Color Stochastic TRI

- Göstergeler

- Huu Tri Nguyen

- Sürüm: 2.0

- Etkinleştirmeler: 10

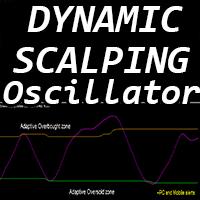

🔹 Color Stochastic – Smarter Stochastic Cross with DCA Insights

✅ Overview

Color Stochastic is an enhanced and visually optimized version of the classic Stochastic Oscillator. It not only shows market momentum, but also identifies intelligent entry points using a DCA (Dollar Cost Averaging) strategy. With clear color-coded arrows for buy/sell signals based on stochastic crossovers at extreme levels, traders can make timely decisions with confidence.

📌 Key Features

-

✔️ Classic Stochastic with advanced customization

-

✔️ Multi-level stochastic calculation (fast and slow)

-

✔️ Detects Buy signals when Stochastic crosses up below a custom level (e.g. 10)

-

✔️ Detects Sell signals when crossing down above a custom level (e.g. 90)

-

✔️ Highlighted overbought/oversold zones

-

✔️ DCA-friendly entries for smarter averaging-in positions

-

✔️ Works in a separate indicator window

-

✔️ Fully customizable settings

-

✔️ Clean and lightweight

🎛 Inputs & Settings

-

KPeriod , DPeriod , Slowing – Stochastic smoothing periods

-

MA Method – SMA, EMA, SMMA, or LWMA

-

Price Type – High/Low or Close/Close

-

Overbought / Oversold – Set your comfort zones

-

Cross Levels – Fine-tune the levels to trigger entries (e.g. Buy <10, Sell >90)

-

Arrow Colors & Sizes – Customize visual alerts

📈 Use Cases

-

Catch early trend reversals at extreme conditions

-

Use as confirmation in confluence strategies

-

Pair with RSI or moving averages for DCA logic

-

Suitable for scalping, day trading, and swing trading

🔔 Alerts

Currently includes visual arrows for buy/sell. Sound or push alerts can be added upon request.

📎 Compatibility

-

MT4 Only

-

Works on all timeframes and symbols

-

Lightweight and non-repainting

🚀 Why Use This Indicator?

Color Stochastic X empowers traders with cleaner, smarter signals derived from a proven oscillator. Especially helpful for traders who employ mean reversion or DCA strategies, this tool reduces noise and enhances confidence at critical market levels.