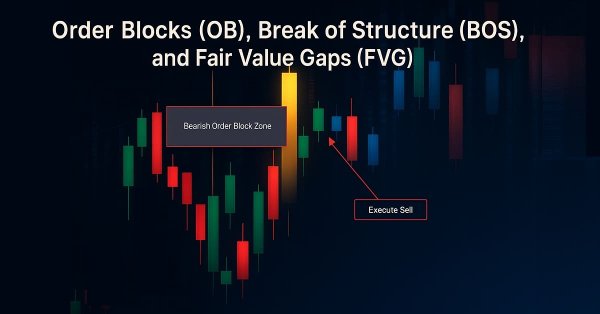

Elevate Your Trading With Smart Money Concepts (SMC): OB, BOS, and FVG

Elevate your trading with Smart Money Concepts (SMC) by combining Order Blocks (OB), Break of Structure (BOS), and Fair Value Gaps (FVG) into one powerful EA. Choose automatic strategy execution or focus on any individual SMC concept for flexible and precise trading.

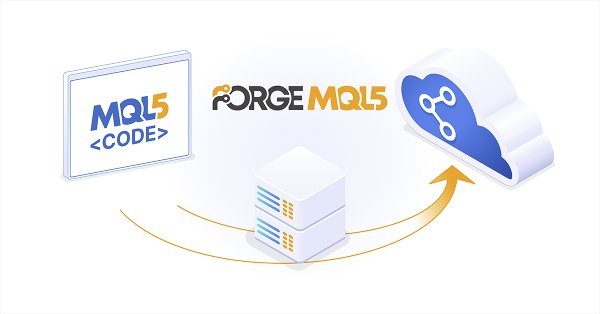

Moving to MQL5 Algo Forge (Part 1): Creating the Main Repository

When working on projects in MetaEditor, developers often face the need to manage code versions. MetaQuotes recently announced migration to GIT and the launch of MQL5 Algo Forge with code versioning and collaboration capabilities. In this article, we will discuss how to use the new and previously existing tools more efficiently.

From Novice to Expert: Animated News Headline Using MQL5 (X)—Multiple Symbol Chart View for News Trading

Today we will develop a multi-chart view system using chart objects. The goal is to enhance news trading by applying MQL5 algorithms that help reduce trader reaction time during periods of high volatility, such as major news releases. In this case, we provide traders with an integrated way to monitor multiple major symbols within a single all-in-one news trading tool. Our work is continuously advancing with the News Headline EA, which now features a growing set of functions that add real value both for traders using fully automated systems and for those who prefer manual trading assisted by algorithms. Explore more knowledge, insights, and practical ideas by clicking through and joining this discussion.

Price Action Analysis Toolkit Development (Part 39): Automating BOS and ChoCH Detection in MQL5

This article presents Fractal Reaction System, a compact MQL5 system that converts fractal pivots into actionable market-structure signals. Using closed-bar logic to avoid repainting, the EA detects Change-of-Character (ChoCH) warnings and confirms Breaks-of-Structure (BOS), draws persistent chart objects, and logs/alerts every confirmed event (desktop, mobile and sound). Read on for the algorithm design, implementation notes, testing results and the full EA code so you can compile, test and deploy the detector yourself.

Big Bang - Big Crunch (BBBC) algorithm

The article presents the Big Bang - Big Crunch method, which has two key phases: cyclic generation of random points and their compression to the optimal solution. This approach combines exploration and refinement, allowing us to gradually find better solutions and open up new optimization opportunities.

Overcoming The Limitation of Machine Learning (Part 3): A Fresh Perspective on Irreducible Error

This article takes a fresh perspective on a hidden, geometric source of error that quietly shapes every prediction your models make. By rethinking how we measure and apply machine learning forecasts in trading, we reveal how this overlooked perspective can unlock sharper decisions, stronger returns, and a more intelligent way to work with models we thought we already understood.

Price Action Analysis Toolkit Development (Part 38): Tick Buffer VWAP and Short-Window Imbalance Engine

In Part 38, we build a production-grade MT5 monitoring panel that converts raw ticks into actionable signals. The EA buffers tick data to compute tick-level VWAP, a short-window imbalance (flow) metric, and ATR-based position sizing. It then visualizes spread, ATR, and flow with low-flicker bars. The system calculates a suggested lot size and a 1R stop, and issues configurable alerts for tight spreads, strong flow, and edge conditions. Auto-trading is intentionally disabled; the focus remains on robust signal generation and a clean user experience.

Black Hole Algorithm (BHA)

The Black Hole Algorithm (BHA) uses the principles of black hole gravity to optimize solutions. In this article, we will look at how BHA attracts the best solutions while avoiding local extremes, and why this algorithm has become a powerful tool for solving complex problems. Learn how simple ideas can lead to impressive results in the world of optimization.

Developing a Replay System (Part 78): New Chart Trade (V)

In this article, we will look at how to implement part of the receiver code. Here we will implement an Expert Advisor to test and learn how the protocol interaction works. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Chart Synchronization for Easier Technical Analysis

Chart Synchronization for Easier Technical Analysis is a tool that ensures all chart timeframes display consistent graphical objects like trendlines, rectangles, or indicators across different timeframes for a single symbol. Actions such as panning, zooming, or symbol changes are mirrored across all synced charts, allowing traders to seamlessly view and compare the same price action context in multiple timeframes.

Developing a Replay System (Part 77): New Chart Trade (IV)

In this article, we will cover some of the measures and precautions to consider when creating a communication protocol. These are pretty simple and straightforward things, so we won't go into too much detail in this article. But to understand what will happen, you need to understand the content of the article.

Simplifying Databases in MQL5 (Part 1): Introduction to Databases and SQL

We explore how to manipulate databases in MQL5 using the language's native functions. We cover everything from table creation, insertion, updating, and deletion to data import and export, all with sample code. The content serves as a solid foundation for understanding the internal mechanics of data access, paving the way for the discussion of ORM, where we'll build one in MQL5.

Getting Started with MQL5 Algo Forge

We are introducing MQL5 Algo Forge — a dedicated portal for algorithmic trading developers. It combines the power of Git with an intuitive interface for managing and organizing projects within the MQL5 ecosystem. Here, you can follow interesting authors, form teams, and collaborate on algorithmic trading projects.

Analyzing binary code of prices on the exchange (Part II): Converting to BIP39 and writing GPT model

Continuing tries to decipher price movements... What about linguistic analysis of the "market dictionary" that we get by converting the binary price code to BIP39? In this article, we will delve into an innovative approach to exchange data analysis and consider how modern natural language processing techniques can be applied to the market language.

Artificial Tribe Algorithm (ATA)

The article provides a detailed discussion of the key components and innovations of the ATA optimization algorithm, which is an evolutionary method with a unique dual behavior system that adapts depending on the situation. ATA combines individual and social learning while using crossover for explorations and migration to find solutions when stuck in local optima.

Self Optimizing Expert Advisors in MQL5 (Part 13): A Gentle Introduction To Control Theory Using Matrix Factorization

Financial markets are unpredictable, and trading strategies that look profitable in the past often collapse in real market conditions. This happens because most strategies are fixed once deployed and cannot adapt or learn from their mistakes. By borrowing ideas from control theory, we can use feedback controllers to observe how our strategies interact with markets and adjust their behavior toward profitability. Our results show that adding a feedback controller to a simple moving average strategy improved profits, reduced risk, and increased efficiency, proving that this approach has strong potential for trading applications.

From Novice to Expert: Animated News Headline Using MQL5 (IX) — Multiple Symbol Management on a single chart for News Trading

News trading often requires managing multiple positions and symbols within a very short time due to heightened volatility. In today’s discussion, we address the challenges of multi-symbol trading by integrating this feature into our News Headline EA. Join us as we explore how algorithmic trading with MQL5 makes multi-symbol trading more efficient and powerful.

Reimagining Classic Strategies (Part 15): Daily Breakout Trading Strategy

Human traders had long participated in financial markets before the rise of computers, developing rules of thumb that guided their decisions. In this article, we revisit a well-known breakout strategy to test whether such market logic, learned through experience, can hold its own against systematic methods. Our findings show that while the original strategy produced high accuracy, it suffered from instability and poor risk control. By refining the approach, we demonstrate how discretionary insights can be adapted into more robust, algorithmic trading strategies.

From Basic to Intermediate: Template and Typename (IV)

In this article, we will take a very close look at how to solve the problem posed at the end of the previous article. There was an attempt to create a template of such type so that to be able to create a template for data union.

Price Action Analysis Toolkit Development (Part 37): Sentiment Tilt Meter

Market sentiment is one of the most overlooked yet powerful forces influencing price movement. While most traders rely on lagging indicators or guesswork, the Sentiment Tilt Meter (STM) EA transforms raw market data into clear, visual guidance, showing whether the market is leaning bullish, bearish, or staying neutral in real-time. This makes it easier to confirm trades, avoid false entries, and time market participation more effectively.

From Basic to Intermediate: Template and Typename (III)

In this article, we will discuss the first part of the topic, which is not so easy for beginners to understand. In order not to get even more confused and to explain this topic correctly, we will divide the explanation into stages. We will devote this article to the first stage. However, although at the end of the article it may seem that we have reached the deadlock, in fact we will take a step towards another situation, which will be better understood in the next article.

From Basic to Intermediate: Template and Typename (II)

This article explains how to deal with one of the most difficult programming situations you can encounter: using different types in the same function or procedure template. Although we have spent most of our time focusing only on functions, everything covered here is useful and can be applied to procedures.

Self Optimizing Expert Advisors in MQL5 (Part 12): Building Linear Classifiers Using Matrix Factorization

This article explores the powerful role of matrix factorization in algorithmic trading, specifically within MQL5 applications. From regression models to multi-target classifiers, we walk through practical examples that demonstrate how easily these techniques can be integrated using built-in MQL5 functions. Whether you're predicting price direction or modeling indicator behavior, this guide lays a strong foundation for building intelligent trading systems using matrix methods.

From Basic to Intermediate: Template and Typename (I)

In this article, we start considering one of the concepts that many beginners avoid. This is related to the fact that templates are not an easy topic, as many do not understand the basic principle underlying the template: overload of functions and procedures.

From Basic to Intermediate: Floating point

This article is a brief introduction to the concept of floating-point numbers. Since this text is very complex please, read it attentively and carefully. Do not expect to quickly master the floating-point system. It only becomes clear over time, as you gain experience using it. But this article will help you understand why your application sometimes produces results different from what you expect.

From Basic to Intermediate: Overload

Perhaps this article will be the most confusing for novice programmers. As a matter of fact, here I will show that it is not always that all functions and procedures have unique names in the same code. Yes, we can easily use functions and procedures with the same name — and this is called overload.

From Basic to Intermediate: Definitions (II)

In this article, we will continue our awareness of #define directive, but this time we will focus on its second form of use, that is, creating macros. Since this subject can be a bit complicated, we decided to use an application that we have been studying for some time. I hope you enjoy today's article.

From Basic to Intermediate: Definitions (I)

In this article we will do things that many will find strange and completely out of context, but which, if used correctly, will make your learning much more fun and interesting: we will be able to build quite interesting things based on what is shown here. This will allow you to better understand the syntax of the MQL5 language. The materials provided here are for educational purposes only. It should not be considered in any way as a final application. Its purpose is not to explore the concepts presented.

Developing a Replay System (Part 76): New Chart Trade (III)

In this article, we'll look at how the code of DispatchMessage, missing from the previous article, works. We will laso introduce the topic of the next article. For this reason, it is important to understand how this code works before moving on to the next topic. The content presented here is intended solely for educational purposes. Under no circumstances should the application be viewed for any purpose other than to learn and master the concepts presented.

Integrating MQL5 with data processing packages (Part 5): Adaptive Learning and Flexibility

This part focuses on building a flexible, adaptive trading model trained on historical XAUUSD data, preparing it for ONNX export and potential integration into live trading systems.

Neural Networks in Trading: Enhancing Transformer Efficiency by Reducing Sharpness (Final Part)

SAMformer offers a solution to the key drawbacks of Transformer models in long-term time series forecasting, such as training complexity and poor generalization on small datasets. Its shallow architecture and sharpness-aware optimization help avoid suboptimal local minima. In this article, we will continue to implement approaches using MQL5 and evaluate their practical value.

Formulating Dynamic Multi-Pair EA (Part 4): Volatility and Risk Adjustment

This phase fine-tunes your multi-pair EA to adapt trade size and risk in real time using volatility metrics like ATR boosting consistency, protection, and performance across diverse market conditions.

Mastering Log Records (Part 10): Avoiding Log Replay by Implementing a Suppression

We created a log suppression system in the Logify library. It details how the CLogifySuppression class reduces console noise by applying configurable rules to avoid repetitive or irrelevant messages. We also cover the external configuration framework, validation mechanisms, and comprehensive testing to ensure robustness and flexibility in log capture during bot or indicator development.

From Novice to Expert: Animated News Headline Using MQL5 (VIII) — Quick Trade Buttons for News Trading

While algorithmic trading systems manage automated operations, many news traders and scalpers prefer active control during high-impact news events and fast-paced market conditions, requiring rapid order execution and management. This underscores the need for intuitive front-end tools that integrate real-time news feeds, economic calendar data, indicator insights, AI-driven analytics, and responsive trading controls.

Self Optimizing Expert Advisors in MQL5 (Part 11): A Gentle Introduction to the Fundamentals of Linear Algebra

In this discussion, we will set the foundation for using powerful linear, algebra tools that are implemented in the MQL5 matrix and vector API. For us to make proficient use of this API, we need to have a firm understanding of the principles in linear algebra that govern intelligent use of these methods. This article aims to get the reader an intuitive level of understanding of some of the most important rules of linear algebra that we, as algorithmic traders in MQL5 need,to get started, taking advantage of this powerful library.