Trend Alpha

- Experts

- Levi Dane Benjamin

- Versione: 1.25

- Aggiornato: 27 dicembre 2025

- Attivazioni: 15

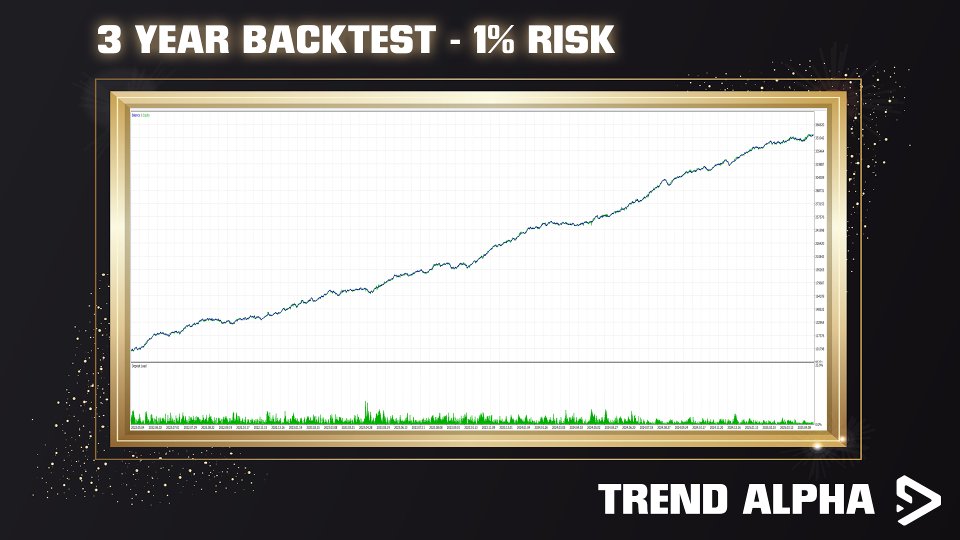

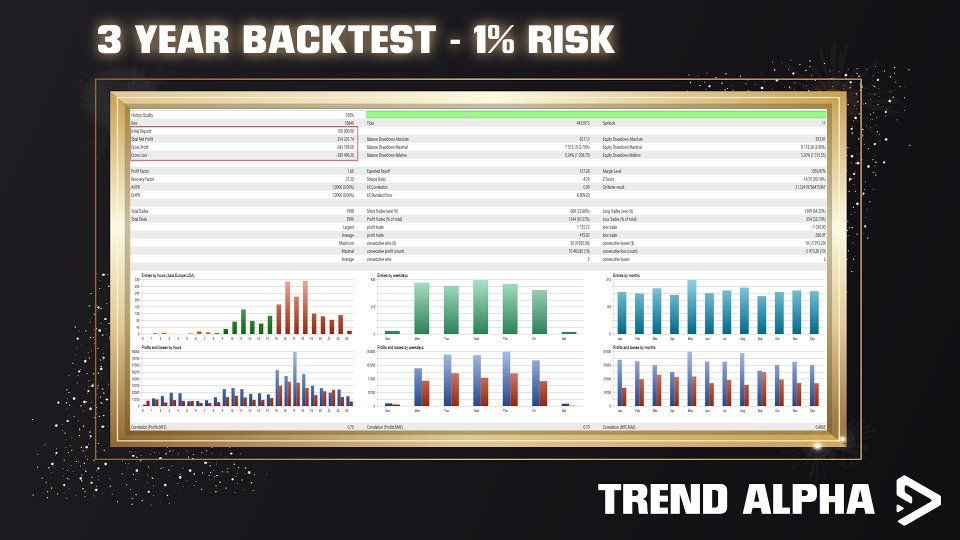

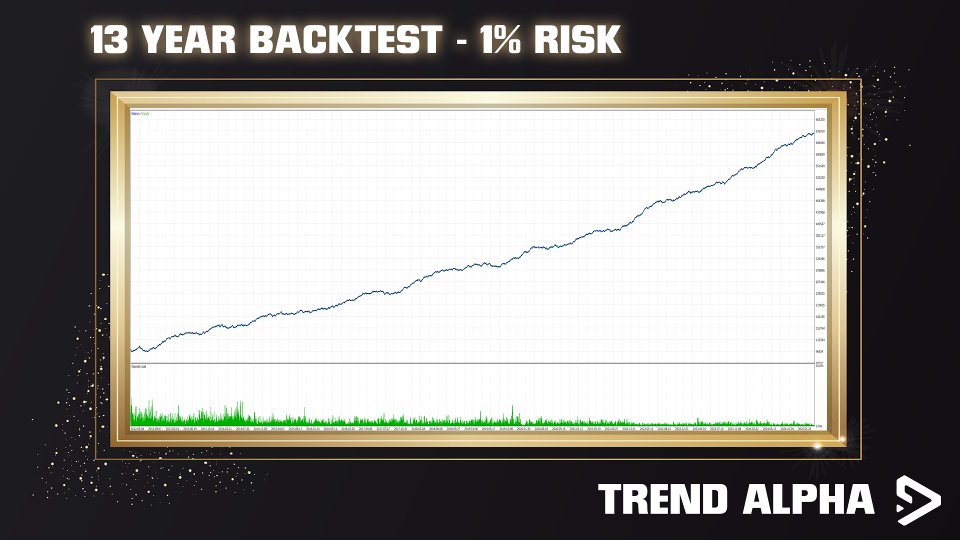

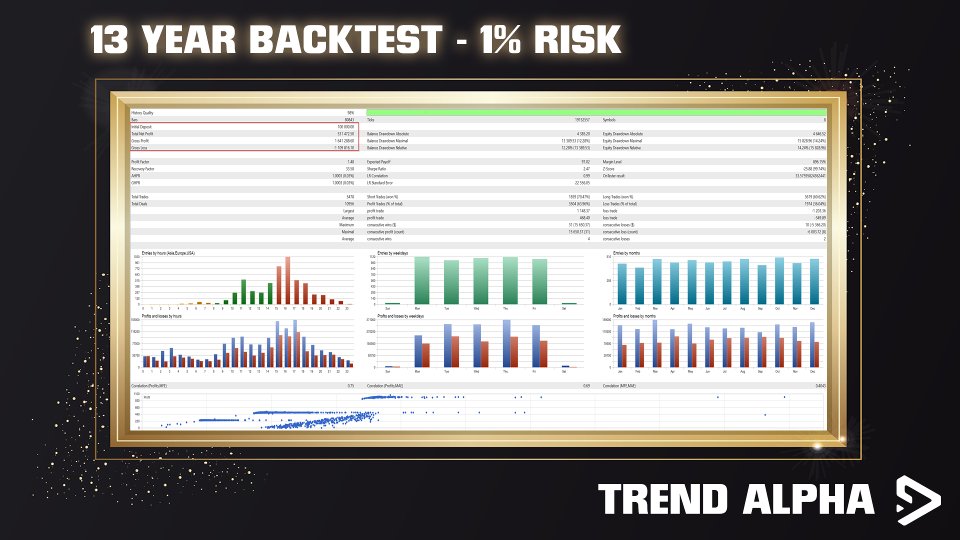

Trend Alpha is an automated Expert Advisor from the DaneTrades EA portfolio. It is built around a rules-based trend-following breakout approach using price action, with additional price-action filters designed to help qualify setups.

The EA is multi-currency and commonly used on trend-driven instruments such as JPY pairs, NAS100, SP500, XAUUSD, and BTCUSD. It is designed for minimal configuration and a straightforward setup process.

Trend Alpha can be used alongside other systems that trade different styles or instruments.

Monitoring is available on Darwinex. Ask for the link.

Why Trend Alpha

Trend Alpha focuses on a transparent methodology based on price action and clearly defined rules. It does not rely on marketing claims, buzzwords, or the expectation of guaranteed outcomes.

Drawdown and losing trades are a normal part of real trading. This EA is intended for users who understand that results can vary and that risk is always present.

Strategy overview

Entries are based on a breakout of a timed range. Because not every breakout is valid, additional price-action filters are used to determine whether a trade is placed. Since the setup is based on a time range, there is typically a maximum of one setup per symbol per day.

Stop loss is placed on the opposite side of the breakout range. Take profit is set as a multiple of the range (commonly between 1x and 2x).

A trailing stop is available and can activate after price moves at least 1x the breakout range. Some symbols may use two take-profit targets with risk split between them.

The system has a long bias typical of many trend-following approaches, while still allowing sell trades under its rules. Sell trades may use smaller targets depending on the symbol and configuration.

Key features

- No martingale, grid, or hedging trade logic

- Stop loss and take profit management per position

- Optional two-stage take profit on selected symbols

- Optional trailing stop based on breakout range movement

- Multi-symbol trading from one chart

- Designed for minimal configuration and straightforward operation

- Configurable risk controls, including drawdown limits

Recommended setup

| Symbol | Attach to any symbol the EA trades (example: USDJPY) |

| Timeframe | H1 |

| Capital | Minimum $250 (example guideline; adjust risk settings to your account) |

| Broker | ICMarkets preferred; compatible with other brokers |

| Account Type | Any |

| VPS | Recommended for stable 24/5 operation |

| Backtesting Mode | Any |

Risk disclaimer

This EA will have losing trades and may experience drawdown. No one can guarantee results, and trading involves risk of loss. Past performance and backtests do not guarantee future results. Use on a demo account first to confirm settings, execution, and broker conditions before running on a live account.

honest EA, and dev, real strategy, very happy.