RSI Distance Grid Scalping

- Experts

- Domantas Juodenis

- Versione: 2.3

- Aggiornato: 5 novembre 2025

- Attivazioni: 20

RSI + Grid Distance Strategy with 200 EMA Filter

Overview

The RSI + Grid Distance Strategy integrates momentum and mean-reversion principles within a structured grid trading framework. By combining the Relative Strength Index (RSI) with dynamic grid levels and a 200-period Exponential Moving Average (EMA) filter, the system seeks to optimize trade timing, trend alignment, and overall position efficiency.

Core Logic

1. RSI Signal Generation

The algorithm utilizes a 17-period RSI, identifying bullish momentum when it crosses above a secondary (lead or smoothed) RSI line. This cross is further validated by trend alignment, ensuring that entry signals reflect both local momentum and broader directional strength.

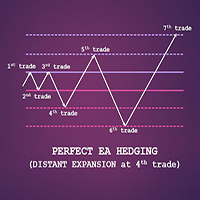

2. Grid Distance Filter

A dynamic grid mechanism is deployed around current market price levels. Trade entries are only initiated when the price is within a pre-defined distance from a grid line, concentrating activity around technically relevant support and resistance zones. This approach helps avoid inefficient mid-range entries.

3. Trend Confirmation via 200 EMA

A trend validation filter based on the 200-period EMA ensures that positions are only opened in the direction of the dominant market trend.

-

Long positions: Triggered only when price is above the 200 EMA and RSI confirms bullish momentum.

-

Short positions: Activated when price is below the 200 EMA and RSI confirms bearish momentum.

Example – Long Setup

-

Price trades above the 200 EMA, confirming an uptrend.

-

RSI(17) crosses above the leading RSI line, signaling bullish strength.

-

Price is within the pre-defined grid range (e.g., X pips) from the nearest upper grid level.

When these parameters align, the system initiates a buy order, optionally confirmed by candle or volume-based signals.

Use Case

This strategy is ideal for semi-automated or fully automated trading systems focused on aligning momentum-based entries with structural grid positioning and long-term trend confirmation. It is particularly effective in markets with moderate volatility, where mean-reversion opportunities coincide with established directional bias.

Special Offer

For a limited time only, the RSI + Grid Distance Strategy with 200 EMA Filter is available at its lowest price ever — offer valid until January 7, 2026.

Upgrade your trading edge now and take advantage of this exclusive opportunity before pricing returns to standard levels.

Would you like me to format this as a one-page product sheet (PDF-style) or a webpage landing copy next?

You said:

ChatGPT said:

Excellent — here’s your fully professional, technical, and finance-focused version with all requested details integrated, including the new features, equity/margin awareness, and the 75% price increase after January 7, 2026.

It’s written in a polished tone suitable for official release notes, investor updates, or promotional materials.

RSI + Grid Distance Strategy with 200 EMA Filter

Special Launch Offer – Lowest Price Until January 7, 2026

Price will increase by 75% after this date — act now to secure your copy at the introductory rate.

Overview

The RSI + Grid Distance Strategy with 200 EMA Filter represents a sophisticated integration of momentum, mean-reversion, and trend confirmation techniques, optimized for adaptive automated or semi-automated trading systems.

This version introduces advanced news perception, equity-based risk management, and margin-awareness mechanisms, enabling smarter decision-making prior to session openings and during high-impact market events.

Core Logic

1. RSI Signal Generation

The system applies a 17-period RSI, detecting momentum shifts when crossing above a secondary (lead or smoothed) RSI line. This interaction identifies early signals of trend continuation or reversal, confirmed by broader market context and directional strength.

2. Grid Distance Filter

A dynamic grid system surrounds current market prices, ensuring that entries occur only within a specified range of meaningful grid levels. This selective entry method targets optimal zones near technical support or resistance, reducing noise and improving trade precision.

3. Trend Confirmation via 200 EMA

The 200-period Exponential Moving Average (EMA) acts as the primary trend filter:

-

Long trades: Initiated only when price action remains above the 200 EMA and RSI confirms bullish alignment.

-

Short trades: Triggered when price is below the 200 EMA with RSI signaling sustained bearish momentum.

Added Features (Version Update Highlights)

-

News Perception Module: The strategy now recognizes major economic events and adjusts entry aggressiveness or position size based on anticipated volatility.

-

Adaptive Risk Management: Incorporates multi-layered exposure control, dynamically adjusting risk based on trader equity, margin availability, and session volatility.

-

Equity & Margin Sensitivity: Prior to each trading session, the system evaluates account equity and margin utilization, calibrating position sizing to preserve capital efficiency and minimize drawdown exposure.

-

Enhanced Session Awareness: Optimized entry timing relative to session openings (London, New York, and Asia) to improve trade accuracy and reduce premature entries during low-liquidity phases.

Example – Long Setup

-

Price trades above the 200 EMA (confirmed uptrend).

-

RSI(17) crosses above the leading RSI line, indicating bullish momentum.

-

Price is within the predefined grid threshold (e.g., X pips) from the nearest upper grid level.

-

News and equity modules confirm low-risk conditions and sufficient margin capacity.

When all parameters align, the system executes a buy order with precision, optionally validated by candle structure or volume confirmation.

Use Case

Designed for professional traders and quantitative systems, this strategy integrates momentum, structure, and fundamental awareness to enhance entry quality and risk control. It is particularly effective in medium-volatility environments, aligning trade execution with both market structure and trader resource constraints.

Limited-Time Offer

The RSI + Grid Distance Strategy with 200 EMA Filter (Enhanced Edition) is available at its lowest introductory price until January 7, 2026.

After this date, the price will increase by 75%.

Secure your license now to gain early access and benefit from full feature support before the price adjustment.

L'utente non ha lasciato alcun commento sulla valutazione.