Dual Switch Grid

- エキスパート

- Aldo Farandy Medya

- バージョン: 1.1

- アップデート済み: 21 8月 2025

- アクティベーション: 10

Overview

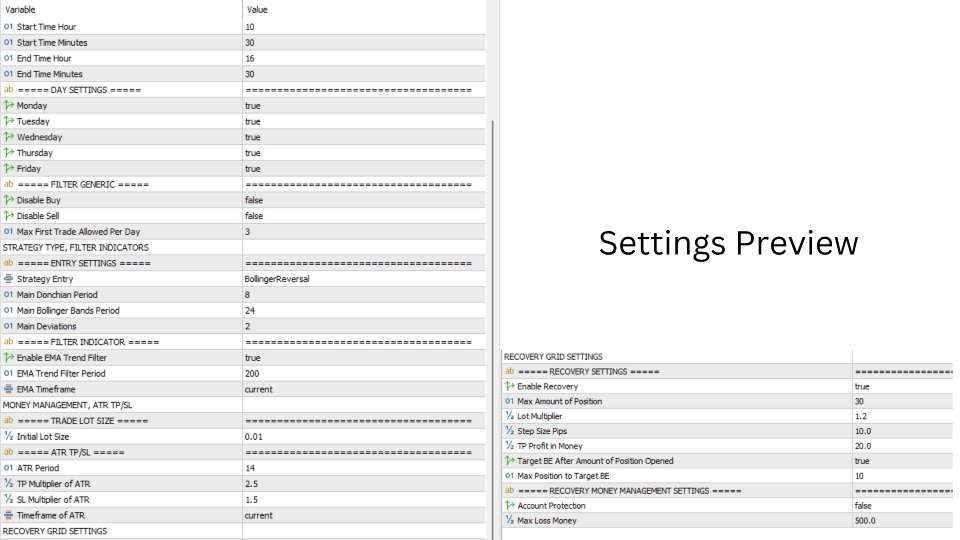

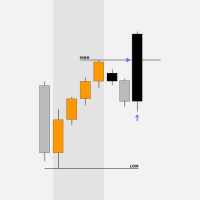

Dual Switch Grid (DSG) is a flexible Grid Expert Advisor designed for traders seeking full control over strategy behavior. It offers two distinct entry models—Donchian trend-following and Bollinger Band mean-reversion—both fully customizable. Users can freely adjust indicator settings, EMA filters to suit their strategy. In addition, DSG features a comprehensive, user-configurable grid recovery system, enabling traders to handle the risk management with ease.

Features it includes :

1. Dual Entry Modes: Toggle between DonchianTrend (breakout trend-following) or BollingerReversion (mean reversion).

2. Built-In EMA Filter: Optional trend confirmation filter to align trades with directional bias. can change the filter to different timeframes to allow multi-timeframe analysis.

3. Time & Day Filters: Define active trading hours and days to avoid bad sessions or news periods.

4. ATR-Based TP/SL System: Dynamically scale targets and stops using volatility.

5. Fully Configurable Grid Recovery System:

- Option to turn off grid recovery and rely on indicator entry completely,

- Adjustable lot multiplier, step size, TP-by-money, Max Position Allowed, and breakeven logic.

- Optional Max Position to BE: switch to target breakeven after a certain amount of grid positions has been opened.

6. Account Protection: Optional max-loss cutoff to guard against extreme market events.

7. No Hidden Logic: All entry and exit conditions are fully exposed and user-editable.

Entry Rules of the EA :

1. DonchianTrend (Trend-Following Mode)

In this mode, the EA uses a Donchian Channel to follow breakouts:

-

Buy Entry: Triggered when price touches the Upper Donchian band

-

Sell Entry: Triggered when price touches the Lower Donchian band

You can optionally enable an EMA filter. If enabled:

-

Buy trades are only allowed when price is above the selected EMA.

-

Sell trades are only allowed when price is below the EMA.

This filter helps confirm trend direction before entering a breakout.

2. BollingerReversal (Mean-Reversion Mode)

In this mode, the EA trades against extreme moves, assuming price will revert:

-

Buy Entry: Triggered when price touches the Lower Bollinger Band

-

Sell Entry: Triggered when price touches the Upper Bollinger Band

You can also enable the EMA trend filter in this mode:

-

If price is above the EMA (uptrend), only buy reversion trades are allowed.

-

If price is below the EMA (downtrend), only sell reversion trades are allowed.

This ensures that reversion trades are taken in the direction of the broader trend, avoiding counter-trend setups in high-momentum environments.

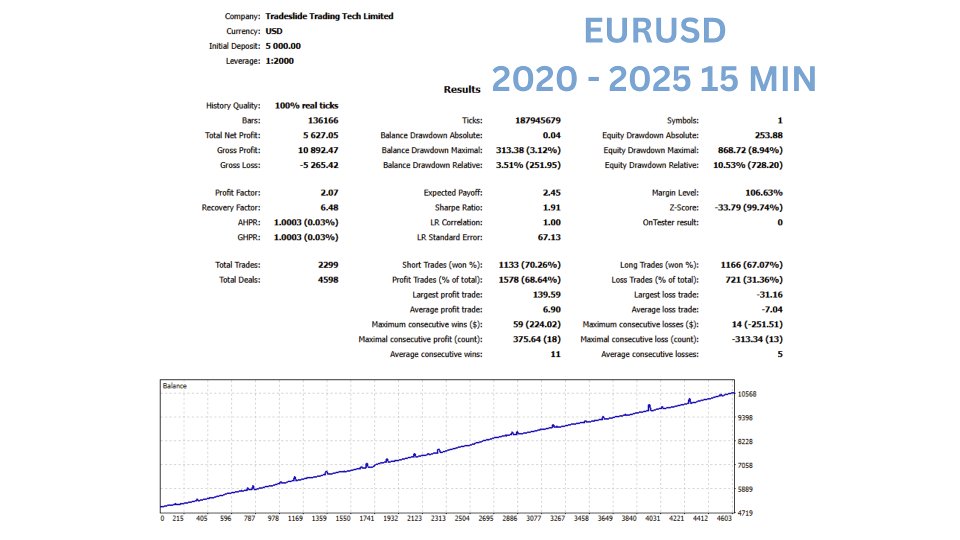

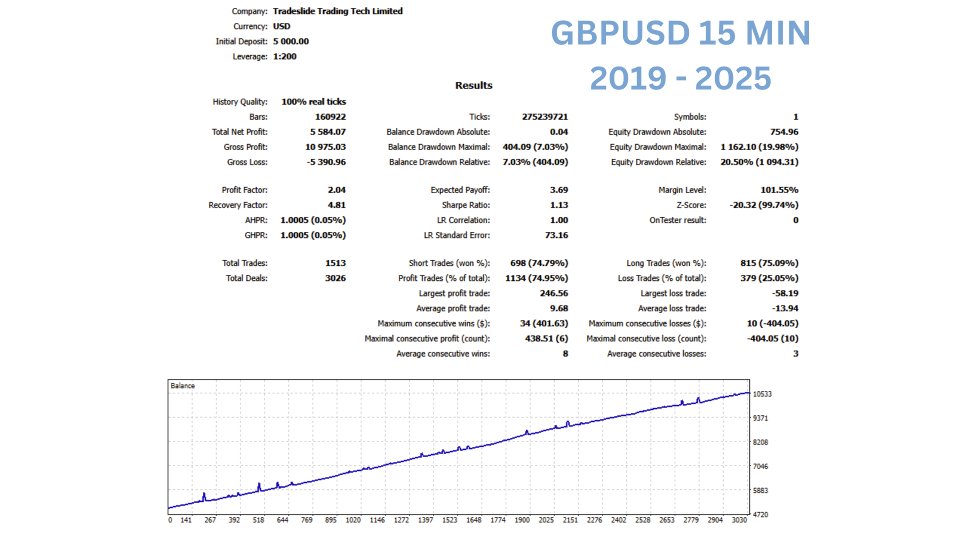

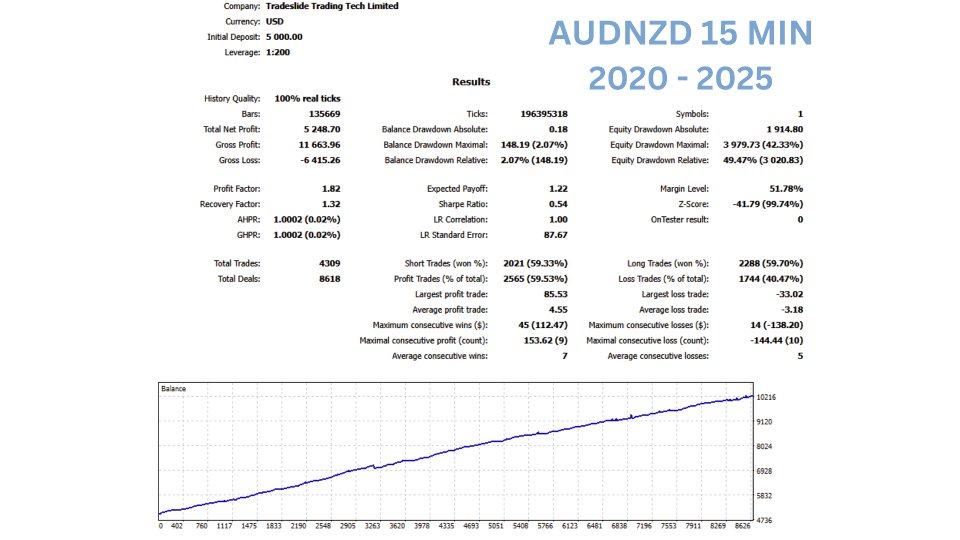

Recommended Pairs

-

✅ EURUSD

-

✅ GBPUSD

-

✅ AUDNZD

These pairs are historically stable and responsive to DSG’s logic.

High-Risk or Volatile Pairs

-

❗ XAUUSD

-

❗ USDJPY

-

❗ Other untested pairs

Use with caution. These instruments have more aggressive volatility and may exhibit periods of extended one direction trend, which may cause large drawdowns.

Minimum Account Size :

- $50 CENT Account (equivalent to 5,000 in account units)

- Or $5,000 Standard Account (with 1:100 leverage or higher)

Use 0.01 lot per 5,000 account units (e.g., $50 on a cent account or $5,000 on a standard account).

This helps maintain stable risk per grid cycle.

✅ EURUSD

✅ GBPUSD

✅ AUDNZD

❗ XAUUSD

❗ USDJPY

❗ Other untested pairs

- $50 CENT Account (equivalent to 5,000 in account units)

- Or $5,000 Standard Account (with 1:100 leverage or higher)

Use 0.01 lot per 5,000 account units (e.g., $50 on a cent account or $5,000 on a standard account).

This helps maintain stable risk per grid cycle.

Recommended VPS :

1. FXVM

2. ForexVPS

3. or any provider with <5ms latency to your broker.

Choose a Broker that has :

1. Tight Spreads

2. Low Slippage

3. Fast Execution

There is no perfect broker, but ECN or RAW spread accounts are generally preferred. Always test execution quality before going live.

⚠️ User Warnings & Limitations

1. This EA includes a grid recovery system, which—while equipped with multiple safety mechanisms—still carries inherent high risk.2. In strong trending markets, extended grid sequences can cause significant drawdowns. Use caution and monitor trades closely.

3. The developer is not responsible for any losses or financial damage resulting from the use of this EA.

4. All decisions regarding risk, settings, usage, and symbol selection are fully under the user's control. As the developer, I provide a flexible toolset—how you apply it is your responsibility.

5. It is strongly recommended to backtest and forward-test on a demo account before going live.

If you have any questions regarding the settings of the EA or anything in particular. feel free to ask me via dm!

I will provide backtested settings on the comments!