BOS Liquidity Sweep

- Indicadores

- Mahmud Hisso

- Versão: 1.0

Market structure indicator for visualizing Break of Structure (BOS) and liquidity sweeps based on price action. For analysis purposes only.

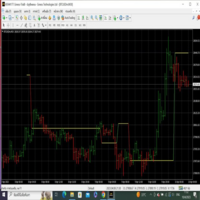

BOS Liquidity Sweep – Market Structure Indicator (MT4)

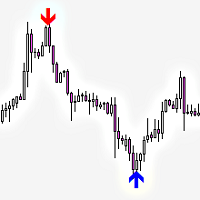

This indicator visualizes Break of Structure (BOS) and liquidity sweeps directly on the chart using pure price action and market structure analysis.

It is designed as a visual analysis tool and does not execute trades automatically.

Concept

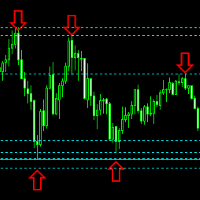

Financial markets often move into areas of higher liquidity before a clearer directional movement develops.

This indicator helps visualize such behavior by combining:

• Market structure (HH, HL, LH, LL)

• Liquidity sweeps

• Structural confirmation via Break of Structure (BOS)

The purpose is to illustrate market behavior, not to generate forced signals.

How it works

1️ Market Structure Detection

The indicator continuously analyzes price movement and identifies:

• Higher High (HH)

• Higher Low (HL)

• Lower High (LH)

• Lower Low (LL)

• Break of Structure (BOS)

These elements form the foundation of the analysis.

2️ Liquidity Sweep Identification

A liquidity sweep is detected when price briefly moves beyond a previous high or low and then returns back into the prior structure.

A sweep is marked when:

• a structural level is exceeded

• the movement is rejected

• price closes back inside the previous structure

No visual signal is displayed at this stage.

3️ Break of Structure Confirmation

After a valid sweep, the indicator waits for structural confirmation.

A BOS is identified when:

• a relevant structure level is broken

• a directional shift becomes visible

Only after this confirmation does a visual signal appear.

When a visual signal appears

A signal is shown only if:

• a clear market structure exists

• a liquidity sweep has occurred

• the sweep is visibly rejected

• a Break of Structure is confirmed

This helps reduce premature interpretations.

When usage may be limited

The indicator may show limited or no output when:

• the market is ranging

• no clear structure is present

• no liquidity sweep occurs

• strong news events distort price behavior

Input Parameters (Overview)

Market Structure

• Swing Length – defines how many candles are used to detect highs and lows

Higher values result in fewer but more significant structure points.

Visual Settings

• Colors for HH / HL / LH / LL

• Line and text size adjustments

Display Options

• Enable or disable visual elements

• Optional informational markers when conditions are met

Platform

• MetaTrader 4

The indicator can be applied to any market and timeframe, depending on price behavior.

Disclaimer

Trading financial instruments involves risk.

This indicator is provided for analysis and educational purposes only and does not constitute investment advice.