Nova WDX Trader

- Experts

- Anita Monus

- Versione: 3.0

- Aggiornato: 13 gennaio 2026

- Attivazioni: 10

Nova WDX Trader — Structural Momentum Intelligence System

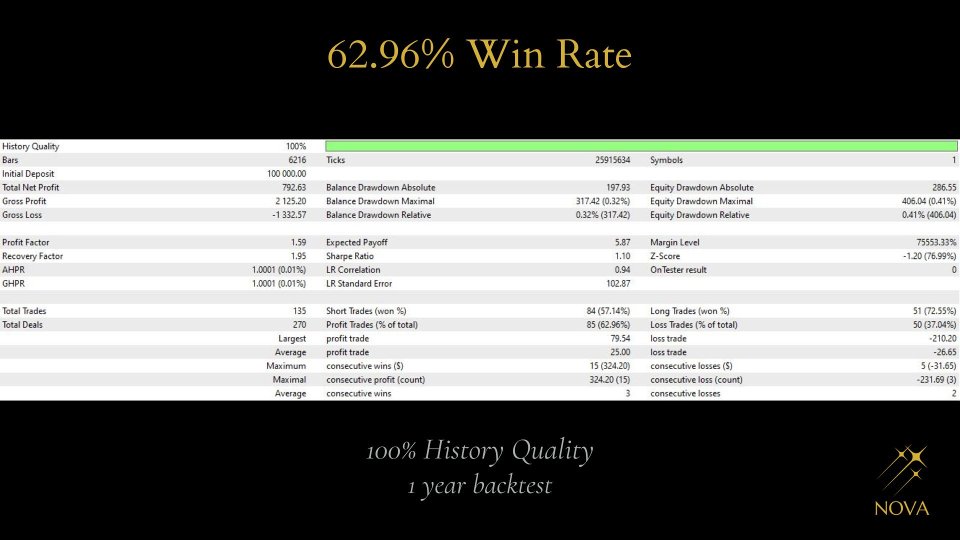

While many automated strategies rely on over-optimized backtests, cent-account demonstrations, or aggressive exposure models, Nova WDX Trader is designed around a disciplined structural framework intended for real-market conditions.

The system prioritizes execution stability, controlled exposure, and internal consistency — avoiding artificial performance amplification and unsustainable risk behavior commonly found in retail automation.

Nova WDX Trader is a next-generation autonomous trading architecture focused on structural momentum recognition and directional stability. Rather than reacting to short-term volatility, the system continuously evaluates market behavior to identify environments where price action demonstrates sustained intent and internal coherence.

At the core of the system lies the Nova Momentum Engine — a proprietary analytical framework that reconstructs directional pressure and trend integrity in real time. The engine applies layered verification logic, rejecting unstable or indecisive conditions and activating only when internal structural alignment reaches an optimal threshold.

Nova WDX Trader operates using a strictly data-driven methodology. All decisions are governed by quantitative evaluation and internal validation processes — without discretionary intervention, emotional bias, or uncontrolled execution behavior.

Core Features

Nova Momentum Engine — Structural Analysis Layer

A proprietary decision framework that evaluates directional strength, internal pressure balance, and momentum sustainability before execution is considered.

Adaptive Market State Mapping

The system continuously classifies market behavior into operational states, dynamically adjusting its internal thresholds to align with evolving market conditions.

Multi-Context Validation Logic

Before initiating any position, Nova WDX Trader validates directional pressure, structural symmetry, momentum persistence, and historical behavioral context. Trades are executed only when confirmation aligns across all analytical layers.

Autonomous Stability Module

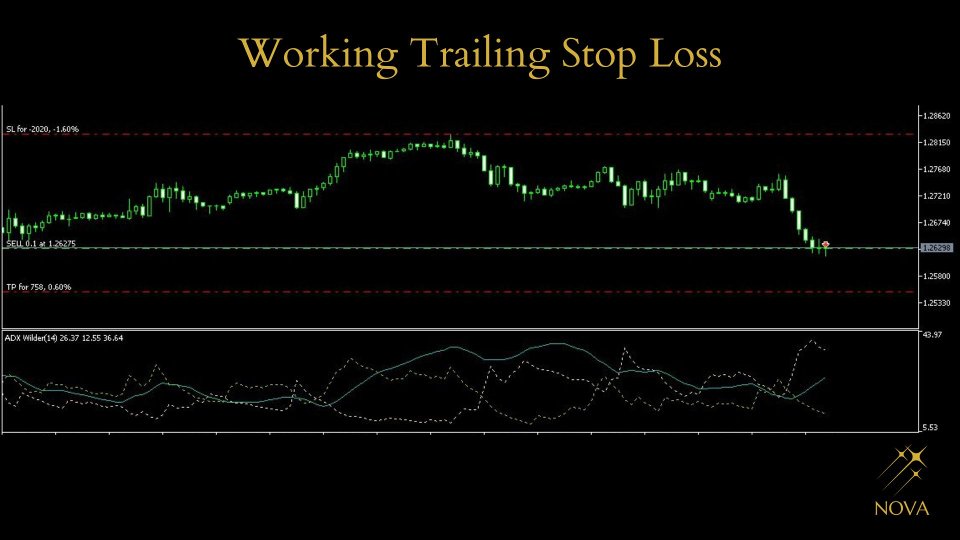

A supervisory protection layer that monitors execution behavior and exposure flow, ensuring controlled operation under varying volatility regimes.

Cold-Metric Decision Framework

All actions are derived exclusively from quantified market data — no discretionary overrides, no emotional triggers, only consistent machine logic.

Structural Architecture

Momentum Cortex — interprets directional strength and internal pressure dynamics.

Directional Mesh Layer — evaluates macro and micro trend coherence.

Behavioral Filter Grid — isolates stable market behavior from transient noise.

Precision Execution Matrix — selects statistically coherent execution zones.

Stability Shield Engine — supervises exposure discipline and execution stability.

This integrated architecture allows Nova WDX Trader to adapt to changing market environments while maintaining strict execution discipline and operational consistency.

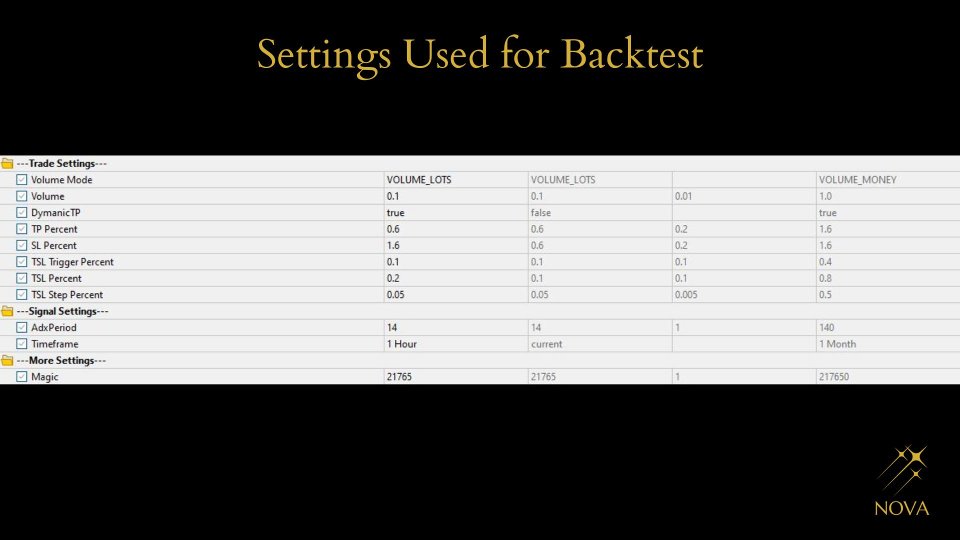

Operating Parameters

Primary instruments: Forex, Metals, Crypto

Optimal timeframes: H1 and higher

Recommended deposit: $300+ for balanced operation

Minimum supported deposit: $100 (high-risk profile)

Minimum leverage requirement: 1:20

Compatible with all brokers; ECN environments with low spreads are recommended for optimal execution quality

Why Nova WDX Trader Stands Apart

Structural momentum evaluation

Directional stability filtering

Multi-layer validation logic

Adaptive market state recognition

Controlled execution framework

Cold, disciplined, machine-level behavior

Nova WDX Trader does not chase price. It observes, classifies, and executes only when market behavior aligns with its internal operational framework.

Positioning

Nova WDX Trader is designed for traders who seek more than reactive automation. It is a refined trading intelligence system for those who value structure, discipline, and algorithmic consistency over impulsive execution.

Disclaimer

This system operates using historical and real-time market data. Past performance does not guarantee future results. Users are responsible for selecting appropriate risk parameters and evaluating suitability before live deployment.